Get the free Form 10-q

Get, Create, Make and Sign form 10-q

Editing form 10-q online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-q

How to fill out form 10-q

Who needs form 10-q?

10-Q Form: A Comprehensive How-to Guide

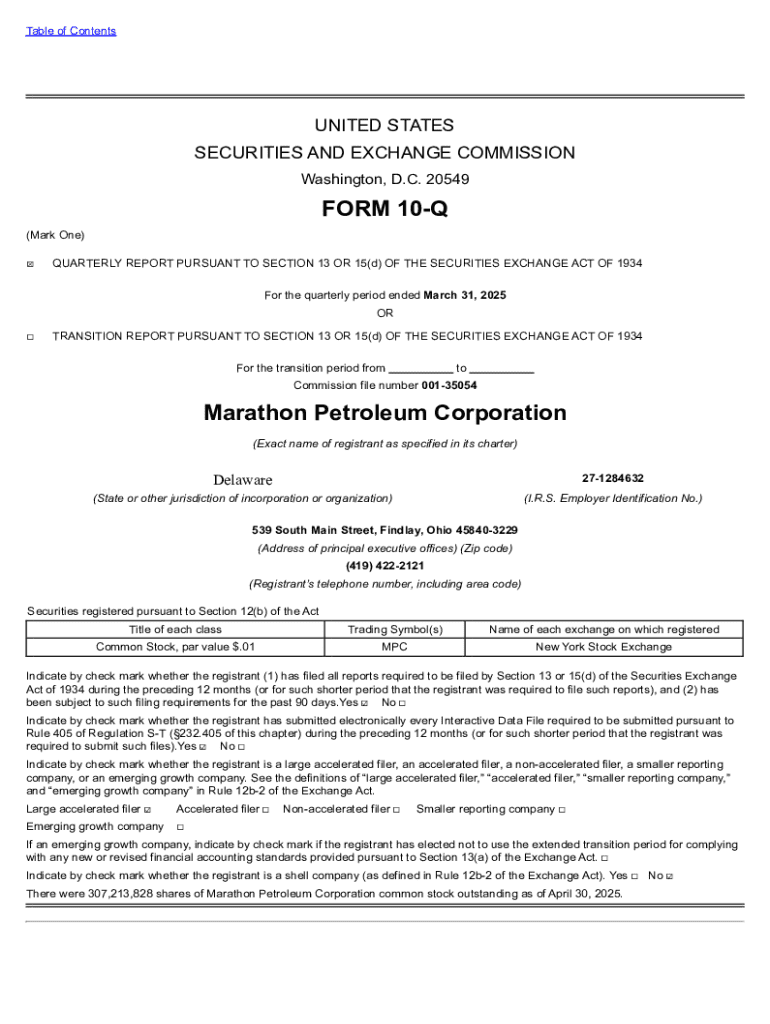

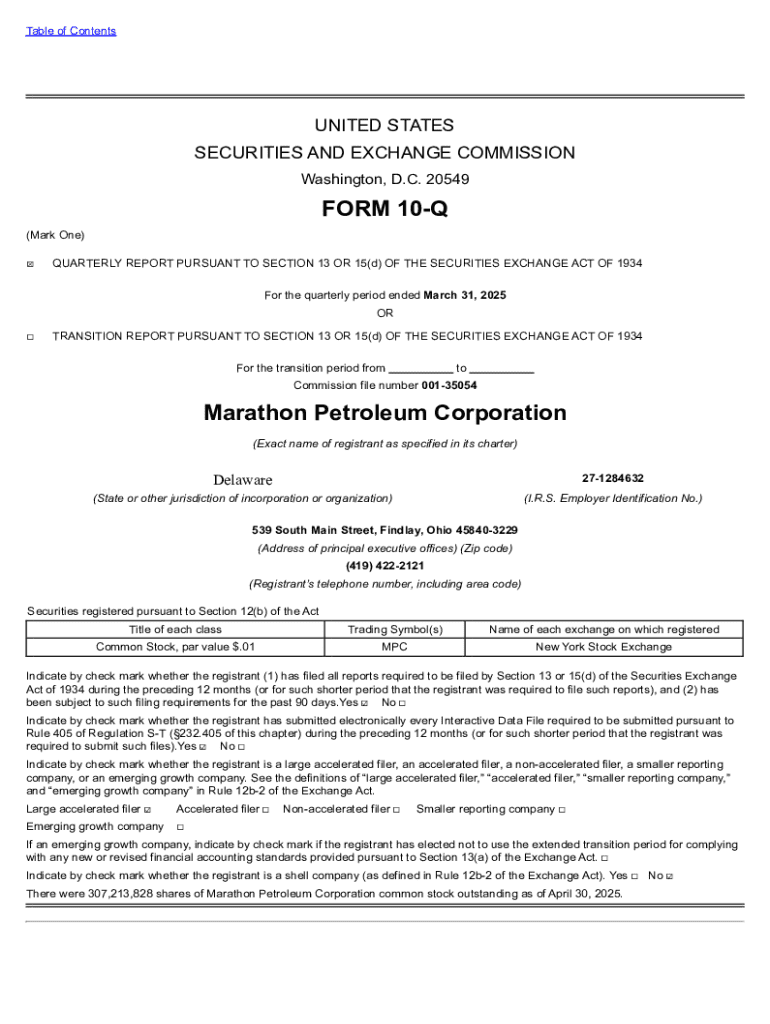

Understanding the 10-Q form

The 10-Q form is a crucial document that public companies are required to submit quarterly to the Securities and Exchange Commission (SEC). It provides an overview of a company's financial performance, covering the company’s financial position, operating results, and any significant developments since the last 10-K filing. This form ensures transparency for investors and stakeholders, allowing them to assess the company's ongoing health and performance, which is essential for informed investment decisions.

