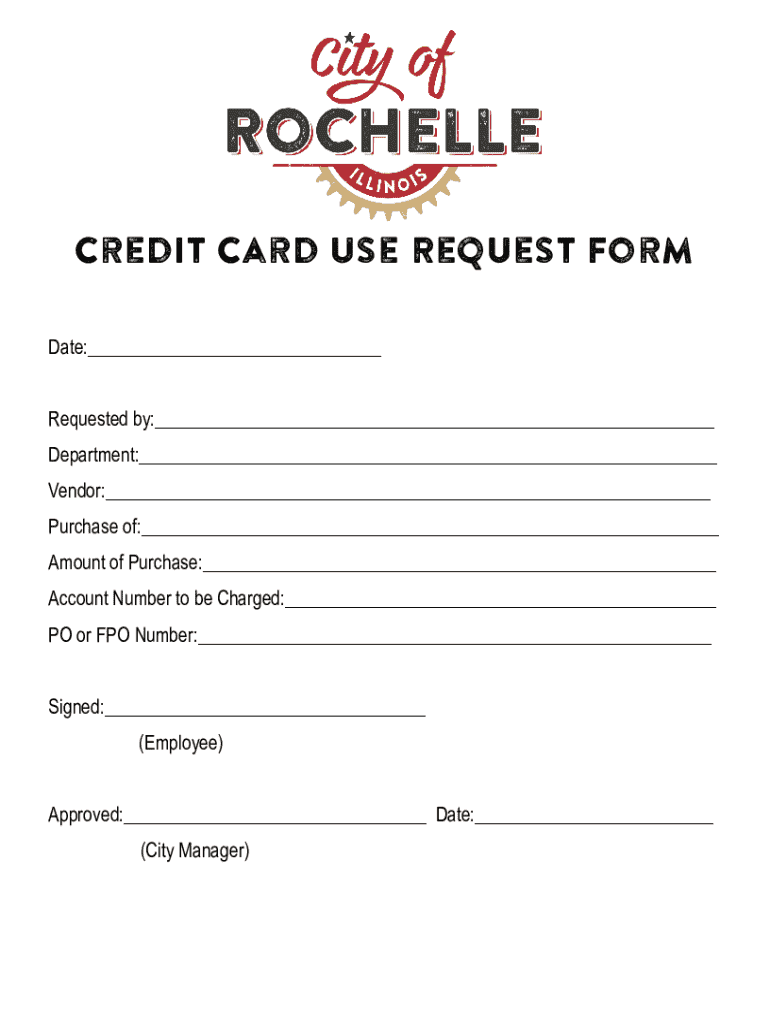

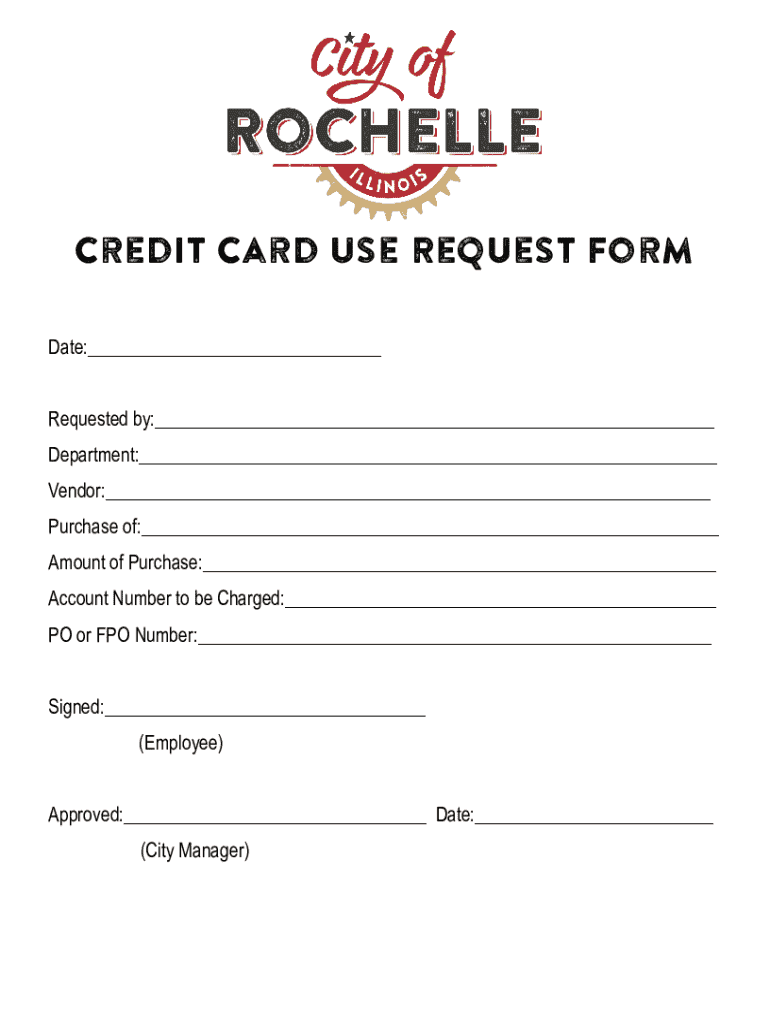

Get the free Credit Card Use Request Form

Get, Create, Make and Sign credit card use request

Editing credit card use request online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card use request

How to fill out credit card use request

Who needs credit card use request?

Credit card use request form - How-to guide long-read

Understanding credit card use request forms

A credit card use request form is a document designed to facilitate and authorize the usage of a company or individual’s credit card for specific transactions. Its purpose extends beyond just a mere formality; it acts as a safety net for both the issuer and the user, ensuring that all transactions are documented, authorized, and compliant with applicable regulations.

Proper documentation in financial transactions is paramount. This form minimizes the risk of unauthorized use, ensuring that businesses maintain control over expenditures. Moreover, it provides financial transparency and accountability, which is crucial in maintaining a healthy fiscal environment.

Key features of a credit card use request form

A well-designed credit card use request form includes several essential components that ensure clarity and legality in transactions. Firstly, the cardholder information is critical as it identifies the person authorized to utilize the card. This information typically includes the name, card number, and department to which the cardholder belongs.

In addition to cardholder information, merchant details are vital. This section should detail the name of the vendor and the purpose of the transaction. The form must also specify authorization limits to prevent overspending and maintain budgetary control. Finally, indicating the date and duration of use is crucial to ensure that the card is not used indefinitely without oversight.

