Get the free Chrb - 65 - chrb ca

Get, Create, Make and Sign chrb - 65

Editing chrb - 65 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out chrb - 65

How to fill out chrb - 65

Who needs chrb - 65?

A Comprehensive Guide to the CHRB - 65 Form

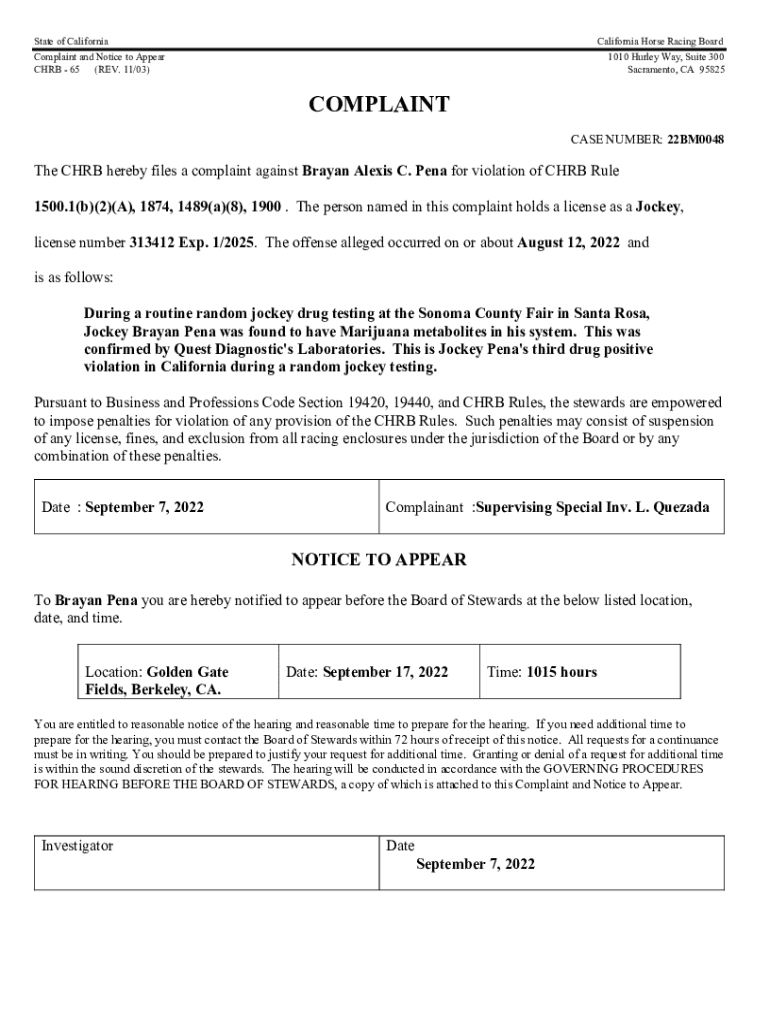

Understanding the CHRB - 65 Form

The CHRB - 65 form is a crucial component in the realm of document management, particularly for professionals and organizations within the racing and wagering industry. This form streamlines the process of compliance and reporting, ensuring that all necessary information is accurately captured and submitted. Its importance cannot be overstated, as it serves as a legal document verifying compliance with regulatory requirements.

The CHRB - 65 form not only facilitates the efficient collection of data but also acts as a safeguard against potential legal issues by ensuring that all required documentation is properly managed and submitted. In a sector where transparency and accountability are paramount, this form becomes indispensable.

Preparing to fill out the CHRB - 65 form

Before diving into the completion of the CHRB - 65 form, it's essential to gather all necessary information and documents. This preparatory work not only makes the process smoother but also ensures that the information provided is accurate and complete, reducing the risk of rejections during submission.

Key documents required for filling out the form typically include identification, financial records, and any previous certifications that may apply to your situation. It's also beneficial to familiarize yourself with the form’s instructions. Understanding these guidelines will help demystify the form and clarify any questions you may have during completion.

