Get the free Information Memorandum

Get, Create, Make and Sign information memorandum

Editing information memorandum online

Uncompromising security for your PDF editing and eSignature needs

How to fill out information memorandum

How to fill out information memorandum

Who needs information memorandum?

Your Comprehensive Guide to the Information Memorandum Form

Understanding information memorandum forms

An information memorandum form serves as a critical document in the world of finance and investment. It typically outlines the essential details about a company and its investment opportunities, providing potential investors with actionable insights that facilitate informed decision-making.

The primary purpose of this form is twofold: it delivers vital information to investors looking to understand the financial viability of the company, and it acts as a persuasive tool for companies to attract potential investors. This makes the information memorandum form a cornerstone of the investment process.

Key components of an information memorandum typically include an executive summary, a financial overview, and a market analysis, all designed to engage investors' interest from the outset.

Types of information memoranda

There are several types of information memoranda depending on the context in which they are used. Understanding these variations is vital for selecting the right format for your needs.

Each type serves specific purposes and audiences, making it essential to choose wisely based on your target investors and the context of your offering.

Preparing your information memorandum form

Creating an effective information memorandum begins with a clear understanding of your audience and their needs. Tailoring your memorandum to resonate with potential investors enhances its impact and ensures it communicates the right messages.

Gathering relevant information is crucial and should include:

Thorough research provides a solid foundation for your memorandum, bolstering the credibility of your claims and projections.

Detailed breakdown of the information memorandum’s sections

Every information memorandum features critical sections designed to present concise information. This breakdown will help you understand what to include in each segment.

Executive summary

The executive summary is vital as it provides a snapshot of your entire document. It should capture the essence of your business and investment potential.

Company overview

Provide insights into your company's mission and vision, along with its history and significant milestones. Highlight the founders and any critical achievements.

Market analysis

This section should delve into industry trends and your target market. Define customer segmentation to clarify potential growth avenues.

Financial projections

Detail your revenue model, historical financial performance, and forecasts. Investors seek clarity on expected returns and financial health.

Management and team profiles

Introduce key personnel and clarify the organizational structure, establishing credibility through proven leadership.

Risk factors and mitigation strategies

Identify potential risks associated with your company or the market, and outline how you plan to manage these risks to assure investors.

Formatting your information memorandum

Well-structured documents enhance readability and impact. It's crucial to consider design aspects when formatting your information memorandum.

Focus on:

Moreover, select a language and tone that best resonate with your target audience, striking a balance between professionalism and accessibility.

Editing and finalizing your information memorandum

After drafting your information memorandum, a thorough editing process is adaptable to maintain clarity and consistency. This step is crucial to ensure that all information flows logically.

Signs of a well-polished document include:

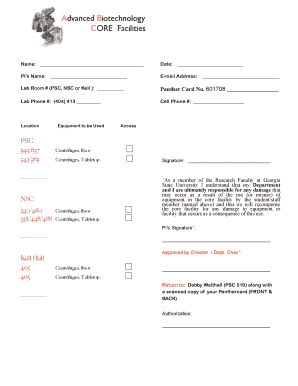

Using pdfFiller to create your information memorandum form

pdfFiller is an excellent cloud-based solution to create an information memorandum form efficiently. It allows users to edit PDFs, eSign, and collaborate seamlessly from anywhere.

The benefits include:

Transitioning to pdfFiller can enhance your document processes significantly.

Interactive tools available on pdfFiller

pdfFiller provides various interactive tools that can streamline the creation and management of your information memorandum.

Frequently asked questions

Understanding common queries surrounding the information memorandum form can alleviate concerns and enhance comprehension.

Additional insights and tips

Creating a compelling information memorandum requires attention to detail and clarity. Avoiding common pitfalls can differentiate successful documents from subpar counterparts.

Ensuring a clear and professional tone throughout enhances engagement, promoting investor interest.

Case studies

By examining successful use cases of information memorandum forms, potential lessons can be applied to future documents. Notably, real-world scenarios highlight both triumphs and failures in conveying investment opportunities.

Each scenario provides valuable insights into best practices for crafting impactful information memorandum forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify information memorandum without leaving Google Drive?

How do I execute information memorandum online?

How do I fill out the information memorandum form on my smartphone?

What is information memorandum?

Who is required to file information memorandum?

How to fill out information memorandum?

What is the purpose of information memorandum?

What information must be reported on information memorandum?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.