Get the free Institutional Professional Investor Account Opening Form

Get, Create, Make and Sign institutional professional investor account

Editing institutional professional investor account online

Uncompromising security for your PDF editing and eSignature needs

How to fill out institutional professional investor account

How to fill out institutional professional investor account

Who needs institutional professional investor account?

Institutional professional investor account form - How-to guide

Understanding the institutional professional investor account

An institutional professional investor account serves as a specialized investment vehicle tailored for organizations such as banks, hedge funds, and large corporations. These accounts are designed to cater to the complex needs of institutions that engage in significant market activities, allowing access to a broader range of financial products and services.

To qualify as an institutional investor, entities typically must meet specific regulatory criteria defined by financial authorities. This includes various financial institutions or organizations with substantial assets under management, such as pension funds, insurance companies, and mutual funds. These entities benefit from unique access to investment opportunities, including private placements and restricted funds, which are not available to retail investors.

Establishing a professional investor account is vital for these institutions due to the enhanced flexibility and opportunities it offers. It enables access to sophisticated investment strategies and advanced trading platforms that enhance overall portfolio management.

Key features of the institutional professional investor account

Institutional professional investor accounts differentiate themselves through their diverse and sophisticated features, catering to the intricate requirements of institutional investors. One of the critical features is the access to advanced financial products, which can include private equity investments, hedge funds, and specialized derivatives.

Alongside this, enhanced portfolio management tools are integral to the account offering. These tools enable investors to track investments conveniently, manage risk exposures, and perform analytical assessments of their portfolios, ultimately leading to more informed decision-making.

Moreover, collaborative document management is another significant advantage. Through platforms like pdfFiller, investment teams can efficiently collaborate on documentation, enhancing communication and workflow efficiency. With tools that allow multiple users to review, edit, and maintain investment documents, collaboration becomes seamless.

