Get the free Form 990

Get, Create, Make and Sign form 990

How to edit form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Form 990 Form: A Comprehensive How-to Guide

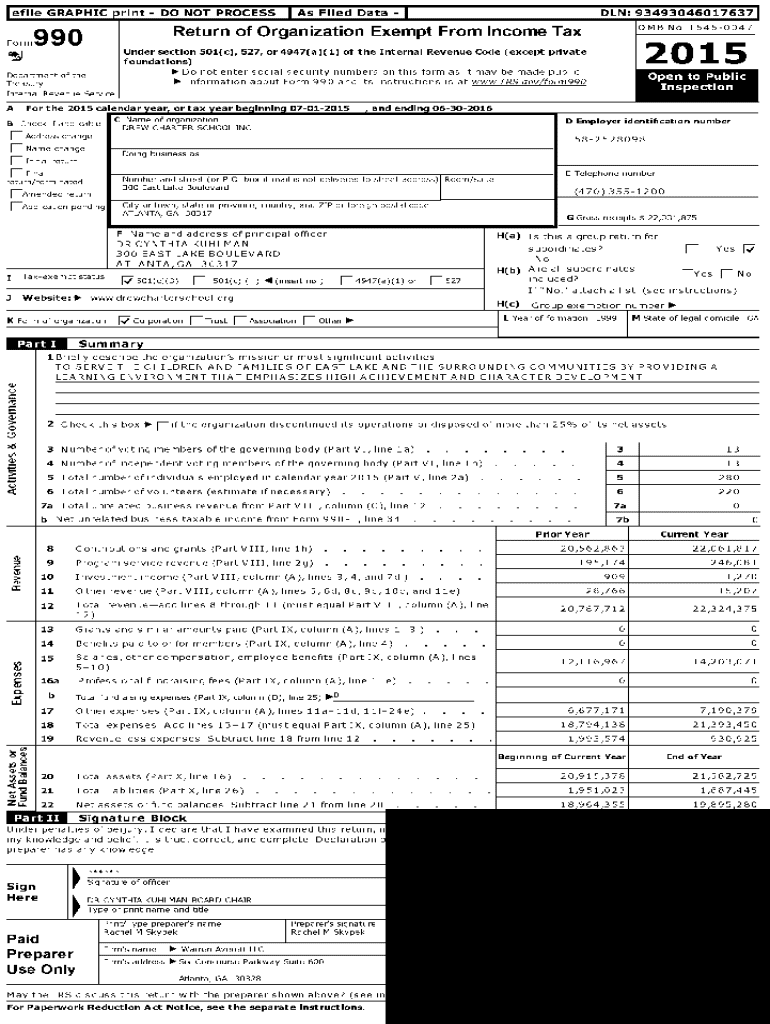

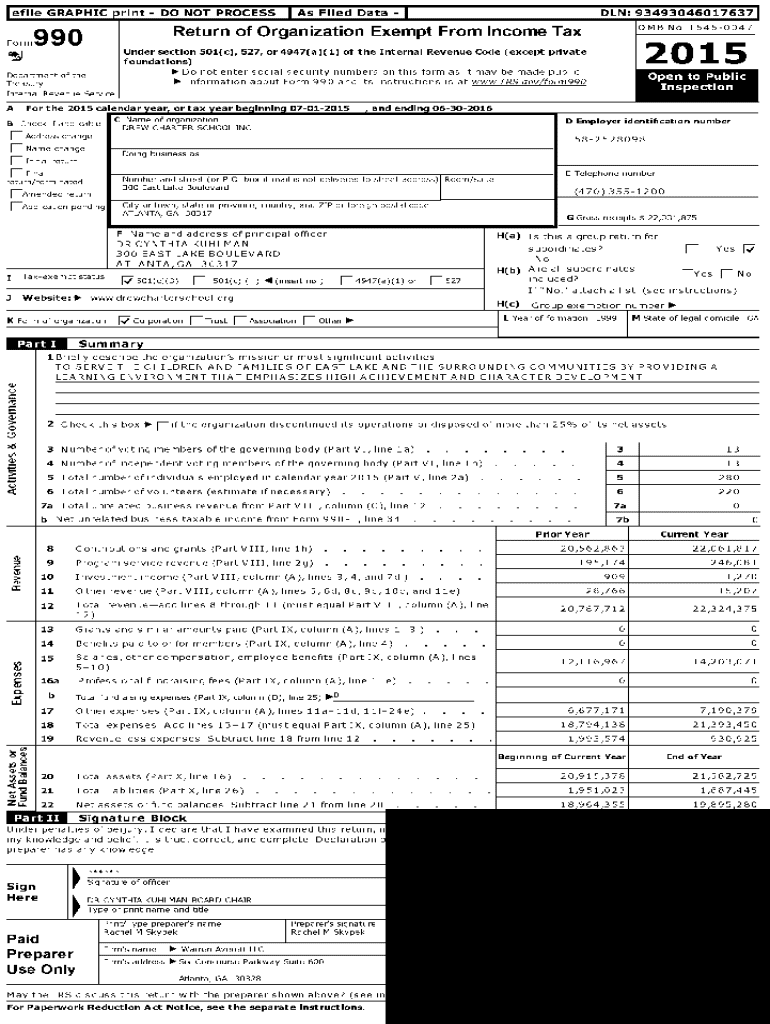

Overview of Form 990

Form 990, officially known as the 'Return of Organization Exempt From Income Tax,' is a crucial document that many tax-exempt organizations must file annually with the IRS. This form provides a comprehensive overview of a nonprofit's financial situation, program activities, and governance, offering transparency to stakeholders and the public.

The importance of Form 990 for nonprofits cannot be overstated—it serves not only as a compliance tool but also as a means to build trust with donors, grantors, and the general public. This document allows organizations to demonstrate their commitment to transparency and accountability, thus fostering confidence among potential supporters.

Understanding the different variants of Form 990

It’s essential to understand that Form 990 comes in several variants, namely Form 990, Form 990-EZ, and Form 990-N. Each of these forms is tailored to fit the needs and reporting requirements of different types of organizations based on their financial activities.

Form 990 is the most comprehensive document requiring detailed financial information, while Form 990-EZ is a streamlined version meant for organizations with less complex finances. On the other hand, Form 990-N, also known as the e-Postcard, is designed for small nonprofits that report less than $50,000 in annual revenues.

Essential filing requirements

Every organization classified as a tax-exempt entity must adhere to specific filing requirements for Form 990. The obligations to file annually ensure that these organizations maintain their tax-exempt status and continue to operate legitimately.

Deadlines for Form 990 submissions vary based on the organization’s fiscal year end. Generally, Form 990 is due on the 15th day of the 5th month after the end of the organization's accounting period. Importantly, nonprofits are also required to keep meticulous records, including detailed accounts of their income, expenditures, and governance, to support their filings.

Step-by-step instructions for completing Form 990

Creating your Form 990 can seem daunting, but breaking it down into steps simplifies the process. To get started with Form 990, obtain the official form through the IRS website or reliable tax document providers.

Using tools such as pdfFiller can significantly enhance your ability to access and fill out the form online efficiently. As you begin filling in each section, it’s crucial to pay close attention to various parts, including organizational information, financial data, governance details, and compliance regulations.

Common mistakes to avoid include overlooking key signatures and failing to report all required financial data accurately. Regularly verifying entries against your organization's financials can prevent these errors.

Best practices for preparing Form 990

Preparing Form 990 is best approached with organization and transparency in mind. First, ensure that all financial records are organized and easily accessible. This efficiency allows for a smoother preparation process and minimizes errors.

Engaging board members in the process is beneficial not only for generating insightful narrative descriptions but also for fostering a sense of ownership regarding organizational transparency. Incorporating effective narrative descriptions improves context, helping readers understand your organization’s mission and impact.

