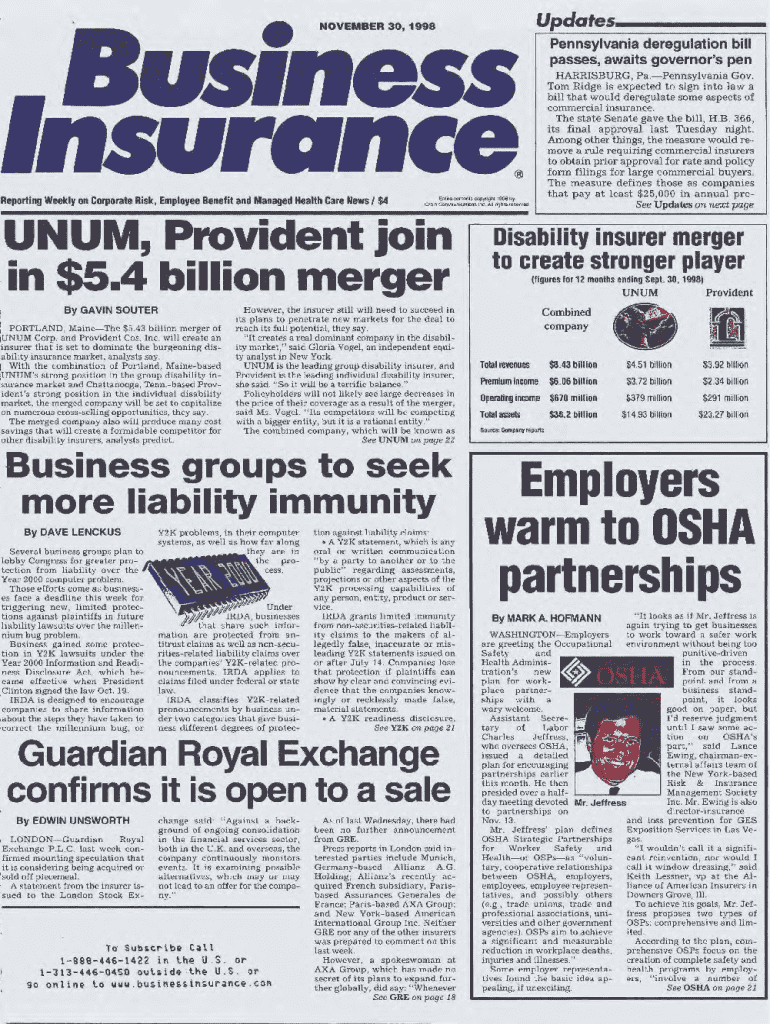

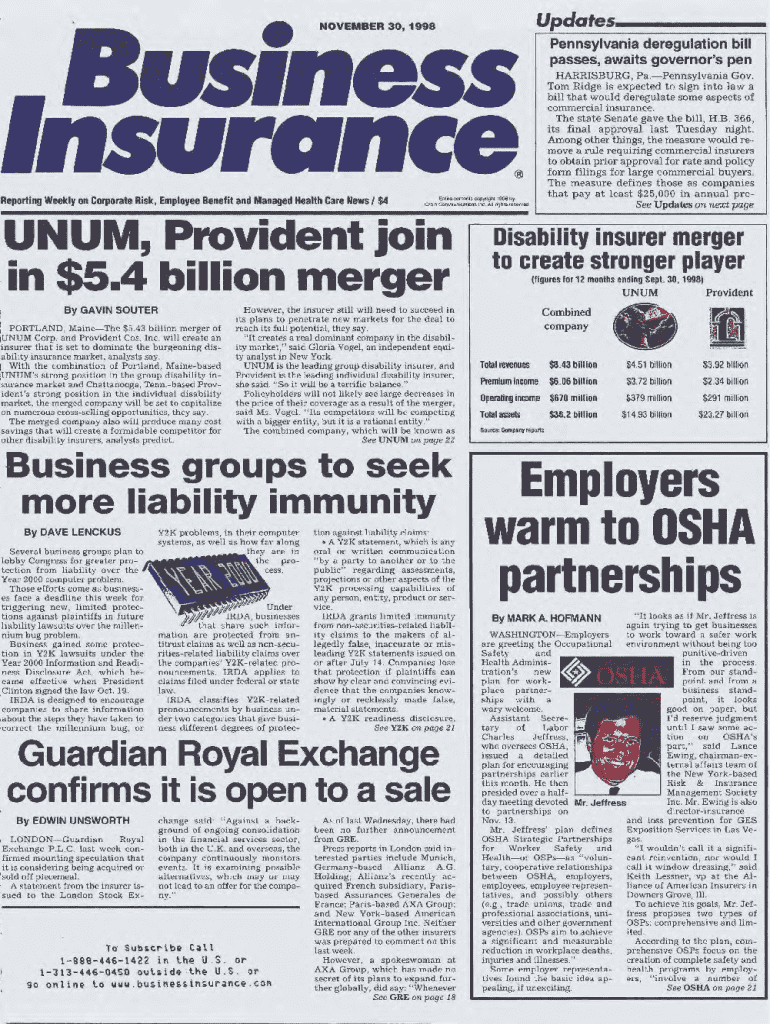

Get the free Business Insurance, November 30, 1998

Get, Create, Make and Sign business insurance november 30

How to edit business insurance november 30 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business insurance november 30

How to fill out business insurance november 30

Who needs business insurance november 30?

