Get the free Mileage Reimbursement Trip Log and Invoice

Get, Create, Make and Sign mileage reimbursement trip log

Editing mileage reimbursement trip log online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mileage reimbursement trip log

How to fill out mileage reimbursement trip log

Who needs mileage reimbursement trip log?

Mileage Reimbursement Trip Log Form: How-to Guide

Understanding mileage reimbursement

Mileage reimbursement is a process that allows employees to be compensated for using their personal vehicles for business-related travel. This practice is essential for organizations to ensure fair treatment of employees who incur costs while traveling on behalf of their employer. Proper tracking of mileage for reimbursement purposes is not only beneficial for employees but also for employers who must maintain accurate financial records.

The importance of tracking mileage cannot be overstated. It ensures that employees receive the correct amount for their travel expenses while providing employers with necessary documentation for tax and audit purposes. Generally, anyone using a personal vehicle for business may be eligible for mileage reimbursement, which often includes employees, contractors, and freelancers.

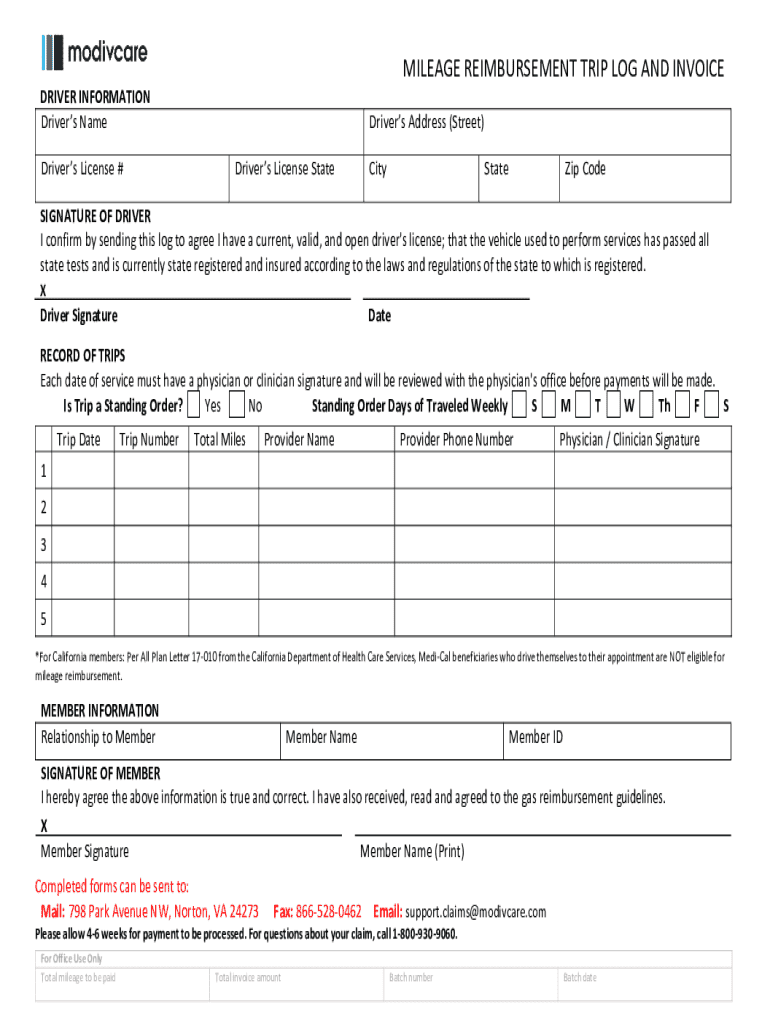

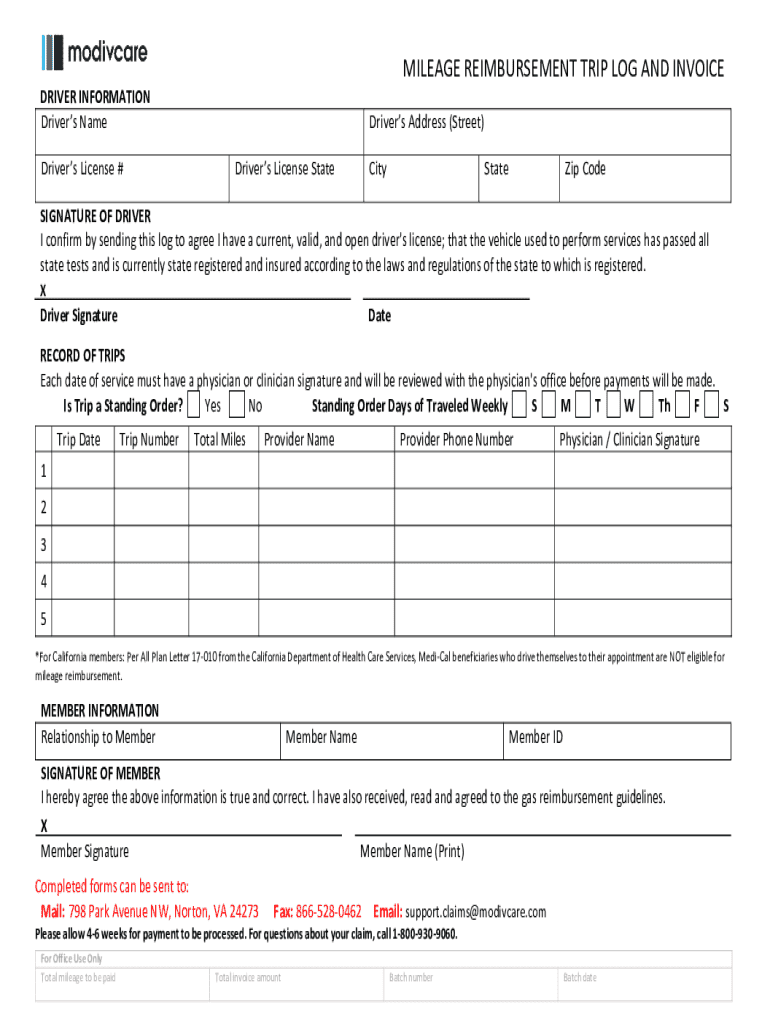

Overview of the mileage reimbursement trip log form

A Mileage Reimbursement Trip Log Form is a structured document designed to help individuals record their travel details and expenses related to business trips. This form is crucial for streamlining the reimbursement process by capturing essential trip information systematically, allowing for both easy completion and clear reporting.

Key components of the form include:

The Mileage Reimbursement Trip Log Form greatly aids in reimbursement claims by organizing all necessary information, reducing the chance of disputes or errors that can delay payment.

Preparing to fill out the trip log form

Before filling out the Mileage Reimbursement Trip Log Form, it is essential to gather all necessary information to ensure accuracy and completeness. Collecting personal details such as your full name, address, and contact information is the first step in this process. Furthermore, having previous logs and supporting documents, like receipts for expenses incurred (e.g., parking, tolls) can provide clarity and support for the reimbursement request.

When choosing the best format for your trip log form, consider whether a digital format or a traditional paper document suits you better. Digital forms typically offer more flexibility, allowing for easy edits and faster submission.

Step-by-step instructions to complete the mileage reimbursement trip log form

Completing the Mileage Reimbursement Trip Log Form is straightforward when you follow these steps:

Utilizing pdfFiller tools for managing your trip log form

pdfFiller provides an efficient platform for managing your Mileage Reimbursement Trip Log Form. To get started, you can easily access the form through the pdfFiller website, where it is available for download or editing online.

Once accessed, pdfFiller allows you to edit the form to customize it according to your specific needs. It also supports eSigning, enabling you to sign your forms online securely. This is particularly useful for ensuring your documentation remains organized and accessible from any device.

