Get the free Form 10-k

Get, Create, Make and Sign form 10-k

How to edit form 10-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-k

How to fill out form 10-k

Who needs form 10-k?

Form 10-K: How to Navigate and Complete Your Filing with pdfFiller

Understanding the Form 10-K

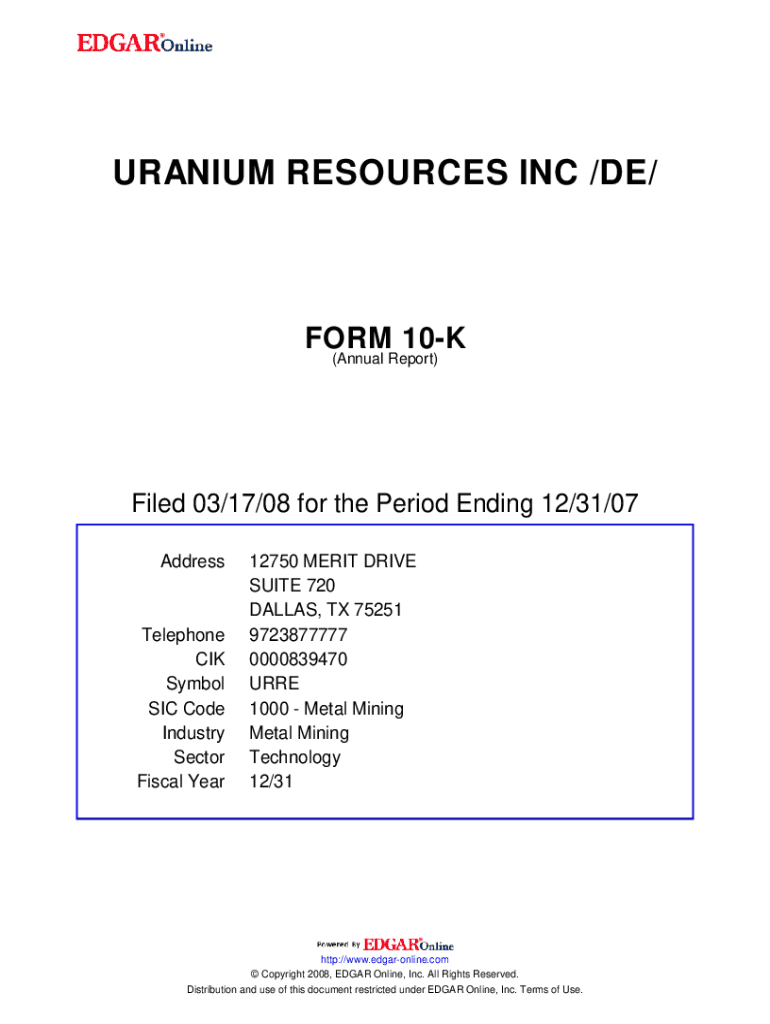

A Form 10-K is an annual report required by the U.S. Securities and Exchange Commission (SEC) for publicly traded companies. This extensive document provides a comprehensive overview of a company's financial performance, including its history, risks, management discussions, and financial statements. The primary purpose of the Form 10-K is to ensure that investors and stakeholders have access to crucial, accurate information about the company, enabling informed investment decisions.

Unlike quarterly reports (Form 10-Q), which provide a snapshot of a company's performance over the last three months, the Form 10-K serves as a more thorough account of an entire fiscal year. This makes it an essential resource for investors, analysts, and regulators.

Importance of filing Form 10-K

Filing a Form 10-K is not merely a regulatory obligation; it plays a critical role in corporate governance and investor relations. By making extensive disclosures about financial performance, challenges, and future outlook, companies enhance their accountability. This is crucial in maintaining trust with shareholders and the market at large.

The timely and accurate filing of Form 10-K helps companies avoid legal pitfalls and sanctions from regulatory bodies. Additionally, it is the cornerstone of transparency, offering investors insights into risk factors and management's strategic direction.

Essential components of the Form 10-K

Understanding the intrinsic components of the Form 10-K is vital for effective completion. The form is divided into several key sections, each serving a unique purpose. For instance, Item 1 provides a comprehensive business overview, laying the foundation for what stakeholders can expect from the company.

