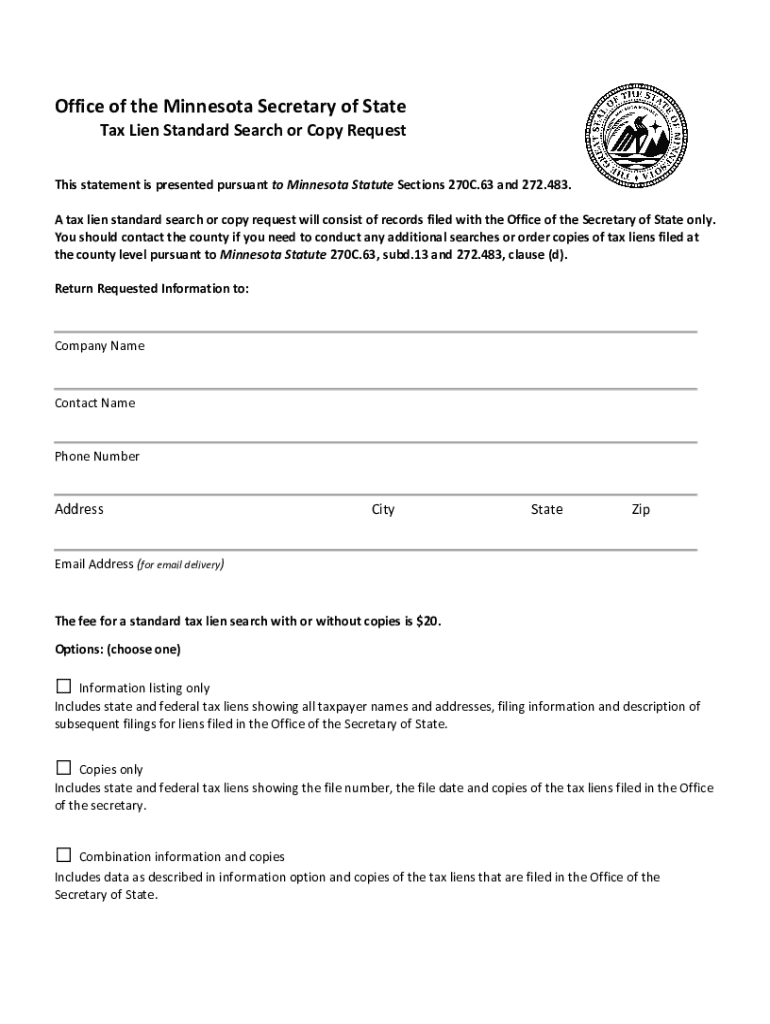

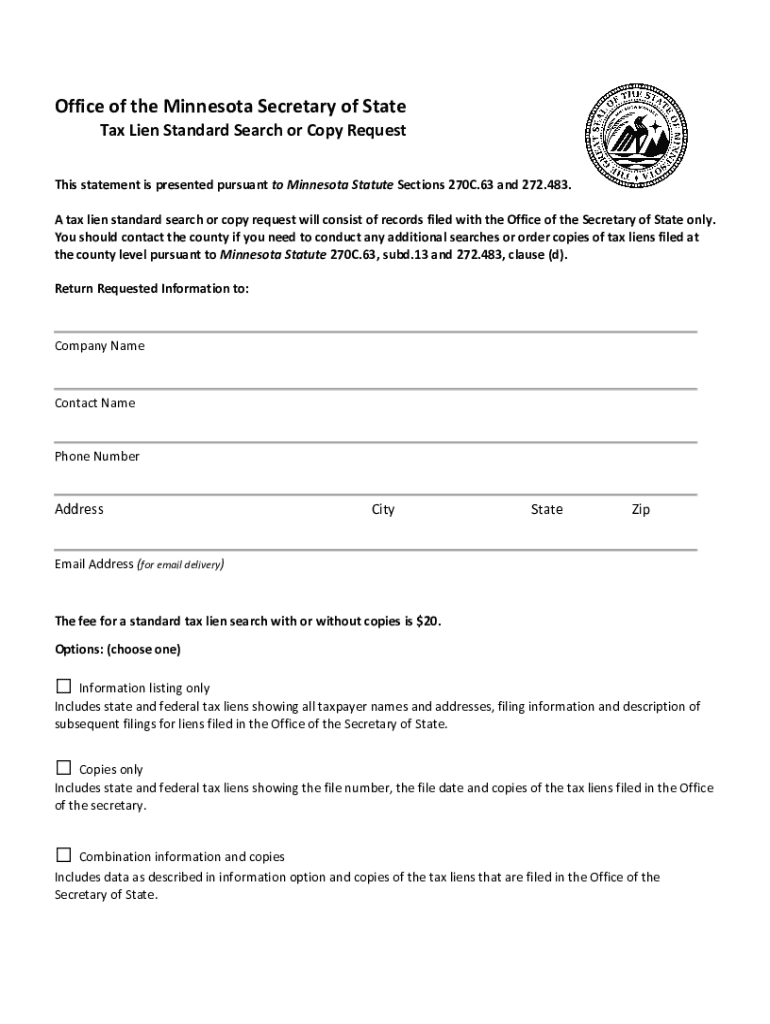

Get the free Tax Lien Standard Search or Copy Request

Get, Create, Make and Sign tax lien standard search

How to edit tax lien standard search online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax lien standard search

How to fill out tax lien standard search

Who needs tax lien standard search?

A Comprehensive Guide to the Tax Lien Standard Search Form

Understanding tax liens

A tax lien is a legal claim imposed by a governmental entity against a property when the owner fails to pay taxes owed. This claim grants the government the right to take possession of the property in case the taxes remain unpaid. Tax liens exist on different levels: federal tax liens are enforced by the IRS, while state and local tax liens are imposed by state governments or local municipalities respectively. The existence of a tax lien signals financial distress and can have a significant impact on an individual's ability to manage their assets.

