Get the free Individual Single Premium Immediate Annuity Application

Get, Create, Make and Sign individual single premium immediate

Editing individual single premium immediate online

Uncompromising security for your PDF editing and eSignature needs

How to fill out individual single premium immediate

How to fill out individual single premium immediate

Who needs individual single premium immediate?

A Comprehensive Guide to the Individual Single Premium Immediate Form

Understanding the individual single premium immediate form

The individual single premium immediate form is a specific document used to facilitate the purchase of an immediate annuity, particularly a Single Premium Immediate Annuity (SPIA). This financial tool allows individuals to convert a lump sum of cash into a series of regular income payments, which begin almost immediately after the investment. For many, this serves as a vital component in retirement planning, offering a predictable income stream during retirement years.

The importance of the individual single premium immediate form lies in its capability to provide financial security. As retirees face challenges such as dwindling savings or unpredictable Social Security benefits, having a steady income source becomes crucial. This form works within the context of annuities by outlining the details of the contract, the amount invested, and the chosen payout frequency.

Key features of the individual single premium immediate form

The individual single premium immediate form boasts several key features that cater to diverse financial needs. One of the standout benefits is the immediate payout characteristic; as soon as the premium is paid, clients can start receiving payments, often within the first month. This immediacy addresses the urgent financial needs of retirees.

The structure and design of the form are straightforward, guiding users through essential sections such as personal details and optional features for their annuity. Eligibility primarily depends on the individual's financial health and often requires a minimum investment. Payments can be customized in terms of duration—ranging from a few years to a lifetime—and frequency—monthly, quarterly, or annually—based on the preferences and requirements of the annuity holder.

