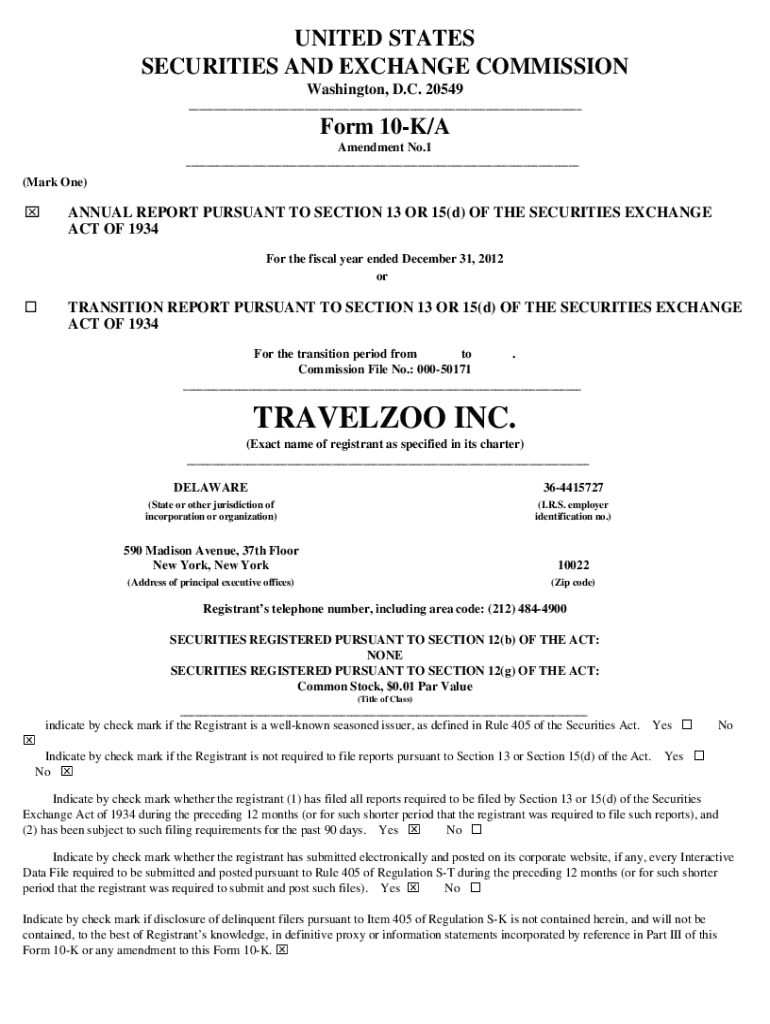

Get the free Form 10-k/a

Get, Create, Make and Sign form 10-ka

Editing form 10-ka online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-ka

How to fill out form 10-ka

Who needs form 10-ka?

Form 10-K: A Comprehensive Guide

Overview of Form 10-K

Form 10-K is a detailed annual report that publicly traded companies in the United States are required to file with the Securities and Exchange Commission (SEC). This vital document provides a comprehensive overview of a company's financial performance, business operations, risk factors, and future outlook. Fundamentally, the Form 10-K serves as a key tool for investors, analysts, and regulatory bodies to assess the health and prospects of a company.

Filing a Form 10-K is critical not only for compliance with SEC regulations but also for maintaining investor confidence. A well-prepared 10-K indicates transparency and accountability, which are crucial in building trust with shareholders and stakeholders. Additionally, the Form 10-K often contains insights into a company’s strategic direction, competitive advantages, and market dynamics which are invaluable for potential investors.

Understanding the structure of Form 10-K

The structure of Form 10-K consists of several mandatory parts, each serving a distinct purpose that contributes to the document's holistic view of the company's operations. Initially, it begins with a Cover Page and a Table of Contents, guiding readers through the various sections detailing vital information about the company.

The primary sections of a Form 10-K include various components such as the Business Overview, Financial Information, Financial Statements and Analysis, and Other Information. Each part dissects different aspects of the company's operations and financial health, allowing stakeholders to gain a nuanced understanding of its performance.

