Get the free Retirement Account Application Package

Get, Create, Make and Sign retirement account application package

Editing retirement account application package online

Uncompromising security for your PDF editing and eSignature needs

How to fill out retirement account application package

How to fill out retirement account application package

Who needs retirement account application package?

Comprehensive guide to the retirement account application package form

Overview of retirement accounts

A retirement account provides individuals and families a means to save and invest money specifically for retirement. These accounts often come with tax benefits that can significantly enhance your savings growth over time. Without the proper retirement strategy, achieving financial independence later in life can be challenging.

Several types of retirement accounts are available, each designed to meet different financial situations and goals. Among the most common are Individual Retirement Accounts (IRAs) and employer-sponsored plans like 401(k)s. Understanding the nuances of each type is crucial for optimizing your retirement savings.

Establishing a retirement account is essential for anyone seeking financial security in their later years. It not only sets aside funds but also takes advantage of tax benefits, compounded interest, and employer match contributions.

Understanding the retirement account application package

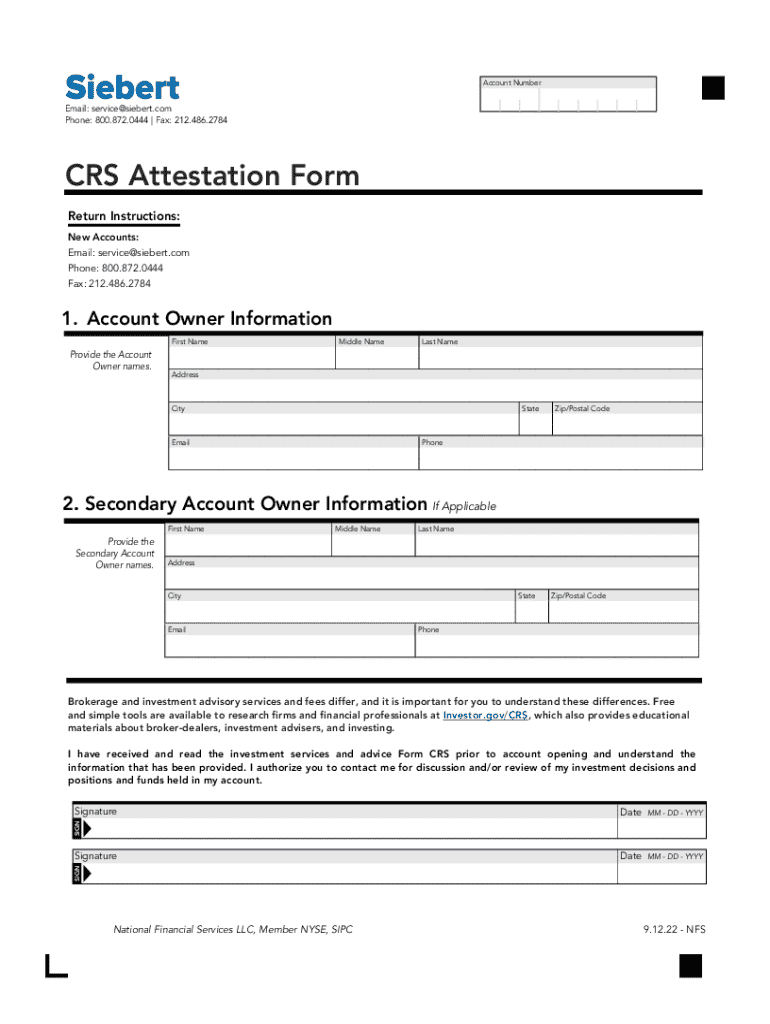

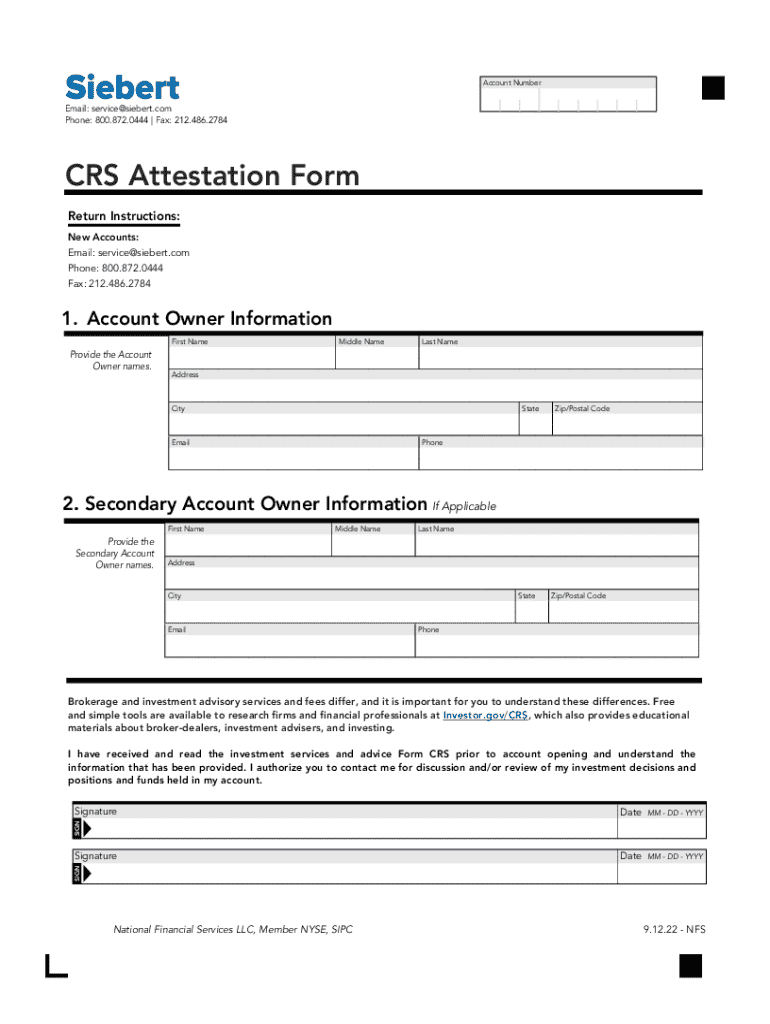

The retirement account application package is a set of documents and forms designed to facilitate the process of setting up a retirement account. This package usually includes an application form, supporting documentation requirements, and supplementary information sheets that guide applicants through the necessary steps.

Each component of the application package plays a crucial role. Without the application form, for instance, your intentions to open an account remain unregistered. Supporting documentation is needed to verify your identity and financial information, while additional information sheets clarify any remaining questions you might have about the process.

Understanding and carefully completing each component of the retirement account application package is essential to avoid delays and ensure compliance with all regulations.

Step-by-step guide to completing the application package

Completing the retirement account application package effectively requires careful attention to detail. By following a structured approach, you can simplify this process and minimize the likelihood of errors.

Addressing these steps methodically will position you for a smoother submission experience.

Editing and modifying your application

Once your retirement account application package is drafted, you may want to refine it. Utilizing tools like pdfFiller can streamline this editing process significantly. With its user-friendly interface, you can adjust forms easily, add annotations, or insert digital signatures.

Collaborating with team members or financial advisors is also simplified. You can share the document and receive real-time feedback, making it easier to finalize any adjustments before submission.

Managing your retirement account application after submission

