Get the free Contribution by Cheque

Get, Create, Make and Sign contribution by cheque

Editing contribution by cheque online

Uncompromising security for your PDF editing and eSignature needs

How to fill out contribution by cheque

How to fill out contribution by cheque

Who needs contribution by cheque?

A Comprehensive Guide to Contribution by Cheque Form

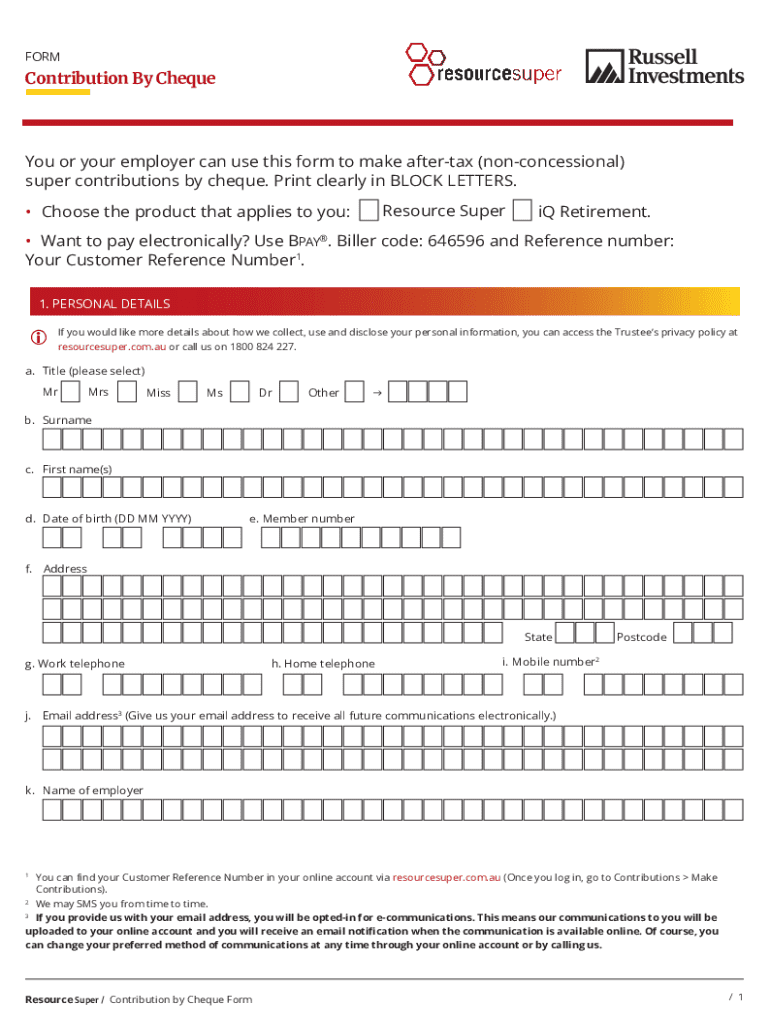

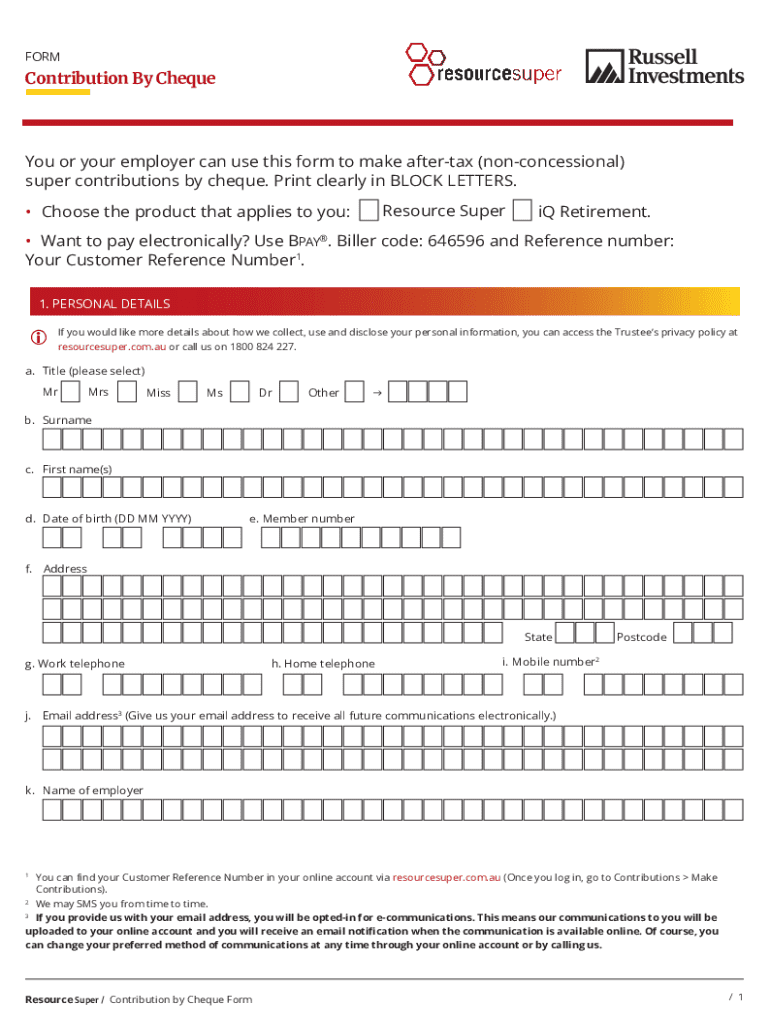

Understanding the Contribution by Cheque Form

The contribution by cheque form serves as a vital tool for individuals and organizations wishing to document financial donations effectively. This form is specifically designed to record the donor's information, the contribution amount, and other essential details, ensuring both the donor and the receiving entity have clear records.

Accurate documentation is crucial in philanthropy to maintain transparency and trust. It provides a paper trail that can be useful for tax purposes, auditing, or simply verifying contributions. Often, organizations require a contribution by cheque form when processing donations, keeping them organized and compliant with regulations.

Scenarios requiring a contribution by cheque form include charitable donations, fundraising events, and any situation where a donor wishes to track their contributions systematically.

Key elements of a contribution by cheque form

A properly filled out contribution by cheque form contains several key elements that ensure all necessary information is captured. To begin with, the required fields typically include:

Optional additions can enhance the form's utility. Donors may wish to designate specific funds for their contribution or set up recurring contributions to provide ongoing support. Additionally, a signature is typically required to validate the form.

Step-by-step instructions for filling out the form

Filling out a contribution by cheque form may seem challenging, but following a clear step-by-step guide simplifies the process. First, prepare by gathering all essential information, including personal details and the amount you wish to donate.

Double-checking these details ensures accuracy before you start filling out the form. When completing the form, follow these steps:

Once you’ve completed the form, be sure to review your submission for any errors to ensure a smooth donation process.

Editing and customizing your contribution by cheque form with pdfFiller

pdfFiller offers an intuitive platform for editing and customizing your contribution by cheque form. Accessing the form through pdfFiller is straightforward, allowing you to begin your edits in mere seconds.

Utilize tools within pdfFiller to add annotations and notes as you edit. Customizing text fields helps tailor the document to your specific requirements. Once your edits are finished, you can save your edited form for future reference, share it with others, or print it out as needed.

Signing the contribution by cheque form digitally

