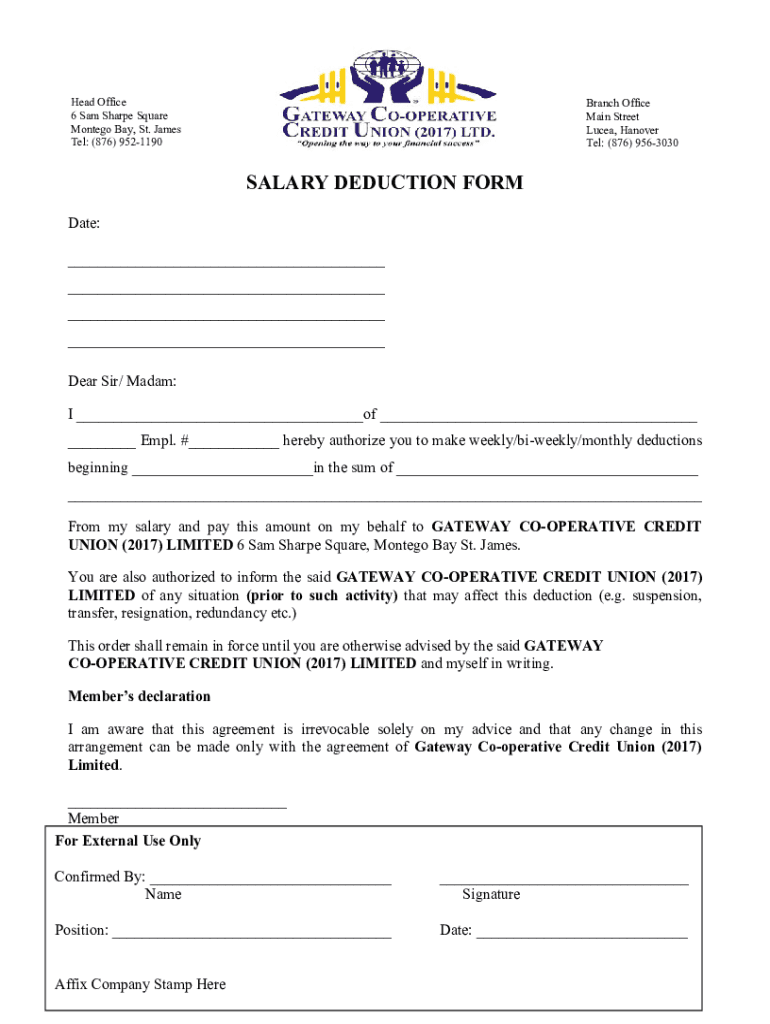

Get the free Salary Deduction Form

Get, Create, Make and Sign salary deduction form

How to edit salary deduction form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out salary deduction form

How to fill out salary deduction form

Who needs salary deduction form?

A comprehensive guide to understanding and using salary deduction forms

Understanding salary deduction forms

A salary deduction form serves as a crucial document utilized by both employees and employers to outline specific deductions from an employee's paycheck. These deductions can be voluntary or mandatory, depending on the agreements made between the employee and the employer. Understanding this form's purpose is vital for both parties as it establishes clear expectations regarding salary management and financial planning.

For employees, having their deductions documented ensures transparency about what is being withheld from their payments, from union dues to retirement contributions. For employers, the salary deduction form helps maintain accurate payroll processing while ensuring compliance with local labor laws. Thus, understanding this form lays a foundation for financial clarity and efficient payroll management.

Types of salary deduction forms

There are various forms of salary deductions, each serving a different purpose. Common types include deduction forms related to healthcare benefits, retirement accounts, and other benefits. Not all are mandatory – some deductions are based on employee choices, while others arise from legal obligations.

Understanding the differences between these forms is crucial. For instance, a health insurance premium deduction is typically deducted pre-tax, thus affecting the taxable income, whereas a union dues deduction might be a flat fee agreed upon as part of union membership. Each type directly affects an employee’s take-home pay and can influence long-term financial planning.

