Get the free Easy-pay Authorization Form

Get, Create, Make and Sign easy-pay authorization form

Editing easy-pay authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out easy-pay authorization form

How to fill out easy-pay authorization form

Who needs easy-pay authorization form?

Easy-Pay Authorization Form: How-to Guide

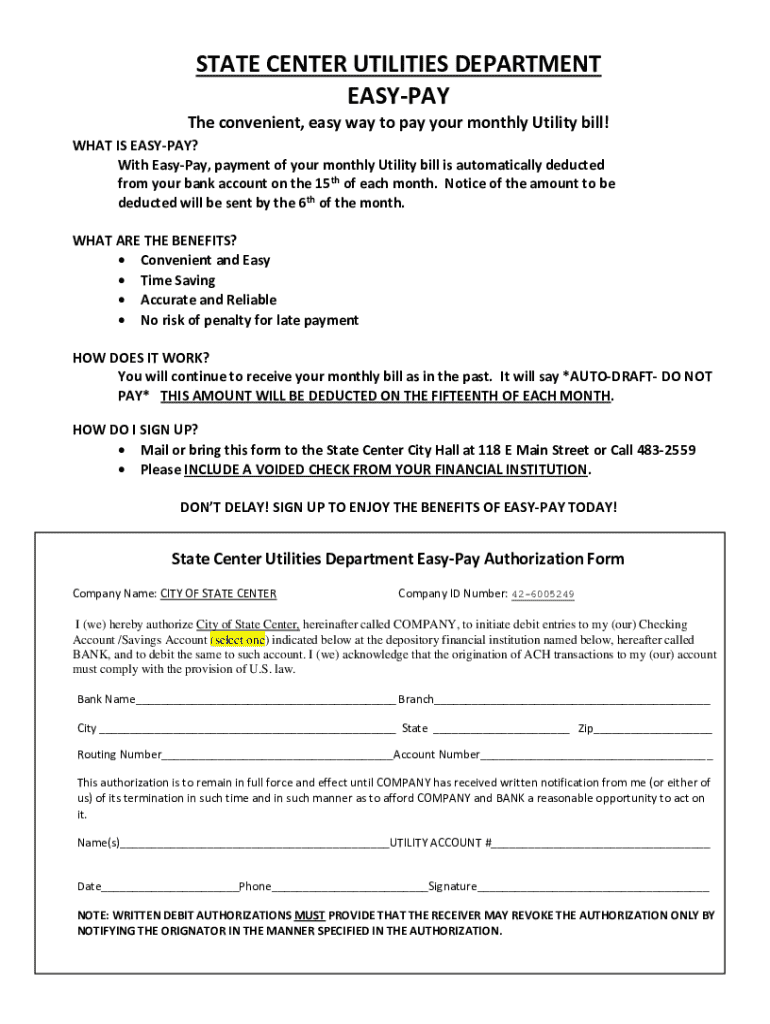

Understanding the Easy-Pay Authorization Form

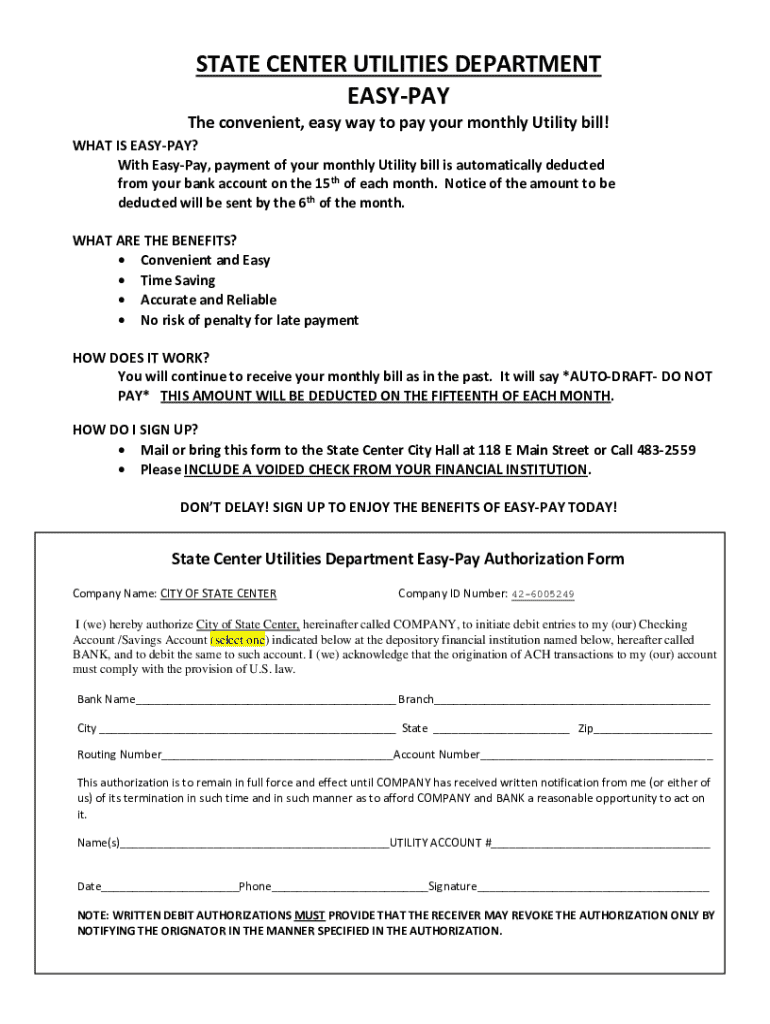

The Easy-Pay Authorization Form is crucial for facilitating automated payments efficiently and securely. This form grants businesses permission to withdraw payments directly from the designated bank account of the user on a pre-agreed basis. It streamlines the payment process, ensuring that bills are settled on time without the hassle of manual transactions.