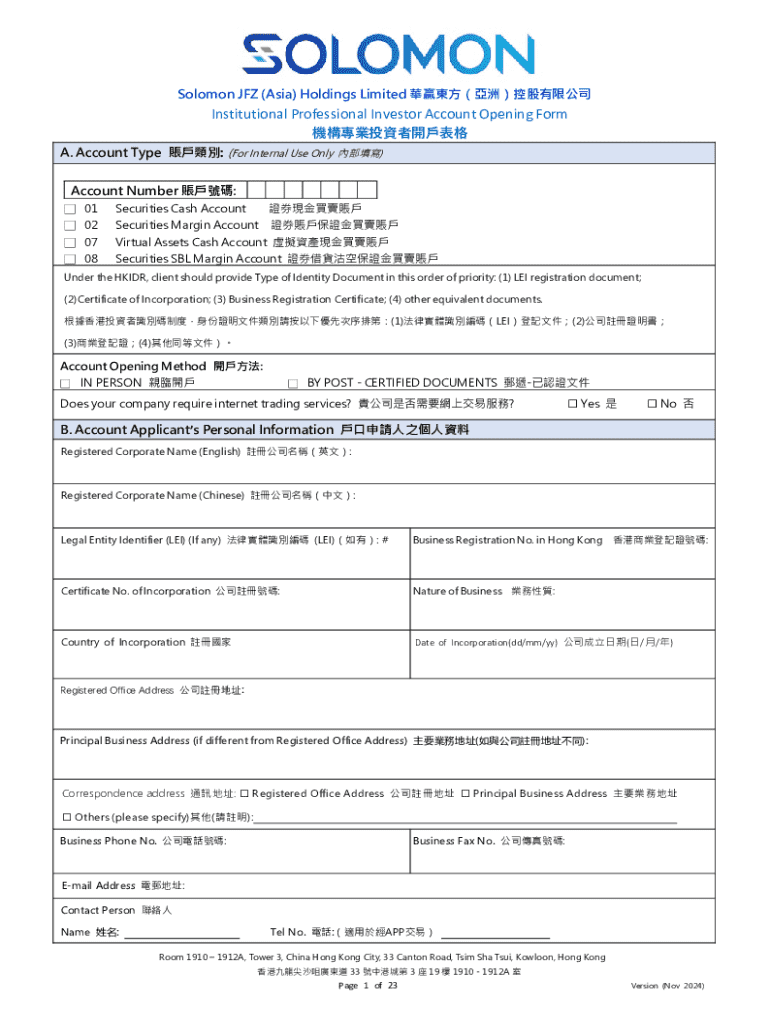

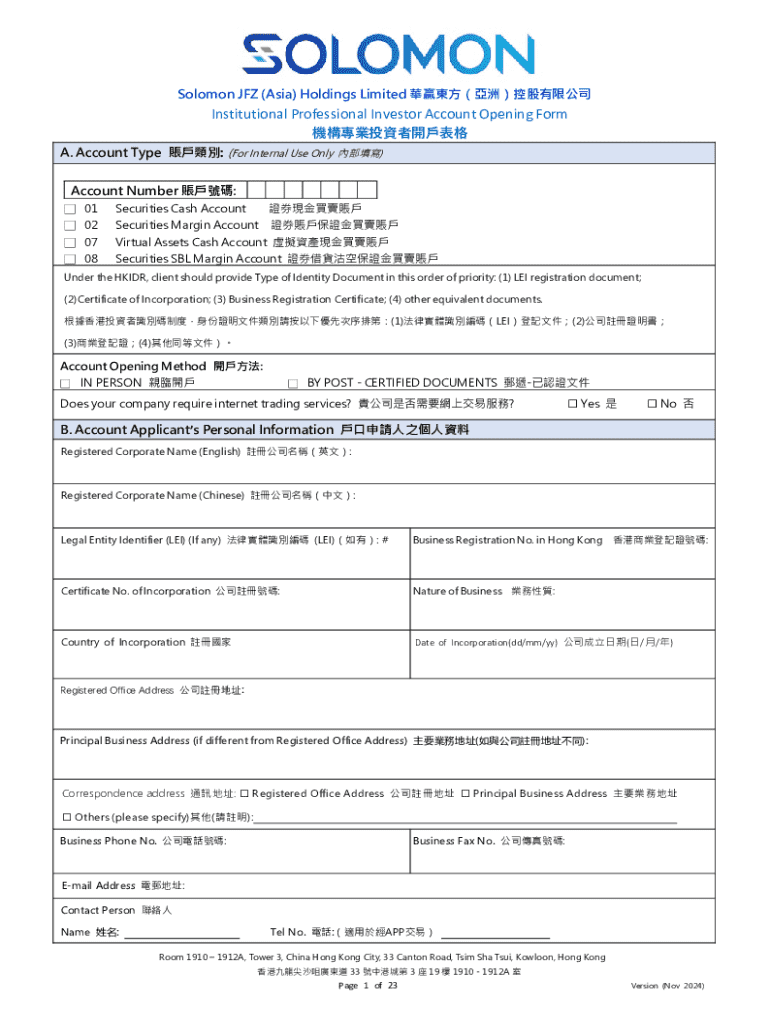

Preparing to fill out the institutional professional investor account form

Before starting to fill out the institutional professional investor account form, it is crucial to gather all necessary documents and information. Required identification documents typically include business registration certificates, tax identification numbers, and various financial statements that verify the institution’s standing.

Additionally, detailed financial information, including balance sheets, income statements, and cash flow statements, must be prepared in advance. Having these details organized can help facilitate a smoother application process and prevent potential delays.

To avoid common pitfalls in the application process, institutions should ensure that all information is accurate and up-to-date. It’s also advisable to review the form comprehensively before submission. Adopting best practices for information gathering, such as maintaining clear records and using structured templates, can significantly streamline the process.