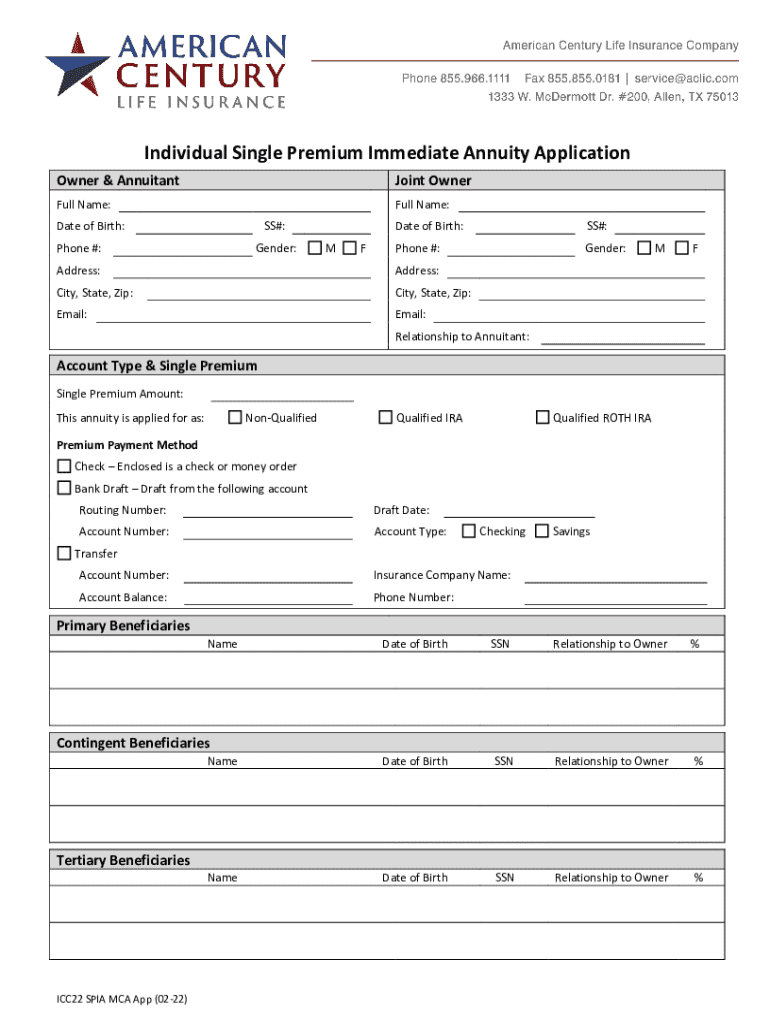

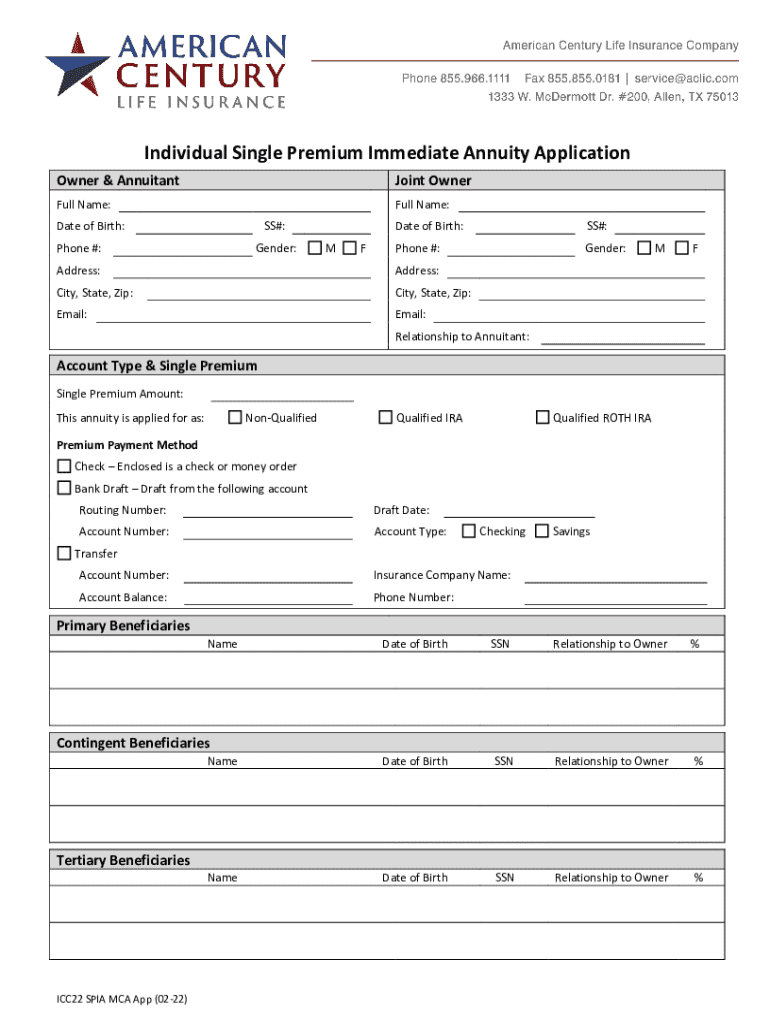

Filling out the individual single premium immediate form

Completing the individual single premium immediate form involves several steps. First, users must enter their personal information, including their name, address, and social security number. Next, the financial information section requires details about the lump sum payment they are willing to invest.

Following these entries, the user selects their annuity options, which may include features like a period certain or joint life options. Once all sections are thoroughly completed, verification and signing are required to finalize the form. To avoid common pitfalls—such as entering inaccurate data or overlooking optional features—users are encouraged to double-check every entry and consult financial advisors where necessary.

Editing and managing the individual single premium immediate form

Making edits to the individual single premium immediate form has become easier with digital tools like pdfFiller. Users can electronically edit the form, allowing for corrections or updates in a seamless manner. Once edited, it is crucial to save and store the completed forms securely, preferably in a password-protected format or secure cloud storage.

Collaboration features available in pdfFiller enable teams to review and discuss modifications effectively. Users can track changes and manage document versions, ensuring the latest information is always at hand, which is particularly useful in team scenarios or when making significant adjustments to financial plans.

Signing the individual single premium immediate form

The signing process for the individual single premium immediate form is crucial, as it formalizes the user’s commitment to the annuity agreement. With the rise of digital document management, eSignatures have become integral to this process. Users can add an eSignature using platforms like pdfFiller, which simplifies the signing procedure while ensuring compliance with legal standards.

Security measures are significant when employing electronic signatures; pdfFiller includes various protocols to ensure authenticity, protecting both the user and the issuer of the annuity from fraudulent activities.

Factors to consider before submitting the form

Before submitting the individual single premium immediate form, several financial considerations must be addressed. Understanding the costs associated with single premium immediate annuities is vital; these may include surrender charges and the total amount disbursed over time. Assessing the advantages and disadvantages will enable individuals to weigh the potential risks of locking funds in an annuity against their financial goals.

