Get the free Hospitalisation & Surgical Claim / Tuntutan Penghospitalan & Pembedahan

Get, Create, Make and Sign hospitalisation surgical claim tuntutan

Editing hospitalisation surgical claim tuntutan online

Uncompromising security for your PDF editing and eSignature needs

How to fill out hospitalisation surgical claim tuntutan

How to fill out hospitalisation surgical claim tuntutan

Who needs hospitalisation surgical claim tuntutan?

Hospitalisation Surgical Claim Tuntutan Form How-to Guide

Understanding the hospitalisation surgical claim tuntutan form

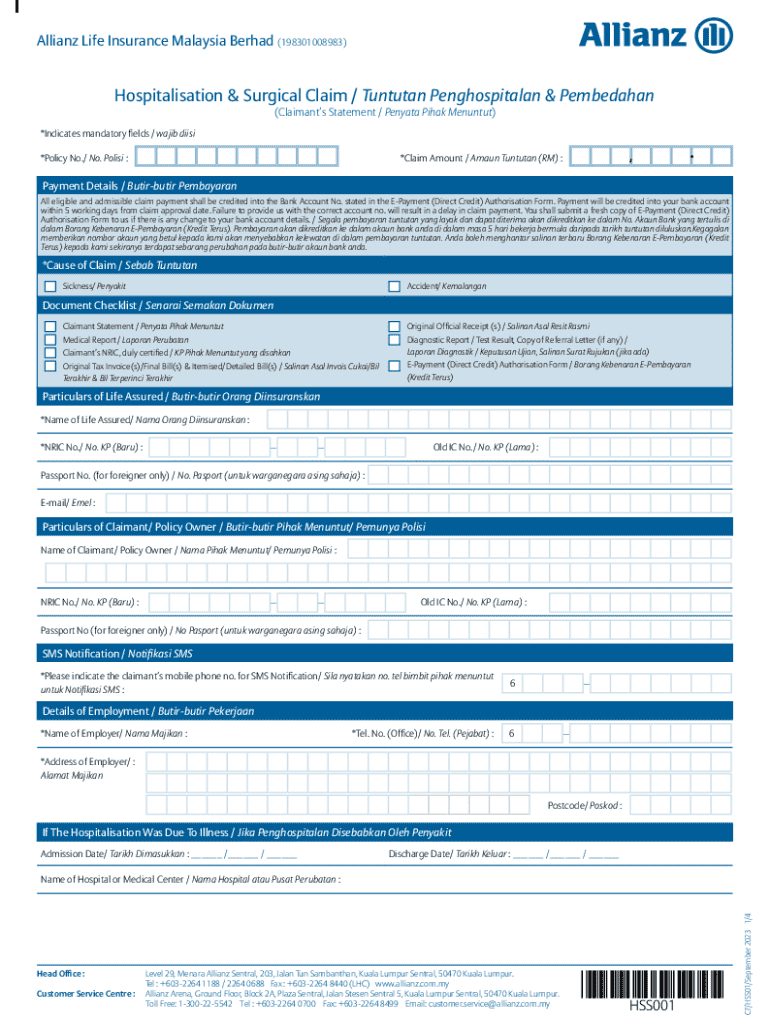

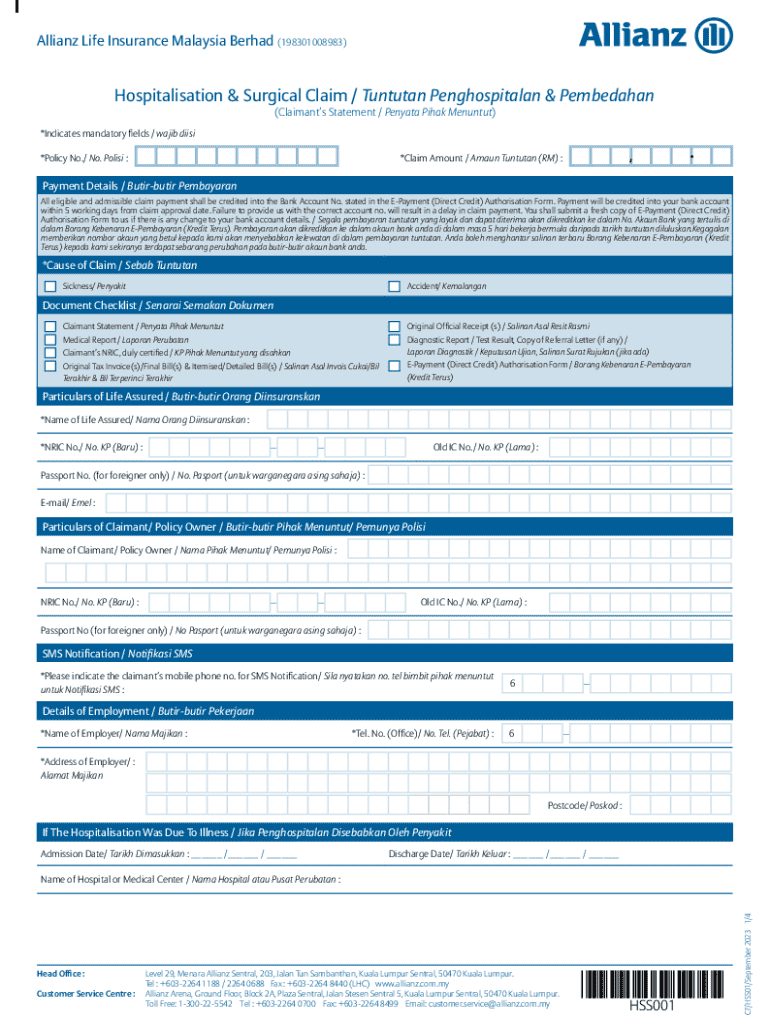

The hospitalisation surgical claim tuntutan form is a crucial document designed to facilitate the reimbursement process for surgical expenses incurred during hospital stays. This form serves two primary purposes: it provides the insurance company with essential details about the patient’s medical situation and the costs involved, ensuring the claim is processed efficiently.

Various scenarios necessitate the completion of this form, such as after undergoing significant surgical procedures or when inpatient hospital care is required. The form collects comprehensive information that allows insurance providers to evaluate claims based on predefined policy criteria.

When to use the form

Understanding when to use the hospitalisation surgical claim tuntutan form is vital. Eligibility criteria are usually outlined in your specific insurance policy, often revolving around the nature of the surgical procedure and the type of coverage plan. It’s essential to know which sections of the form are mandatory and which ones may be filled out optionally, as this can vary widely depending on the procedures involved.

Gathering necessary information

Effective completion of the hospitalisation surgical claim tuntutan form begins with collecting necessary personal information. Essential details typically include the full name of the patient, up-to-date contact information, and relevant insurance information such as policy numbers. Ensuring that this data is accurately presented can significantly expedite the claims process.

