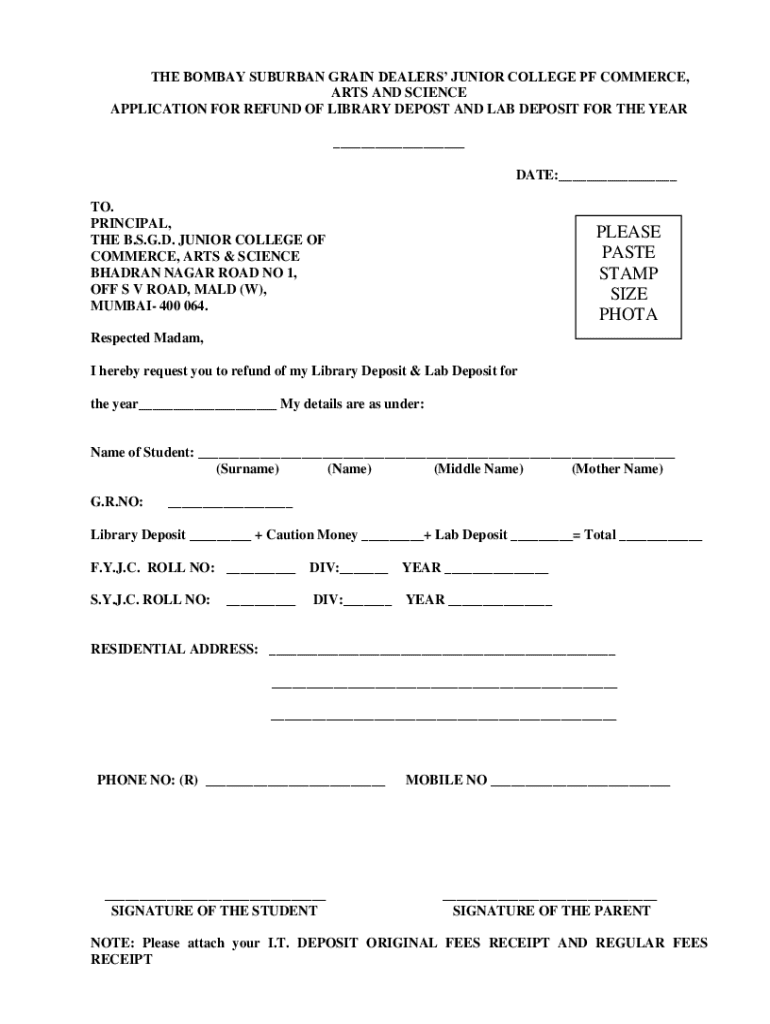

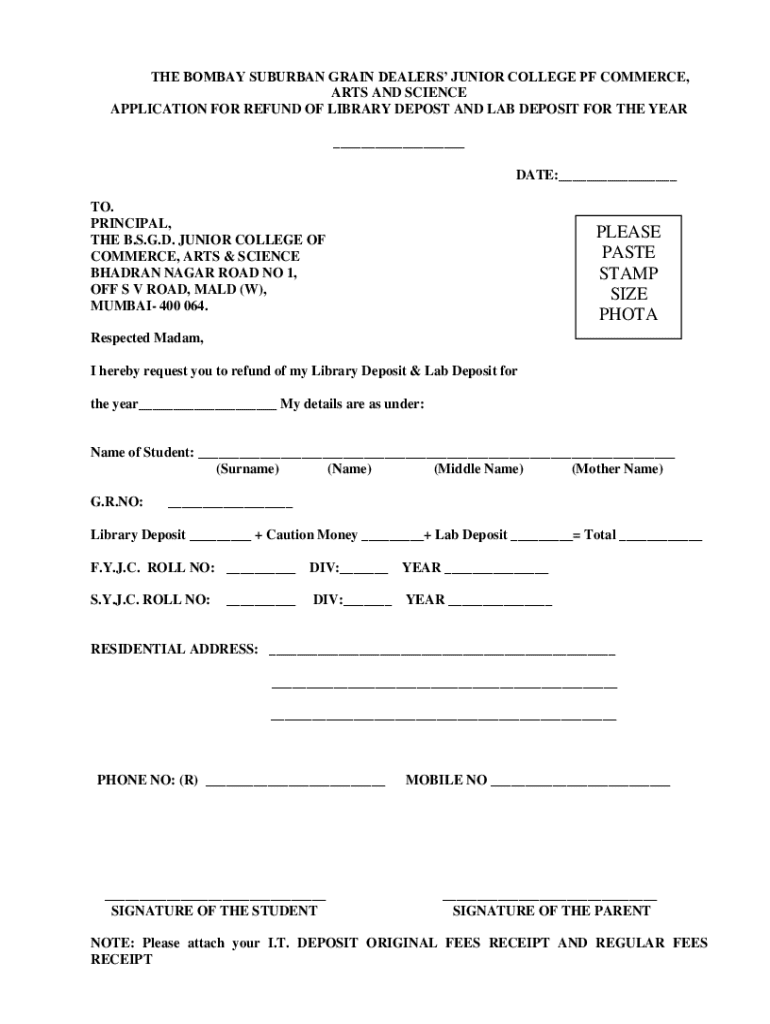

Get the free Application for Refund of Library Depost and Lab Deposit

Get, Create, Make and Sign application for refund of

How to edit application for refund of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out application for refund of

How to fill out application for refund of

Who needs application for refund of?

