Get the free Sec Form 4

Get, Create, Make and Sign sec form 4

Editing sec form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 4

How to fill out sec form 4

Who needs sec form 4?

SEC Form 4: A Comprehensive Guide to Filing and Management

Understanding SEC Form 4: A Comprehensive Overview

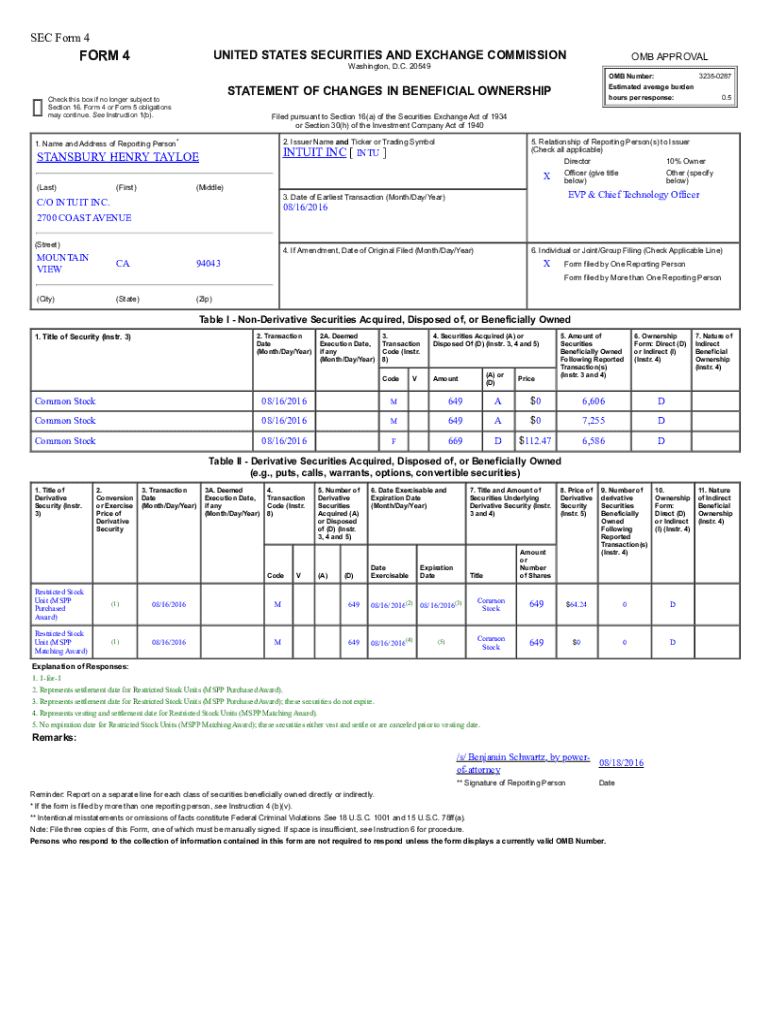

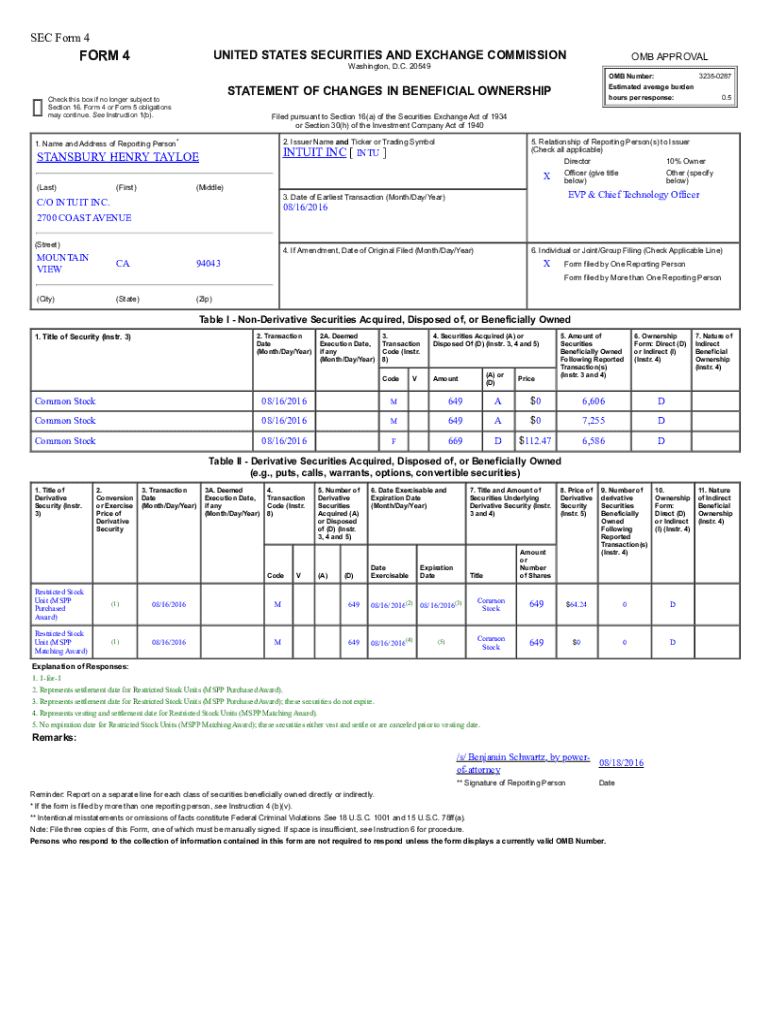

SEC Form 4 is a crucial document that must be filed by insiders when they buy or sell certain securities in their company. This form aims to promote transparency and accountability in the trading activities of an organization's officers, directors, and beneficial owners who hold more than 10% of a company’s equity securities. Its primary purpose is to ensure that the investing public has access to information regarding insider trading, thereby holding executives accountable for their financial actions.

The importance of SEC Form 4 transcends mere compliance. It plays a pivotal role in corporate governance as it allows investors and stakeholders to make informed decisions based on insider movements. When insiders are transparent about their trades, it fosters trust and confidence in the company’s management, which is essential for healthy market functioning.

Who is required to file?

The SEC requires that specific individuals and entities file Form 4, primarily focusing on ‘insiders.’ These insiders include corporate officers, directors, and any beneficial owners who control more than 10% of a company's stock. Filing this form ensures that these individuals disclose their trading activities, thus maintaining market integrity.

The obligation to file SEC Form 4 is designed to prevent insider trading, a practice that undermines the market's fairness and can lead to legal repercussions. Hence, compliance is not just a regulatory requirement but an ethical obligation for the insiders.