Step-by-step guide to completing the account form

Completing the institutional professional investor account form involves several key sections that must be filled out accurately. First, Section 1 requires personal and institutional information, including the primary contact’s details, institutional address, and registration details. Being thorough in this section ensures proper communication through the application process.

In Section 2, applicants must provide detailed financial information, which includes reporting total assets under management, annual revenue, and other relevant financial metrics. This section is critical as it establishes the institution's credibility and investment capacity.

Moving on to Section 3, applicants describe their investment experience and objectives. Institutions should emphasize their investment strategies, including risk tolerance and target returns. Transparency regarding investment philosophy aids the reviewing body in understanding the institution's goals.

Finally, Section 4 addresses compliance and regulatory disclosures. It is vital to disclose any pertinent information, including past regulatory actions or conflicts of interest, to comply with governing regulations.

Editing and customizing the institutional professional investor account form

pdfFiller provides robust tools for editing the institutional professional investor account form, allowing users to create a customized template that fits their specific needs. Utilizing the editing capabilities, users can seamlessly modify PDFs, adding or removing fields, notes, and comments as needed to ensure all information is relevant and clear.

Collaborating with team members on the form is made easy with pdfFiller’s sharing options, enabling multiple stakeholders to review and comment on the document in real-time. This collaborative environment enhances synergy within investment teams, ensuring that everyone involved can contribute to the final submission effectively.

Signing and submitting the institutional professional investor account form

Once the institutional professional investor account form is completed and customized according to the institution’s requirements, it’s crucial to sign the document. pdfFiller simplifies this process by allowing users to create and apply a digital signature easily. The platform ensures that the eSignature process complies with legal regulations, providing an added layer of authenticity to the form.

After signing, institutions can submit their completed forms through various channels, including electronic submission via the platform or traditional mail. An immediate confirmation of submission can often be expected, detailing what steps to anticipate next—this might include application processing timelines and potential follow-ups.

Post-submission: Managing your institutional account with pdfFiller

After submitting the institutional professional investor account form, monitoring the application status is a crucial next step. Through pdfFiller, institutions can easily track their application's progress, receiving updates directly through the platform. This oversight ensures that any necessary communications or actions are promptly undertaken.

In addition, institutions may need to make updates to their account information over time. Procedures should be in place for efficiently updating details, such as changing authorized signatories or adjusting contact information. Users can leverage pdfFiller to make these updates, ensuring that their account always remains accurate and responsive.

For any questions or support needs, pdfFiller provides robust customer service, available to assist with common inquiries or technical issues. This support system is vital for ensuring institutions maximize their use of the platform and manage their accounts effectively.

Additional forms related to institutional professional investors

Institutions often require additional documentation to accompany the institutional professional investor account form. Notably, the account information update form allows entities to amend existing details without needing to submit extensive new applications. This flexibility encourages efficient account management and maintenance.

Related investment forms might also be necessary, covering aspects such as investment policy statements or compliance certifications. Each document serves a specific purpose that aids in the overall operational framework. Additionally, understanding the fee schedule associated with institutional accounts is crucial; this overview should clarify any potential fees tied to account maintenance and transaction-related costs.

User manual for personalizing your experience

To enhance efficiency while using the pdfFiller platform, users should familiarize themselves with available features that allow for personalization. Custom dashboards can be created to provide quick access to commonly used forms, making navigation more intuitive. This customization can greatly speed up the document preparation process during busy periods.

For new users, adhering to best practices is essential for maximizing the pdfFiller experience. Utilizing built-in tutorials and support resources, users can learn how to navigate the platform effectively, making their engagement with pdfFiller much more productive. Over time, understanding advanced features will further optimize workflow, ensuring that institutional tasks are handled with ease.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get institutional professional investor account?

How do I edit institutional professional investor account in Chrome?

How do I edit institutional professional investor account on an Android device?

What is institutional professional investor account?

Who is required to file institutional professional investor account?

How to fill out institutional professional investor account?

What is the purpose of institutional professional investor account?

What information must be reported on institutional professional investor account?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.