Application for refund of form: A comprehensive guide

Understanding the application for refund

An application for refund of form is a formal request submitted by an individual or entity seeking the return of funds paid, typically due to an overpayment or unsatisfactory services. Understanding the nuances of this application is crucial for securing a smooth refund process.

Filing for a refund serves as a protective measure for consumers, ensuring they are reimbursed for any errors or service shortcomings. Whether it’s a tax refund from the government or a service refund from a provider, the act of formally requesting a refund helps maintain financial integrity.

Types of refund applications

Refund applications can be categorized into several types, each with its own specific criteria. Understanding these categories can empower individuals and teams to submit their applications correctly and promptly.

The primary categories of refunds include tax refunds, overpayment refunds, and service refunds. Each category has unique requirements that applicants must satisfy to ensure their applications are deemed valid.

Essential information required for filing

Before submitting an application for refund of form, it is essential to gather all necessary information to ensure a thorough and complete application. Each piece of information plays a crucial role in the processing of your refund request.

Essentially, the information required generally falls into two categories: personal details and transaction details. Properly collating this data can greatly expedite the processing of your refund.

Step-by-step guide to filling out the application form

Filling out the application form accurately is crucial for a successful refund claim. Here is a thorough step-by-step guide to assist you in this process.

Start by preparing your information, which includes ensuring you have all the required details at hand. Next, access the refund application form, which is typically available on the official website of the respective organization issuing refunds.

It's important to check for common mistakes. Submitting incomplete applications or incorrect documentation can delay or even deny your refund request.

Submitting your application

Once you have filled out the application form, the next step is submission. Understanding the different options available for submitting your application can help you choose the most convenient method for your situation.

Most organizations offer multiple options for submitting refund applications, including online, mail, or in-person submissions. Each method has its own advantages.

Remember to track your application status if submitted online. This will help you stay informed of any updates or actions required.

Post-submission steps

After submitting your application for refund of form, it’s essential to know what to expect. The review process can vary based on the organization and type of refund requested.

Typically, you will receive a confirmation of receipt, followed by an evaluation phase where your application is reviewed for accuracy and validity. Common outcomes include approval, denial, or requests for more information.

In case of delays or denials, be proactive. Keep open lines of communication with the organization involved for clarity and a potential appeal process.

Understanding your rights and responsibilities

It’s critical to understand both your rights and responsibilities when filing an application for refund of form to ensure a smooth process and avoid possible pitfalls.

As an applicant, you are entitled to receive clear communication regarding your refund status, timelines, and outcomes. However, it is also your responsibility to provide accurate information and complete documentation as required.

Familiarizing yourself with any legal considerations, such as the deadlines for filing and response times for organizations, is essential in safeguarding your rights.

FAQs about refund applications

Many individuals may have common questions regarding the application for refund of form. Below are some frequently asked questions that can provide clarity.

Interactive tools and resources

Utilizing available interactive tools and resources can simplify the application process. Many organizations provide eForms or templates that can ease data input and submission.

Through websites like pdfFiller, you can access a variety of resources, including tutorials on completing documents and community forums for additional support.

Utilizing pdfFiller for seamless application management

Managing your refund applications becomes significantly easier with tools like pdfFiller. Their platform provides useful features that enhance the overall experience of document management.

With pdfFiller, users can edit PDFs efficiently, eSign documents, and collaborate seamlessly with team members, making the refund process streamlined and organized.

The benefits of using a cloud-based document management system are numerous, including secure document storage, enhanced workflow efficiency, and access from anywhere, making the application process smoother.

Personal and team success stories

Success stories can provide valuable insights into the refund application process. Users of pdfFiller have shared their experiences, highlighting how the platform facilitated their claims.

For example, a small business used pdfFiller to streamline multiple refund applications related to overpaid taxes. They reported a significant reduction in processing time by using the editing and eSignature tools available.

Language and assistance options

For those who face language barriers, finding support can make a significant difference in navigating the application for refund of form process.

Many organizations and platforms offer multilingual resources to assist non-native speakers in completing their applications. Additionally, contacting support for language assistance can further enhance accessibility.

About pdfFiller

pdfFiller is dedicated to providing users with an efficient and accessible document management solution. The company's mission focuses on empowering individuals and teams by simplifying the process of document creation, editing, and management.

With a commitment to customer satisfaction, pdfFiller aims to enhance the user experience by continually refining its platform, ensuring that your application for refund of form process is as smooth as possible.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send application for refund of for eSignature?

How do I make changes in application for refund of?

Can I create an eSignature for the application for refund of in Gmail?

What is application for refund of?

Who is required to file application for refund of?

How to fill out application for refund of?

What is the purpose of application for refund of?

What information must be reported on application for refund of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.