Filing deadlines and regulations

Form 4 must be filed with the SEC within two business days of the transaction date. This regulatory framework is critical; any delay may result in penalties or increased scrutiny from regulators. The SEC enforces stringent rules to ensure these filings are accurate and timely, highlighting the importance of meticulous record-keeping and understanding of insider trading laws.

Key components of SEC Form 4

SEC Form 4 contains several key components designed to capture essential details regarding the transactions. The form requires information about the insider, such as their name, role in the company, and the nature of the transaction. Specific sections also ask for the transaction date, amount of shares bought or sold, and the price at which the transaction occurred.

Understanding common terminology, such as 'exercise of option' or 'disposition', is crucial for accurately filling out this form. Accurate input of these details ensures compliance with SEC rules and avoids any risks associated with filing inaccuracies.

Transaction types explained

Various types of transactions must be reported on SEC Form 4. The most common include purchases, sales, and option exercises. It’s important to recognize the various codes associated with each type of transaction, as these codes provide insight into the nature of each insider's trading behavior. For instance, 'P' indicates a purchase, and 'S' signifies a sale.

The distinction between transaction date and filing date is also significant; the transaction date marks when the trade occurs, while the filing date is when the form is submitted to the SEC. Timely filings are critical because delays can lead to unintended legal repercussions or market misinterpretations.

