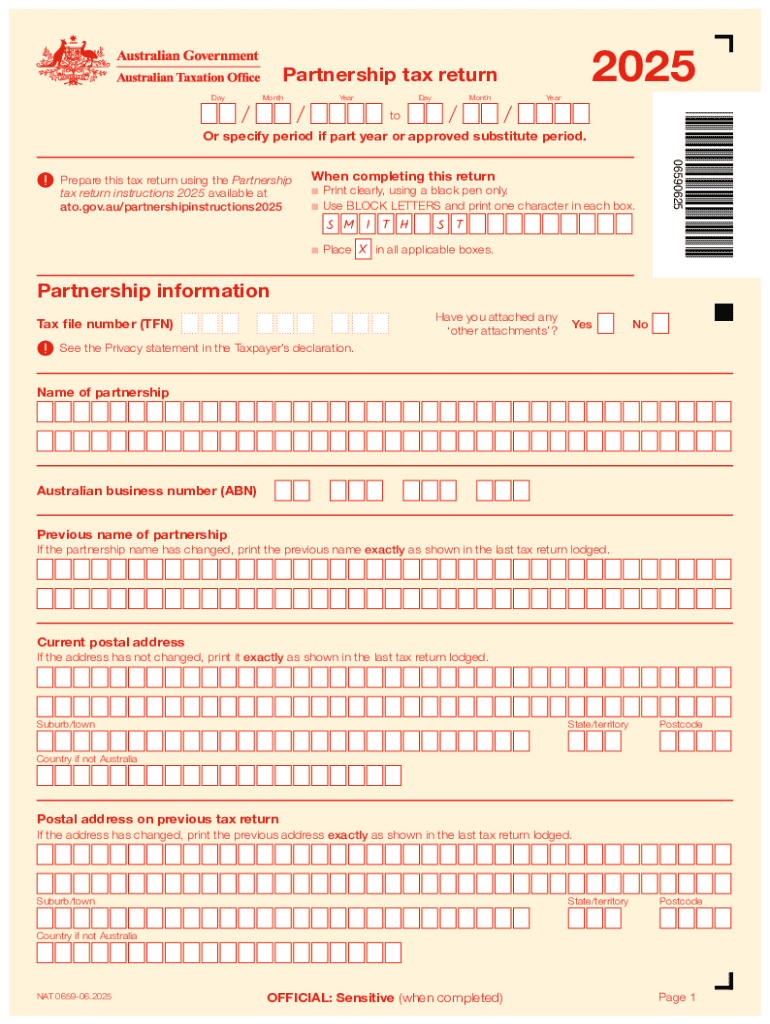

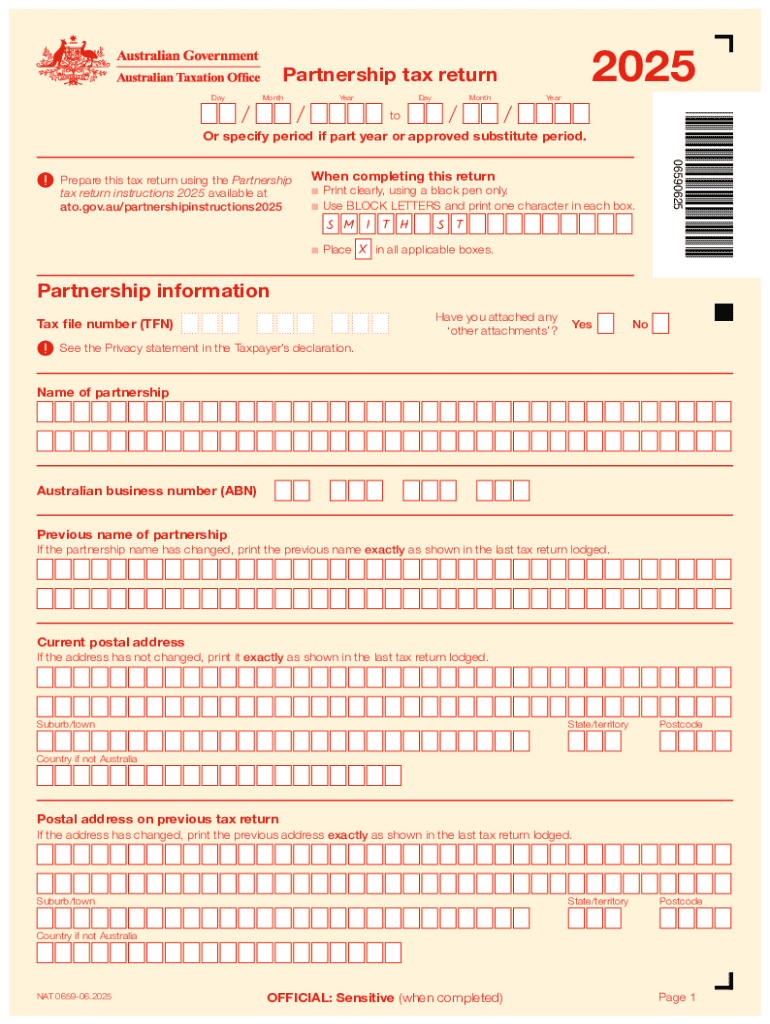

Get the free Partnership Tax Return

Get, Create, Make and Sign partnership tax return

How to edit partnership tax return online

Uncompromising security for your PDF editing and eSignature needs

How to fill out partnership tax return

How to fill out partnership tax return

Who needs partnership tax return?

Comprehensive Guide to the Partnership Tax Return Form

Understanding the partnership tax return form

The partnership tax return form, primarily IRS Form 1065, serves as the official document for reporting the income, deductions, gains, and losses of a partnership. It's crucial for all partnerships, including limited liability companies (LLCs) that have chosen to be taxed as partnerships, to file this form annually. By detailing the financial activities of the partnership, this form provides the IRS with necessary information about the entity's financial state.

Filing a partnership return is essential not only for compliance but also for accurately calculating each partner's income, which is subsequently reported on their individual tax returns. Understanding the intricacies of this form ensures that partners can avoid potential penalties and can effectively communicate their business's fiscal responsibilities and advantages.

IRS Form 1065 includes essential features such as the partnership’s fiscal year, the type of partnership structure, and each partner's respective share of credits and deductions. Familiarity with these components is vital for navigating the complexities of partnership taxation.

Who needs to file the partnership tax return form?

