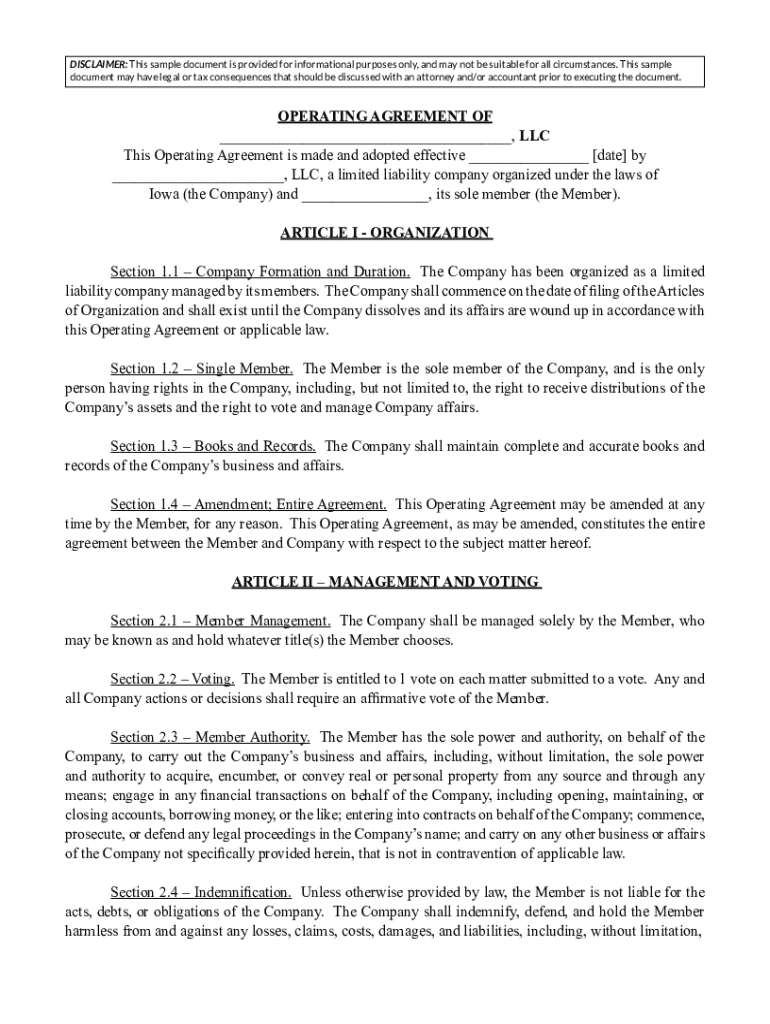

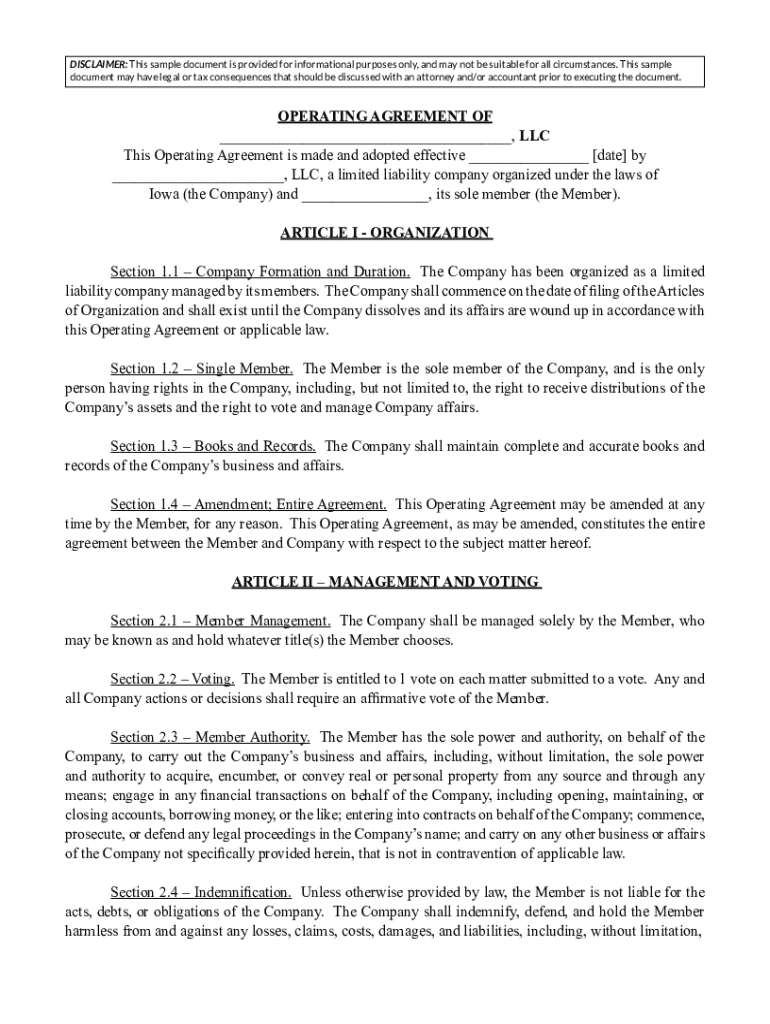

Get the free operating agreement llc iowa

Get, Create, Make and Sign iowa llc operating agreement form

Editing operating agreement llc iowa online

Uncompromising security for your PDF editing and eSignature needs

How to fill out operating agreement llc iowa

How to fill out iowa single-member llc operating

Who needs iowa single-member llc operating?

