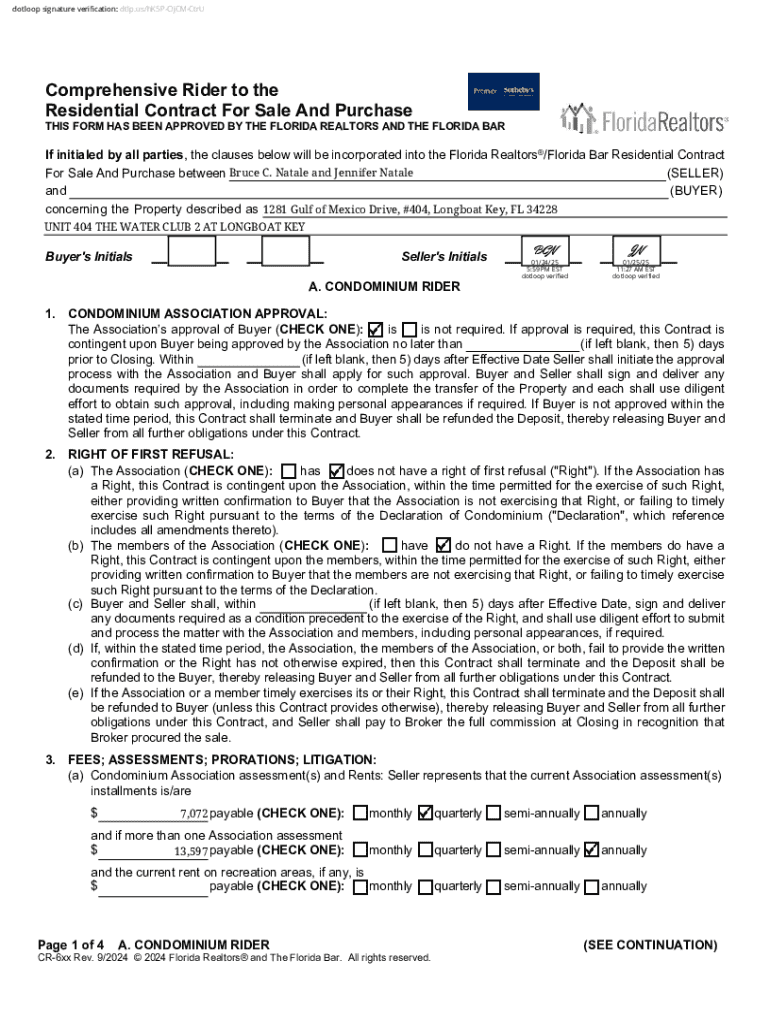

Get the free Comprehensive Rider to the Residential Contract for Sale and Purchase

Get, Create, Make and Sign comprehensive rider to form

Editing comprehensive rider to form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out comprehensive rider to form

How to fill out comprehensive rider to form

Who needs comprehensive rider to form?

