Get the free Business License & Tax Application

Get, Create, Make and Sign business license tax application

How to edit business license tax application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business license tax application

How to fill out business license tax application

Who needs business license tax application?

Business License Tax Application Form: A Comprehensive Guide

Overview of business license tax application

A business license tax is a crucial requirement for operating legally in most jurisdictions. This license demonstrates that a business complies with local regulations and is authorized to conduct its activities. It not only brings legitimacy but also helps in consumer protection and local governance. The significance of obtaining a business license tax lies in its role in ensuring that businesses contribute to local economic development and pay their fair share of taxes.

Key reasons for applying include avoiding fines and legal issues, enhancing business credibility, and gaining access to valuable resources and networks. The application process generally involves completing a specific form, submitting necessary documents, and making payment. Each locality may have unique procedures, hence being informed is essential.

Understanding the overall application process ensures that applicants can navigate through bureaucracy efficiently. This involves knowing where to apply, what documents are needed, and how long the process typically takes.

Types of business licenses

Different types of business licenses cater to various sectors and business models. Understanding the specific type pertinent to your business is critical.

Each type of license comes with different requirements and regulations that govern the specific industry. Therefore, researching thoroughly is crucial.

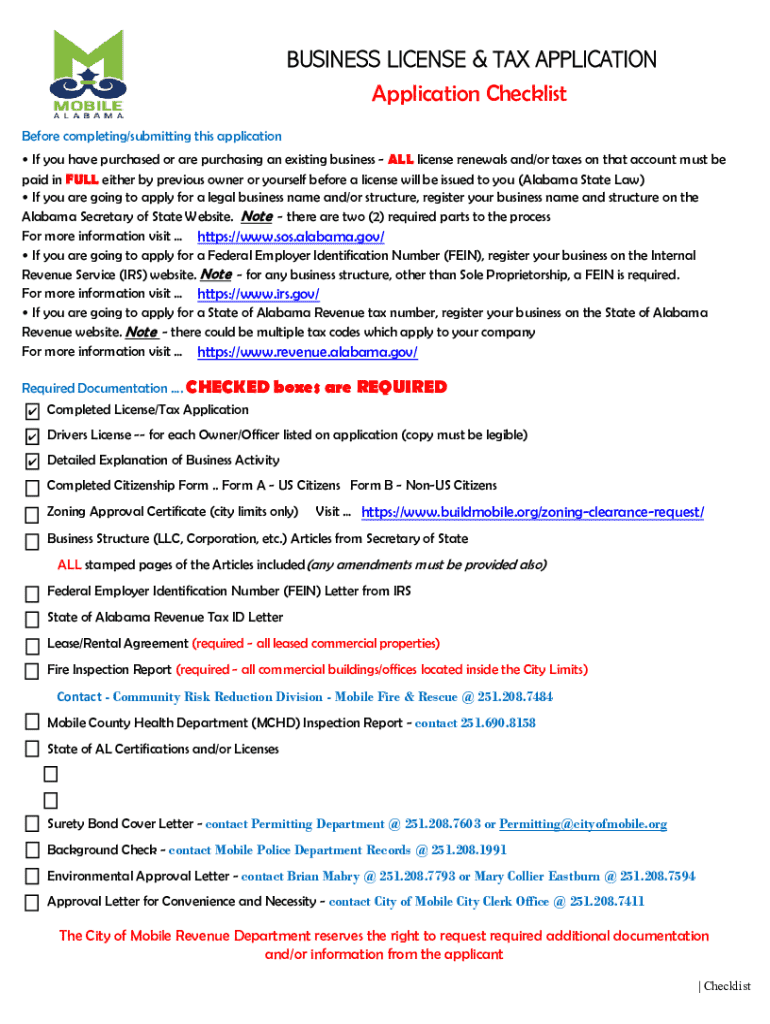

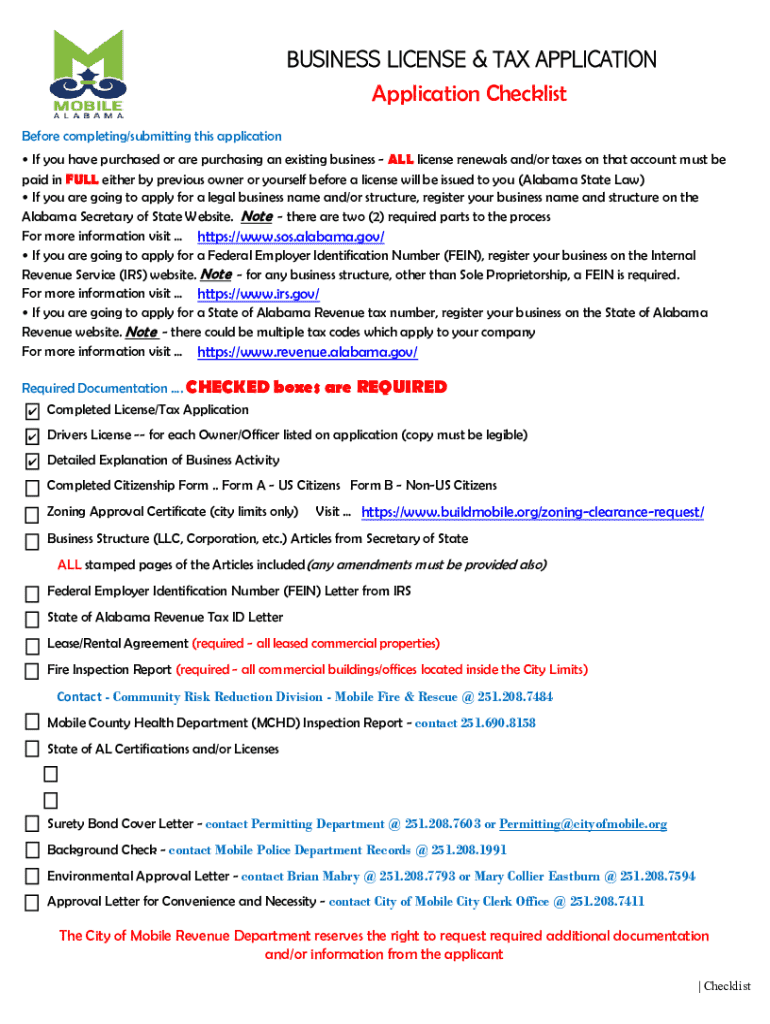

Understanding the business license tax application form

The business license tax application form is a critical document that needs to be filled out accurately to avoid delays. It typically consists of various sections that capture essential information related to the applicant and the business.

Alongside the form, certain documents are commonly requested, such as personal identification, proof of business address, and financial records. Having these documents ready can facilitate a smoother application process.

Step-by-step guide to completing the application form

Completing the business license tax application form can be streamlined by following a structured approach. Here’s a step-by-step guide.

Utilizing pdfFiller’s tools can enhance your experience, especially when it comes to ensuring accuracy and completeness of the form.

Fee schedule and payment information

