Get the free Sec Form 17-c

Get, Create, Make and Sign sec form 17-c

Editing sec form 17-c online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 17-c

How to fill out sec form 17-c

Who needs sec form 17-c?

SEC Form 17-: Comprehensive Guide to Understanding and Managing Disclosures

Understanding SEC Form 17-

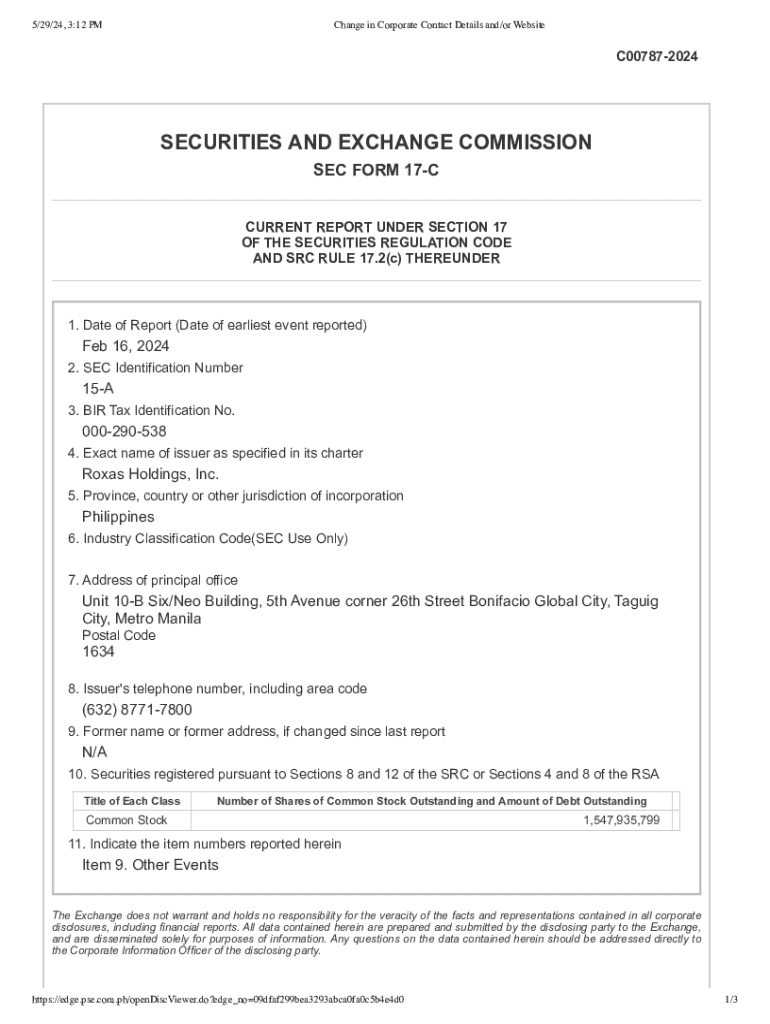

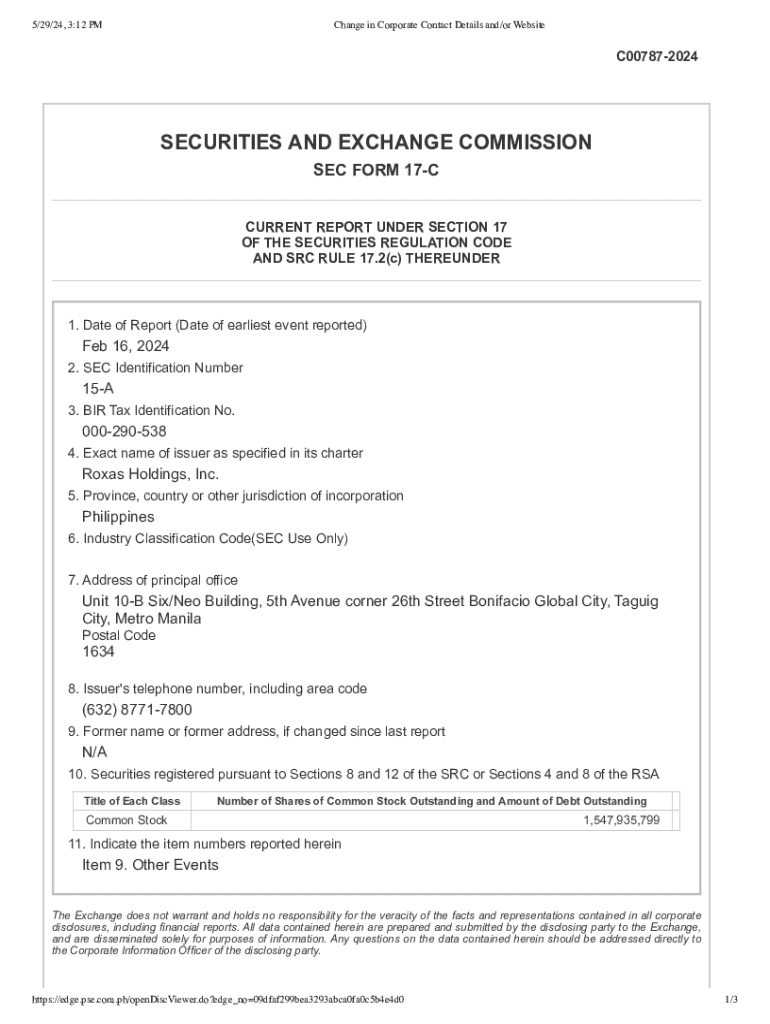

SEC Form 17-C is a crucial disclosure document mandated by the Securities and Exchange Commission (SEC) for publicly-listed companies in the Philippines. Its primary purpose is to ensure transparency by requiring the timely disclosure of material information that may affect an investor's decision-making. This obligation allows investors to have access to significant events like mergers, acquisitions, or any changes in executive leadership, ensuring a fair and equitable trading environment.

The importance of timely disclosures like SEC Form 17-C cannot be overstated. Not only do these disclosures aid in maintaining investor trust and market integrity, but they also ensure compliance with legal obligations. Companies are required to file these reports immediately after the occurrence of events that could materially influence a company’s stock price or operational standing, thus adhering to the principle of full and fair disclosure.

Detailed breakdown of Form 17- sections

Form 17-C includes various sections that provide a comprehensive structure for companies to report necessary information. This structure helps filers to organize their disclosures efficiently. Understanding these sections is essential for accuracy and completeness.

General information for filers

Who needs to file SEC Form 17-C? Primarily, any publicly-listed company in the Philippines must file this form. This requirement extends to other entities as specified by the SEC, such as those with securities registered under the SEC. The filing deadlines vary based on the nature of the event but generally require immediate disclosure following a material event or change.

Current report requirements

Various events require disclosure on Form 17-C, including but not limited to mergers and acquisitions, management changes, and significant regulatory developments. Companies must determine the materiality of each event to know whether to file. The threshold for reporting material events is typically driven by the potential impact on stock prices and investor perception.

Issuer information and securities details

When completing this section of Form 17-C, it’s critical to provide accurate details such as company name, SEC registration number, and relevant securities information. Common mistakes include misreporting figures or omitting essential identifiers. These inaccuracies can lead to unnecessary inquiries from the SEC, or worse, penalties for non-compliance.

Nature of the reportable event

The nature of the reportable event must be clearly articulated in the filing. This includes categorizing the event and providing supporting information or documents when necessary. Events can be classified into categories such as routine operational changes or significant strategic shifts. Examples include announcing a new product line or changes in ownership.

Step-by-step instructions for filling out SEC Form 17-

Filling out SEC Form 17-C requires careful preparation to ensure compliance and accuracy. Companies should follow a systematic approach to guarantee all necessary information is covered before submission.

Pre-filing preparation

Prior to filing Form 17-C, companies must gather all relevant information related to the reportable event. This may include board meeting minutes, financial statements, or other supporting documentation. Documentation will not only streamline the filling process but can also enhance the quality of disclosures made.

