Get the free W-9

Get, Create, Make and Sign w-9

How to edit w-9 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out w-9

How to fill out w-9

Who needs w-9?

Comprehensive Guide to the W-9 Form: Understanding, Completing, and Managing Your Tax Forms

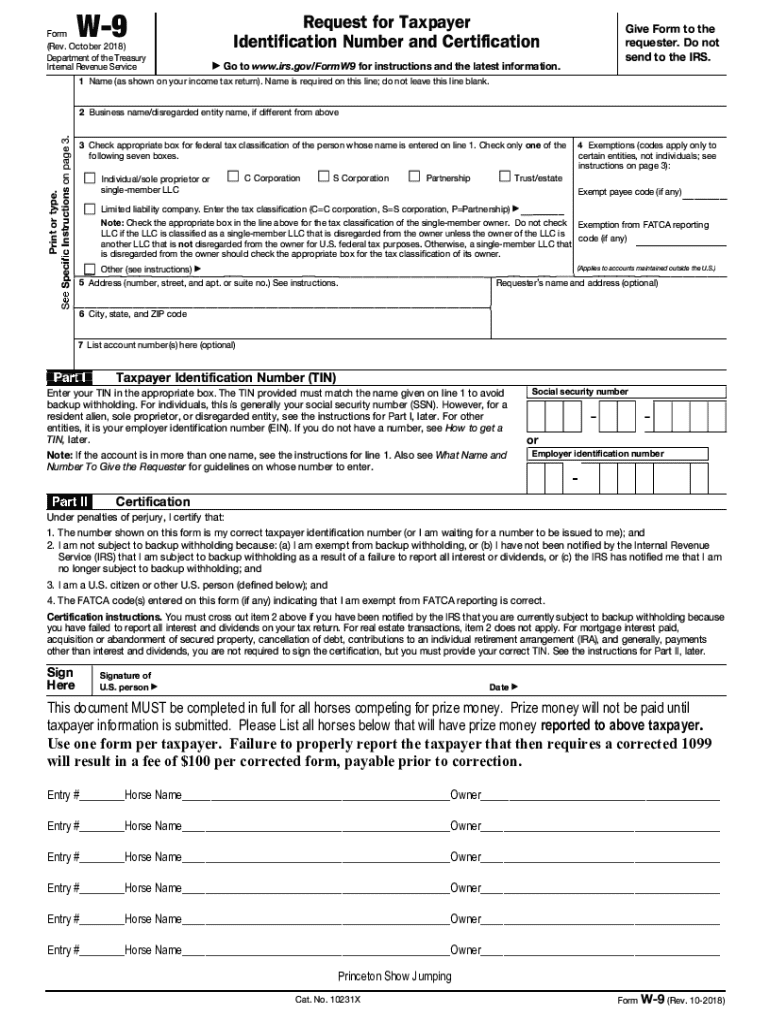

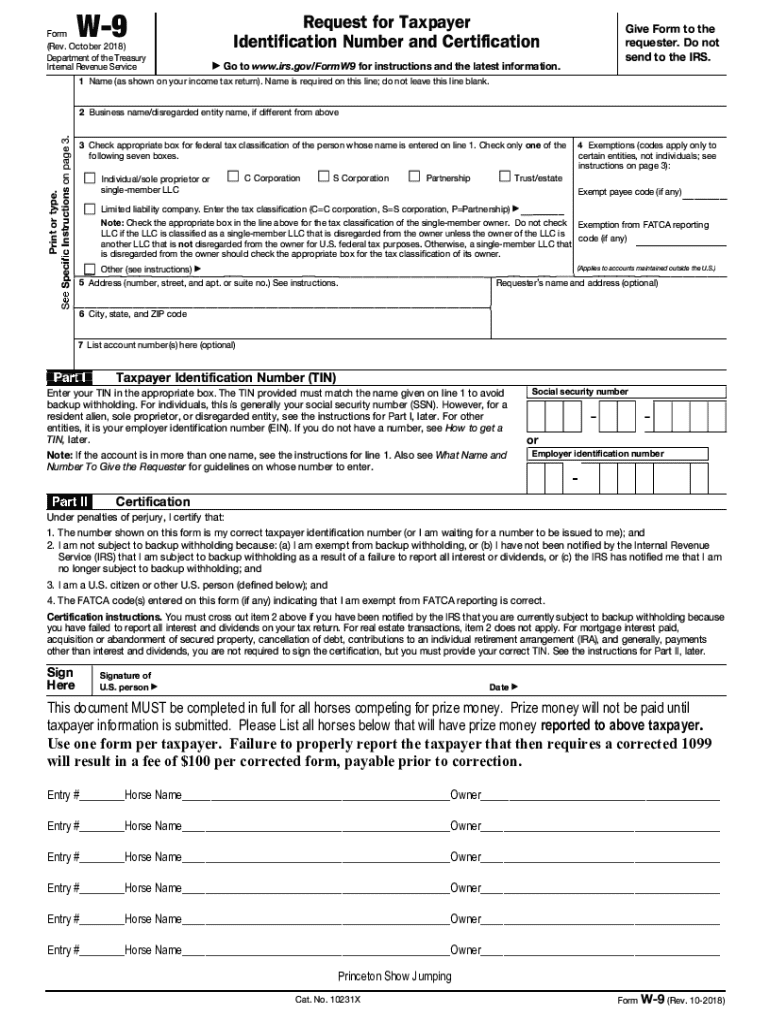

Understanding the W-9 form

The W-9 form is a crucial document in the realm of U.S. taxation, designed to provide essential taxpayer information to entities that must report income paid to non-employees. The primary purpose of the W-9 is to establish the identity of individuals and businesses as they relate to their taxpayer identification numbers (TIN). Such identification is vital in determining whether tax withholding is necessary.

Understanding who needs to fill out a W-9 form is equally important. Typically, freelancers, independent contractors, and businesses that outsource work will be required to complete this form when providing services. Additionally, partnerships and various financial transaction scenarios necessitate a W-9, making it an indispensable document.

Importance of the W-9 form in various scenarios

Freelancers and independent contractors often find themselves in situations where a W-9 form is essential for their income reporting. Without completing this form, employers cannot issue a Form 1099, which details earnings paid to non-employees. This can lead to complications during tax filing seasons, as misreporting income can result in audits or penalties.

Detailed walkthrough: how to fill out the W-9 form

Filling out a W-9 form requires attention to detail to ensure accuracy. Here’s a step-by-step breakdown of each section:

Common mistakes to avoid

Mistakes while filling out the W-9 can lead to delays and complications. A few common pitfalls to keep in mind include:

Interactive tools for W-9 management

Utilizing pdfFiller can substantially ease the process of filling and managing W-9 forms. The platform offers interactive tools that make document management seamless.

Using pdfFiller for W-9 completion

With pdfFiller, you can easily fill out your W-9 online without needing to print or scan. Here is a step-by-step guide:

eSign features for W-9

pdfFiller also supports electronic signatures that abide by legal standards. Here’s how you can leverage this feature:

W-9 form use cases

The W-9 form applies in several use cases, proving its versatility beyond just freelancer transactions.

When to request a W-9

Timing is essential when dealing with W-9 forms. For businesses and contractors, requesting a W-9 upfront, ideally as part of the onboarding process, ensures compliance and streamlines tax filing later. By proactively managing when to request the form, you can avoid delays and potential issues down the line.