After you've submitted your retirement account application package, there are important steps to follow. First, be aware of processing times, as these can vary from institution to institution. It's wise to track the status of your application on the institution's website or app.

If revisions are necessary or if your application is denied, understanding the appeal process can save time and reduce stress. Don't hesitate to inquire further about any missing information or errors that might have led to a retraction.

Interactive tools for managing your retirement account

pdfFiller offers several interactive tools designed to enhance your experience when managing your retirement account application. With features such as eSignature capabilities and document sharing options, it's easy to ensure that all involved parties can access, sign, and review documents as needed.

Furthermore, the cloud-based storage solutions make retrieving your forms and documents simple, regardless of when or where you need them. This accessibility is especially valuable for individuals and teams, enabling seamless collaboration.

Common questions and troubleshooting

Navigating through the retirement account application process can bring up several questions. Some of the most frequently asked include specifics about the types of documentation required and how long it typically takes for applications to be processed.

In cases of confusion or specific queries, contacting customer support can quickly clarify outstanding concerns, enabling you to move forward confidently with your application.

Conclusion: empowering your retirement planning

With the right tools and guidance, the retirement account application package form can become a manageable task rather than a daunting one. pdfFiller's platform simplifies the entire application process, enhancing ease of use with its editing and document management features.

By understanding each aspect of the application package and accessing helpful resources, you can take significant strides in empowering your retirement planning. Choosing the right tools like pdfFiller ensures you’ll complete your paperwork with confidence and efficiency.

Key features of pdfFiller for your retirement planning

pdfFiller allows users to create, edit, and manage documents efficiently. The platform's cloud capabilities mean that you can access your retirement account application package from anywhere with internet access, making family discussions or team collaborations easier than ever.

Additionally, the platform is designed to streamline all document-related tasks tailored to your retirement planning needs, ensuring that you remain organized and informed throughout the entire application process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the retirement account application package electronically in Chrome?

How do I edit retirement account application package straight from my smartphone?

How do I complete retirement account application package on an iOS device?

What is retirement account application package?

Who is required to file retirement account application package?

How to fill out retirement account application package?

What is the purpose of retirement account application package?

What information must be reported on retirement account application package?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.