Get the free Form 4

Get, Create, Make and Sign form 4

How to edit form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 4

How to fill out form 4

Who needs form 4?

How-to Guide: Form 4 Form

Understanding the Form 4 form

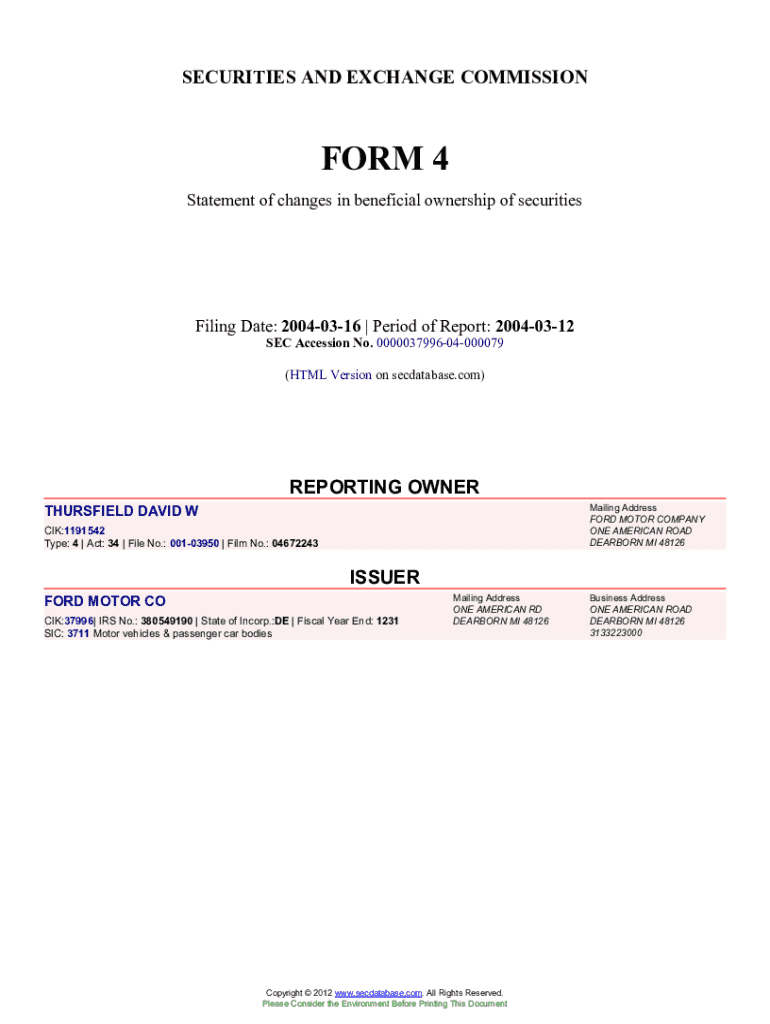

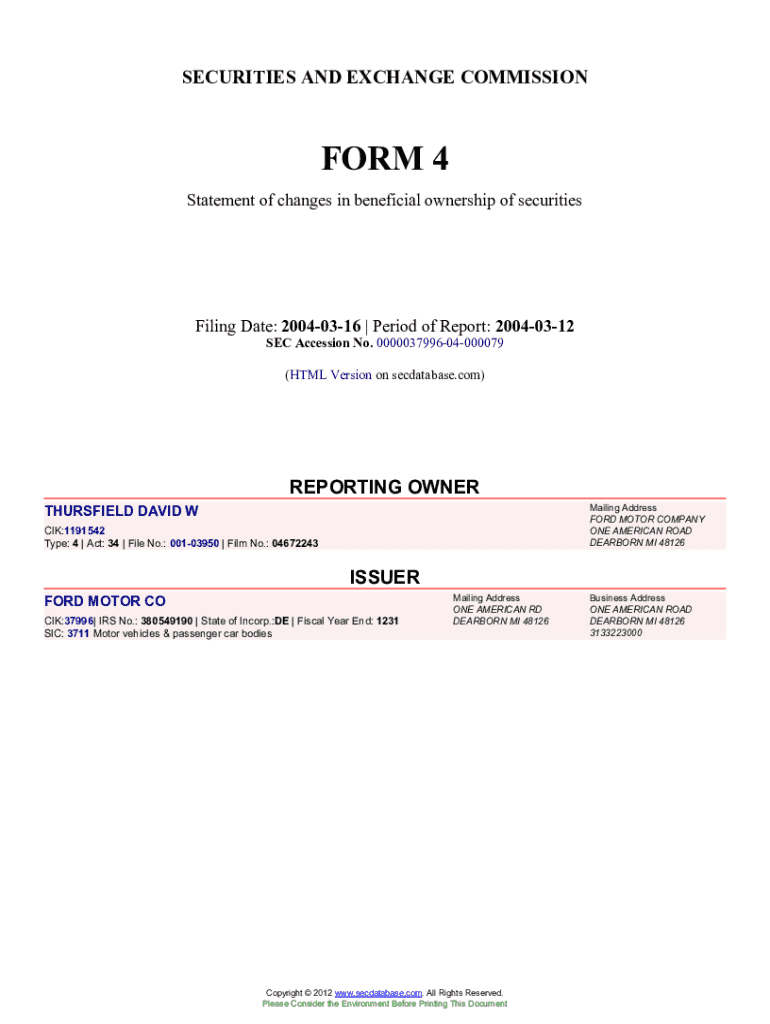

The Form 4 form plays a critical role in the regulatory framework for numerous transactions, particularly within the securities industry. Officially known as the 'Statement of Changes in Beneficial Ownership of Securities,' this form is primarily used by insiders of publicly-traded companies to report their trades. Its main purpose is to ensure transparency and accountability in financial markets, enabling investors to make informed decisions based on the actions of major shareholders.

The importance of the Form 4 form cannot be overstated. Regulatory bodies, especially the U.S. Securities and Exchange Commission (SEC), require this form to closely monitor insider trading to prevent fraud and protect investors. Failing to file this form can result in legal challenges and penalties for individuals and organizations alike.

Key features of the Form 4 form

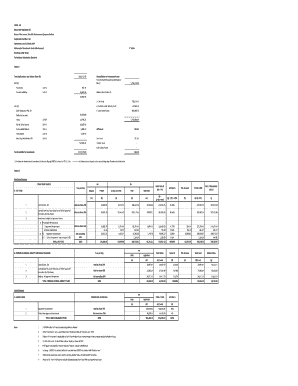

The Form 4 form consists of several key sections that must be accurately filled out. Key features of this form include Personal Information, which requires details about the reporting person, as well as the Description of Transaction section, where the particulars of security transactions are outlined. Other important features include the Date of Transaction, the number of shares, and the price at which they were traded.

In addition to these sections, the Form 4 form includes options for checkboxes that allow filers to indicate specific types of transactions, such as whether the shares were acquired or disposed of. Signatures and dates are also mandatory to ensure the authenticity of the submission. These fields validate the information provided, affirming that all details are correct.

Preparing to fill out the Form 4 form

Before diving into filling out the Form 4 form, it's crucial to gather the necessary information and supporting documents. To complete the form accurately, you will need personal identification details, including the name and address of the reporting individual or organization. It's also critical to have transaction-related documents ready, such as stock purchase agreements or sales confirmations.

In today's age, utilizing the right tools can make form completion seamless. A combination of software and hardware is often necessary. pdfFiller is highly recommended for its versatility in editing and e-signing documents. Additionally, having a good-quality scanner and printer on hand can facilitate easy document management.

Step-by-step instructions for filling out the Form 4 form

Filling out the Form 4 form may seem daunting at first, but by following these straightforward steps, the process can be streamlined for both individuals and organizations.

Step 1: Accessing the form

The first step is accessing the Form 4. Several options exist for obtaining the form, whether through official SEC websites or directly through pdfFiller. Users can download the form in a fillable format that allows for easy input.

