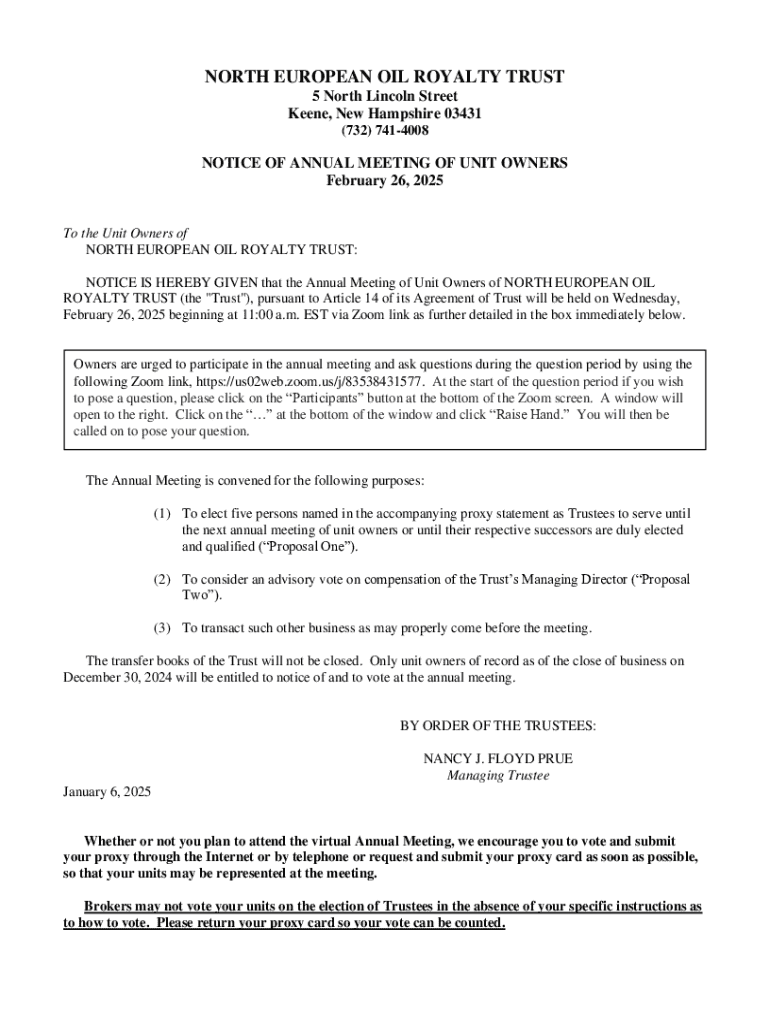

Get the free North European Oil Royalty Trust Notice of Annual Meeting

Get, Create, Make and Sign north european oil royalty

How to edit north european oil royalty online

Uncompromising security for your PDF editing and eSignature needs

How to fill out north european oil royalty

How to fill out north european oil royalty

Who needs north european oil royalty?

North European Oil Royalty Form: A Comprehensive How-To Guide

Understanding the North European oil royalty landscape

The oil royalty landscape in Northern Europe is marked by a rich history of resource extraction, primarily driven by countries like Norway, Denmark, and the United Kingdom. Historically, oil production began in the North Sea in the 1960s, which significantly reshaped the economy of these nations. The revenues generated have led to the establishment of dedicated oil funds, particularly in Norway, which invests proceeds from oil royalties into future economic stability.

Each country has developed its own set of regulations that govern oil royalty payments and reporting. Understanding these nuances is central to compliance and maximized financial returns. Royalty forms play a critical role in ensuring transparency in financial reporting and adherence to national laws, impacting not just the companies involved but also local economies and stakeholders.

Essential elements of the North European oil royalty form

A North European oil royalty form typically contains several standard fields that require precise information. Key sections include identification details of the property owner and operator, as well as financial metrics such as gross revenues and expenses incurred during the reporting period. This form needs to be completed diligently since any inaccuracies can lead to legal complications or financial penalties.