Utilizing pdfFiller for seamless form management

pdfFiller stands out as a formidable tool for nonprofits looking to manage Form 990 efficiently. With options to edit the form directly, collaborate with colleagues, and securely eSign documents, it simplifies the filing process significantly.

The cloud-based nature of pdfFiller allows users to access their documents from anywhere, making it a convenient option for teams spread across different locations. This functionality is particularly useful for nonprofit organizations that may require different team members to input information or review the form prior to submission.

Understanding penalties for non-compliance

Failing to file Form 990 can have serious implications for nonprofit organizations. The IRS imposes penalties for non-compliance, which can escalate based on the duration of the delay and the organization’s revenue size. Understanding these penalties is critical for ensuring your organization remains in good standing.

Common repercussions for late or incorrect filings include financial penalties and implications on your tax-exempt status. Organizations may lose their tax exemption altogether if they fail to file for three consecutive years. To rectify non-compliance issues, organizations should promptly file any missed returns and provide explanations for the discrepancies.

Public inspection regulations for Form 990

Public inspection of Form 990 is not only a regulatory requirement but also a critical principle of nonprofit governance. Organizations must make their Form 990 available for public inspection, underscoring their commitment to transparency.

The IRS requires that organizations make their filings accessible without requiring any charge, and you should also post it prominently on your website. Frequently, potential donors and other stakeholders will review Form 990s before making funding decisions, highlighting the importance of transparency.

Leveraging Form 990 for charity evaluation research

Form 990 serves as a vital resource for donors and researchers alike in the evaluation of nonprofit organizations. By analyzing the financial data and narrative descriptions within the form, potential supporters can gauge the effectiveness and sustainability of nonprofits.

For researchers, Form 990 data provides insight into industry trends, compensation practices, and operational efficiencies within the nonprofit sector. By comparing these details across various organizations, they can derive meaningful insights that aid in assessing the overall health and impact of charities.

Fiduciary reporting on Form 990

Fiduciary reporting is an essential aspect of governance that organizations must address in their Form 990 filings. This reporting highlights the accountability of board members and management regarding their financial stewardship of the nonprofit.

Key sections of Form 990 focus on fiduciary responsibilities, including compensation information for top officials and board members. Organizations should strive for transparency and consistency in these disclosures as they foster trust with stakeholders and enhance governance.

FAQs about Form 990

One common question regarding Form 990 is who must file this essential document. Generally, all organizations classified as 501(c)(3) must file Form 990, although certain exemptions based on size and income can apply. It’s crucial for organizations to understand their specific requirements under the IRS guidelines.

Another frequently asked question relates to the modality of filing—whether electronic submission or paper filing is preferable. While electronic submission is encouraged for its efficiency and ease, organizations do have the option to file by mail if necessary. Organizations should also be aware of possible exceptions to filing requirements, which may be granted under certain conditions.

Form 990 data published by the IRS

Transparency in nonprofit operations is significantly enhanced through Form 990 data published by the IRS. This data acts as a facilitator, allowing the public, researchers, and policymakers to review the financial health and operational practices of nonprofit organizations.

Navigating IRS resources for Form 990 data offers a wealth of information. Users can analyze trends, make comparisons, and derive insights that inform future decision-making, both for donors and nonprofits. This data-driven approach empowers stakeholders to take informed actions in the nonprofit sector.

Third-party resources and tools for Form 990 preparation

Consider utilizing third-party resources and tools for preparing Form 990, especially if your organization faces complexities or has limited internal accounting expertise. Numerous recommended software options exist that can simplify the filing process and ensure compliance.

In addition to software solutions, engaging consultants or professionals with experiences specific to Form 990 can provide valuable insights and reduce common pitfalls associated with the filing process. Networking with peers in the nonprofit sector can also lead to sharing best practices and additional support.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 990 to be eSigned by others?

Can I create an eSignature for the form 990 in Gmail?

How do I edit form 990 straight from my smartphone?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.