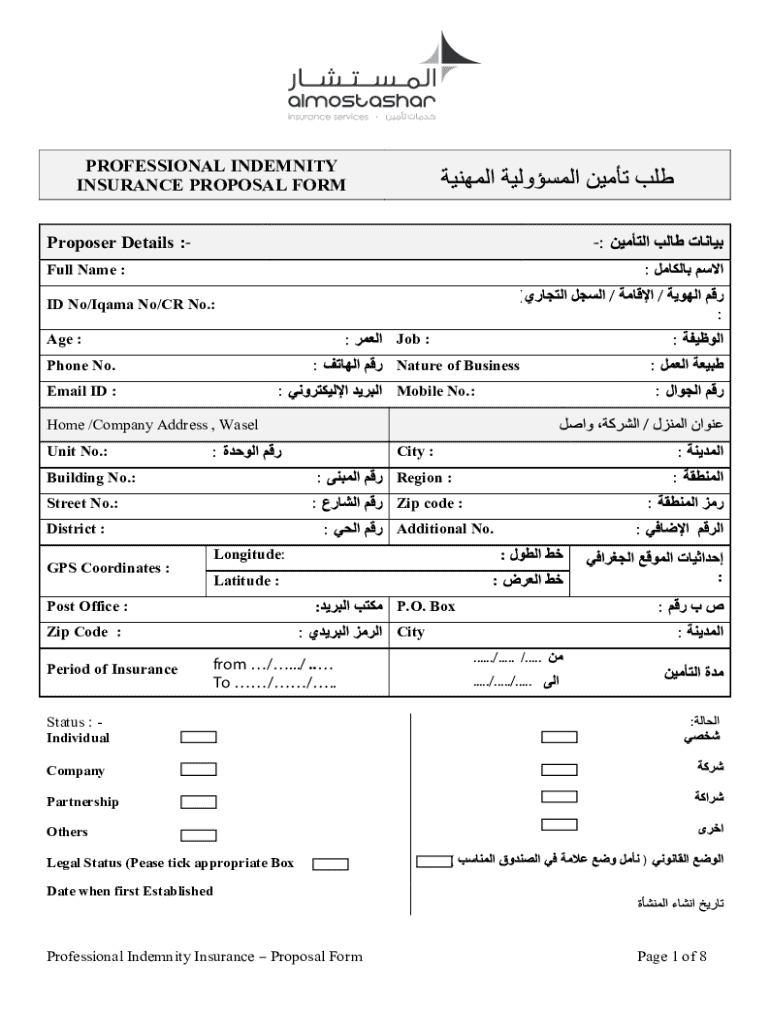

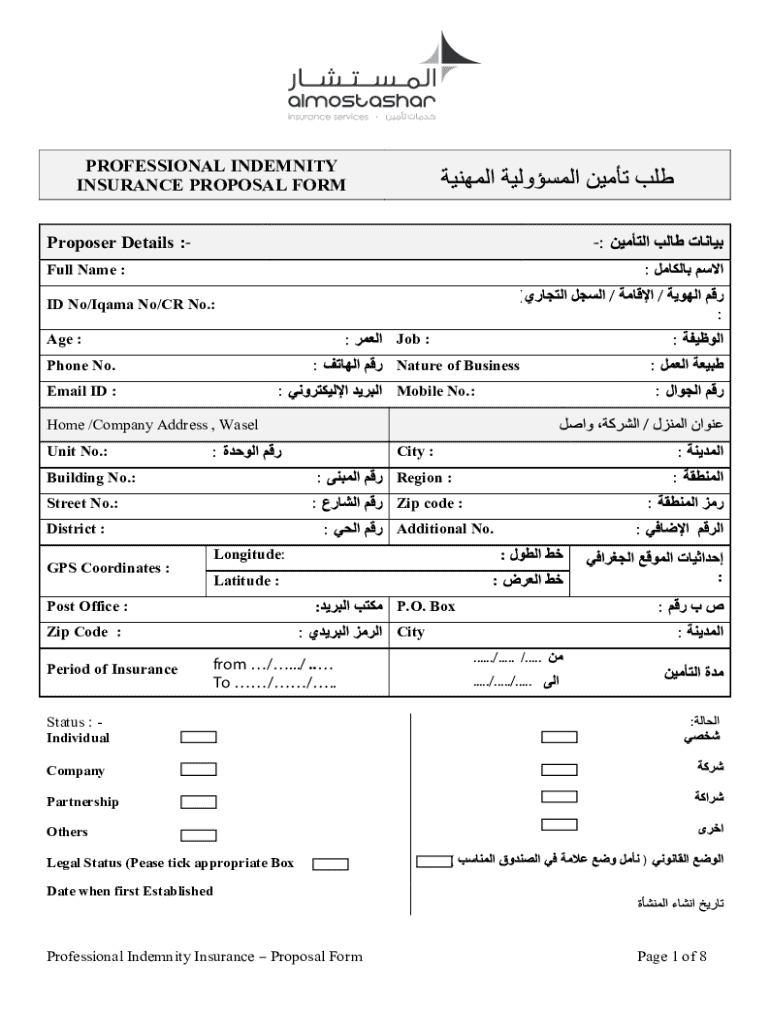

Get the free Professional Indemnity Insurance Proposal Form

Get, Create, Make and Sign professional indemnity insurance proposal

Editing professional indemnity insurance proposal online

Uncompromising security for your PDF editing and eSignature needs

How to fill out professional indemnity insurance proposal

How to fill out professional indemnity insurance proposal

Who needs professional indemnity insurance proposal?

Professional indemnity insurance proposal form - How-to guide

Understanding professional indemnity insurance

Professional indemnity insurance (PII) is a specialized form of insurance designed to protect professionals against claims of negligence, errors, or omissions in the services they provide. It is particularly vital for individuals in high-risk professions where the potential for legal claims is significant. This insurance not only covers the cost of legal defense but also any settlements or judgments that may arise from claims made against a professional.

The importance of professional indemnity insurance cannot be overstated. It shields professionals from financial devastation in the event of claims that could exceed their capacity to cover. Industries like law, healthcare, engineering, and consulting are just a few examples where this insurance is crucial. Without adequate coverage, professionals risk losing their hard-earned reputation, career, and financial stability.

What is a professional indemnity insurance proposal form?

A professional indemnity insurance proposal form is a detailed application that professionals must complete to apply for coverage. It serves as a formal request to insurers and provides crucial information regarding the applicant’s professional activities, risk exposure, and prior claims history. This form acts as a gateway for insurers to assess the risk associated with insuring a specific professional.

From a legal standpoint, the proposal form holds significant implications. Any inaccuracies or omissions may lead to the rejection of claims or even the cancellation of the policy. Therefore, understanding the necessity of each section, as well as the overall purpose, is essential. Insurers seek to ensure that applicants are honest and comprehensively disclose their professional activities to tailor the coverage appropriately.

Preparing to complete the proposal form