Each country has specific regulations that must be adhered to when completing these forms. For instance, in Norway, the government has stringent measures regarding the transparency of revenue reporting, while Sweden might have different thresholds for exemption. Filers often encounter common pitfalls, such as overlooking documentation requirements, which can hinder compliance efforts.

Step-by-step guide to filling out the North European oil royalty form

Successfully completing the North European oil royalty form requires meticulous preparation. Initially, gather all necessary documentation, including past financial records and any relevant agreements. Familiarizing yourself with the specific financial terms used in oil royalties can significantly ease the process.

Here’s a detailed look at each section of the form:

Editing and modifying the North European oil royalty form

Utilizing pdfFiller offers an efficient method for editing the North European oil royalty form. With its cloud-based capabilities, users can upload their forms and make necessary adjustments easily. Tools available on the platform allow for quick edits, annotations, and even field adjustments, ensuring that the document is accurate before submission.

Collaboration is streamlined with pdfFiller, enabling teams to engage in the review process effectively. Best practices for team reviews include establishing clear timelines for feedback and adopting eSignatures enabling secure and prompt approvals while keeping records straight.

Common mistakes and how to avoid them

Mistakes during the completion of the North European oil royalty form can lead to significant complications, including financial penalties or audits. Some frequent errors include misreporting revenues or expenses and failing to attach important supporting documentation.

To avoid these pitfalls, implement strategies like peer reviews and the use of checklists that outline essential requirements. Additionally, a solid understanding of localized regulations tailored to the specific country can prevent non-compliance and further complications.

Interactive tools and resources for better management

pdfFiller provides a suite of interactive tools designed to facilitate the completion and management of the North European oil royalty form. Cloud-based access allows users to work on forms from anywhere, ensuring that collaboration can take place seamlessly regardless of team members' locations.

Real-time data validation is another crucial feature, providing immediate feedback on entries and ensuring accuracy. Users can also access customer support and help centers for additional assistance when needed.

Staying updated with changes in oil royalty regulations

The regulatory landscape for oil royalties can be quite dynamic, with frequent updates that can impact filing requirements and compliance. It is important for individuals and corporations to remain educated about these changes. Government websites and industry advisories serve as valuable resources for staying informed.

Setting up alerts for regulatory updates through tech tools can ensure that you never miss essential changes. Workshops and information sessions hosted by professional associations also offer insight into evolving best practices.

Frequently asked questions about the North European oil royalty form

One common question regarding the North European oil royalty form is what to do if a filing deadline is missed. In such cases, it’s vital to immediately contact the relevant regulatory authority to inform them of the situation and seek guidance on remedial action.

Another frequently asked question concerns how to correct submitted forms if mistakes are discovered post-submission. Generally, the protocol involves submitting a corrected form along with a cover letter explaining the nature of the errors. Proper adherence to these processes helps in mitigating the potential negative impacts of errors.

Case studies and examples of successful filings

Examining real-world applications of successful oil royalty submissions can offer valuable insights. For instance, consider a Norwegian oil company that consistently meets regulatory standards through thorough documentation and proactive financial reporting. Their strategy includes utilizing automated tools for revenue tracking and expense documentation, ensuring accuracy and compliance.

Lessons learned from common difficulties faced by filers include the importance of maintaining clear records and engaging in regular training for team members on the latest regulations. This proactive approach aids in minimizing errors and averting costly penalties.

Leveraging pdfFiller for seamless document management

Consolidating your document needs with pdfFiller is strategic for streamlining processes associated with the North European oil royalty form. The platform's comprehensive suite of editing, signing, and managing tools simplifies what can often be a complex and stressful process.

Future-proofing your submission process is achievable through pdfFiller’s adaptability to evolving forms and regulations. Users can be confident that they are always utilizing the latest features and compliance standards, allowing for optimized financial reporting.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute north european oil royalty online?

Can I edit north european oil royalty on an iOS device?

How do I edit north european oil royalty on an Android device?

What is north european oil royalty?

Who is required to file north european oil royalty?

How to fill out north european oil royalty?

What is the purpose of north european oil royalty?

What information must be reported on north european oil royalty?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.