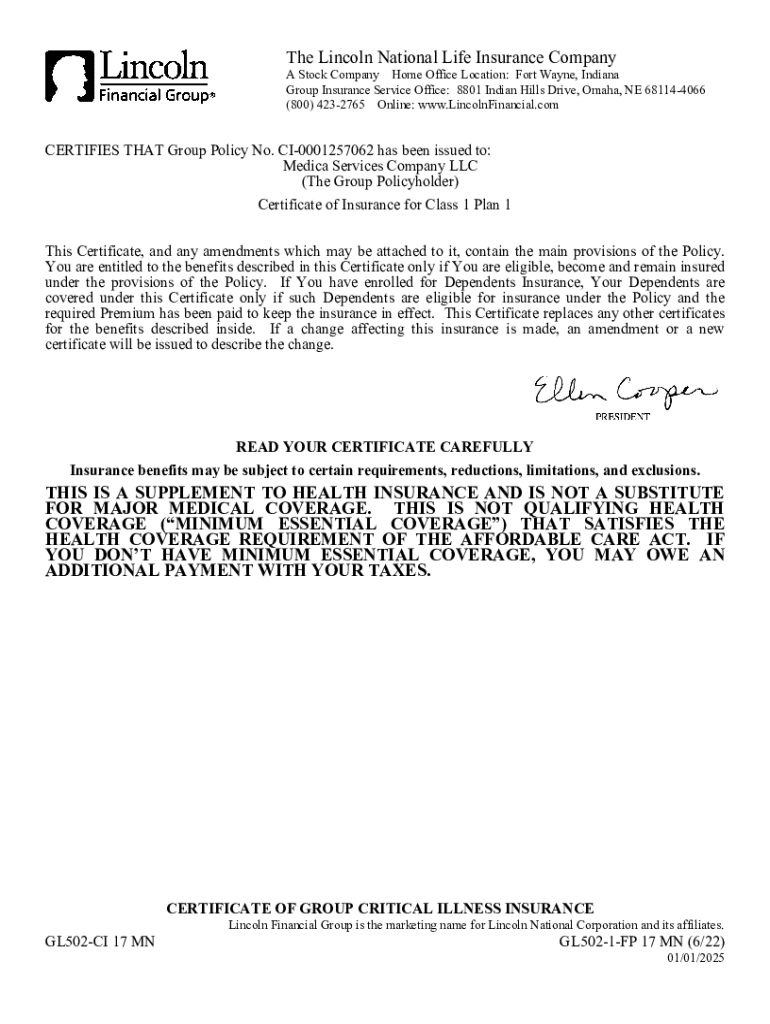

Get the free Group Critical Illness Insurance Certificate

Get, Create, Make and Sign group critical illness insurance

How to edit group critical illness insurance online

Uncompromising security for your PDF editing and eSignature needs

How to fill out group critical illness insurance

How to fill out group critical illness insurance

Who needs group critical illness insurance?

Understanding the Group Critical Illness Insurance Form: A Comprehensive Guide

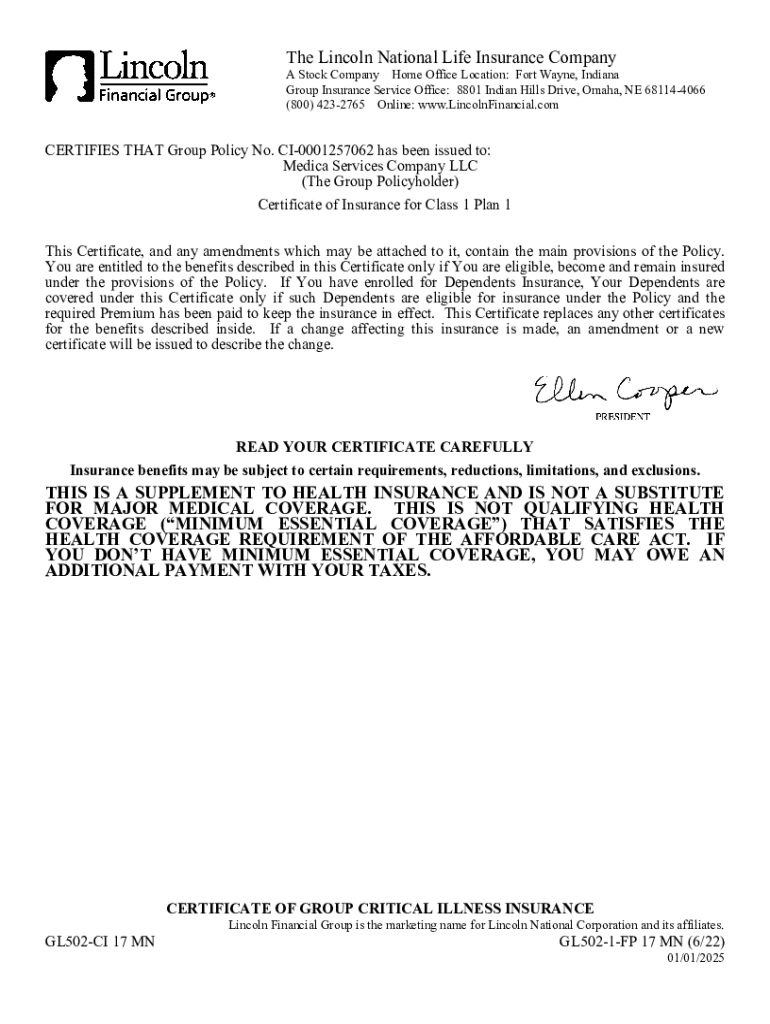

Overview of group critical illness insurance

Group critical illness insurance is a collective insurance policy offered by employers or organizations to their employees or members, providing financial protection against certain severe health conditions. It pays a lump sum benefit upon diagnosis of listed critical illnesses, supporting individuals during challenging times when they may struggle financially due to medical issues.

