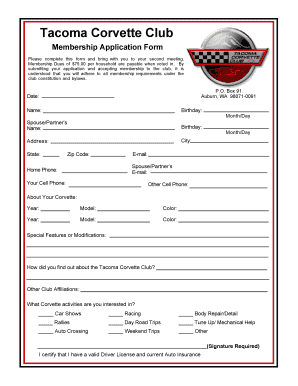

Get the free Schedule 14a

Get, Create, Make and Sign schedule 14a

Editing schedule 14a online

Uncompromising security for your PDF editing and eSignature needs

How to fill out schedule 14a

How to fill out schedule 14a

Who needs schedule 14a?

A comprehensive guide to Schedule 14A form

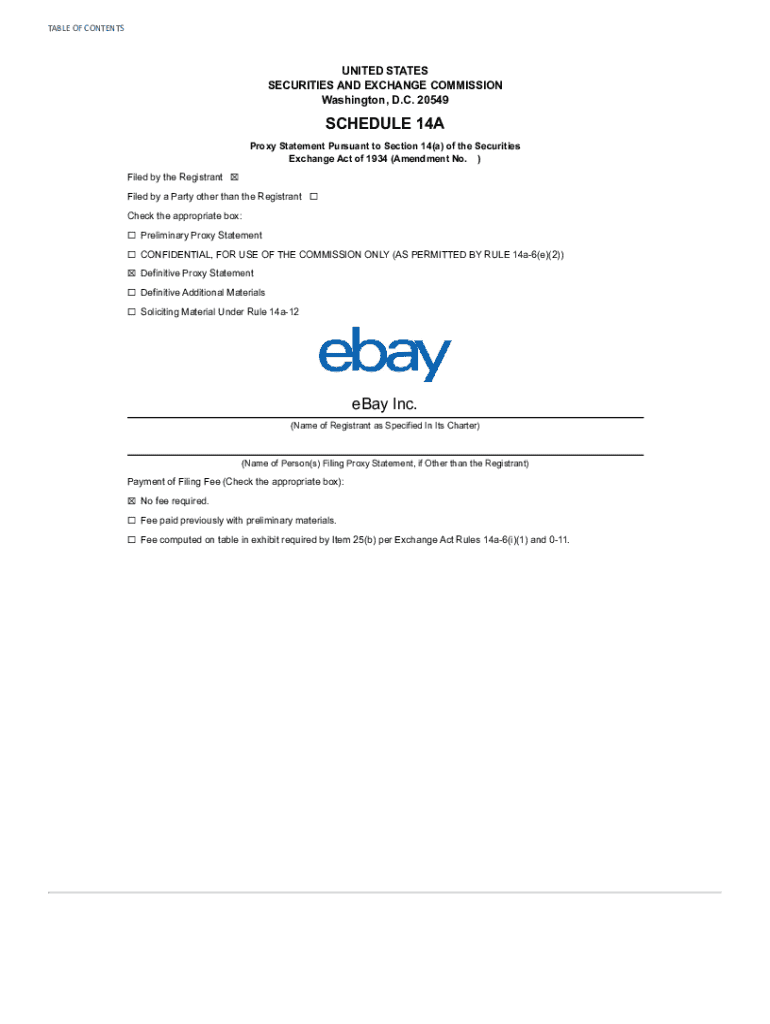

Understanding the Schedule 14A form

The Schedule 14A form is an essential document required by the U.S. Securities and Exchange Commission (SEC) that allows publicly traded companies to solicit shareholder votes on matters such as electing directors, approving executive compensation, and other corporate governance issues. The purpose of this form is to ensure that shareholders receive detailed information before making decisions during annual meetings or when special votes arise.

This form plays a crucial role in enhancing transparency and corporate accountability. By providing shareholders with comprehensive information, it enables informed voting that influences corporate governance and strategic decisions. Companies are obligated to file Schedule 14A when they conduct a proxy solicitation, offering vital insights into corporate operations, thereby empowering investors.

Key components of Schedule 14A

Schedule 14A comprises several key elements that collectively provide shareholders with the information necessary to make informed decisions. Understanding these components is vital for both filers and shareholders. A breakdown includes:

Visual examples of these components can significantly aid in comprehension. For instance, proxy statements may include a detailed agenda and resolutions, while shareholder proposals could highlight the proposed changes an investor wishes to see implemented.

Filing requirements and deadlines

Filing a Schedule 14A form comes with specific requirements and deadlines that must be adhered to strictly to avoid penalties. The traditional timeline for annual filings is usually set around the time of the company’s annual meeting. Companies must file the Schedule 14A at least 20 days before the meeting to allow shareholders adequate time to review the information.