Understanding the Comprehensive Rider to Form in Real Estate Transactions

Understanding the comprehensive rider

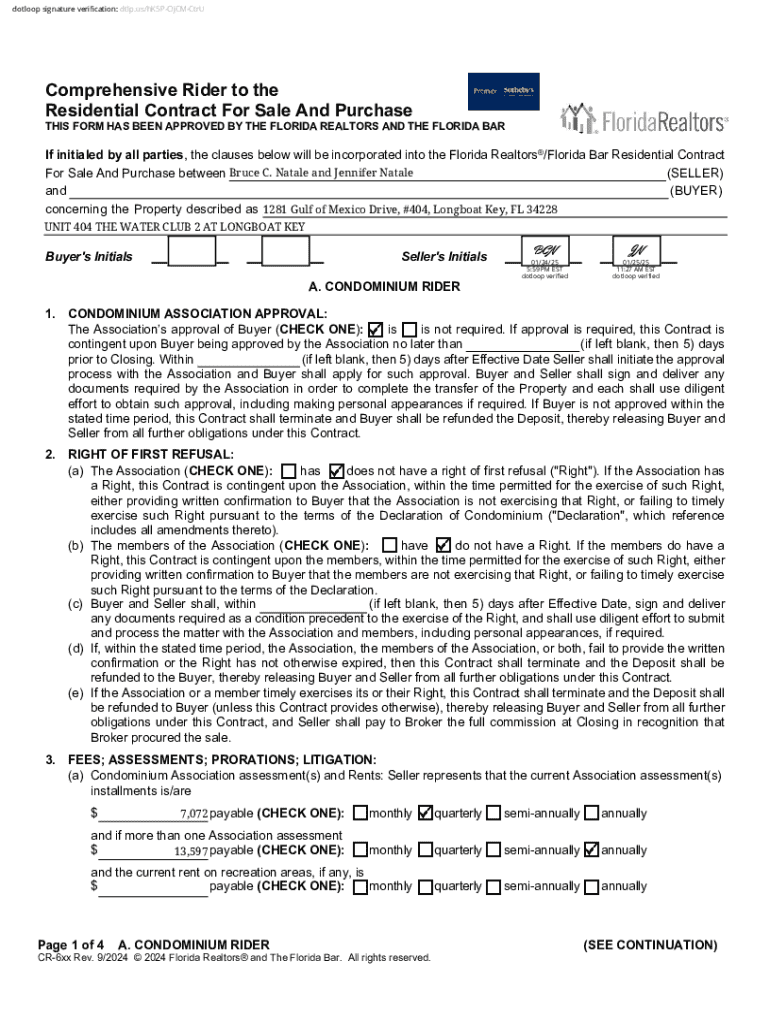

A comprehensive rider to form is an additional document that supplements the primary real estate contract, outlining specific insurance coverage and contingencies. This rider is crucial in real estate transactions, acting as a vital mechanism to ensure that both buyers and sellers clearly understand their obligations and protections under the agreement.

The importance of a comprehensive rider cannot be overstated; it serves not only as a protective measure but also as a means of clarifying the nuances of the deal. By detailing aspects like insurance requirements and contingencies, a comprehensive rider provides enhanced clarity and reduces the chances of misunderstandings between the parties.

The role of the comprehensive rider in contracts

The comprehensive rider enhances the residential contract for sale by providing detailed conditions that must be met by both parties. Through this addition, sellers can clarify what coverage they are willing to provide, while buyers can understand what protections are guaranteed under the sale.

Including a comprehensive rider carries legal implications; it creates enforceable obligations for both parties. Typically, real estate contracts without riders can lead to misunderstandings about insurance provisions, but a comprehensive rider mitigates these risks. A common misconception is that riders are merely suggestions— in reality, they are legal agreements with binding effects.

Key elements typically found in a comprehensive rider

A comprehensive rider typically outlines various critical components. For example, it will describe the exact coverage required, such as homeowner's insurance to protect against standard risks, and flood insurance for properties in flood-prone areas. These elements are essential, especially in states like Florida, where flooding is a significant concern.

Additionally, a comprehensive rider will include contingencies and conditions that must be satisfied before finalizing the sale. This could range from obtaining acceptable insurance policies to proving financial capability. Duration and renewal terms are also addressed, highlighting how long the coverage will remain active and what steps are necessary for renewal.

Assessing insurance costs: Homeowner and flood insurance

When understanding the comprehensive rider to form, assessing insurance costs for homeowner's and flood insurance is essential. For instance, in Florida, the average cost of homeowner's insurance can range significantly based on numerous factors. Recent studies show that the costs of insurance premiums in Florida can average around $3,500 annually for standard homeowner's insurance.

Insurance premiums are influenced by several factors, including property location, coverage limits, and personal claims history. For example, properties situated in high-risk flood zones will likely require higher premiums than those in safer areas. Buyers should consider these variables as they navigate their potential insurance costs.