In addition to personal information, crucial medical information is required. This includes specific details about the surgical procedures performed, along with the respective dates of hospitalization and discharge. Documenting these details accurately is key, as they allow the insurance company to assess the validity of the claim. Lastly, assembling complete financial documentation is necessary. This may encompass hospital bills, receipts for medical expenses, and the corresponding insurance policy details to substantiate the claim.

Detailed walkthrough for completing the form

Completing the hospitalisation surgical claim tuntutan form is a straightforward process when broken down into manageable steps. To begin, navigate to the designated form location, typically available on your insurance provider's website or accessible through pdfFiller for ease of use.

Start by filling in personal details, ensuring accuracy in spelling and information format. Filling out these fields correctly is imperative to avoid complications during processing. For documenting surgical procedures, familiarize yourself with specific codes and terminology commonly used in medical claims. You may find sample entries for procedures such as appendectomies or knee surgeries helpful as guidelines.

Inputting financial information

Accurate reporting of financial information is critical to secure the compensation due from your insurance provider. Clearly outline all relevant medical expenses incurred during the surgical process, ensuring that you include co-payments or any out-of-pocket expenses. Maintain a clear record of all amounts paid to the hospital, medical professionals, and any additional services rendered. Reviewing your entries can help mitigate errors and lead to a smoother claims process.