Any partnership engaging in business activity, regardless of its income level, must file the partnership tax return form. This includes general partnerships, limited partnerships, and LLCs that elect to be taxed as partnerships. Each partner’s ownership stake is documented, making it important for collaborations among multiple partners to follow the correct guidelines.

There are certain exceptions, such as when a partnership dissolves or when it doesn’t meet the minimum income thresholds. Additionally, some states may have specific regulations that necessitate a partnership return even if the federal requirements do not apply. Ignoring the filing obligation can result in penalties, interest charges, and potential audits, making timely and accurate filing imperative.

Step-by-step guide to completing the partnership tax return form (Form 1065)

Completing Form 1065 requires diligent preparation and awareness of the necessary details. Start by gathering required information, which includes not just the partnership's financial statements and previous year’s returns but also partner-specific details—such as Social Security numbers, ownership percentages, and contributions to capital. This foundational step facilitates smoother completion of the form.

When filling out Form 1065, focus on the core sections, including the income section that summarizes revenue and deductions. Additionally, include detailed supplemental schedules. Schedule B contains other pertinent details while Schedule K informs each partner about their share of the income, deductions, and credits. Accuracy is key—always double-check figures and ensure compliance with IRS guidelines.

Common errors include misreporting income or omitting required supplemental schedules. Before submission, create a checklist to confirm that all sections are filled correctly and that all partners agree on the distributive share items recorded.

