Get the free Transfer of Income Distribution Cum Capital Withdrawal Plan - Enrolment Form - (idcw...

Get, Create, Make and Sign transfer of income distribution

How to edit transfer of income distribution online

Uncompromising security for your PDF editing and eSignature needs

How to fill out transfer of income distribution

How to fill out transfer of income distribution

Who needs transfer of income distribution?

Transfer of Income Distribution Form: A Comprehensive How-to Guide

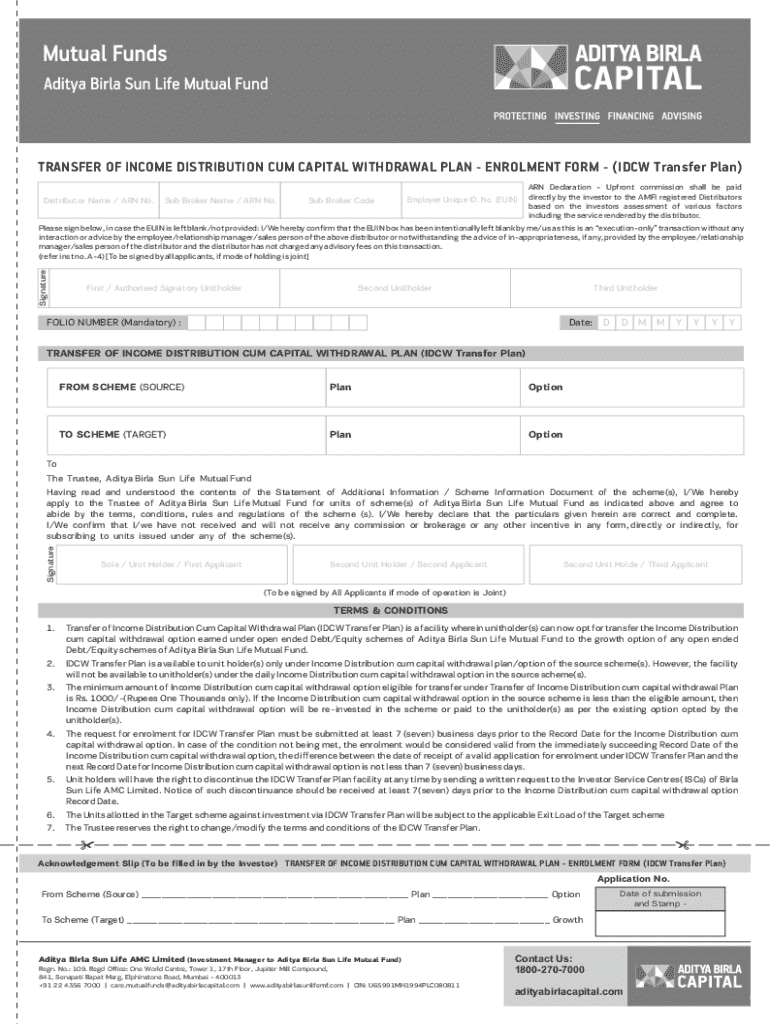

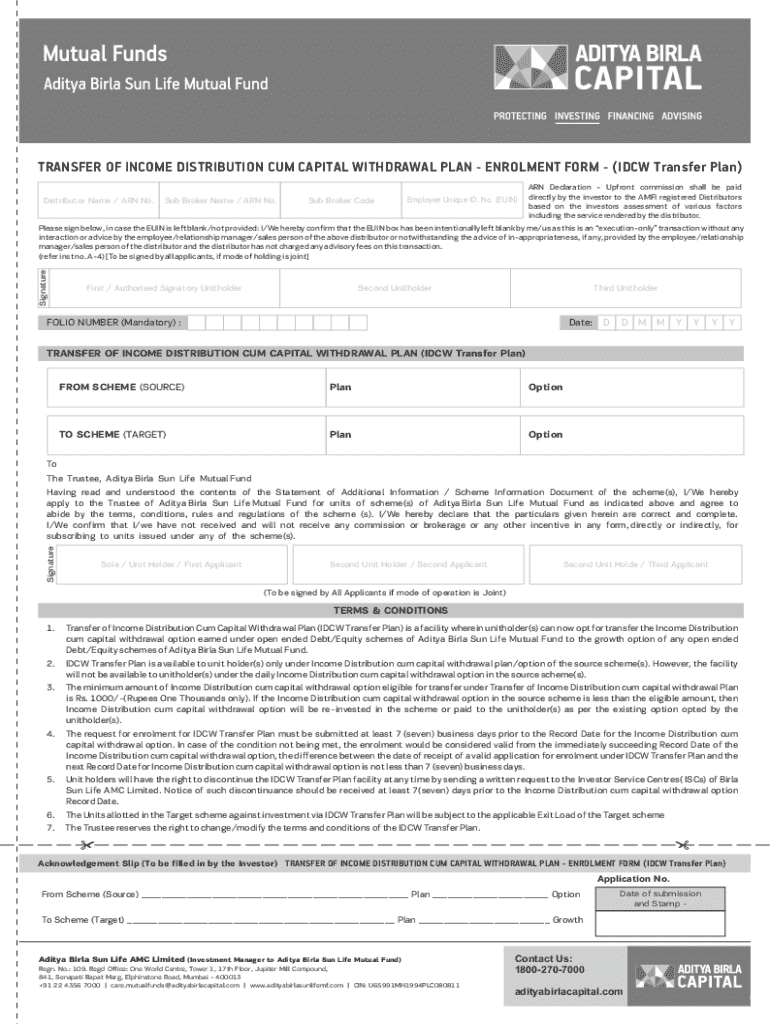

Understanding the transfer of income distribution form

The transfer of income distribution form is a crucial document used primarily to manage the allocation and distribution of income for tax and financial planning purposes. This form enables individuals and entities to formally specify how their income should be distributed among various accounts or beneficiaries. Understanding its definition and purpose is essential for effective financial management.