When to use a salary deduction form

Circumstances arise in the workplace that necessitate the use of salary deduction forms. Understanding when to implement them can streamline financial processes significantly. For instance, any employee engaging in a union must authorize the deduction of union dues from their salaries to continue enjoying union benefits.

Similarly, employee contributions towards retirement plans or health insurance premiums require explicit authorization through these forms, ensuring all parties are aware of the agreed deductions. The timing of these deductions can also fluctuate based on employment contracts or changes in insurance plans, so it's critical to remain informed of any updates to maintain financial health.

Detailed breakdown of the salary deduction form

A salary deduction form typically includes several critical sections designed to collect precise information. The form generally starts with personal information such as the employee's name and address, followed by employment details like job title, department, and employee ID.

The heart of the form lies in the specific deduction authorizations included. This section allows employees to indicate which deductions they consent to, such as retirement contributions or health insurance premiums. It’s imperative to fill out each part of the form accurately to avoid any discrepancies that could arise later on.

In filling out personal information, start with full legal names and current addresses. When defining employment status, specify if you're full-time, part-time, or a contractor. Lastly, it is crucial to understand and choose the correct deductions that align with your financial goals while remaining compliant with your employer's policies.

How to fill out the salary deduction form

Filling out the salary deduction form effectively requires careful attention to detail. Start by gathering all necessary information before accessing the form on pdfFiller. Accurate instructions can aid users in ensuring compliance and accuracy, making the financial management process smoother.

Using pdfFiller to access the form can simplify the process. Users can input details directly into the digital format, ensuring clarity and professionalism in submissions. Review the filled form meticulously to prevent any errors, as incomplete or incorrect information could delay processing.

Common mistakes to avoid include skipping mandatory fields, overlooking security precautions for sensitive data, and neglecting to clarify deductions that may require further documentation. Paying attention to these details will enhance the likelihood of a successful submission.

Editing and customizing your salary deduction form

Occasionally, changes may be required after submitting a salary deduction form. Ensuring there’s an efficient process for these adjustments can save time and confusion. If modifications are needed, communicating with HR or payroll departments promptly will facilitate an easier transition.

Using pdfFiller’s editing tools, users can personalize their forms post-submission, ensuring all details remain current and relevant. Compliance with employer policies is imperative; making changes without their knowledge may lead to complications.

Signing and submitting the salary deduction form

Once the salary deduction form is completed and reviewed for accuracy, the next step is signing and submission. Depending on the company's policies, some forms may require electronic signatures, while others might allow handwritten signatures. Utilizing e-signature solutions like pdfFiller makes this process efficient and secure.

After signing, understanding the submission process is vital. Employees should know where to send their forms, whether it’s directly to their payroll department or through an internal HR system. Proper submission ensures timely processing, minimizing delays in payroll adjustments.

Tracking your salary deductions

Once a salary deduction form has been submitted, tracking the deductions over time becomes essential. Keeping records of deductions can help in budgeting and financial forecasting. Tools like pdfFiller allow users to access past deductions easily, ensuring a clear understanding of how regular deductions impact net income.

Regularly communicating with payroll departments can provide insights into any discrepancies or changes in deductions. Monitoring these figures not only ensures accuracy but also fosters effective financial planning for future assets and expenditures.

Frequently asked questions (FAQs)

As employees navigate the intricacies of salary deduction forms, several common questions often arise. Understanding these can alleviate concerns and clarify processes for efficient financial management.

Case studies: Real-life examples

Consider the experiences of individuals using salary deduction forms effectively to manage their finances. For instance, one employee utilized the form to streamline retirement contributions, leading to a more structured savings plan over the years.

In another scenario, an employee adjusted their health insurance deductions after a significant life change, which not only improved their healthcare coverage but also eased their financial burdens. These examples highlight the profound impact of using salary deduction forms correctly on financial planning.