Exploring important schedules for Form 1065

Form 1065 is supported by several important schedules that enhance compliance and accuracy. Schedule K-1 is particularly valuable as it details each partner's share of the partnership's income, deductions, and credits, which must then be reported on the partners' individual tax returns. It's fundamental for partners to receive this schedule after the return is filed.

Another crucial component is Schedule M-1, which reconciles the income reported per the partnership's books with the income reported on the tax return itself. Completing each supplementary schedule accurately is vital, as it helps to illuminate the financial health of the partnership and ensures that partners are taxed fairly based on their actual income.

Filing options for the partnership tax return form

When it comes to submitting the partnership tax return form, partnerships have several options. eFiling is often the preferred method due to its efficiency, lower likelihood of errors, and faster processing times. However, paper filing is still an option if a partnership prefers a traditional approach, albeit with slightly lower efficiency.

Key deadlines for Form 1065 typically fall on March 15th of each year. If more time is needed, partnerships can file for an extension, which grants an additional six months to submit. Understanding these deadlines is crucial in avoiding penalties while ensuring compliance.

Post-filing: what to expect after submission

After submitting the partnership tax return form, expect to receive an acknowledgment from the IRS, confirming receipt of the filing. However, there can be delays and issues that arise from errors or omissions on the form, which could lead to unnecessary complications during the review process.

If a partnership finds errors in the submitted form, amending the return is possible by filing Form 1065-X, which should detail the corrections and the reasons for the amendment. This process helps to minimize future issues with the IRS and ensures that partners are accurately represented.

FAQs about the partnership tax return form

Partnerships often have questions regarding tax returns, particularly when income generation is involved. If a partnership does not generate income, it may still be required to file Form 1065 to ensure that partners report their capital investments and any losses. It’s critical to maintain proper documentation in these cases.

When dealing with losses, partners should be informed of how these will affect their individual tax situations since losses can offset income in other areas. For complex partnership structures, resources like tax professionals or IRS publications can be beneficial in navigating the specifics of partnership taxation.

Understanding partnership taxation

Partnerships are pass-through entities, meaning that the income is not taxed at the partnership level but is passed through to the individual partners to be reported on their personal tax returns. This structure differs significantly from corporate taxation, where the corporation itself is taxed on its earnings.

Comprehending this distinction is vital as it impacts how partners strategize their tax liabilities. Proper accounting practices, such as meticulous record-keeping and regular communication about profits and contributions, are necessary for maintaining compliance and optimizing tax outcomes.

Leveraging pdfFiller for partnership tax return management

pdfFiller provides robust tools for managing your partnership tax return form seamlessly. When preparing IRS Form 1065, users can edit the PDF directly, making it easier to input accurate data. With features for eSigning and collaborating in real-time, teams can work together efficiently, regardless of location.

The cloud-based platform ensures that documents are securely stored and accessible from anywhere, enhancing productivity and reducing the likelihood of lost paperwork. Optical recognition technology can further simplify document handling by converting scanned documents into editable formats.

Additional insights and services offered by pdfFiller

Beyond just Form 1065, pdfFiller provides a range of other forms relevant to partnerships, allowing users to efficiently manage the entire suite of necessary documents. With templates and tools designed to streamline document management, partnerships can maintain compliance and handle various business forms easily.

Membership benefits with pdfFiller include access to an extensive library of legal documents, automated workflows, and storage capabilities that enhance the efficiency of managing business forms. This all-in-one solution positions partnerships to save time, minimize hassles, and focus on growing their business.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in partnership tax return without leaving Chrome?

How do I fill out the partnership tax return form on my smartphone?

How do I edit partnership tax return on an Android device?

What is partnership tax return?

Who is required to file partnership tax return?

How to fill out partnership tax return?

What is the purpose of partnership tax return?

What information must be reported on partnership tax return?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.