Before filling out the professional indemnity insurance proposal form, it is crucial to gather the necessary documentation. Accurate and complete information is vital in ensuring your application is considered seriously by insurers. Start by compiling essential business information such as your business name, contact details, and address. This foundational data establishes a framework for your proposal.

Additionally, having detailed information about your professional qualifications and experience is important. Insurers want to understand your expertise, especially in high-risk fields. Furthermore, if you have a prior claims history, document the details comprehensively, as transparency about past claims is paramount in determining coverage.

Understanding required coverage

Understanding the types of coverage available under a professional indemnity insurance policy is essential when preparing your proposal. Coverage options can vary significantly depending on the field you operate in. For instance, certain professions may require specialized policies that cover specific risks related to their business activities. Assessing the appropriate level of coverage is equally crucial, as underinsurance can be as detrimental as having no coverage.

Step-by-step guide on filling out the proposal form

Filling out the professional indemnity insurance proposal form can seem daunting, but breaking it down into manageable sections simplifies the process. Start with Section 1, which typically requires the applicant's details. Ensure you accurately include your personal and company information, and take care to verify the correctness of every detail. This section establishes your identity to the insurer, so accuracy is paramount.

Next, Section 2 focuses on business operations. Here you’ll describe your business activities succinctly, explaining what you do clearly. It’s also important to provide accurate revenue figures and client details, as this information helps insurers gauge your risk level. If you underestimate your business scale, you risk encountering issues later when claims might arise.

Section 3: Risk assessment

In Section 3, you will need to perform a risk assessment. Identify and articulate potential risks associated with your profession. Recognizing risks not only aids insurers in defining your policy but also helps you proactively manage those risks. Evaluating your risk profile involves understanding factors like client types, project scopes, and any previous claims history.