Editing and customizing the form

Using platforms like pdfFiller offers significant advantages when customizing your hospitalisation surgical claim tuntutan form. One of the standout features includes the ability to edit, highlight, and annotate the document as needed. Users can update any section that may require additional clarity, ensuring the form is both complete and representative of the actual circumstances.

In addition to customization, eSigning the form has become a standard practice, efficiently verifying the authenticity of submissions. This electronic signing process minimizes paperwork and allows for quicker submission times. Users can easily follow the steps to electronically sign the document within pdfFiller, streamlining the process and improving convenience.

Common mistakes to avoid

Completing the hospitalisation surgical claim tuntutan form can be a cumbersome process, and it’s easy to make common mistakes that could jeopardize the claim. One prevalent error is submitting incomplete forms. Every section of the form is designed to gather vital information, and neglecting any part can cause delays in claims approval.

Another frequent pitfall is incorrect financial reporting. Errors in the financial details can lead to discrepancies that may affect the outcome of the claim. It's also essential to ensure that all necessary documentation is attached; neglecting to include vital records such as receipts or doctor’s notes can result in denial of the claim. A checklist can be helpful for verifying that all required attachments are included.

Submitting the hospitalisation surgical claim tuntutan form

Once the hospitalisation surgical claim tuntutan form has been meticulously completed, the next step is submission. Depending on your insurance provider, this may involve online submission platforms, which usually facilitate quicker processing. It is crucial to follow any specific instructions given by your provider for entering or uploading claims.

If online submission is not feasible, alternative methods such as mail or in-person submission may be utilized. After submission, tracking the status of your claim is paramount; many insurance companies allow you to monitor your claim online or through their customer service. Understanding the expected response times can help manage expectations regarding your claim.

Frequently asked questions (FAQs)

Despite thorough preparation, questions may arise post-submission of the hospitalisation surgical claim tuntutan form. For instance, if a claim is denied, it’s important to know the steps for appeal or resubmission. Each insurance provider typically has defined procedures for challenging a denial, which may include providing additional documentation or clarifications.

Processing times for claims can also vary significantly; understanding the general expectations will help you remain patient during this time. If mistakes occur on the form, it is vital to know how to correct them properly. Some providers allow amendments to be submitted alongside a request for reconsideration of the claim.

Utilizing online tools for efficient claim management

In today's fast-paced environment, leveraging online tools like pdfFiller for hospitalisation surgical claim tuntutan form management can significantly expedite the claim process. One of the key advantages is the cloud-based access, allowing users to manage their documents from anywhere with an internet connection. This flexibility is particularly beneficial for individuals or teams working collectively on complex claims.

Additionally, interactive features enhance accessibility. Real-time updates and status tracking help keep all stakeholders informed, while mobile access enables users to address their claims on-the-go. By utilizing these features, users can streamline their claims process, ensure nothing gets overlooked, and maintain better organization.

Tips for successful claim management

Successful claim management hinges significantly on organized and systematic practices. Keeping thorough documentation organized is paramount; this can be accomplished by classifying documents by type — medical records, receipts, and communications with insurance providers. Using a digital file system or physical folder organization can help maintain clarity.

Additionally, keeping records of all communications regarding claims is essential, whether through emails, phone calls, or in-person discussions. This practice ensures clear accountability and provides a reference for future interactions. Regularly reviewing your insurance policy's benefits is also wise; understanding what is covered under your plan can prevent unnecessary complications when filing claims.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in hospitalisation surgical claim tuntutan without leaving Chrome?

Can I create an electronic signature for signing my hospitalisation surgical claim tuntutan in Gmail?

How do I fill out the hospitalisation surgical claim tuntutan form on my smartphone?

What is hospitalisation surgical claim tuntutan?

Who is required to file hospitalisation surgical claim tuntutan?

How to fill out hospitalisation surgical claim tuntutan?

What is the purpose of hospitalisation surgical claim tuntutan?

What information must be reported on hospitalisation surgical claim tuntutan?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.