In addition, potential applicants should critically evaluate their individual financial situation and future needs, considering factors like life expectancy and other income sources. The tax implications related to SPIA payouts should not be overlooked, as they can influence the overall financial strategy associated with retirement planning.

Customization options for single premium immediate annuities

The individual single premium immediate form allows for various customization options that can significantly impact the payout structure of the annuity. Clients can choose between different payout frequency options—monthly, quarterly, or annually—based on their financial needs. Furthermore, selecting additional features like inflation protection or a return of premium option can also enhance the personalized benefits attached to their annuity.

These customizations not only reflect personal financial aspirations but also affect investment profiles, helping individuals tailor their annuity to fit their unique retirement scenarios effectively.

Comparing individual single premium immediate annuities

When contemplating the individual single premium immediate form, it's essential to compare it with other retirement solutions. This type of annuity generally offers distinct benefits over both fixed indexed annuities and variable annuities, particularly in terms of predictability of income and immediate payout. Unlike deferred annuities, which accumulate value before payouts commence, SPInAs ensure an instant income stream, appealing to those in or approaching retirement.

Moreover, a detailed examination of factors influencing this decision—such as expected lifestyle changes, inflation, and market conditions—can better prepare individuals for long-term financial health, shaping the choice between different annuity options.

Case studies and financial scenarios

Understanding the real-life implications of the individual single premium immediate form can be enhanced through case studies. For example, Michael, a 65-year-old retiree, opted for a SPIA to secure a steady income after selling his business. This decision provided him with peace of mind and financial stability, demonstrating the form's role in creating a sustainable retirement plan.

A comparative analysis of different scenarios—such as the financial strategies utilized by various individuals—can yield valuable insights. Examining these strategies not only illustrates the form's effectiveness but also highlights the diversity of options available when planning for retirement.

Preparing for the future: Is the individual single premium immediate form right for you?

Determining whether the individual single premium immediate form is suitable for you requires introspection about one’s financial circumstances and retirement objectives. This form is especially beneficial for those nearing retirement who desire predictable, reliable income without the complexities of market volatility.

Furthermore, key advantages of enrolling in a SPIA—including longevity risk mitigation and immediate payout—should be weighed against personal investment experiences and comfort with various financial products. Evaluating all factors thoroughly can guide users toward making informed decisions about their financial futures.

Frequently asked questions about the individual single premium immediate form

Individuals often have queries regarding the filling, managing, and overall use of the individual single premium immediate form. Common questions might involve clarifications about eligibility, possible adjustments after submission, or how various options impact payouts. Expanding these discussions can help demystify the process and empower users with the knowledge required to navigate their financial planning better.

Understanding the legalities and obligations associated with the form is equally important. Clarity around the obligations created by signing the form ensures that users are cognizant of their rights as annuity holders, arming them with essential information to make confident financial choices.

Support channels for individual single premium immediate form users

Navigating the individual single premium immediate form may present challenges, which is why utilizing customer support options from pdfFiller is invaluable. Users can find diverse channels for assistance, whether through live chat, email support, or extensive FAQ sections dedicated to the form.

Seeking professional financial advice before completing your form also increases the likelihood of making sound decisions aligned with individual financial goals. Utilizing available resources enhances the form-filling experience and minimizes potential errors during the process.

Legal information relevant to the individual single premium immediate form

When dealing with the individual single premium immediate form, legal considerations become paramount. Users must understand the essential legal terms and conditions associated with their annuity contracts, including the implications of the commitments they are making. Knowledge of both rights and responsibilities will empower individuals when entering into these agreements.

Additionally, legal documentation in annuity agreements requires attention to details such as beneficiary designations and payout stipulations, which can affect both the immediate and long-term financial landscape of the holder. Maintaining a solid grasp of these legal aspects fortifies the security of financial decisions tied to the individual single premium immediate form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my individual single premium immediate in Gmail?

Can I edit individual single premium immediate on an Android device?

How do I complete individual single premium immediate on an Android device?

What is individual single premium immediate?

Who is required to file individual single premium immediate?

How to fill out individual single premium immediate?

What is the purpose of individual single premium immediate?

What information must be reported on individual single premium immediate?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.