The trend of eSigning has transformed the document management landscape, making it convenient for individuals and organizations alike. Using pdfFiller, you can quickly sign your contribution by cheque form electronically.

Digital signatures not only enhance security but also streamline the submission process. pdfFiller ensures that your signature remains confidential while complying with legal requirements. To eSign your form, simply follow a step-by-step guide provided within the platform, ensuring your donation is officially validated.

Submitting your contribution by cheque form

Submitting the contribution by cheque form can be done using various methods, allowing flexibility based on your convenience. Choose from the following submission methods:

To ensure timely processing, be mindful of submission deadlines set by the receiving organization.

Tracking your contribution

Maintaining records of your contribution is crucial as it serves multiple purposes, from tax deductions to personal budgeting. After submitting your contribution by cheque form, it's smart to keep a copy for your records.

To confirm that your contribution has been received, follow these steps:

Being proactive about tracking your contributions helps avoid potential issues in the future.

Troubleshooting and frequently asked questions

Mistakes while filling out the contribution by cheque form are not uncommon. Some common mistakes to avoid include leaving out required fields, failing to sign the form, or using outdated forms. Regularly check with your organization to ensure you are using the most current version.

Additionally, the following frequently asked questions address common concerns related to contribution by cheque forms:

Best practices for using contribution by cheque forms

To ensure a smooth process during contributions, consider the following best practices:

Implementing these practices leads to better financial management and clear communication with charitable organizations.

Additional features of pdfFiller relevant to contribution by cheque forms

pdfFiller provides several additional features that enhance the utility of contribution by cheque forms. Collaborative editing options can be vital for teams working on group donations, allowing seamless teamwork in document preparation.

Once contributions are submitted, continuous document management through pdfFiller ensures you have access to all your forms at any time. This is particularly useful for keeping track of multiple contributions and simplifies future donation planning.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete contribution by cheque online?

How do I edit contribution by cheque in Chrome?

Can I sign the contribution by cheque electronically in Chrome?

What is contribution by cheque?

Who is required to file contribution by cheque?

How to fill out contribution by cheque?

What is the purpose of contribution by cheque?

What information must be reported on contribution by cheque?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.