Regular updates to W-9 forms can also be crucial if a contractor's details change or if new tax classifications take effect. Keeping this information current avoids any issues with tax reporting.

Managing your W-9 forms

Safely managing W-9 forms is vital to protect sensitive information. Best practices in storing W-9s include:

How often to obtain updated W-9 forms

Circumstances that necessitate a new W-9 form include changes in tax classification or address. It is a good practice for businesses to review and request updated W-9 forms annually or whenever a contractor's contract is renewed.

Important considerations with W-9 forms

Understanding backup withholding is essential for anyone filling out a W-9 form. This process applies when a taxpayer does not provide accurate information or fails to report taxable income properly. Businesses must be vigilant in managing compliance to avoid triggering backup withholding.

Additionally, financial institutions often need a W-9 for account openings or credit applications. These requirements highlight the broader implications of using W-9 forms, extending beyond simple income reporting.

Signature requirements and digital/electronic considerations

The signature on a W-9 can be traditional or electronic. The legal standing of electronic signatures is recognized under federal law, making them a viable option for anyone filling out the form digitally.

Establishing a consistent W-9 reporting process is important for any business employing independent contractors. Keeping updated records and adjusting practices as new IRS regulations emerge can improve accuracy and compliance.

Quick links and helpful guides

Accessing valuable W-9 resources through pdfFiller can streamline your document management. Utilize the direct links to fillable W-9 forms for quick access.

Moreover, for visual learners, video tutorials are available to guide you through filling out the W-9 form and using pdfFiller effectively.

Additional insights

Understanding related forms such as the 1099-MISC is important for anyone dealing with W-9s. The 1099-MISC is typically used to report payments made to independent contractors, closely linked to information derived from the W-9.

For further information, external links to IRS resources can provide comprehensive insights into W-9 processing, rules, and compliance. The official IRS W-9 page offers definitive guidelines for completing the form correctly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send w-9 to be eSigned by others?

Can I create an electronic signature for the w-9 in Chrome?

How do I fill out w-9 on an Android device?

What is w-9?

Who is required to file w-9?

How to fill out w-9?

What is the purpose of w-9?

What information must be reported on w-9?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.