Get the free Sarbanes-oxley Act of 2002 Implications for Environmental Counsel

Get, Create, Make and Sign sarbanes-oxley act of 2002

Editing sarbanes-oxley act of 2002 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sarbanes-oxley act of 2002

How to fill out sarbanes-oxley act of 2002

Who needs sarbanes-oxley act of 2002?

Understanding the Sarbanes-Oxley Act of 2002 Form

Overview of Sarbanes-Oxley Act of 2002

The Sarbanes-Oxley Act of 2002 (SOX) was enacted in response to high-profile corporate scandals like Enron and WorldCom, which eroded public trust in financial markets. Its primary goal is to protect investors by improving the accuracy and reliability of corporate disclosures. More specifically, the Act aims to enhance corporate governance and accountability within publicly traded companies. Consequently, organizations must comply with stringent regulations designed to ensure transparency in financial reporting.

Key principles of compliance under SOX include transparency, accountability, and accuracy. These principles aim to hold corporate executives responsible for maintaining the integrity of financial statements. Compliance not only mitigates the risk of corporate fraud but also fosters a culture of ethical business practices, paving the way for sustainable business operations.

Understanding the Sarbanes-Oxley Form

The Sarbanes-Oxley Act of 2002 Form is a critical document used to ensure compliance with the regulations set forth by SOX. This form serves multiple purposes, including certifying the accuracy of financial statements and confirming that necessary internal controls are in place. Its significance lies in its role as a safeguard for stakeholders, as it enhances accountability and mitigates the risk of corporate malpractice.

Accurate completion of the Sarbanes-Oxley Form is paramount, as inaccuracies can result in severe penalties for both companies and individuals. Companies could face hefty fines, loss of reputation, and even legal action if they fail to meet compliance requirements. Individual executives, particularly CEOs and CFOs, could find themselves liable for civil and criminal charges resulting from misleading or false certifications.

Major provisions of the Sarbanes-Oxley Act

The Sarbanes-Oxley Act contains several provisions that emphasize corporate governance and financial accountability. One of the most notable is Section 302, which mandates that both the CEO and CFO of a corporation personally certify the accuracy of financial reports. This provision ensures that top executives are held accountable for the information they present to shareholders and regulators.

Another significant section, Section 404, requires management to assess and report on the effectiveness of internal controls over financial reporting. This provision emphasizes the need for a robust system of internal controls to prevent inaccuracies and fraud in financial documents. Meanwhile, Section 806 provides whistleblower protections, making it illegal for companies to retaliate against employees who report fraud or violations of the law. Finally, Section 906 introduces criminal penalties for executives who knowingly certify misleading financial reports, reinforcing the consequences of dishonesty.

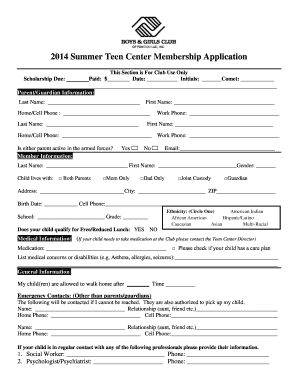

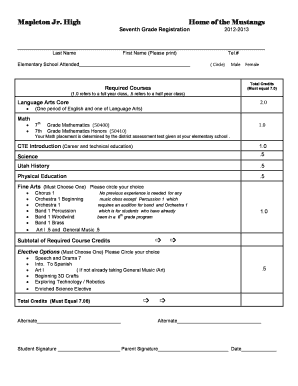

Preparing to fill out the Sarbanes-Oxley form

To effectively complete the Sarbanes-Oxley Form, one must gather essential information. Key details include the name of the company, financial statements being certified, internal controls in place, and the identity of the certifying officers. Having a comprehensive understanding of these details not only streamlines the filling process but ensures compliance and minimizes errors.