Planning for critical illness coverage is essential for both individuals and organizations. For employers, offering such a plan improves employee wellbeing and morale, while also acting as a recruitment and retention tool. Individuals benefit from having peace of mind and support when facing life-altering illnesses.

Understanding the group critical illness insurance form

The group critical illness insurance form is a crucial document for participants enrolling in the plan. Its primary purpose is to gather necessary information that ensures proper assessment and eligibility for coverage. Completing this form accurately is essential for a smooth claim process later on.

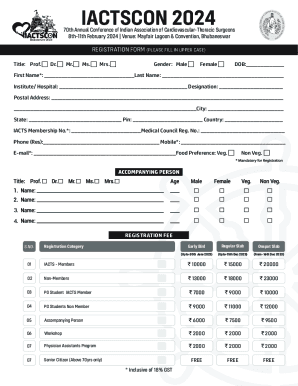

When filling out the form, specific information is typically required to gauge health risk and determine coverage. This includes personal information, medical history, and employment details.

This structured form supports the claim process by streamlining the verification of details, ensuring that claims can be processed efficiently when necessary.

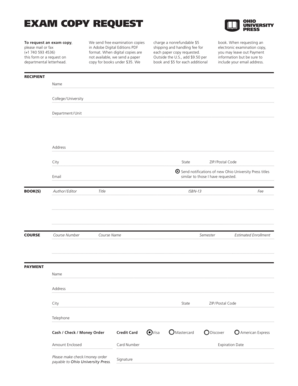

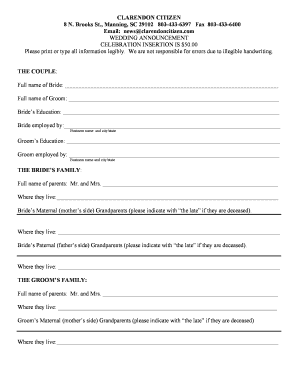

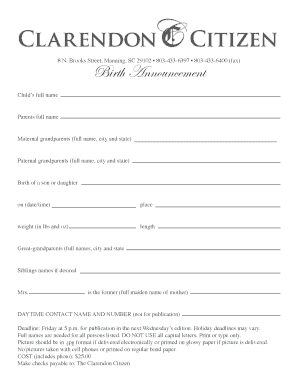

Step-by-step guide to filling out the group critical illness insurance form

Filling out the group critical illness insurance form may initially seem daunting, but it can be accomplished efficiently with the right preparation. Begin by gathering all necessary documents and reviewing the policy details provided by your employer.

When you're ready, start filling out the form carefully, section by section. Each part requires specific information that must be complete for successful submission.

For accuracy and completeness, consider utilizing tips such as highlighting essential parts of the form or keeping a checklist of required documents at hand to avoid overlooking any details.

Once completed, carefully review your responses. It's essential to double-check the information provided to catch and correct any discrepancies before submission. Utilizing pdfFiller’s editing tools can aid in making these adjustments smoothly.

When ready, submit the form through pdfFiller online, ensuring you follow the prompts for digital submission. Alternatively, check if there are other options, such as mail or fax, if needed.

After form submission

After submitting your group critical illness insurance form, you will enter the review phase. This stage is critical, as the insurer will verify the information provided to assess eligibility. Understanding the timeline for this process can help manage expectations.

Typically, the review process can take anywhere from two weeks to several months, depending on the complexity of your application and the volume of claims the insurer is processing.

Common questions & troubleshooting

Navigating the intricacies of the group critical illness insurance form may lead to questions or complications. Familiarizing yourself with common inquiries can smoothen your experience.

For instance, understanding who is eligible to submit a form is essential. Typically, only active employees or members of the group are allowed to submit.

Clarifying medical questions can sometimes be tricky; don’t hesitate to reach out to healthcare providers or the insurance company for guidance.

Final tips for success

Successfully managing your group critical illness insurance form and overall claims process hinges on understanding and utilizing the tools at your disposal. Using pdfFiller can streamline the process, making it more efficient.

Make the most of digital signatures during the submission process for added convenience. Collaborating in real-time with team members or family while preparing your submission can ensure all bases are covered.

Lastly, managing and securely storing your completed forms is crucial. Utilizing pdfFiller’s cloud-based platform allows you to access and manage your documents from anywhere with ease, maintaining an organized approach to your insurance policy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit group critical illness insurance from Google Drive?

Can I create an eSignature for the group critical illness insurance in Gmail?

Can I edit group critical illness insurance on an Android device?

What is group critical illness insurance?

Who is required to file group critical illness insurance?

How to fill out group critical illness insurance?

What is the purpose of group critical illness insurance?

What information must be reported on group critical illness insurance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.