Interactive tools and resources on pdfFiller

pdfFiller not only facilitates the creation and management of salary deduction forms but also provides users with various interactive tools to optimize their financial understanding. Online calculation tools for estimating deductions can aid in preventing surprises during payroll runs.

In addition, pdfFiller offers templates for related documents, ensuring users have access to all necessary resources, including contracts and agreements that might affect deductions. The community support and testimonials on the platform also create a collaborative environment for sharing experiences.

Conclusion: Empowering your financial decisions

Utilizing a salary deduction form empowers employees to make informed financial decisions. Understanding how to navigate this document not only enhances financial literacy but also fosters a proactive approach to managing one's finances effectively.

In conclusion, leveraging the features and benefits of pdfFiller ensures continuous, hassle-free access to document management. When employees know how to effectively use salary deduction forms, they can optimize their earnings while fulfilling necessary obligations, paving the way for thoughtful financial planning.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the salary deduction form electronically in Chrome?

How do I fill out salary deduction form using my mobile device?

How do I complete salary deduction form on an Android device?

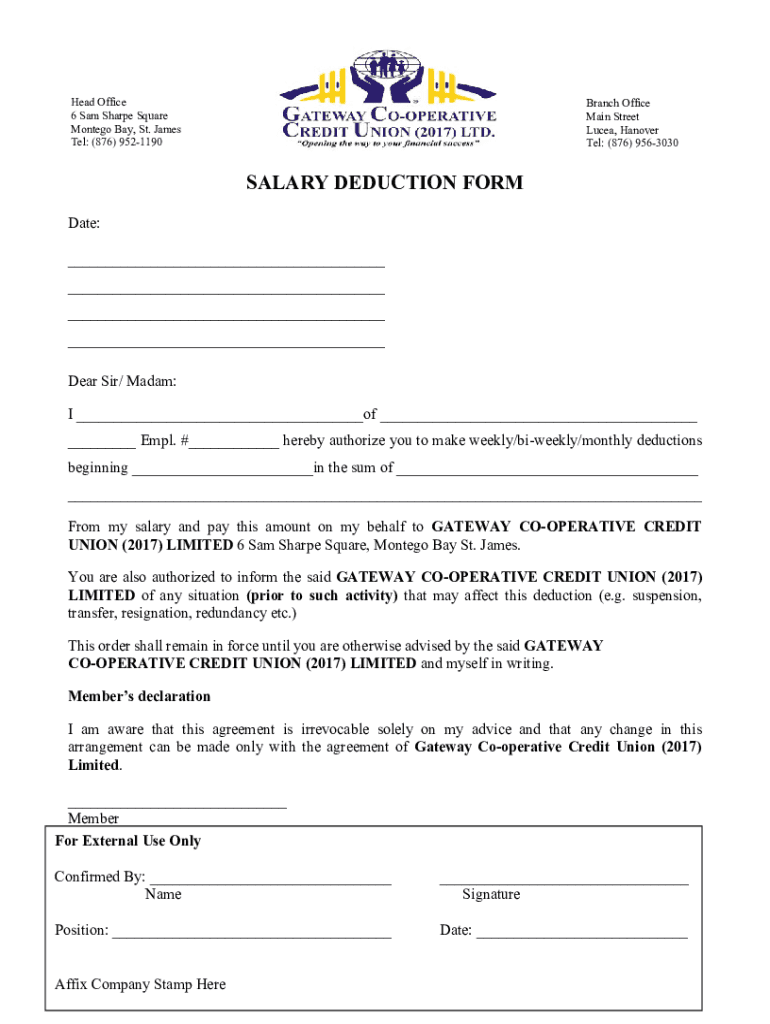

What is salary deduction form?

Who is required to file salary deduction form?

How to fill out salary deduction form?

What is the purpose of salary deduction form?

What information must be reported on salary deduction form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.