To enhance efficiency in completing the Sarbanes-Oxley Form, utilizing tools like pdfFiller can be beneficial. This versatile platform offers interactive features that simplify the editing process, ensuring users can manage documents effectively and securely. Firms can leverage this technology to maintain compliance seamlessly while adapting their document management strategies.

Step-by-step guide to filling out the Sarbanes-Oxley form

Filling out the Sarbanes-Oxley Form requires a structured approach. Begin with Step 1: gathering necessary documentation. Compile a checklist that includes financial statements, internal control assessments, and details of the certifying officers to simplify your prep work.

Step 2 involves completing the various sections of the form. Each section must be addressed thoroughly; provide precise data, ensuring accuracy and transparency. Step 3 focuses on reviewing the completed form. Confirm that all information is accurate by double-checking figures and statements. Utilize tools such as pdfFiller for final reviews, which can also indicate possible errors or omissions.

Finally, Step 4 requires signing and submitting the form. You can digitally sign the document using pdfFiller’s electronic signature feature, streamlining submission through a secure cloud system while ensuring compliance with legal requirements.

Common challenges when completing the Sarbanes-Oxley form

Completing the Sarbanes-Oxley Form can come with challenges. A common issue is the misinterpretation of requirements; many organizations struggle to fully understand the compliance prerequisites set by SOX. This often leads to mistakes that can have severe consequences. It's crucial for teams to familiarize themselves with the regulations to avoid pitfalls.

Another challenge is managing compliance with deadlines. Failure to meet submission deadlines could result in fines or increased scrutiny from regulators. Implementing a structured timeline for completing each phase of the form while utilizing reminders can significantly improve compliance and response times.

Managing and storing Sarbanes-Oxley compliance documents

Best practices for document management are essential in maintaining compliance with the Sarbanes-Oxley Act. Organizing compliance documents securely in the cloud promotes accessibility and prevents loss or mismanagement of crucial information. Establish clear filing systems, perhaps by categorizing documents based on type, date, or compliance status.

Utilizing solutions like pdfFiller not only aids in the initial completion of compliance forms but also facilitates ongoing management. Features such as version control and secure sharing ensure you maintain an accurate and up-to-date record of compliance documentation, making audits straightforward and less stressful.

Case studies and success stories

Numerous organizations have successfully navigated the complexities of compliance with the Sarbanes-Oxley Act, establishing models for best practices within their industries. For instance, a Fortune 500 company revamped its financial reporting processes to align with SOX requirements, which not only improved trust among investors but also increased operational efficiency. Such initiatives demonstrate that effective compliance can lead to enhanced organizational integrity and success.

Conversely, companies that have faced challenges frequently highlight the importance of proactive engagement with compliance requirements. Insights gained from companies that have undergone scrutiny often emphasize the need for continuous training and awareness among staff, ensuring everyone understands their roles in maintaining compliance.

Conclusion: The future of Sarbanes-Oxley compliance

The landscape of corporate governance and compliance continues to evolve, driven by technological advancements and shifting regulatory frameworks. Emerging trends indicate a growing emphasis on automation and artificial intelligence in compliance processes, making it easier for companies to manage their obligations efficiently. A proactive approach to compliance, leveraging technology to streamline processes and improve reporting accuracy, will likely define the future of Sarbanes-Oxley compliance.

As companies adapt to these changes, ongoing training and embracing robust compliance technologies will be crucial. Platforms like pdfFiller offer accessible document management solutions that empower organizations to meet compliance standards effectively while enhancing transparency and trust with their stakeholders.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete sarbanes-oxley act of 2002 online?

How do I edit sarbanes-oxley act of 2002 straight from my smartphone?

Can I edit sarbanes-oxley act of 2002 on an Android device?

What is sarbanes-oxley act of?

Who is required to file sarbanes-oxley act of?

How to fill out sarbanes-oxley act of?

What is the purpose of sarbanes-oxley act of?

What information must be reported on sarbanes-oxley act of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.