Iowa Single-Member Operating Form: A Comprehensive Guide

Understanding Iowa single-member LLCs

A single-member limited liability company (LLC) is a popular business structure in Iowa that combines the liability protection of a corporation with the flexibility of a partnership. This unique structure is designed for entrepreneurs who want to operate their business without the complexities typically associated with larger corporate entities. Unlike multi-member LLCs, which involve multiple owners, a single-member LLC is owned by one individual, providing a streamlined management experience.

The single-member LLC structure in Iowa presents numerous benefits. Primarily, the single member enjoys limited personal liability against debts and legal obligations incurred by the LLC. Additionally, it allows for pass-through taxation, meaning profits are reported on the owner’s personal tax return, avoiding the double taxation issue that corporations face.

The importance of an operating agreement

An operating agreement for an Iowa single-member LLC is a crucial document that outlines the workings of the LLC. It defines the business's operational structure, ownership rights, and member responsibilities. Importantly, while Iowa law does not explicitly require a single-member LLC to have an operating agreement, having one is highly advisable.

The legal significance of the operating agreement cannot be overstated. It serves as the foundational document that can help protect the single member's limited liability status. In the event of a dispute or legal challenge, having a well-documented operating agreement can show that the LLC operates as a separate entity, safeguarding the owner's personal assets.

What is an Iowa single-member operating agreement?

An Iowa single-member LLC operating agreement is a formal document that articulates how the LLC will be run. This agreement addresses essential aspects such as management roles, profit distribution, and procedures for making amendments. Although the single member typically has complete control over the business, clarifying operational norms through the agreement prevents potential conflicts and misunderstandings that may arise later.

By specifying the delineation of duties and responsibilities within the operating agreement, the single member can manage expectations regarding decision-making processes and profit allocation. This clarity is invaluable in maintaining a professional business environment, even as the sole owner.

Key components of an Iowa single-member operating agreement

Essential elements of an Iowa single-member LLC operating agreement should be crafted to ensure robust governance and operational fluidity. Below are key articles and their corresponding features:

Step-by-step guide to drafting an Iowa single-member operating agreement

Creating an operating agreement for your Iowa single-member LLC can be straightforward. Follow these steps to ensure your document is comprehensive and compliant:

Common inquiries about Iowa single-member operating agreements

Several common questions arise regarding Iowa single-member LLC operating agreements. Below are answers to frequently asked inquiries:

Iowa legal requirements for LLCs

Establishing an LLC in Iowa involves a series of structured steps that must be followed closely. First, prospective business owners must file Articles of Organization with the Iowa Secretary of State. This document officially registers the LLC and includes vital details such as the LLC's name, principal office address, and registered agent information.

Finally, securing an Employer Identification Number (EIN) from the IRS is necessary for tax purposes and to facilitate opening business bank accounts. This number serves as the social security number for your business.

Necessary forms and templates

When preparing to establish your Iowa single-member LLC, several forms and templates will be essential. Key documents include the Articles of Organization, which registers your LLC with the state and is a prerequisite for operating legally. Additionally, the EIN application is pivotal for tax matters and financial operations.

For ease of access, you can find the Iowa Single-Member LLC Operating Agreement templates available on pdfFiller. Moreover, consider utilizing forms like Membership Certificates and Meeting Minutes, which may be necessary for operational documentation.

Moving forward with your Iowa single-member

Taking the next steps to establish your Iowa single-member LLC can be straightforward with the right resources at your disposal. By creating a well-drafted operating agreement and maintaining compliance with Iowa's regulations, you can maximize your business's potential. Use platforms like pdfFiller to ensure your documents are properly created, signed, and stored securely for future reference.

Regular updates to your operating agreement as your business evolves are also necessary. This proactive approach will ensure continued alignment with your business goals and compliance with any changes in laws or regulations.

Using interactive solutions on pdfFiller

pdfFiller offers a suite of interactive features that enhances the document creation and management experience. Users can easily access and utilize its editing and eSigning tools, making the process of drafting your Iowa single-member LLC operating agreement efficient and effective. Collaboration with business partners or advisors becomes seamless on pdfFiller, allowing for real-time feedback and input.

These solutions streamline workflows, ensuring that your business documents remain organized and accessible from anywhere. By utilizing these features, you can focus more on running your business rather than managing paperwork.

Best practices for managing your single-member

Managing a single-member LLC in Iowa requires diligence and attention to detail. Best practices include regularly reviewing and updating the operating agreement to reflect the current business landscape and any changes in ownership or operations. Staying informed about tax implications is equally important, as single-member LLCs are often subject to different tax regulations than corporations.

Incorporating these best practices can contribute to a well-organized, efficient, and compliant business environment, which enhances long-term sustainability and operational success.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit operating agreement llc iowa from Google Drive?

How do I edit operating agreement llc iowa on an iOS device?

How do I complete operating agreement llc iowa on an Android device?

What is iowa single-member llc operating?

Who is required to file iowa single-member llc operating?

How to fill out iowa single-member llc operating?

What is the purpose of iowa single-member llc operating?

What information must be reported on iowa single-member llc operating?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.