Get the free M&g Junior Isa Investment Application Form

Get, Create, Make and Sign mg junior isa investment

How to edit mg junior isa investment online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mg junior isa investment

How to fill out mg junior isa investment

Who needs mg junior isa investment?

Guide to the mg Junior ISA Investment Form

Understanding the Junior ISA

A Junior ISA (Individual Savings Account) is a savings account specifically designed for children under the age of 18. It allows parents, guardians, and family members to save or invest on behalf of a child, providing an opportunity to build a financial foundation for their future. Junior ISAs are flexible and can be a powerful tool for long-term savings and investments.

The primary purpose of a Junior ISA is to promote saving among children, helping to cultivate positive financial habits from a young age. The key benefits are tax-free growth and withdrawals, setting the stage for a substantial financial resource by the time the child reaches adulthood.

Key features of the Junior ISA

One of the most attractive aspects of a Junior ISA is its tax advantages. Funds within the account grow tax-free, meaning that interest or investment gains are not subject to income tax or capital gains tax. This allows the savings to compound more efficiently over time.

Moreover, withdrawals from a Junior ISA are also tax-free, providing flexibility for parents to access funds if necessary. However, it’s essential to understand the contribution limits associated with these accounts.

Types of Junior ISAs

There are two main types of Junior ISAs available: Cash Junior ISAs and Stocks and Shares Junior ISAs. Each option has unique characteristics that cater to different financial goals.