Submitting your mileage reimbursement trip log form

Submitting your Mileage Reimbursement Trip Log Form can be carried out through various methods, including email, online portals, or fax, depending on your employer's preferred processes. Check with your HR department for the most appropriate submission method.

To ensure timely processing of your reimbursement, aim to submit your form promptly after travel. Ideally, keep track of the processing timelines to follow up appropriately, ensuring you receive your reimbursement without significant delays.

Frequently asked questions about mileage reimbursement

Individuals typically have a lot of questions regarding mileage reimbursement. A few common queries include:

Addressing these questions can help streamline the process and provide clarity for employees navigating mileage reimbursement protocols.

Best practices for record keeping

Maintaining an accurate log of your mileage and travel expenses is crucial for potential future needs, including audits or tax preparation. Regularly updating your trip log not only keeps records current but also aids in accurate reporting when reimbursement requests arise.

Consider using recommended tools and apps specifically designed for tracking mileage. Such technology can automate your record-keeping processes, allowing you to capture details effortlessly.

Additional considerations

It’s important to understand the differences between personal and business mileage for reimbursement purposes. Personal travel typically does not qualify, whereas travel related to business tasks is eligible. Additionally, keep in mind the tax implications of mileage reimbursement—you may need to report this income differently based on local tax laws.

Staying informed about policy updates is vital, as reimbursement procedures can evolve or change. Having up-to-date knowledge will assist both employees and employers in navigating these changes effectively.

Customer testimonials and case studies

Many users have shared their experiences with the Mileage Reimbursement Trip Log Form, often noting how a straightforward, well-organized setup made the reimbursement process seamless. Case studies reflect how employing a digital solution, such as the one provided by pdfFiller, has increased efficiency and user satisfaction.

Such accounts underline the importance of adopting a reliable system that enhances documentation management and simplifies travel expense reporting.

Related forms and resources

On the pdfFiller platform, users can find a variety of related forms that may assist in the broader context of employee expenses, such as travel authorization forms and expense reimbursement forms. Having access to these additional resources can streamline document handling and improve overall efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send mileage reimbursement trip log to be eSigned by others?

Can I create an eSignature for the mileage reimbursement trip log in Gmail?

How do I edit mileage reimbursement trip log straight from my smartphone?

What is mileage reimbursement trip log?

Who is required to file mileage reimbursement trip log?

How to fill out mileage reimbursement trip log?

What is the purpose of mileage reimbursement trip log?

What information must be reported on mileage reimbursement trip log?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.