The common reasons for tax liens include unpaid income taxes, property taxes, and business taxes. When taxes remain unpaid for an extended period, the government has the authority to place a lien on the property, leading the owner into potential legal and financial trouble if the obligations aren't met.

Importance of conducting a tax lien search

Conducting a tax lien search is vital for anyone engaging in real estate transactions or business dealings. Tax liens can severely affect credit ratings, making it challenging to secure financing or loans. A lien can remain on a credit report for up to seven years, thereby reducing an individual's creditworthiness.

For potential buyers and business owners, a tax lien search reveals hidden liabilities tied to a property or business. This proactive measure helps avoid legal implications that could arise post-transaction should a lien be discovered later.

The tax lien search process

The tax lien search process typically follows a structured timeline that can vary based on the jurisdiction and complexity of the search. A comprehensive search should include reviewing public records, contacting local tax authorities, and potentially consulting legal professionals for more detailed inquiries.

Key elements that contribute to an effective search involve gathering specific details such as the individual's or business's name, property address, and tax identification number. While most searches are straightforward, common challenges include incomplete information or discrepancies in recorded data, which can hinder the process.

Using pdfFiller for a comprehensive tax lien search

pdfFiller is an excellent platform for users seeking an effective solution for managing tax lien searches. With features that allow for PDF editing, eSigning, and team collaboration, this cloud-based tool is designed to streamline the documentation process involved in tax lien searches.

To access the Tax Lien Standard Search Form on pdfFiller, start by navigating to their website and selecting the appropriate template that suits your needs.

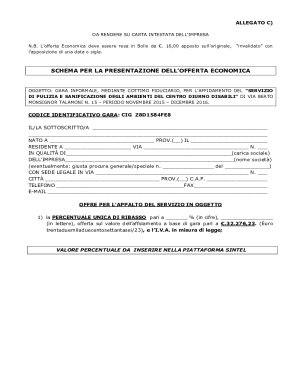

Filling out the tax lien standard search form

Filling out the Tax Lien Standard Search Form requires accuracy to ensure efficiency in your search. The form is typically divided into several sections that need detailed attention.

Common errors to avoid include omitting key details, providing incorrect property addresses, and misidentifying lien sources. Each mistake can lead to delays in processing your search.

Editing and managing your tax lien search documents

Once you've filled out the tax lien form, pdfFiller offers capabilities that allow you to edit your documents even after completion. You can make adjustments as necessary, ensuring all information remains accurate and up-to-date.

Collaboration tools within pdfFiller enable you to involve team members in reviewing your documentation before submission. This pre-submission review can prevent errors and enhance the quality of your applications. Additionally, using the platform's storage solutions, you can save and securely store completed searches for easy access in the future.

eSigning your tax lien search form

eSigning provides a modern alternative to traditional signing methods, offering numerous benefits such as speed, security, and convenience. The process not only saves time but also ensures your documents remain legally binding.

To electronically sign your Tax Lien Standard Search Form within pdfFiller, simply follow these steps: open the completed document, click on the eSign option, and follow the instructions to create and insert your signature. Once signed, ensure that the form is ready for submission.

Submitting the tax lien standard search form

After completing and signing the form, pdfFiller simplifies the submission process. Users can select from various submission options that accommodate individual preferences, whether that be email, direct upload, or integration with other platforms.

Confirming receipt of the submission and tracking status is also streamlined through the platform. Most submissions will have a wait time that can vary based on local governmental processing times, and being aware of these timelines can help manage expectations effectively.

Understanding the results of your tax lien search

Once your tax lien search is completed, understanding the results is crucial. Search results could indicate the presence of liens, past delinquencies, or confirm that no liens are attached, which is the desired outcome.

If the search reveals a lien, the next steps typically involve contacting the relevant tax authority for resolution options, which may include negotiating payment or developing an agreement for repayment. Resources available through pdfFiller can assist in crafting communications with tax authorities and navigating resolution processes.

Avoiding common pitfalls in tax lien searches

While a tax lien search can be straightforward, there are various pitfalls to avoid. Misunderstanding lien report details is common; be sure to read the findings thoroughly. Timing issues can arise, especially if searches are initiated close to deadlines or transaction dates, resulting in potential delays.

Regularly updating yourself on tax lien laws and regulations is also crucial, as these can change frequently and may impact the validity and outcomes of your search.

Exploring related topics in tax and legal compliance

Beyond tax liens, this guide emphasizes the importance of understanding other related searches, such as Uniform Commercial Code (UCC) filings. For property and business owners, ongoing due diligence is essential to mitigate risks associated with hidden liens or other encumbrances.

Case studies have shown how businesses that diligently conduct thorough lien searches can avoid significant legal challenges and financial liabilities, thus reinforcing the value of preventative measures in managing property and business ownership.

Conclusion: Mastering tax lien searches with pdfFiller

Mastering the tax lien search process is an invaluable skill for both individuals and businesses. Successful navigation through the complexities of tax liens can prevent unexpected financial burdens that would otherwise derail transactions.

The robust functionalities offered by pdfFiller, including document management, eSigning, and collaboration, empower users to efficiently handle tax lien search forms and make informed decisions about property transactions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit tax lien standard search online?

How do I fill out tax lien standard search using my mobile device?

How do I edit tax lien standard search on an iOS device?

What is tax lien standard search?

Who is required to file tax lien standard search?

How to fill out tax lien standard search?

What is the purpose of tax lien standard search?

What information must be reported on tax lien standard search?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.