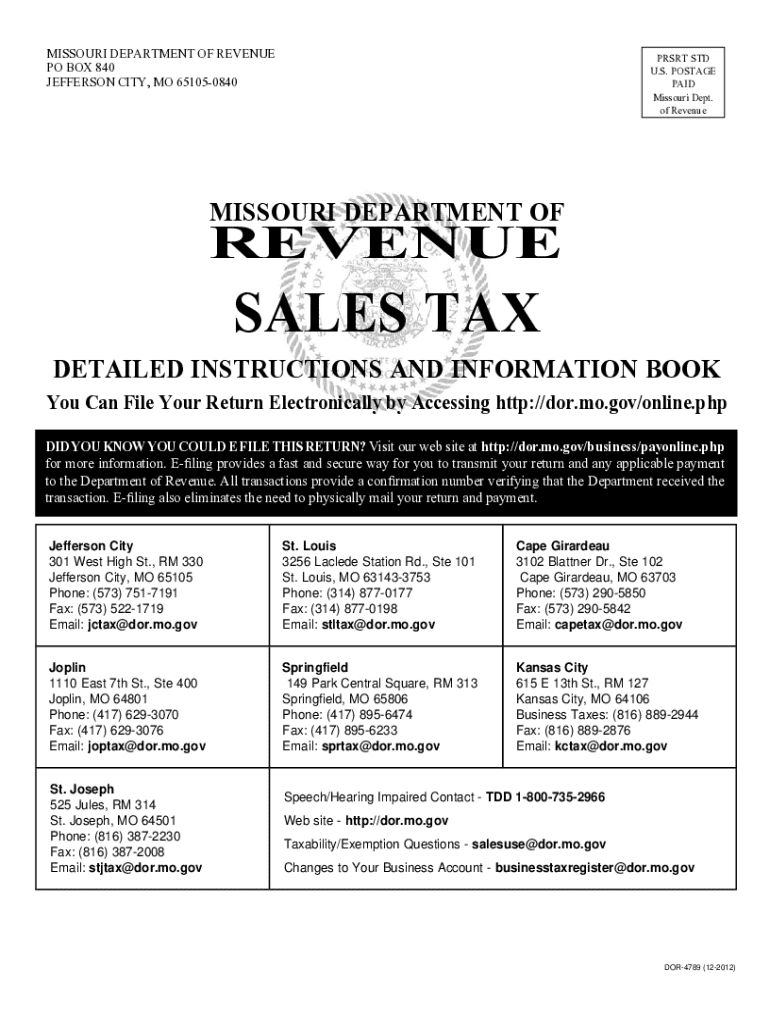

Get the free Sales Tax Detailed Instructions and Information Book

Get, Create, Make and Sign sales tax detailed instructions

Editing sales tax detailed instructions online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sales tax detailed instructions

How to fill out sales tax detailed instructions

Who needs sales tax detailed instructions?

Understanding and Utilizing the Sales Tax Detailed Instructions Form

Overview of sales tax forms

A sales tax form is a legal document required by tax authorities for reporting sales tax collected on taxable goods and services. It ensures that businesses comply with state and local tax regulations, accurately reflecting the amount of tax they owe. The importance of accurate sales tax reporting cannot be overstated; incorrect filings can lead to penalties and interest, while accurate reporting helps maintain the integrity of the tax system.

Understanding sales tax regulations

Sales tax regulations differ significantly across states and local jurisdictions. State laws dictate tax rates, what items are taxable, and specific reporting rules. Understanding key terminology — such as 'taxable sales,' 'exempt items,' and 'nexus' — is crucial for compliance. Nexus refers to the connection a business has with a state that obligates it to collect sales tax there.

Generally, businesses engaging in sales within a state where they have physical presence or substantial economic presence must file sales tax forms. This can include brick-and-mortar stores, online sellers, and service providers. Remaining aware of your responsibilities is essential to avoid conflicts with tax authorities.