A Comprehensive Guide to the Business Insurance November 30 Form

Understanding the Business Insurance November 30 Form

The Business Insurance November 30 Form is a critical document required for certain businesses to report various types of insurance coverage they hold. This form helps insurance regulators maintain oversight on the market and ensure businesses are adequately protected against risks. Completing the form is not just a matter of compliance; it is an essential step in safeguarding your business assets.

Timely submission of the November 30 Form holds significant importance. Missing the deadline can result in penalties or even complications in your insurance coverage, leaving your business vulnerable. Thus, understanding the ins and outs of this form is crucial.

Who needs to complete the November 30 form?

Typically, businesses that operate in sectors requiring insurance oversight must complete the November 30 Form. This includes companies ranging from small startups to large corporations that hold specific types of insurance such as general liability, professional liability, or property insurance.

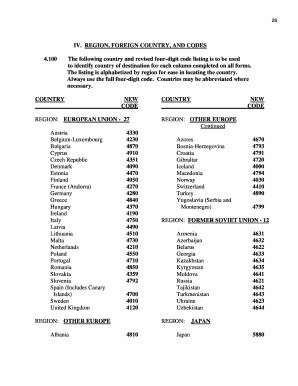

Eligibility criteria may vary based on regional regulations, but in general, all businesses with liability exposures, workers' compensation obligations, or property insurance should consider this form to ensure full compliance.

Key filing dates and deadlines

The November 30 Form is typically due by the end of November each year, and businesses should mark this date on their calendars. For organizations with a fiscal year ending different than a calendar year, there may be additional complexities to consider.

Failing to submit on time can lead to financial consequences, such as fines or increased premiums. It can also lead to a lapse in coverage, which can leave a business unprotected.

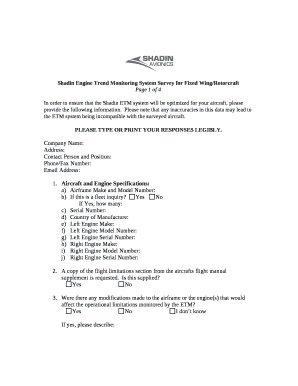

Detailed instructions for completing the form

Completing the Business Insurance November 30 Form may seem daunting, but by following a step-by-step approach, you can ensure accuracy. The initial step is to gather all necessary information, including your business's official documents and insurance policies.

pdfFiller simplifies this process through interactive tools that allow you to create, edit, and eSign your documents online. Using pdfFiller’s document creator can streamline collaboration and minimizes errors.

Managing your business insurance after form submission

Once your Business Insurance November 30 Form has been submitted, tracking its status is essential. Most insurance regulators provide online platforms where you can verify submission and review any notifications regarding your insurance status.

It's also vital to understand the terms of your revised or secured insurance policy after submission. Familiarity with your coverage limits, exclusions, and terms ensures you're not caught off guard when a risk occurs.

Renewal and modification processes

Insurance policies typically come with renewal dates that coincide with the November 30 deadline, necessitating diligent management to ensure continuous coverage. If your business needs change—whether through expansion, introducing new services, or facing increased risks—modifying your coverage is essential to keep pace with your evolving exposure.

Frequently asked questions about the November 30 form

Completing the November 30 Form can raise various concerns. One common question is how to correct any errors found after submission. If you discover a mistake, it is critical to contact your insurance provider immediately to discuss the options available for amendments.

Another concern relates to missed deadlines. If you find yourself in this predicament, prompt communication with your insurer and potentially initiating coverage retroactively may be necessary to avoid excessive penalties.

Importance of business insurance for all types of companies

Investing in business insurance is a pivotal decision that impacts nearly every aspect of operations. Insurance protects your assets from unforeseen events, offering peace of mind as you conduct day-to-day business activities.

Furthermore, good insurance serves as a risk management tool, posturing your business favorably against potential financial pitfalls.

Success stories: businesses thriving with proper insurance

Several businesses have flourished due to their proactive approach to insurance, showcasing the benefits of timely coverage and the right type of policies. For instance, a local contractor managing a series of construction projects safeguarded against liability claims by ensuring comprehensive general liability coverage and regularly updating it as projects escalated.

Another example is a tech startup that regularly reviews its professional liability insurance, enabling them to adapt their coverage to accommodate rapid growth, securing a significant client base without fearing unmanageable risks.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find business insurance november 30?

How do I fill out the business insurance november 30 form on my smartphone?

How can I fill out business insurance november 30 on an iOS device?

What is business insurance november 30?

Who is required to file business insurance november 30?

How to fill out business insurance november 30?

What is the purpose of business insurance november 30?

What information must be reported on business insurance november 30?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.