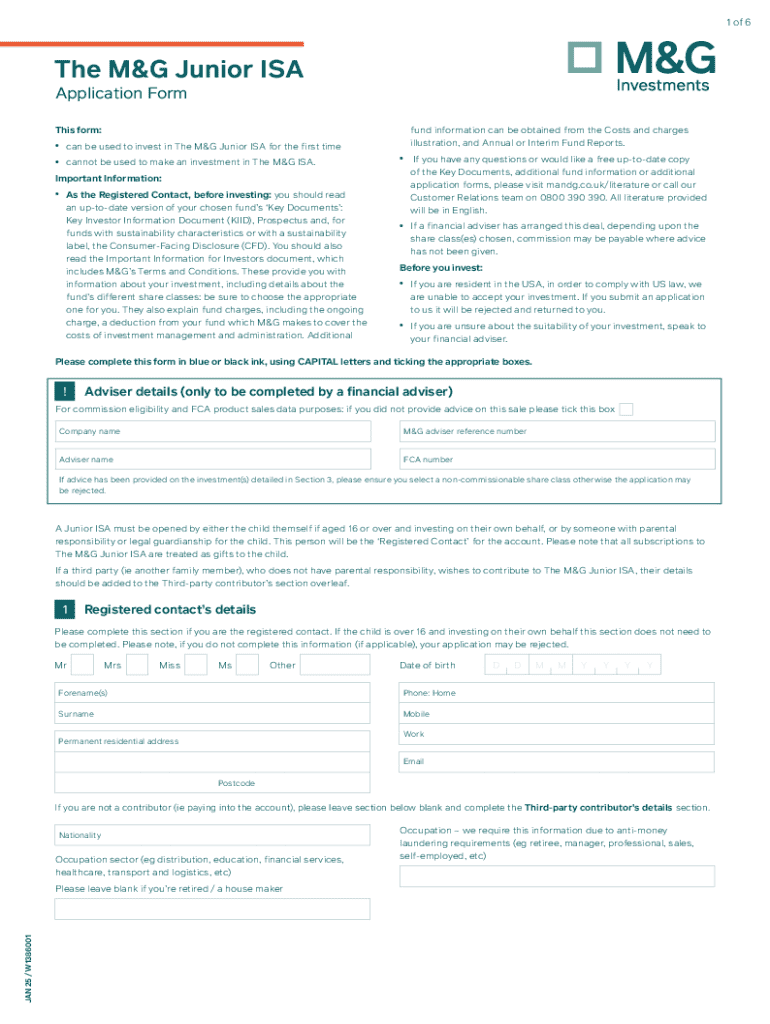

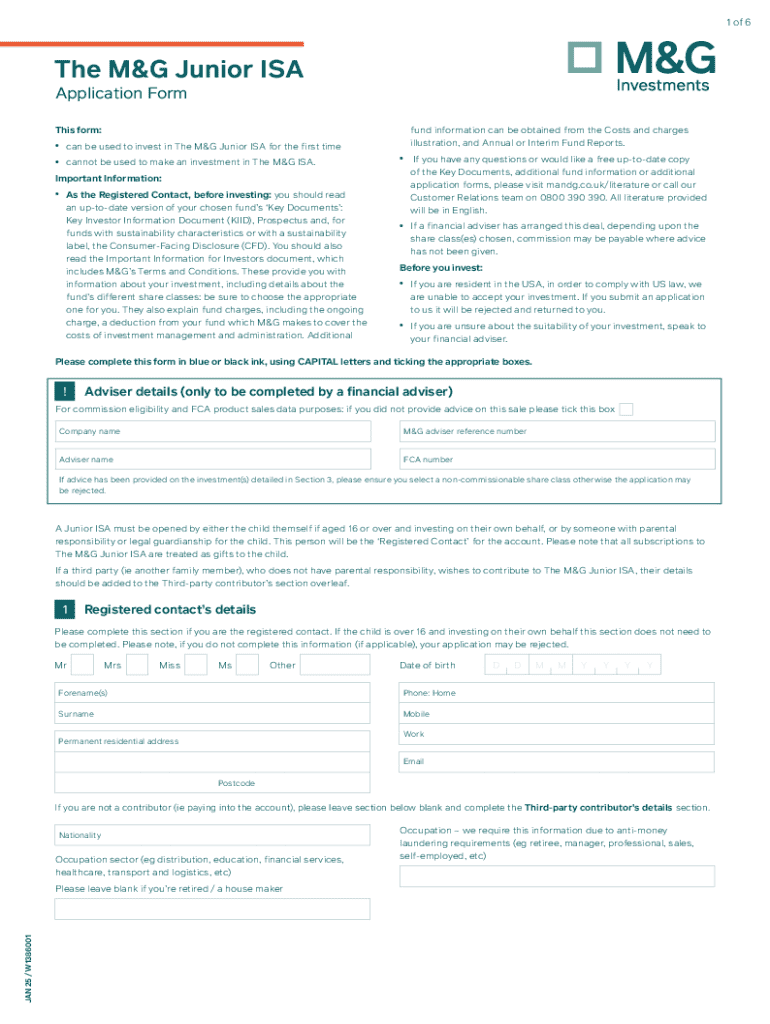

Filling out the mg Junior ISA investment form

Completing the mg Junior ISA investment form is a crucial step in setting up your child’s investment account. To simplify the process, follow these steps to ensure everything is filled out correctly.

Common mistakes include not signing the form or incorrectly entering information, which can delay the application process. Double-check all entries before submission.

Managing your Junior ISA investment

Once the mg Junior ISA investment form is submitted and your account is established, effective management becomes essential. Regular monitoring of the account allows you to track growth and make informed decisions about future contributions.

You can access your account online for real-time updates. Making additional contributions can be done easily, ensuring you maximize the benefits of the Junior ISA. Understanding the rules surrounding withdrawals is critical to avoid penalties.

Strategies for maximizing Junior ISA potential

To get the most out of a Junior ISA, consider best practices when investing. Starting early can make a significant difference, thanks to compound interest. Even small, regular contributions can grow into a substantial fund by the time the child reaches adulthood.

Diversifying investment choices between Cash and Stocks and Shares Junior ISAs is a smart strategy. It balances security with growth potential, ensuring that you can adjust based on market conditions and individual financial goals.

Frequently asked questions about Junior ISAs

As with any financial product, it's crucial to address common concerns about Junior ISAs. Understanding the implications of various scenarios can provide clarity and confidence in your investment.

Tools for Junior ISA investors

Utilizing the right tools can significantly enhance your Junior ISA investment experience. Various calculators and resources can help you estimate future savings and make informed decisions.

How pdfFiller enhances the Junior ISA experience

pdfFiller provides an array of tools designed to simplify the document management process related to Junior ISAs. With its seamless online document creation and management capabilities, users can easily fill out the mg Junior ISA investment form without hassle.

The platform offers editing and signing capabilities, allowing you to customize your forms, and add signatures digitally. Moreover, the collaborative tools for families and financial advisors enable better communication and documentation management, vital in maintaining your Junior ISA.

Next steps after completing the mg Junior ISA investment form

After submitting the mg Junior ISA investment form, it’s important to stay engaged with your investment. You should receive confirmation of your application, but you can also track your investment account online.

Keeping a regular check on your account helps in planning additional contributions, while also preparing for future withdrawals. Maintaining an active role in your child’s financial education and investment journey prepares them for financial responsibility when they transition to adulthood.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get mg junior isa investment?

How do I execute mg junior isa investment online?

Can I edit mg junior isa investment on an iOS device?

What is mg junior isa investment?

Who is required to file mg junior isa investment?

How to fill out mg junior isa investment?

What is the purpose of mg junior isa investment?

What information must be reported on mg junior isa investment?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.