Accessing the sales tax detailed instructions form

Finding the sales tax instructions can be straightforward. Most state tax authority websites host downloadable forms and detailed guides. To simplify this process, pdfFiller offers an accessible platform where you can find a variety of tax-related forms, including specific sales tax detailed instructions.

The pdfFiller interface is designed with user-friendliness in mind, making it easy to navigate through various forms and templates, ensuring you find the exact document you need.

Detailed instructions for filling out the sales tax form

Filling out the sales tax form accurately is crucial for tax compliance. Let’s break down the key sections of the form:

Contact information

Provide accurate details like the business name, address, and contact information. Ensure this information matches your tax records to avoid confusion.

Sales and use tax calculation

Calculating taxable sales involves identifying the total sales amounts minus any exemptions. Make sure to regularly check for changes in tax rates and apply them accordingly, as overlooking updated rates is a common mistake.

Exemptions and deductions

Claiming exemptions requires supporting documentation, which may include reseller certificates or specific exemption declarations. Be meticulous; failing to present the necessary documentation can result in denied exemptions and unexpected liabilities.

Payment information

Several payment methods are available for fulfilling your sales tax obligation. Familiarize yourself with the payment deadlines established by your state to avoid late fees and penalties.

Common challenges and troubleshooting tips

Completing tax forms can be overwhelming, and many face common challenges. Errors such as incorrect calculations, missing required information, or misunderstanding regulations frequently arise during form completion.

If you realize you’ve made a mistake after submitting your form, most states allow corrections to be made with an amended return. Always consult with tax professionals for advice tailored to your particular situation. Additionally, pdfFiller offers extensive resources, including FAQs and help sections, to assist users in finding solutions.

Digital solutions with pdfFiller

Using pdfFiller for sales tax forms introduces a multitude of benefits. You can access editable templates that ease the form-filling process, allowing you to input data seamlessly.

The eSigning feature allows for quick approvals without the delays of traditional signatures. Furthermore, pdfFiller’s collaboration tools enable teams to work on documents together in real-time, which can significantly streamline the tax filing process.

Users can easily view and track submissions, ensuring that all forms are filed correctly and on time.

Frequently asked questions (faqs)

Handling your sales tax documents securely is a top priority. Digitally storing these documents using pdfFiller guarantees both access and security. You can easily organize your files and ensure that sensitive information is protected.

If you miss a filing deadline, make sure to file as soon as possible and consult your state’s guidelines about penalties and interest. Timely communication with tax authorities can mitigate potential repercussions.

pdfFiller employs high-level security measures, ensuring the protection and confidentiality of your documents. This includes encryption protocols and routine security assessments.

Contacting support for further assistance

If you need assistance with pdfFiller features, reaching out for support is simple. The platform offers several channels, including live chat and email support, to address your questions effectively.

Additionally, you can explore community forums and extensive learning resources that pdfFiller provides to enhance your understanding of the platform's capabilities.

User testimonials and success stories

Businesses have reported significant improvements in efficiency when utilizing pdfFiller for their sales tax filings. For example, companies that previously struggled with timely submissions have streamlined their processes, allowing them to focus on growth.

Case studies highlight how pdfFiller's collaborative tools have enabled teams to work together more effectively, reducing the time spent on tax forms and paperwork.

Conclusion on streamlining sales tax filing

Utilizing pdfFiller enhances your ability to manage sales tax documents efficiently. Its user-friendly platform, coupled with powerful tools for collaboration and electronic signatures, simplifies a traditionally burdensome process.

We encourage users to explore pdfFiller's features and maximize the benefits of an organized digital document management system. Adopting these technological solutions marks a significant step towards streamlining your sales tax filing processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the sales tax detailed instructions in Chrome?

How do I fill out the sales tax detailed instructions form on my smartphone?

How do I edit sales tax detailed instructions on an iOS device?

What is sales tax detailed instructions?

Who is required to file sales tax detailed instructions?

How to fill out sales tax detailed instructions?

What is the purpose of sales tax detailed instructions?

What information must be reported on sales tax detailed instructions?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.