How a comprehensive rider functions in practice

Integrating a comprehensive rider in your contract involves several crucial steps. Initially, you must recognize the need for additional coverage based on your property's specifics. Engaging a real estate professional is vital at this stage— they can provide guidance on necessary coverages and contingencies.

Once the insurance requirements are identified, the next step is drafting and reviewing the rider. This stage is critical since the language used must clearly convey the necessary terms. Finally, both parties should finalize and sign the contract, ensuring that the comprehensive rider is attached, thus making the agreement enforceable.

Navigating complex situations with a comprehensive rider

Navigating complexities in a comprehensive rider often involves addressing common challenges that may arise, including disputes regarding coverage or claims. It's not uncommon for buyers or sellers to disagree on what was initially intended, leading to potential conflicts that could derail the transaction.

Best practices for management and negotiation include maintaining clear lines of communication and documentation. Should disputes arise, having legal assistance can make a significant difference. An attorney can help interpret the rider and assist in resolving conflicts, ensuring that both parties adhere to the agreed terms.

Interactive tools for managing comprehensive riders

pdfFiller offers innovative document management solutions that greatly facilitate the handling of comprehensive riders. With features for editing and customizing riders to meet specific needs, users can effectively tailor documents according to their requirements.

In addition to customization, pdfFiller incorporates eSignature capabilities for streamlined processing, allowing users to quickly finalize agreements remotely. Furthermore, its collaborative tools enable team reviews and approvals, enhancing efficiency in document management—crucial for real estate professionals looking to secure smooth transactions.

Tailoring your comprehensive rider for specific needs

Customization of a comprehensive rider is essential for addressing diverse real estate transactions. No two properties are the same, and insurance needs can vary significantly based on individual circumstances. Thus, tailoring the rider to meet unique property risks is crucial for adequate protection.

Ongoing management and updates to the rider can also enhance its effectiveness. Regular reviews can ensure that both parties are compliant with current insurance standards and that any changes in property condition or local regulations are immediately addressed.

Case studies: Successful implementation of comprehensive riders

Analyzing case studies can provide valuable insights into the successful implementation of comprehensive riders in real estate transactions. For example, a recent residential sale involved a comprehensive rider that effectively covered both homeowner's and flood insurance. This proactive approach not only facilitated the sale but also ensured that the buyer felt secure in their investment.

Another case study highlighted how utilizing the rider led to successful insurance claims, demonstrating the protective nature of such comprehensive agreements. Key lessons learned from these examples include the necessity of precise language in riders and the importance of keeping all parties informed throughout the process.

Future of comprehensive riders in real estate transactions

The future of comprehensive riders in real estate transactions is shaped by emerging trends in document management and evolving legal requirements. With a growing shift towards digital solutions, users are increasingly seeking efficient ways to manage contracts and riders. As technologies evolve, the role of comprehensive riders is likely to expand, incorporating more dynamic clauses that reflect changing market dynamics.

Additionally, as compliance considerations continue to evolve, the necessity for comprehensive riders will likely grow. Adapting to legal changes and maintaining compliance will remain essential for both buyers and sellers as they navigate real estate transactions.

Frequently asked questions (FAQs)

Understanding the comprehensive rider to form may prompt several questions among potential users. One question often raised is the difference between a comprehensive rider and a standard policy. In essence, while standard policies provide basic coverage, a comprehensive rider offers tailored provisions that cater to specific needs and risks associated with a transaction.

Individuals may also wonder how to determine if they need a comprehensive rider. The need arises when specific insurance coverage requirements go beyond the standard policy offerings. The rider should encompass necessary language that reflects the unique circumstances surrounding the property and the transaction.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my comprehensive rider to form directly from Gmail?

How can I modify comprehensive rider to form without leaving Google Drive?

How do I complete comprehensive rider to form online?

What is comprehensive rider to form?

Who is required to file comprehensive rider to form?

How to fill out comprehensive rider to form?

What is the purpose of comprehensive rider to form?

What information must be reported on comprehensive rider to form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.