General components

Detailed section breakdown

Filing dates and requirements

Form 10-K must be filed annually, and entities are bound by strict deadlines. Typically, large accelerated filers must submit their 10-K within 60 days following the end of their fiscal year, whereas accelerated filers have a 75-day window, and all other registrants are given 90 days. It’s crucial for businesses to adhere to these timelines to avoid penalties.

Publicly traded companies, as mandated by the SEC, are required to submit Form 10-K. However, the specifics can vary based on a company's size, reporting category, and fiscal year-end date. Unlike quarterly reports (Form 10-Q), Form 10-K encompasses a much broader range of information, offering an annual snapshot of the company’s overall performance and outlook.

Key highlights from Form 10-K

Key highlights from the Form 10-K include a comprehensive overview of a company’s financial performance, particularly its revenue growth, profitability margins, and debt management. The management’s discussion and analysis (MD&A) section provides valuable insights about what the numbers really mean, offering a narrative that contextualizes the data in relation to market conditions and company strategies.

Further, the financial statements, including the balance sheet, income statement, and cash flow statement, contain detailed numerical data critical for evaluating the financial health of the company. These documents not only showcase financial metrics but also demonstrate management's effectiveness in utilizing resources and capital.

Common pitfalls in completing Form 10-K

Completing Form 10-K can pose various challenges, especially for companies navigating the intricate regulatory landscape. One common pitfall is neglecting to provide complete and accurate disclosures, particularly regarding risk factors and financial performance. Such oversights can not only mislead investors but also result in an SEC investigation.

Another issue is failing to keep the narrative engaging within the MD&A section, which should relay a compelling story of the company's journey. By avoiding generic descriptions, companies can elevate their narrative, thus enhancing investor interest and confidence.

Tools and resources for filling out Form 10-K

Utilizing interactive tools can simplify the often complicated process of filling out Form 10-K. pdfFiller offers various resources that empower individuals and teams to create, edit, sign, and manage their documents efficiently from virtually anywhere. Features like real-time collaboration enable users to work closely on the document, ensuring accuracy and coherence in the final submission.

Furthermore, the step-by-step editing process provided by pdfFiller makes navigating through the complexities of Form 10-K a breeze. This platform ensures that all required fields are addressed adequately while offering cloud storage solutions, facilitating easy access to documents for all team members.

Frequently asked questions (FAQs)

Investors and companies often have queries regarding the intricacies of Form 10-K. One common question is the difference between Form 10-K and Form 10-Q. While the 10-K provides an annual overview of a company’s performance, the 10-Q covers quarterly financial results and is less comprehensive in its disclosures.

Another frequent inquiry is about accessing previously filed Form 10-Ks. Investors and researchers can readily download them from the SEC’s EDGAR database, which archives these filings to ensure public accessibility. Additionally, after a Form 10-K is filed, companies are permitted to amend submitted forms if they discover significant omissions or errors.

Related forms and documents

Understanding how Form 10-K correlates with other SEC filings is essential for a comprehensive grasp of the regulatory landscape. For instance, Form 8-K is utilized for reporting unscheduled events or material changes that may be crucial to shareholders, contrasting with 10-K’s structured annual reporting. Moreover, Form 10-Q provides quarterly updates on financial performance.

Each of these forms delivers different layers of insight into a company’s performance, making it vital for investors to consider them in tandem. Familiarizing oneself with this interconnected set of documents enables more informed decisions regarding investments based on complete and current information.

Further learning and exploration

For those wishing to deepen their understanding of Form 10-K and its nuances, various resources are available. Video tutorials and step-by-step guides are excellent tools for visual learners, offering insights into navigating the complexities of filling out this essential document. Furthermore, case studies analyzing successful Form 10-Ks can provide practical examples of best practices in reporting.

External educational resources can supplement one's knowledge as well. By taking advantage of these learning tools, users can enhance their comprehension of the Form 10-K and the broader implications it carries for investment and regulation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my form 10-ka in Gmail?

Can I create an electronic signature for the form 10-ka in Chrome?

How do I edit form 10-ka straight from my smartphone?

What is form 10-ka?

Who is required to file form 10-ka?

How to fill out form 10-ka?

What is the purpose of form 10-ka?

What information must be reported on form 10-ka?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.