Step 2: Filling out the form

Next, begin filling out the form section by section. Start with the personal information, which includes the name, title, and relation to the company. Provide a detailed description of the transaction including the date and number of shares involved. Remember to include your signature and date, affirming the truthfulness of your claims.

Step 3: Reviewing your inputs

Before submission, it's paramount to review your inputs meticulously. Common mistakes such as inaccurate names, wrong transaction dates, or omissions could lead to issues down the line. A thorough review ensures your form maintains compliance.

Step 4: Using interactive tools on pdfFiller

Utilizing pdfFiller's interactive tools can enhance the completion process. Features like Easy Fill and Autofill save time by streamlining data input, while validation checks may flag potential errors.

Editing and modifying the Form 4 form

Post completion, you may find instances where the Form 4 needs editing. Amendments can become necessary for various reasons, whether it’s correcting a typo or updating transaction information. pdfFiller’s editing features allow users to add annotations, modify text boxes, and update fields easily.

Editing should happen before the submission of the form. Recognizing the importance of accuracy and up-to-date information is key to maintaining compliance and preventing delays or issues when filing with regulatory bodies.

Signing the Form 4 form

The Form 4 form requires a signature to affirm the validity of the information provided. In recent years, electronic signatures have gained traction for their convenience and acceptance by regulatory bodies. pdfFiller offers options for users to eSign documents quickly.

It's essential to understand the legal validity of electronic signatures. Under regulations such as the ESIGN Act, eSignatures are legally binding in many scenarios, thus providing a secure alternative to traditional pen-and-ink signatures.

Submitting the Form 4 form

After completing and signing your Form 4 form, the next step is submission. There are multiple options available for submission. Users can submit the document online directly through pdfFiller, leveraging its user-friendly interface to complete the process quickly.

If you prefer the traditional route, mailing the Form 4 is still an option, but be mindful of timing to ensure compliance with filing deadlines. Once submitted, you can track your submission status via the SEC’s website or through pdfFiller for immediate updates.

Managing your Form 4 form records

Effective document management is crucial after submitting the Form 4 form. Utilizing pdfFiller for document management provides a centralized space for all your forms. Users can save versions of their forms for future reference and maintain an organized approach to record keeping.

Best practices include creating distinct folders for different transactions, ensuring quick access and easy retrieval of necessary documentation. This strategy minimizes confusion and ensures compliance with regulatory requirements over time.

Common challenges and solutions

Filing the Form 4 form may pose certain challenges to users. Common questions include issues with obtaining the form, misunderstanding certain sections, and technical difficulties when using electronic filing systems. Understanding these challenges can prime users to prepare better.

Solutions may include extensive FAQs addressing common concerns or direct customer support services provided by pdfFiller to ensure any difficulties are resolved promptly. Emphasizing user education can also significantly reduce the rate of errors and compliance issues.

Success stories

Real-world success stories highlight the efficacy of properly managing the Form 4 form through effective tools like pdfFiller. Many users report that leveraging the platform has streamlined their filing process, minimizing errors and saving valuable time. Testimonials frequently cite ease of use and the ability to manage multiple documents seamlessly from one place.

Case studies further support these claims, illustrating how individuals and organizations have successfully navigated the challenges of the Form 4 form. With strategies they learned from pdfFiller tutorials, these success stories serve as encouragement for new users.

Next steps after submitting the Form 4 form

After submitting the Form 4 form, users should be prepared for the next steps in the process. Monitoring the status of your submission and ensuring all related documents are updated is vital for maintaining accuracy in your files. Users are encouraged to keep records as changes occur to ensure compliance in future filings.

Utilizing pdfFiller's ongoing document management tools can help make this task easier, allowing you to stay organized and compliant moving forward. Constant vigilance in document management can prepare you for any future regulatory demands that may arise.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit form 4 online?

How do I edit form 4 in Chrome?

How do I edit form 4 straight from my smartphone?

What is form 4?

Who is required to file form 4?

How to fill out form 4?

What is the purpose of form 4?

What information must be reported on form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.