Certain situations may require expedited filings. For example, if there are significant corporate actions or a large shareholder proposal, the SEC may require a quick turnaround on the 14A filings. Companies must remain vigilant about compliance, as failure to meet filing requirements can result in investigations, penalties, or even trading halts.

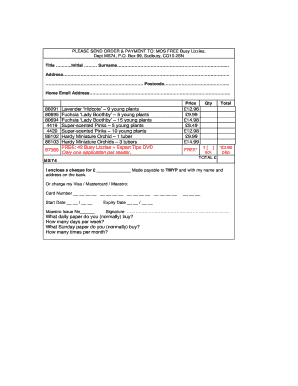

Step-by-step guide to completing Schedule 14A

Completing the Schedule 14A form can seem daunting, but with a clear step-by-step approach, any corporate secretary or compliance officer can handle it. Start by preparing for the filing process. Gather all necessary information, such as the agenda for the meeting, details about director nominees, and compensation for executives. It’s also imperative to understand the disclosure obligations towards shareholders.

While filling out the form, ensure careful attention to detail in sections like Proxy Information and Executive Compensation. Clarity is paramount; avoid jargon, and use straightforward language to explain the proposals clearly. Common mistakes include failing to provide sufficient details or missing shareholder resolution language, which can lead to delays in approval.

The SEC review process

Upon submission of Schedule 14A, the SEC undertakes a review process. This review typically involves evaluating the completeness and accuracy of the disclosures, potentially leading to requests for additional clarification or amendments. The timelines for SEC reviews can vary, but companies should expect feedback within a few weeks after filing.

Responding to SEC comments is a critical step; companies must act swiftly to address any issues raised. For instance, if the SEC requests clarification on executive compensation details or shareholder proposals, an efficient response can mitigate delays and potential compliance concerns. Real-world case studies highlight significant amendments requested by the SEC, illustrating both the importance and complexity of the review process.

Impact on corporate governance and investor relations

The Schedule 14A form significantly impacts corporate governance by enhancing transparency and promoting accountability within publicly traded companies. This transparency is crucial for improved shareholder engagement, as providing clear and comprehensive disclosures fosters trust between management and investors. Companies can no longer afford to keep shareholders in the dark about decision-making processes.

Effective filings can strengthen investor relations. Companies that communicate important proposals effectively are likely to experience increased shareholder support, which can bolster stock performance. To improve investor relations, companies need to adopt distinctive practices like regular communication of their corporate strategies through these filings.

Interactive tools and resources

Leveraging tools like pdfFiller can vastly simplify the process of completing and managing your Schedule 14A filings. Users can access templates and samples for the Schedule 14A form, which helps streamline preparations. Utilizing digital tools enhances the filing process, allowing for easy edits and eSigning options from anywhere.

Collaborating on submissions can also become easier with platforms like pdfFiller. The platform allows team members to work together on documents, ensuring accuracy and completeness before submission. Additionally, frequent FAQs about the platform guide users through the intricacies of using it for Schedule 14A filings.

Case studies and insights

Analyzing significant Schedule 14A filings can provide valuable lessons for all stakeholders. Companies often showcase innovative governance practices or respond to shareholder demands through these filings. For example, a notable case involved a company that altered its executive compensation structure based on shareholder feedback, ultimately leading to increased approval rates for board proposals.

Through examining case studies, trends in Schedule 14A filings can be identified, revealing best practices that enhance corporate governance. Understanding these trends helps companies align their operations more closely with shareholder expectations.

Related forms and resources

Schedule 14A does not exist in isolation; it is part of a broader framework of SEC filings. Other significant forms include the 10-K, which provides an annual report on the company’s financial performance, and DEF 14A, which contains additional proxy materials. Understanding how these forms interrelate can provide greater insight into a company’s governance landscape.

Resources for ongoing education in corporate governance are abundant. Workshops, webinars, and online courses can enhance understanding of these processes, ensuring that corporate professionals are well-equipped to handle their responsibilities effectively.

Conclusion and further learning

Engaging with corporate governance topics is not just about compliance—it's about driving effective corporate actions that help foster shareholder trust. Utilizing tools and platforms such as pdfFiller empowers users to manage documents and filings with ease. Staying updated on SEC guidelines and best practices remains critical for corporate officers and legal teams.

The value of effective documentation and transparent communication cannot be overstated in today’s corporate environment. By making informed presentations through Schedule 14A filings, companies not only adhere to regulations but also promote positive relationships with their investors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit schedule 14a on a smartphone?

How do I fill out schedule 14a using my mobile device?

How do I edit schedule 14a on an Android device?

What is schedule 14a?

Who is required to file schedule 14a?

How to fill out schedule 14a?

What is the purpose of schedule 14a?

What information must be reported on schedule 14a?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.