Step-by-step instructions for completing SEC Form 4

Before diving into filling out SEC Form 4, preparation is key. Start by gathering essential documents that confirm your transaction details and ownership structure. This preparation will involve obtaining accurate information on the number of shares owned and understanding your current securities transactions.

Once you have your documents in place, proceed to fill out the form by entering your details in each section accurately. An example might include stating the transaction date, the nature of the transaction, and the number of shares bought or sold. Ensure every detail is correct; common mistakes include misreporting the number of shares or erroneous transaction dates, which can complicate your compliance with SEC regulations.

Submitting your SEC Form 4

Submitting SEC Form 4 is primarily done electronically via the SEC's EDGAR system. This online platform is user-friendly and allows you to follow specific instructions to validate your submission. Alternatively, you may submit a paper form, but this is less common and may require additional steps to ensure proper filing.

Be sure to retain confirmation of your submission, as this receipt serves as vital evidence that you complied with your filing obligations. Utilizing online resources such as PDFfiller can streamline this process significantly by allowing you to edit and manage your form digitally, enhancing efficiency and reducing errors.

Managing your SEC Form 4 filing

Keeping track of your SEC Form 4 filing is paramount after submission. You can confirm receipt of your filing through the SEC's EDGAR system. This enables you to monitor the status of your submission and ensure it's publicly accessible for stakeholders and investors.

If you find errors post-submission, it’s critical to amend your SEC Form 4 immediately. The SEC provides a clear process for filing amendments, which includes providing an explanation for the corrections. Failure to amend inaccuracies can lead to legal complications and undermine the trust of potential investors.

Leveraging PDFfiller for SEC Form 4

PDFfiller provides powerful tools that streamline the completion of SEC Form 4. With features like editable templates, electronic signatures, and collaboration tools, you can create and manage your documents efficiently. These functionalities are crucial for teams needing a collaborative approach to completing necessary filings.

For instance, PDFfiller’s extensive library of templates allows users to begin with a compliant framework. Moreover, the e-signature capabilities ensure that all signatures are legitimate and documented. Through these tools, workflows can be optimized, saving both time and reducing the risk of errors associated with manual editing.

Understanding the impact of SEC Form 4 disclosures

The disclosures made on SEC Form 4 significantly impact market behaviors and investor decisions. Timely and accurate disclosures enhance transparency, fostering greater trust among investors. When insiders trade their shares, their actions can be viewed as a signal of their confidence in the company’s future performance. This can influence the stock price, either positively or negatively, depending on the nature of the transactions.

In contrast, failure to file on time or inaccuracies can lead to legal implications. The SEC imposes penalties for such breaches, and investors may lose confidence, resulting in diminished market performance. Thus, it is crucial to approach SEC Form 4 filings with the utmost seriousness.

Real-world examples and case studies

Throughout history, there have been significant insider transactions reported via SEC Form 4 that have impacted market dynamics. For example, notable filings from technology giants often show patterns that busy investors watch closely. Such behaviors can influence stock prices, thereby giving potential insights into how insiders view future company performance.

However, incorrect filings can lead to considerable repercussions. In one case, a prominent CEO faced scrutiny and legal challenges following an inaccurate SEC Form 4 filing that resulted in significant stock price manipulation. These instances underline the importance of accuracy and compliance.

Resources for further learning

For those looking to enhance their understanding of SEC Form 4, various resources are available online. From templates and filled examples that simplify the completion process to educational articles and FAQs, these materials are invaluable for anyone tasked with filing this crucial document.

Platforms like PDFfiller not only provide ready-to-go templates but also offer educational webinars that delve deeper into compliance and best practices for form submissions. Engaging with these resources can lead to improved accuracy, compliance, and understanding of the broader implications of SEC disclosures.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit sec form 4 from Google Drive?

How do I make changes in sec form 4?

How do I fill out sec form 4 on an Android device?

What is sec form 4?

Who is required to file sec form 4?

How to fill out sec form 4?

What is the purpose of sec form 4?

What information must be reported on sec form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.