The importance of the 10-Q form in financial reporting cannot be overstated. It facilitates ongoing monitoring of companies and can serve as an indicator of potential investment opportunities or risks. Given its frequency, it constantly updates investors on a company’s performance in between the more comprehensive annual filings. The SEC mandates the 10-Q to promote accountability and assist in preventing securities fraud.

Who needs to file a 10-Q?

Every public company is required to file a 10-Q, making it a standardized expectation regardless of the company’s size or industry sector. This includes companies listed on national exchanges and those that are registered under the securities laws. The requirement ensures that the SEC has regular updates on public companies’ operations and finances.

The key difference between a 10-Q and other filings, such as the 10-K, lies in the frequency and depth of the reports. While the 10-K is an annual report offering comprehensive details about a company’s financial condition, the 10-Q provides a less detailed, yet timely update. Companies must file a 10-Q for the first three quarters of their fiscal year, while the 10-K is required annually.

Contents of a 10-Q form

A 10-Q form consists of several key components that provide a holistic view of a company's quarterly performance. It includes financial statements that summarize financial operations, including the balance sheet, income statement, and cash flow statement. Each of these financial statements presents critical insights, such as the company’s income, resources, and cash management practices, reflecting its operational efficiency over the quarter.

Furthermore, the Management’s Discussion and Analysis (MD&A) section allows the company's management to provide context and insight into the financial data. This analysis empowers investors to grasp the qualitative factors influencing financial performance, including market conditions, business strategies, and risks. Disclosures regarding market risks are also essential, further informing stakeholders about potential vulnerabilities.

Preparing the 10-Q form

Preparation is critical for a successful 10-Q filing. A pre-filing checklist allows companies to ensure compliance with SEC regulations. Important steps include gathering the necessary financial data from accounting records and reviewing consistency with previous filings to avoid discrepancies. Coordination among finance and legal teams is also essential to confirm comprehensive reporting.

A step-by-step guide for filling out the 10-Q ensures meticulousness in crafting the report. Electronic submission is done through EDGAR, requiring knowledge of formatting and submission guidelines. Utilizing automated tools like pdfFiller facilitates collaboration and editing, ensuring the accuracy of data before submission. It’s also crucial to adhere to the deadlines set by the SEC to avoid penalties and compliance issues.

Filing the 10-Q

Filing your 10-Q properly is paramount. Successful submission is executed electronically through EDGAR, where companies are assigned unique filing symbols that must be utilized. Understanding these symbols, as well as creating a user account on EDGAR, will streamline the filing process. An understanding of the SEC’s submission validation can greatly reduce the chances of errors.

Common mistakes such as delays due to missing information, incorrect disclosures, or late filings can lead to penalties and further scrutiny from regulators. Companies must remain vigilant to ensure all required information is accurately and timely submitted. Consistent reviews of filing requirements and updates from SEC can support compliance.

Post-filing considerations

After the filing, monitoring is crucial for any inquiries or comments from the SEC. Companies should have a structured process to respond efficiently to feedback, which may involve filing amendments if necessary. Adequate communication among stakeholders during this period is vital to sustain investor trust.

The insights gained from the 10-Q data can be invaluable for internal decision-making and investor relations. Analyzing quarterly results can uncover strengths and weaknesses in a company's operations, providing management teams with data-driven insights to adjust strategies effectively. This shared information with investors enhances credibility and promotes transparency.

Resources for 10-Q filers

Effective document management is essential for 10-Q filers, and tools like pdfFiller can optimize this process. Its interactive tools and templates streamline creation, editing, and collaboration on various documents, including forms needed for 10-Q. By tapping into pdfFiller’s features, companies can ensure rigorous document reviews and approvals before submission.

Expert tips for managing the complexities of 10-Q filings include engaging with skilled financial professionals or consultants who understand the intricacies of SEC requirements. Staying informed about recent changes to regulations and best practices can also safeguard a company against compliance risks, thus ensuring that the filing process runs smoothly and efficiently.

Conclusion

Timely and precise reporting through the 10-Q form is fundamental in maintaining market integrity and investor confidence. A robust process built around efficient systems like pdfFiller enhances accuracy and compliance while allowing companies to manage their document lifecycle effectively. By embracing a cloud-based solution, organizations can navigate the complexities of financial reporting while focusing on their core business operations.

Ultimately, the 10-Q is not just a regulatory requirement; it’s a powerful tool for demonstrating transparency and fostering trust in the company’s operations. With the right preparation, filing processes, and post-filing strategies, companies can harness the potential of their 10-Q filings for strategic advantage in the marketplace.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify form 10-q without leaving Google Drive?

How do I edit form 10-q in Chrome?

How do I complete form 10-q on an iOS device?

What is form 10-q?

Who is required to file form 10-q?

How to fill out form 10-q?

What is the purpose of form 10-q?

What information must be reported on form 10-q?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.