Further sections delve into crucial areas such as risk factors, legal proceedings, and financial data, building a holistic understanding of the company’s health and prospects. The Management's Discussion and Analysis (MD&A) section is particularly important as it offers context to the financial results, helping to bridge historical performance with future outlook.

Preparing to file a Form 10-K

Preparation is key to a successful filing of Form 10-K. Knowing the deadlines is the first step. Public companies are required to file their Form 10-K within 60 to 90 days after the end of their fiscal year, depending on their size. Keeping track of these deadlines is essential. Utilizing a filing calendar can help ensure that no critical dates are missed.

Gathering the necessary information is the next crucial step. This includes compiling financial data from various departments, ensuring consistency and accuracy. Engaging with cross-functional teams, such as finance, legal, and compliance, can facilitate the swift collection of required data. Each team will have insights that will contribute to a well-rounded report.

Using pdfFiller to create your Form 10-K

pdfFiller offers a user-friendly platform for creating your Form 10-K. Accessing the correct template is the first step. Upon logging in, users can find the Form 10-K template easily within pdfFiller’s extensive library of forms. This tailored template ensures all required information is organized systematically, allowing for straightforward editing.

Editing and customizing the Form 10-K template is simple with pdfFiller’s intuitive editing tools. Users can seamlessly input their company's financial data while remaining within the standardized framework of the SEC’s requirements. The capacity for real-time collaboration further enhances the user experience, allowing multiple team members to contribute simultaneously, ensuring the document reflects a comprehensive view of the company.

E-signing and finalizing your Form 10-K

The advent of e-signatures has transformed the finalization process of the Form 10-K. Understanding the laws surrounding e-signatures is essential since they must meet specific legal standards to be considered valid. Fortunately, pdfFiller ensures compliance with these regulations, simplifying the e-signing process significantly.

Once your team has reviewed and made necessary edits to the document, e-signing can be executed within the platform. Detailed instructions facilitate the e-signing process, ensuring each stakeholder can quickly and securely sign the document, which enhances the efficiency of the filing process while fulfilling compliance requirements.

Submitting your Form 10-K

Submitting your Form 10-K is the final step in the filing process. Initially, familiarize yourself with the filing procedure on the SEC's EDGAR system, where all 10-Ks must be electronically submitted. Carefully reviewing the submission instructions is crucial to avoid any submission-related errors, as missing details can result in delays or rejections.

After submitting the Form 10-K, it’s important to monitor for confirmation from the SEC. Keeping organized records will aid in addressing any queries or issues that may arise post-filing. Maintaining a structured records system not only serves current needs but also provides a robust framework for future filings.

Managing and storing your Form 10-K

Once filed, managing and storing your Form 10-K becomes critical for future reference and compliance. Utilizing pdfFiller’s document management features allows users to organize their files efficiently for easy future access. This organization can prove invaluable for audits, investor inquiries, and planning future reports.

Beyond basic storage, pdfFiller’s platform offers sharing options that let companies distribute their filed form with stakeholders swiftly. This ensures that all relevant parties stay informed and engaged post-filing. Additionally, keeping your records organized aids in making preparation for the next year’s filings smoother, leveraging past learnings to improve efficiency.

Resources and additional support

pdfFiller aims to provide users with comprehensive support throughout their Form 10-K filing process. For any questions or challenges faced while using pdfFiller, customers can access the dedicated help section, where they can find resources tailored to assist with common issues. Engaging with customer service provides further clarity when navigating complex filings or using platform features.

In addition to support, pdfFiller also offers a range of related form templates that ensure users can maintain all necessary documentation within one platform. This centralized approach streamlines workflow, simplifying the overall management of various regulatory forms.

Key considerations for the 2025 annual reporting and proxy season

As regulatory expectations evolve, it's essential for companies to remain proactive in their reporting strategies. For the upcoming 2025 annual reporting season, staying updated with current trends and changes in regulations will be paramount. This includes understanding the growing demand for clarity in sustainability disclosures and other significant market developments.

Planning next steps post-filing should involve a thorough review of the learnings garnered from the current filing experience. This reflective practice not only enhances future filings but also positions companies to adapt swiftly to any emerging demands or challenges in the market.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 10-k for eSignature?

How do I edit form 10-k in Chrome?

How do I complete form 10-k on an Android device?

What is form 10-k?

Who is required to file form 10-k?

How to fill out form 10-k?

What is the purpose of form 10-k?

What information must be reported on form 10-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.