Get the free 2023 Annual Report

Get, Create, Make and Sign 2023 annual report

Editing 2023 annual report online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2023 annual report

How to fill out 2023 annual report

Who needs 2023 annual report?

2023 Annual Report Form: A Comprehensive How-To Guide

Understanding the 2023 annual report form

The 2023 annual report form is a crucial document that provides a comprehensive overview of a business's financial health and operational accomplishments over the past year. Its primary purpose is to inform stakeholders, including investors, regulators, and the general public, about the company’s activities, financial condition, and future outlook. Fulfilling this reporting obligation is vital for maintaining transparency and compliance within the business landscape.

The importance of the 2023 annual report form cannot be overstated. Not only does it serve regulatory purposes, but it also plays a critical role in shaping the company’s narrative on its achievements, challenges, and strategic direction. The form includes key features such as financial statements, management discussions, and governance structures, allowing stakeholders to make informed decisions based on the company’s reported performance.

Who needs the 2023 annual report form?

Filing the 2023 annual report form is mandated for various entities involved in business operations. Primarily, business owners and operators are responsible for submitting this report, which is critical for maintaining the legitimacy of their business and ensuring transparency with stakeholders. Corporations, limited liability companies (LLCs), and non-profit organizations are among the key players required to file.

The preparation of the annual report often necessitates collaboration among several teams within an organization. Financial departments are typically tasked with compiling and presenting financial data, while compliance teams ensure that all regulatory requirements are met. This teamwork is essential in producing an accurate and comprehensive submission.

Key dates and deadlines for filing

For 2023, deadlines for filing the annual report vary by state and must be adhered to strictly to avoid penalties. Most states typically require the report to be submitted within a few months after the close of the fiscal year. For businesses operating on a calendar year, this usually means that the annual report must be filed by April 15, 2023, but businesses should verify specific local regulations to confirm exact deadlines.

Late submissions can have significant repercussions, including hefty fines and potential lawsuits for non-compliance. State-specific variations can also impact filing requirements, including differing fees or additional documentation necessary per jurisdiction.

Step-by-step instructions for completing the 2023 annual report form

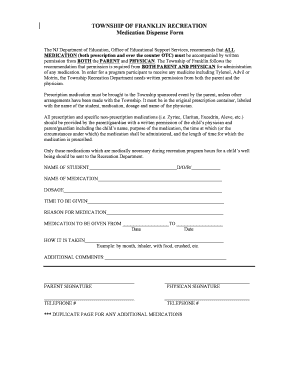

Completing the 2023 annual report form requires careful preparation and organization. Begin by gathering essential information, such as the most recent financial statements. Have your Tax ID and relevant business structure details ready, as these are critical components of the report.

Breaking down the sections of the form is essential for clarity and accuracy. The company overview section typically summarizes the entity's mission, key accomplishments, and significant challenges faced throughout the year. Following this, financial performance metrics must be presented, showcasing key indicators such as revenue, profits, and growth figures. Lastly, include governance information that provides insights into the board's structure and any changes in leadership.

Tools and resources for filling out the annual report form

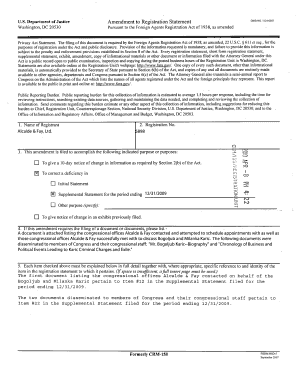

Leveraging digital tools can significantly streamline the process of filling out the 2023 annual report form. pdfFiller is an exceptional resource for seamless document management, enabling users to edit PDFs effortlessly and collaborate with team members in real-time. This platform supports interactive features to ensure that all necessary parties can contribute effectively without confusion.

The interactive tools available for financial calculations can help refine the accuracy of reported figures, while readily accessible templates and sample reports serve as helpful guides during the document preparation phase. By utilizing these resources, teams can minimize errors and ensure an organized approach to completing the form.

eSigning and submitting the annual report form

As businesses increasingly move towards digital platforms, the significance of eSigning for legal compliance has surged. Using pdfFiller, you can eSign your report efficiently, ensuring that all necessary signatures are obtained without the hassle of printed documents. eSigning your report not only streamlines the submission process but also enhances the document's validity and integrity.

To eSign your report with pdfFiller, follow these simple steps: Upload your completed annual report form, select the eSign feature, and place your signature where required. Best practices include ensuring that all team members review the document before signing to avoid any discrepancies or misunderstandings.

Managing your annual report documentation

Once submitted, managing your annual report documentation becomes essential for future reference and compliance checks. Organizing reports in a dedicated folder, whether physically or digitally, can ensure easy access whenever required. Regularly tracking the submission status is equally important; many states provide online tools allowing users to verify if their report has been processed.

Maintaining records not only helps with future filings but also serves as a basis for strategic conversations within the organization. This practice not only fosters accountability and transparency but fundamentally influences your business planning and forecasting strategies for years to come.

Reflecting on your annual report: Analyzing and utilizing insights

Post-submission reflection on the annual report is crucial for fostering a culture of continuous improvement. Analyze the insights gained from the report, identifying areas of strength and opportunities for growth. This not only aids in strategic decision-making but also informs stakeholders about the company's trajectory moving forward.

Moreover, reporting trends offer valuable data for preparing for next year’s filing. Continuous analysis of performance metrics highlights shifts in market conditions, consumer behavior, and operational efficiency, allowing organizations to proactively adjust their strategies to align with learning from the previous year's experience.

FAQs about the 2023 annual report form

Navigating the complexities of filing the 2023 annual report form can lead to various questions. Common queries relate to specific filing requirements, such as who must submit, when reports are due, and what resources are available for assistance during the filing process. Furthermore, troubleshooting issues that may arise during submission is a frequent concern.

Your state’s regulatory office can provide clarity on questions regarding deadlines, required forms, and issues encountered during submission. Keeping a list of frequently asked questions handy can prepare your team for a smooth filing process.

Related forms and templates to consider

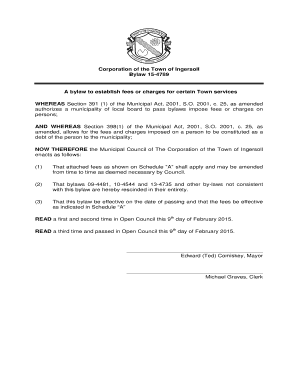

In addition to the 2023 annual report form, businesses may need to consider related documents that complement their annual reporting obligations. Similar reporting forms, such as quarterly financial statements and audit reports, can offer additional insights into the financial health of the organization.

Financial statement templates and compliance templates may also be valuable resources in ensuring that key compliance measures are met while preparing for the next submission cycle. Organizations should remain vigilant about understanding the types of reports required by law and how best to prepare them.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 2023 annual report directly from Gmail?

How do I complete 2023 annual report online?

How do I make edits in 2023 annual report without leaving Chrome?

What is annual report?

Who is required to file annual report?

How to fill out annual report?

What is the purpose of annual report?

What information must be reported on annual report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.