Understanding and selecting the appropriate filing software is another essential step. Platforms like pdfFiller streamline the process, allowing for easy editing, collaboration, and e-signature capabilities.

Completing the form

When filling out Form 17-C, it’s crucial to follow a structured approach for accuracy. This includes carefully transitioning through each section while ensuring all entries are complete and correct. Engaging multiple team members in this process may help capture different perspectives and reduce oversight.

Reviewing and editing your submission

Using pdfFiller’s editing tools allows teams to collaborate effectively before the final submission. Major focus should be placed on consistency and clarity, as this affects investor perception. Ensure that all data is cross-verified and that the document is free of typographical errors.

Best practices for managing SEC disclosures

Effective management of SEC disclosures is fundamental for maintaining compliance and investor relationships. Public companies should adopt best practices that promote regular review of compliance policies and a proactive stance towards filing updates.

Maintaining compliance

Regular reviews of compliance policies are necessary to ensure that companies are up-to-date with SEC requirements. Establishing a schedule for filing updates could enhance responsiveness, allowing the company to adapt to any regulatory changes promptly.

Leveraging pdfFiller’s features for document management

pdfFiller offers a comprehensive suite of tools that empower users to manage document workflows efficiently. eSigning capabilities ensure timely approvals, while collaborative tools facilitate team input, boosting overall productivity.

Preparing for investor relations and public scrutiny

Crafting clear and comprehensible reports is vital—not just for regulatory adherence, but also for fostering positive investor relations. Companies should develop strategies for managing public relations effectively after disclosures, ensuring that they are perceived positively in the wake of important announcements.

Interactive tools and resources

To facilitate the filing process, companies can access various interactive tools and resources that assist in accurately completing SEC Form 17-C. These resources include fillable templates, FAQs, and regulatory updates.

Fillable templates for SEC Form 17-

Using interactive forms offers several advantages. These templates guide users step-by-step through the filing process while ensuring accuracy and completeness. pdfFiller provides easy access to these types of templates, greatly enhancing the user experience.

FAQs and troubleshooting common issues

Addressing frequently asked questions can help demystify the filing process for new filers. It’s common to encounter issues related to documentation or submission timelines. Companies should ensure their teams are aware of supportive resources for resolving typical filing issues promptly.

Updates on regulatory changes affecting SEC Form 17-

Staying informed about regulatory changes impacting SEC Form 17-C is essential. Companies can utilize pdfFiller’s update notifications to ensure they’re always aware of the latest requirements, enhancing compliance.

Related forms and document management solutions

In addition to SEC Form 17-C, companies should be aware of other relevant SEC filings. Integrating document solutions like pdfFiller can significantly improve the overall efficiency of managing multiple forms and documents, allowing teams to streamline their workflows.

User experience with pdfFiller

User feedback demonstrates that pdfFiller has remarkably improved compliance and filing efficiency. Success stories highlight how teams have benefited from centralized document management and enhanced collaborative efforts.

Features highlight: cloud-based access and security

The ability to access documents from any location through cloud-based solutions empowers teams working across different regions. Additionally, pdfFiller prioritizes security, ensuring that users have peace of mind when managing sensitive information.

Contact information for further assistance

For additional support, pdfFiller users can easily reach out to customer support for guidance on form-specific questions. Utilizing community forums and knowledge bases can also provide valuable insights into common issues or challenges.

Professional consultation services

In complex cases, companies may benefit from engaging legal or compliance professionals. Partnering with experts can help ensure best practices are implemented, ultimately safeguarding the company’s compliance and integrity in disclosures.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit sec form 17-c online?

How do I fill out sec form 17-c using my mobile device?

How do I fill out sec form 17-c on an Android device?

What is sec form 17-c?

Who is required to file sec form 17-c?

How to fill out sec form 17-c?

What is the purpose of sec form 17-c?

What information must be reported on sec form 17-c?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.