By utilizing the Easy-Pay system, users enjoy several advantages such as timely bill payments, potentially avoiding late fees, and minimizing the risk of forgetting due dates. Additionally, this system offers peace of mind, knowing that essential bills are managed automatically.

Who needs the Easy-Pay Authorization Form?

The Easy-Pay Authorization Form is designed for a variety of individuals and organizations. Primarily, homeowners and renters use it to automate household bills such as utilities, mortgage payments, and insurance. Small business owners also find the Easy-Pay system beneficial for managing payroll and supplier invoices.

Scenarios that often necessitate this form include setting up automatic bill payments for utilities and service subscriptions, or enabling timed payments for loans and mortgages. By understanding your payment patterns, leveraging the Easy-Pay system can significantly reduce time spent managing finances.

Key components of the Easy-Pay Authorization Form

The Easy-Pay Authorization Form consists of several essential sections that ensure all necessary details are captured accurately. A typical structure includes personal information, payment information, agreement terms, and signature verification. Each segment is designed to capture specific details vital for the smooth processing of payments.

For instance, the personal information section requires the user's name, address, and contact details to identify the account holder. In contrast, the payment information section involves banking details such as account number and routing number, both of which are essential for making direct debits.

Common terminology explained

Within the Easy-Pay Authorization Form, several terms are frequently utilized, which may be unfamiliar to some users. Understanding these terms is vital for completing the form accurately and ensuring compliance with its terms.

For example, 'authorization' refers to the permission granted by the user allowing the business to withdraw funds, while 'recurring payment' denotes the establishment of regular payments over a determined period. These definitions help clarify the responsibilities and expectations tied to the agreement.

Step-by-step instructions for completing the Easy-Pay Authorization Form

Before filling out the Easy-Pay Authorization Form, certain preparatory steps are necessary. Users should gather relevant information, including their bank details, personal identification, and any existing payment agreements. This prior organization helps facilitate a smoother completion process.

For optimum efficiency, review the form layout prior to starting and ensure all documentation is readily available. Here’s a step-by-step walkthrough of how to complete the form:

Managing your Easy-Pay authorization

Once the Easy-Pay Authorization Form is completed, the next step is submission. Users have several options for sending in their form; they can choose to submit online through a secure portal or opt for traditional mail. If submitting online, always ensure that you receive a confirmation notification, which helps maintain a record of your submission.

After submission, processing times vary based on the institution but typically range from a few business days to a week. After you submit, it’s advisable to check the status of your Easy-Pay setup periodically through the service's designated contact methods or online account management options.

Troubleshooting common issues with Easy-Pay authorization

Encountering issues with your Easy-Pay Authorization can be frustrating. If your authorization doesn’t go through, the first step is to confirm that all personal and account information entered on the form is accurate. Reach out to customer support for assistance and provide any relevant details from your submission.

If you need to change or update your bank account information after authorization, it is generally permissible by merely resubmitting the Easy-Pay Authorization Form with the updated details. For cancellations, a specific process exists that typically involves notifying your bank or service provider and detailing your intent to stop payments, all of which should be done in writing.

Interactive tools and resources

To enhance your experience with Easy-Pay, utilizing interactive tools like an Easy-Pay calculator can help estimate your potential savings with automated payments. This resource allows users to project their future savings based on habitual payment patterns.

Additionally, having access to FAQs related to Easy-Pay Authorization can clarify common points of confusion and support users in navigating their agreements effectively. For those seeking more assistance, helpful links to relevant resources and customer service can streamline any further inquiries you may have regarding the Easy-Pay system.

Sign-up for Easy-Pay updates

Keeping updated with changes related to the Easy-Pay system is vital for all users. Opting into email notifications not only ensures you’re informed about any updates but also enhances your user experience by keeping you aware of new features or changes to terms.

The benefits of staying connected with updates include timely alerts about any potential disruptions to service or enhancements that could further streamline your payment process, which enhances overall financial management.

Conclusion

Navigating the Easy-Pay Authorization Form becomes significantly easier with a comprehensive understanding of its components and proper management practices. pdfFiller empowers users not only to fill out and sign these forms efficiently but also facilitates document management seamlessly through its cloud-based platform. By leveraging the capabilities of pdfFiller, users can simplify their payment processes, ensuring timely and hassle-free transactions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my easy-pay authorization form directly from Gmail?

How do I execute easy-pay authorization form online?

How do I edit easy-pay authorization form on an Android device?

What is easy-pay authorization form?

Who is required to file easy-pay authorization form?

How to fill out easy-pay authorization form?

What is the purpose of easy-pay authorization form?

What information must be reported on easy-pay authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.