Get the free Receipts and Expenditures Report of a Political or Party Committee

Get, Create, Make and Sign receipts and expenditures report

Editing receipts and expenditures report online

Uncompromising security for your PDF editing and eSignature needs

How to fill out receipts and expenditures report

How to fill out receipts and expenditures report

Who needs receipts and expenditures report?

Your Complete Guide to Receipts and Expenditures Report Form

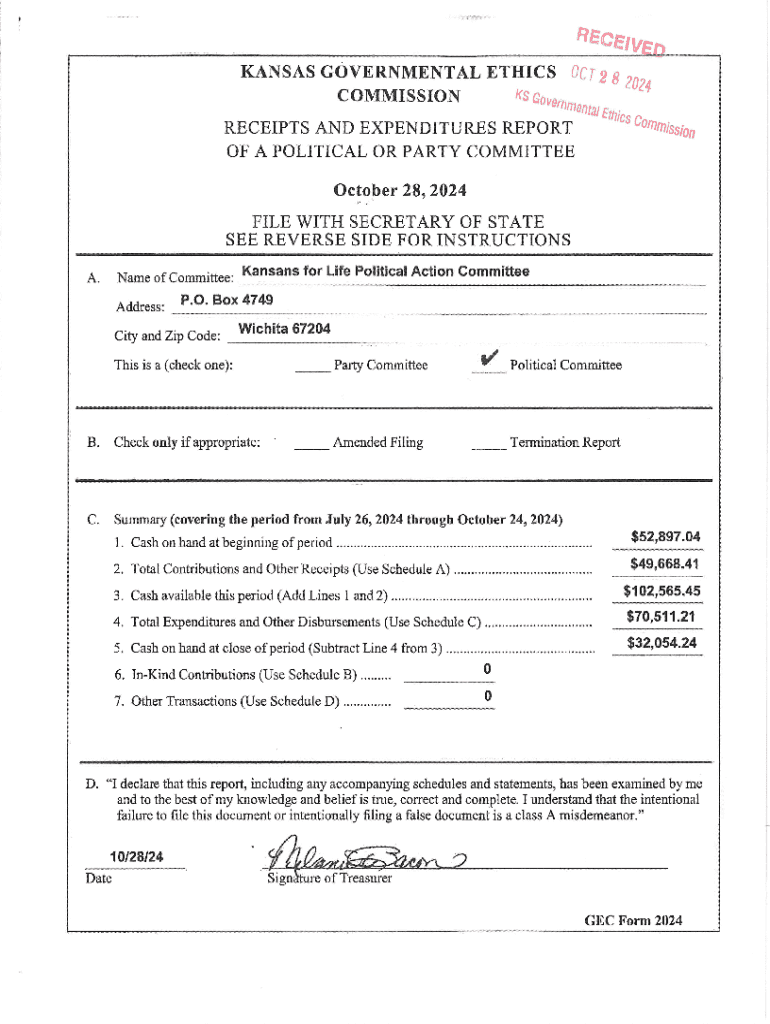

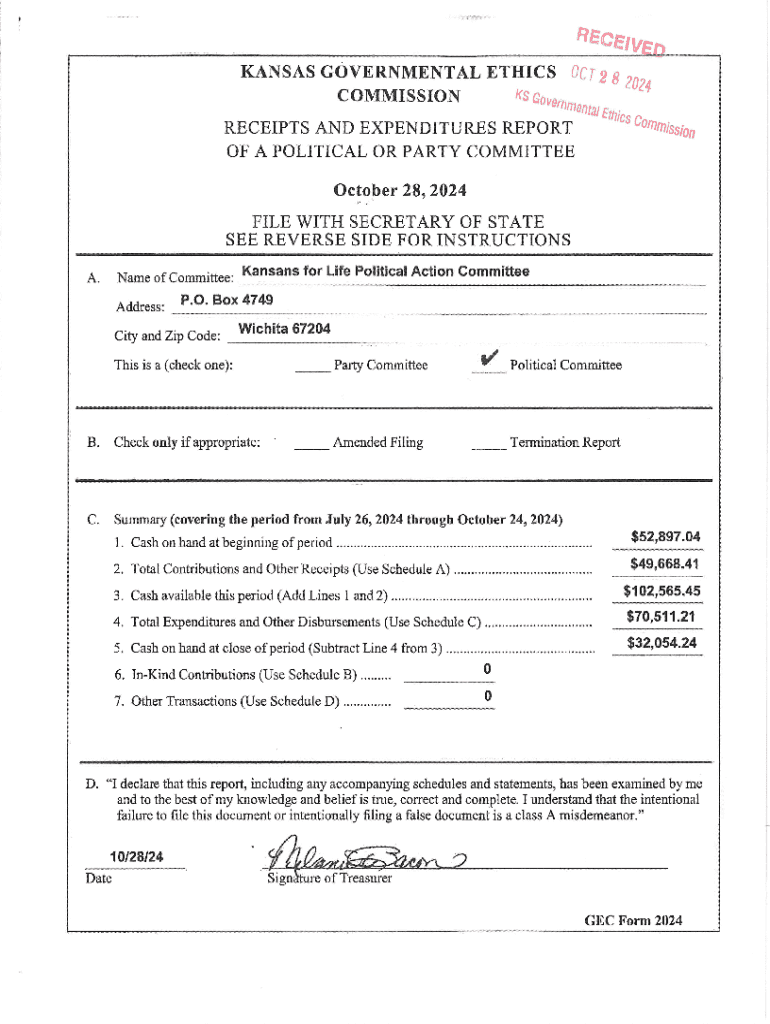

Understanding the receipts and expenditures report form

A receipts and expenditures report is a crucial document that details an individual or organization’s income and expenses over a specific period. Its primary purpose is to provide a clear and concise overview of financial transactions, helping stakeholders understand the flow of money. This report increases financial transparency and ensures accountability, making it essential for effective financial oversight.

The importance of this report cannot be overstated. Whether for internal review or external audit, having a comprehensive record fosters trust and promotes better financial management. For leaders in governance, corporations, and nonprofits, filing this report correctly can have significant implications, ranging from budget approval to compliance with legal regulations.

Key components of the receipts and expenditures report form

The receipts and expenditures report form typically consists of several key sections that capture all necessary financial information. The receipts section outlines the income generated during the reporting period, while the expenditures section details all expenses incurred. Following these sections is a summary of transactions, which provides a snapshot of overall financial activity.

Understanding the terminology is essential for anyone filling out this report. Income is generally associated with total inflow from sales or services, whereas revenue may include various streams, such as grants or donations. Fixed expenses are predictable costs like rent, whereas variable expenses can fluctuate, such as utilities based on usage. Each report should cover a defined reporting period, ensuring that entries align with financial cycles for accuracy.

Step-by-step guide to filling out the receipts and expenditures report form

Before starting the report, gathering all necessary documentation is crucial to ensure accuracy. Key documents to consider include invoices, receipts for expenses, and bank statements. This comprehensive preparation helps in cross-verifying data entries and maintaining correctness across the report.

When you begin filling out the receipts section, be detailed. Each source of income should be clearly labeled with amounts and corresponding dates. It’s easy to skip minor receipts, but every dollar counts, so avoid common pitfalls like rounding errors or missing entries.

In the expenditures section, categorize all expenses accurately. Each entry should denote its purpose—be it operational, administrative, or programmatic. Furthermore, documenting spending helps in future budget planning, as it reveals spending patterns, allowing teams to allocate resources effectively.

After filling the form, a thorough review is necessary. Double-check calculations, verify data entry, and explore using tools like spreadsheets or financial software for easier verification of totals and subtotals. This step cannot be overlooked, as discrepancies can lead to financial missteps.