Step-by-step instructions on filling out the CHRB - 65 form

When tackling the CHRB - 65 form, a structured approach is vital. Begin by closely reading each section and determining which information is applicable to your circumstances. Here’s a breakdown to guide you through the process.

Common pitfalls to avoid include rushing through, overlooking specific details, or misinterpreting any sections, as this could lead to incomplete submissions and delays.

Section 1: Personal information

This section requires basic information about the individual or organization completing the form. Essential fields include full name, contact details, and relevant identification numbers. Best practices dictate that you double-check spellings and numbers for accuracy.

Section 2: Financial data

Accurate reporting in this section is crucial as it impacts your overall compliance status. Include all pertinent financial data, such as income streams and expenditures. Ensure that all figures are current and supported by documentation.

Section 3: Compliance and certification

You must acknowledge compliance with all relevant regulations in this section. This involves listing necessary certifications that validate your claims and ensure adherence to industry standards.

Section 4: Review and finalization

Before submitting, conduct a thorough review of the entire form. Check that all sections are completed accurately and ensure that no mandatory fields are left blank. This diligence will help you avoid unnecessary delays in processing your submission.

Editing and customizing the CHRB - 65 form

Utilizing pdfFiller's editing tools allows you to amend the CHRB - 65 form securely and efficiently. Changes can be made swiftly without compromising the integrity of the document, which is crucial for maintaining compliance.

Adding signature fields is also straightforward with pdfFiller. You can easily set up electronic signatures to expedite the signing process, ensuring that all stakeholders can review and sign the document without the need for physical meetings.

Managing your CHRB - 65 form with pdfFiller

pdfFiller enhances your document management experience by offering workflow automation features that streamline submission processes. By utilizing these features, you can minimize manual tasks and reduce time spent handling paperwork.

Collaboration tools within pdfFiller allow teams to share the CHRB - 65 form with ease, enabling multiple stakeholders to review and provide feedback efficiently. Additionally, version control features help you keep track of modifications throughout the completion process, ensuring accountability and clarity.

Common FAQs regarding the CHRB - 65 form

Many users encounter similar questions when filling out the CHRB - 65 form. Addressing these frequently asked questions can clear up confusion and provide clarity—a critical aspect when managing compliance.

Common issues might include where to find specific information or how to edit previously submitted forms. Resolving these concerns proactively can save valuable time and effort.

Best practices for submitting your CHRB - 65 form

Ensuring a timely and accurate submission of the CHRB - 65 form requires careful planning and attention to detail. Stick to a checklist when preparing your submission, and make sure to adhere to all relevant deadlines.

Keep key deadlines in mind for submission, as not adhering to these can lead to potential penalties or rejection of your submission. Understanding the submission guidelines will also help you navigate the process more smoothly.

Real-life applications of the CHRB - 65 form

The CHRB - 65 form has been effectively utilized by numerous individuals and organizations to streamline compliance and reporting processes. Case studies reveal that organizations harness this form to ensure operational efficiency and adherence to regulatory standards.

Success in document management often hinges on how well forms like the CHRB - 65 are handled. Anecdotal evidence suggests that accurate form submissions contribute significantly to operational efficiency and reduced compliance risks.

Conclusion and encouragement to explore pdfFiller

Leveraging a platform like pdfFiller empowers users to manage the CHRB - 65 form and other documents seamlessly. The cloud-based nature of this tool ensures that document management is accessible from anywhere, enabling professionals to stay organized and compliant without hassle.

With a range of additional tools and templates, pdfFiller supports not just the CHRB - 65 form but also a variety of other documentation needs. Users are encouraged to delve deeper into the resources available to enhance their engagement with form management and compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in chrb - 65 without leaving Chrome?

How can I edit chrb - 65 on a smartphone?

How can I fill out chrb - 65 on an iOS device?

What is chrb - 65?

Who is required to file chrb - 65?

How to fill out chrb - 65?

What is the purpose of chrb - 65?

What information must be reported on chrb - 65?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.