Get the free Minutes of the Salary Board Meeting

Get, Create, Make and Sign minutes of form salary

Editing minutes of form salary online

Uncompromising security for your PDF editing and eSignature needs

How to fill out minutes of form salary

How to fill out minutes of form salary

Who needs minutes of form salary?

Understanding Minutes of Form Salary Form

Understanding salary forms

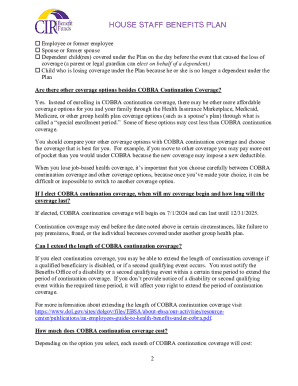

Salary forms serve as formal documentation of an employee's compensation package. They play a pivotal role in ensuring transparent communication between employers and employees regarding their earnings. Accurate salary documentation is essential for compliance, budgeting, and financial planning within an organization. Various types of salary forms exist, including employee salary statements, payroll forms, and tax withholding forms, each tailored to fulfill distinct needs.

The role of these forms cannot be overstated, as they protect both employees and employers. Employees depend on their salary forms for clarity about their pay structure, while employers use them for record-keeping and legal compliance. Well-maintained salary forms ensure that financial disputes are minimized and that everyone involved understands their responsibilities.

Key elements of salary forms

A comprehensive salary form contains several key pieces of information critical for its efficacy. At the most basic level, the form must include employee details like their name, ID, and job title. These elements help to identify the person receiving the salary and link it to the organization’s payroll system.

Furthermore, the salary form should include tax information, which denotes withholding allowances that might apply to the employee. It's essential for clarity on what portion of the salary will be deducted for taxes. Additionally, any benefit contributions, such as health insurance and retirement plans, must be documented to reinforce an understanding of total compensation.

Filling out the minutes of salary form

Filling out a salary form can seem straightforward, but attention to detail is crucial. Begin by gathering all necessary information, ensuring that you have personal and employment details at hand for accurate completion. It’s vital to double-check which specific salary components apply to that particular employee.

Best practices for managing salary forms

Effective management of salary forms involves regular updating and strict attention to accuracy. Organizations must ensure that salary forms are reviewed periodically to reflect any changes in an employee’s role, pay structure, or tax laws. Confidentiality is another crucial aspect; securing storage for these documents is essential to protect sensitive employee information.

Adopting a digital platform can greatly enhance the accessibility and management of salary forms. Cloud-based solutions like pdfFiller streamline processes, allowing for easy data entry, tracking changes, and secure sharing. This ensures that all stakeholders can access the most current employee compensation records while maintaining necessary confidentiality.

Common mistakes to avoid

Several pitfalls can arise when managing salary forms. One common mistake is neglecting to include essential details, which can lead to confusion during payroll processing. Accuracy in calculations, particularly concerning taxes and deductions, is paramount to avoid compliance issues or over/underpayment of employees.

Legal and compliance considerations

With ongoing changes in labor laws and regulations, ensuring compliance in salary documentation is imperative. Organizations must familiarize themselves with laws surrounding salaries, taxes, and employee rights to avoid severe repercussions. Failure to adhere to these regulations may result in audits, penalties, or legal action.

Proper documentation practices not only shield your organization legally but also foster trust and transparency with employees. Highlighting the significance of compliance ensures that employees feel confident in their remuneration and that they are being treated fairly by their employers.

Salary form templates and examples

Having access to standardized forms can streamline the process of salary documentation. Various templates are available that cater to different salary structures and organizational needs. These templates ensure consistency across the board and make it simpler for human resources teams to manage paperwork effectively.

Interactive tools and resources

Utilizing online calculators can significantly enhance accuracy in estimating salaries and deductions. Many platforms provide interactive salary form examples, allowing users to practice filling them out in a simulated environment. These resources ensure that users feel more confident in managing their salary documentation.

Moreover, accessing cloud-based storage solutions enables teams to collaboratively manage forms. This not only streamlines access but also contributes toward maintaining accurate records, which are crucial for regulatory compliance and strategic planning.

Collaboration and feedback on salary forms

Encouraging team collaboration can significantly impact the quality of salary forms. By involving several team members in the preparation process, organizations can harness diverse perspectives, which enhance the quality and accuracy of the documentation.

Collecting feedback is equally important. Continuous improvement in salary form templates contributes to clarity and better understanding among employees. Revising forms based on user input ensures that they remain functional and effective tools in managing salary information.

Managing changes and updates to salary forms

Salary forms may need to be revised periodically, especially when there are changes in an employee’s compensation structure or tax laws. It is vital that organizations have a clear protocol for updating salary forms to ensure that all records are current and accurate.

Communicating changes effectively to stakeholders is essential to maintain transparency and trust. Make sure everyone involved understands any updates to the salary documentation practices and how they may be affected.

Empowering users with pdfFiller

pdfFiller stands out as a powerful tool designed for managing salary forms efficiently. With its features for editing PDFs seamlessly, users can modify forms directly online and avoid cumbersome paperwork. Additionally, the eSignature capabilities facilitate quick approvals, essential in fast-paced work environments.

The collaboration tools provided by pdfFiller allow team input and review processes to be managed fluidly. Cloud-based access means that these features are available from anywhere, empowering users to take charge of their salary form management with ease and confidence.

Conclusion and further learning

Understanding the significance of minutes of form salary form and related documents is crucial for individuals and organizations alike. By exploring the various templates available via pdfFiller, users can find the right fit for their needs and stay updated on changes in salary-related documentation practices.

Emphasizing ongoing learning and adaptation is key for effective salary management, empowering users to streamline their processes while ensuring legal compliance and organizational efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find minutes of form salary?

How do I edit minutes of form salary straight from my smartphone?

How do I complete minutes of form salary on an iOS device?

What is minutes of form salary?

Who is required to file minutes of form salary?

How to fill out minutes of form salary?

What is the purpose of minutes of form salary?

What information must be reported on minutes of form salary?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.