Utilizing interactive tools for enhanced reporting

With technological advancements, cloud-based document tools like pdfFiller have transformed how users approach receipts and expenditures report forms. These platforms allow users to create, edit, and share documents effortlessly, enhancing collaboration among team members regardless of their location.

Leveraging templates saves time and ensures consistent formatting across reports. With pdfFiller’s extensive collection of customizable templates, users can tailor forms to meet specific organizational needs while ensuring compliance with regulatory requirements. The ability to pre-fill templates also streamlines the process, allowing for quick updates each reporting period.

eSigning and secure document management

As digital transactions become standard, managing document security and compliance is paramount. Secure document handling includes encrypting sensitive data and utilizing trusted platforms for sharing and signing. pdfFiller ensures that documents remain protected throughout their lifecycle while allowing for easy access and accountability.

Utilizing eSignatures on your receipts and expenditures report creates a seamless, paperless process. Using pdfFiller’s eSigning tool, users can sign and send documents in just a few clicks. It’s essential to follow best practices for eSignatures, including ensuring all parties are verified and that the signature complies with jurisdictional laws, thereby ensuring legal validity.

Common questions and troubleshooting

While filling out the receipts and expenditures report form, many individuals encounter recurring questions. Common filing mistakes typically include missing signatures, incorrect date entries, or misclassifying income and expenses. These errors can lead to complications, including late fines or audit triggers if not addressed early.

For personalized help, utilize available support resources from pdfFiller. Their customer service teams are equipped to help you navigate any specific queries, ensuring smooth report preparation and submission.

Best practices for ongoing financial management

Establishing regular reporting habits is essential for effective financial oversight. Setting up a routine for record-keeping not only facilitates accountability but also aids in organizing financial data systematically. Adopting tools like pdfFiller can ensure that you have all your documents organized and easily accessible.

Leveraging data from past reports can provide invaluable insights into budgeting decisions. By analyzing trends in receipts and expenditures, organizations can adjust their strategies and optimize resource allocation for future growth. Moreover, forecasting tools available on various platforms can enhance financial planning, making it easier to anticipate income and expenses.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit receipts and expenditures report straight from my smartphone?

Can I edit receipts and expenditures report on an iOS device?

Can I edit receipts and expenditures report on an Android device?

What is receipts and expenditures report?

Who is required to file receipts and expenditures report?

How to fill out receipts and expenditures report?

What is the purpose of receipts and expenditures report?

What information must be reported on receipts and expenditures report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.