When applying for a business license tax, understanding the fee structure is paramount. Typically, application fees will vary based on the type of business and location.

It’s advisable to check local regulations for any specific instructions related to payment.

Special circumstances and amendments

Business licenses may need updates or amendments due to changes in business operations. Understanding how to report these changes is crucial.

Being proactive about updating your business license helps to avoid potential fines or interruptions in operations.

Frequently asked questions (FAQs)

Understanding the nuances of the business license tax application process can come with many questions. Here’s a list of frequently asked questions that can provide clarity.

Consulting local authority websites can provide customized answers based on your locality.

Tips for successful application submission

Submitting your business license tax application can be straightforward if you follow certain best practices. Here are some tips to ensure a successful submission.

Proper organization and diligence can greatly reduce the chances of application rejection.

Interactive tools and features on pdfFiller

pdfFiller provides a variety of tools that simplify the document management process for business license applications. These features enhance user experience and facilitate document handling.

These features are tailored to help individuals and teams efficiently manage their documentation across various platforms.

How pdfFiller empowers your document management

Utilizing pdfFiller for your business license tax application not only simplifies the process but also provides a range of benefits that enhance productivity.

The emphasis on user experience and functionality makes pdfFiller a robust choice for managing business-related documents.

Contact information for support

For further assistance with your business license tax application, pdfFiller offers various support channels.

Having reliable support can ease concerns throughout the application process.

Legal considerations related to business licenses

Understanding the legal landscape surrounding business licenses is critical for compliance and operational integrity.

Being informed about these legal requirements can save time and resources and ensure smooth operations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my business license tax application directly from Gmail?

How can I get business license tax application?

How do I fill out the business license tax application form on my smartphone?

What is business license tax application?

Who is required to file business license tax application?

How to fill out business license tax application?

What is the purpose of business license tax application?

What information must be reported on business license tax application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.