Get the free estate-planning-questionnaire-140204.docx

Show details

435 Commercial St NE Suite 201 PO Box 804 Salem OR 97308 Phone: (503) 5852255 Fax: (503) 3648033 www.churchilllaw.com CONFIDENTIAL FAMILY INFORMATION QUESTIONNAIRE FAMILY INFORMATION: Date: Your Full

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign estate-planning-questionnaire-140204docx

Edit your estate-planning-questionnaire-140204docx form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your estate-planning-questionnaire-140204docx form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit estate-planning-questionnaire-140204docx online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit estate-planning-questionnaire-140204docx. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out estate-planning-questionnaire-140204docx

How to fill out estate-planning-questionnaire-140204docx:

01

Start by carefully reading through the entire questionnaire to familiarize yourself with the content and sections.

02

Gather all necessary documents and information such as personal identification, list of assets, and details about beneficiaries.

03

Begin filling out the questionnaire by providing accurate and up-to-date personal information including name, address, and contact details.

04

Proceed to answer the sections related to your marital status, children, and family members. Include their names, ages, and any relevant details.

05

Move on to the section about your assets and liabilities. List all your properties, financial accounts, investments, debts, and any other relevant information.

06

Next, answer the questions regarding your healthcare preferences, including your wishes for medical treatment and end-of-life decisions.

07

Complete the section related to your desired distribution of assets and beneficiaries. Specify who should receive what and any special conditions or requests.

08

If applicable, provide information about any previous wills, trusts, or estate planning documents.

09

Double-check all the information you've provided to ensure accuracy and completeness.

10

Finally, review the questionnaire once again to make sure you haven't missed any sections or questions.

Who needs estate-planning-questionnaire-140204docx:

01

Individuals who want to create or update their estate plan.

02

People with substantial assets or complicated financial situations.

03

Individuals who want to ensure that their wishes regarding their assets, healthcare, and beneficiaries are legally documented and followed.

04

Couples or parents who want to make arrangements for their minor children or dependents.

05

Those who want to minimize the potential for family disputes or conflicts over their estate.

06

People who want to assign specific individuals to make decisions on their behalf in case of incapacity.

07

Individuals who want to take advantage of tax planning strategies to minimize estate taxes.

08

Anyone looking to have peace of mind knowing that their affairs are in order and their loved ones will be taken care of as planned.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

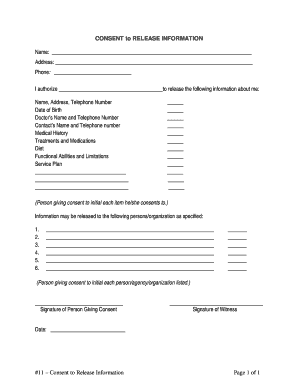

What is estate-planning-questionnaire-140204docx?

estate-planning-questionnaire-140204docx is a document used in the estate planning process to gather information about assets, beneficiaries, and other important details.

Who is required to file estate-planning-questionnaire-140204docx?

Individuals who are involved in estate planning, such as executors, trustees, or individuals creating a will, may be required to fill out estate-planning-questionnaire-140204docx.

How to fill out estate-planning-questionnaire-140204docx?

Estate-planning-questionnaire-140204docx can be filled out by providing accurate and detailed information about assets, beneficiaries, debts, and other relevant details as requested in the form.

What is the purpose of estate-planning-questionnaire-140204docx?

The purpose of estate-planning-questionnaire-140204docx is to help individuals organize and document important information related to their estate planning, making the process easier for their heirs and beneficiaries.

What information must be reported on estate-planning-questionnaire-140204docx?

Information such as assets, liabilities, beneficiaries, account information, insurance policies, and other relevant details related to the individual's estate planning must be reported on estate-planning-questionnaire-140204docx.

How do I edit estate-planning-questionnaire-140204docx in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing estate-planning-questionnaire-140204docx and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I fill out the estate-planning-questionnaire-140204docx form on my smartphone?

Use the pdfFiller mobile app to complete and sign estate-planning-questionnaire-140204docx on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I complete estate-planning-questionnaire-140204docx on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your estate-planning-questionnaire-140204docx, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

Fill out your estate-planning-questionnaire-140204docx online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Estate-Planning-Questionnaire-140204docx is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.