Section 4: Claims history

Section 4 is dedicated to your claims history. As you fill in this section, it's essential to report past claims accurately. Remember that being transparent and honest is crucial since misrepresentation can lead to denied claims or even policy cancellation. If you have had previous claims, include all necessary details such as dates, amounts, and outcomes. Insurers are interested in understanding past issues to better assess potential risks.

Section 5: Coverage selection

Finally, Section 5 deals with coverage selection. Utilize this section to weigh your options regarding policy add-ons and limits. Consider the benefits of additional coverage and how it aligns with your professional needs. Understanding co-insurance, which often involves shared expenses with your insurer, and deductibles is equally important. Make sure you choose coverage that adequately protects against the specific risks you face.

Common mistakes to avoid while completing the proposal form

When filling out the professional indemnity insurance proposal form, it’s easy to overlook critical details that may lead to rejection. Common mistakes include misrepresenting your business operations or financial details, which can result in severe consequences during claims processing. Misleading the insurer opens the door to potential fraud accusations and future issues.

Another common pitfall is failing to review the proposal thoroughly before submission. This step is essential, as many errors could be caught through careful revision. Having a colleague review your application can also provide an additional layer of scrutiny that may catch any overlooked details.

Submitting your proposal form

Once you have completed your professional indemnity insurance proposal form, the next step is to submit it properly. There are various methods available for submission, including hard copy and electronic formats. Electronic submissions are becoming more prominent due to their efficiency. Utilizing tools like pdfFiller enables seamless electronic form submission, allowing you to edit, sign, and send the document directly to the insurer.

After submission, knowing what to expect can alleviate anxiety. Most insurers will offer a timeline for reviewing your application, and following up through email or a phone call is advisable. Proactive communication not only demonstrates your interest in the process but also ensures you stay informed about your proposal's status.

Managing your professional indemnity insurance policy

Once your professional indemnity insurance policy is approved, the management of that policy becomes equally important. Regularly monitoring policy changes and updates will ensure you remain adequately covered. Stay informed about any modifications in terms or coverage that the insurer might implement, as these could affect your protection levels.

Best practices for managing documentation related to your policy include utilizing platforms like pdfFiller for a more streamlined experience. This technology allows you to efficiently manage files, track revisions, and easily collaborate with your team. Having a systematic approach to updating and reviewing policy details facilitates ongoing compliance and risk management.

Leveraging technology to enhance your proposal experience

In the digital age, leveraging technology has become essential for improving the proposal experience. Platforms like pdfFiller offer myriad features that facilitate the smooth completion of the professional indemnity insurance proposal form. Digital signatures enable efficient signature collection, and document sharing enhances collaborative efforts, allowing multiple stakeholders to contribute seamlessly.

Utilizing interactive tools imbues the process with flexibility and adaptability. With solutions that support editing directly within PDFs and instant cloud storage, pdfFiller can streamline document management, promoting a hassle-free experience when preparing professional indemnity insurance proposals.

Frequently asked questions (FAQs)

Understanding common queries surrounding the professional indemnity insurance proposal process can make it easier for applicants. For starters, many individuals wonder how long it takes for their proposal to be processed. Typically, the timeline varies by insurer, but it can range from a few days to several weeks depending on the complexity of the application.

Another frequent question relates to the financial implications of misrepresentation on the proposal form. Insurers take any undeclared risks seriously, potentially leading to denial of claims or cancellation of the policy. Clarity and honesty in your application thus cannot be overstated.

Conclusion of the process

In conclusion, having professional indemnity insurance is vital to safeguarding your career against potential financial loss due to claims arising from your professional services. A well-prepared proposal form is the first step in securing the coverage you need. As you navigate the process, remember to manage your documentation diligently and stay proactive about understanding your policy.

Regular updates, collaborative management, and leveraging digital tools like pdfFiller will not only simplify your experience but also greatly enhance your document management approach. In a world where both business and risk evolve rapidly, staying well-informed and adequately insured can make all the difference.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find professional indemnity insurance proposal?

How do I edit professional indemnity insurance proposal straight from my smartphone?

How do I complete professional indemnity insurance proposal on an Android device?

What is professional indemnity insurance proposal?

Who is required to file professional indemnity insurance proposal?

How to fill out professional indemnity insurance proposal?

What is the purpose of professional indemnity insurance proposal?

What information must be reported on professional indemnity insurance proposal?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.