Its importance cannot be understated; it aids in reducing tax liabilities, ensuring that funds are allocated correctly, and providing a clear record for financial auditing. Hence, the transfer of income distribution form serves as a foundational tool in financial documentation and compliance.

Who needs to complete this form?

Various individuals and entities may need to complete the transfer of income distribution form. The primary target audience includes business owners, financial planners, and individuals seeking to organize their income for personal or investment purposes. Specifically, those engaged in trust distributions, estates, or complex financial scenarios will find this form especially useful.

Several scenarios call for submission of this form, including transferring income from a trust to its beneficiaries, distributing profits among business partners, or reallocating income from different investment streams. Recognizing these situations can help you determine when to complete this essential document.

Steps to complete the transfer of income distribution form

Completing the transfer of income distribution form requires careful attention and preparation. Start by gathering the necessary information to ensure that you have all the required documentation at hand. This may include income statements, tax records, and details of accounts or beneficiaries.

Once you've organized your documents, you can begin filling out the form. Following a systematic approach usually helps to avoid errors and ensures that each section is correctly completed.

Filling out the form

When filling out the transfer of income distribution form, each section requires careful completion. Begin with Section A, which collects your personal information. Provide accurate contact details to avoid any issues later on.

Section B addresses income details, where you will enumerate all your sources of income. Ensure that the amounts listed are current and correctly reported. Lastly, Section C is where you'll give your distribution instructions, indicating how you wish your income to be allocated.

To aid in accuracy, utilize resources available on pdfFiller for maximizing efficiency while completing this form.

Editing the form using pdfFiller

Editing your transfer of income distribution form can be effortlessly accomplished using pdfFiller. First, access pdfFiller's editing tools by logging into your account. Once inside, upload your document, and the intuitive interface will guide you through the editing process.

pdfFiller offers various editing options, such as adding text, inserting checkboxes, and even incorporating images. This flexibility ensures that your form meets all specific requirements and that adjustments can be made quickly.

Managing the completed form

Once you have accurately filled out the transfer of income distribution form, managing it efficiently is crucial. Begin by signing the form; pdfFiller offers digital signature options, allowing you to eSign securely. Digital signatures carry legal validity, preserving the authenticity of your documents.

After signing, consider your submission method. You can choose to submit the form online through pdfFiller or via postal mail. Tracking your submission can help you stay informed on its status, ensuring you’re aware of any updates or potential issues.

Storing and managing your documents

With the transfer of income distribution form completed and submitted, effective document storage becomes essential. pdfFiller's cloud storage solutions provide easy access to your documents from anywhere, ensuring you can retrieve them whenever necessary.

Organizing your documents within pdfFiller is straightforward. You can categorize forms, create folders, and utilize search features to find your documents quickly. This level of organization supports quick reference and compliance when needed.

Common issues and solutions

While filling out the transfer of income distribution form, several mistakes could hinder your submission process. Common errors include incomplete sections, incorrect income details, and lack of signatures. To avoid these issues, double-check each section for accuracy and ensure every required field is filled.

If your form gets rejected after submission, take a pro-active approach. Carefully review the rejection notice to identify the reasons for denial. Correct any mistakes noted and immediately resubmit the form. Regularly checking submission status can help you stay informed about the approval process.

Additional tools and features in pdfFiller

pdfFiller offers numerous interactive tools designed to simplify income distribution management. These tools include calculators and estimators that can assist in assessing potential tax implications of different income distributions. Utilizing visual guides and diagrams can clarify processes and help navigate complexities.

Moreover, collaborative features enable seamless teamwork. Assign roles to different team members, ensuring clear accountability. With built-in commenting and feedback systems, users can exchange ideas and suggestions, streamlining document handling.

Success stories: how pdfFiller has helped users

Numerous individuals and teams have shared success stories, illustrating how pdfFiller has transformed their documentation processes. Individual users often highlight how easily they could complete their transfer of income distribution forms, leading to seamless financial management. Testimonials emphasize the efficiency gained through the user-friendly interface of pdfFiller.

On a larger scale, teams have benefited significantly from pdfFiller's collaborative features. By streamlining document management and reducing back-and-forth communication, teams report enhanced productivity. This shift has allowed teams to focus more on strategic decision-making rather than administrative tasks.

Frequently asked questions (FAQs)

Accessing the transfer of income distribution form can be straightforward through pdfFiller. Users can simply navigate the site or utilize direct links to locate the form. Staying informed about updates also helps ensure that you are using the most current version of the form.

In terms of editing after submission, most policies regarding forms depend on specific regulations, but generally, modifications might be disallowed once the document has been officially submitted. Lastly, if you forget your login information, recovering your account is easy with password recovery steps provided by pdfFiller.

Support and customer service

For further assistance while using the transfer of income distribution form, pdfFiller offers extensive help options. Users can access helpful user guides and tutorials that cover various functionalities on the platform. These resources provide step-by-step instructions for completing documents effectively.

In addition, pdfFiller provides live chat and email support for any immediate concerns. Direct contact information for support representatives is readily available, ensuring that users can receive timely assistance when needed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit transfer of income distribution from Google Drive?

How can I send transfer of income distribution to be eSigned by others?

How do I complete transfer of income distribution on an Android device?

What is transfer of income distribution?

Who is required to file transfer of income distribution?

How to fill out transfer of income distribution?

What is the purpose of transfer of income distribution?

What information must be reported on transfer of income distribution?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.