Beyond its basic components, there are legal and compliance considerations. Many companies have specific requirements outlined in their financial policies, making it critical for users to understand these stipulations when filling out the form. Variations may occur for different use cases, such as travel reimbursements versus one-off purchases, thus necessitating tailored forms.

How to fill out a credit card use request form

Completing a credit card use request form can seem daunting, but with a methodical approach, it becomes manageable. Start by gathering all required information. This includes your personal details, specifics about the merchant, and the transaction type.

Begin filling in your personal details accurately, ensuring that your name and department are spelled correctly to avoid confusion. Next, specify the transaction type clearly—whether it’s an online purchase, a payment for services, or travel-related spending. Don’t forget to set appropriate authorization limits. This sets boundaries on how much can be spent and under what circumstances.

Accuracy and security are vital throughout this process. Mistakes can lead to delays in authorizing payments, and a lack of information can hinder approvals. Make sure to double-check all entries and keep sensitive information secure to prevent unauthorized access.

Common mistakes to avoid when filling out the form

When it comes to filling out a credit card use request form, there are several common pitfalls to be mindful of. Incomplete information is one of the most prevalent issues. Failing to provide all requested details can lead to processing delays or outright rejection of the request.

Incorrect dates can also pose significant problems, as lenders and issuers rely heavily on accurate timelines. Another frequent error is missing signatures or failing to specify limits. Without a proper signature, the form lacks authenticity, and vague spending caps can lead to unauthorized overspending. Being aware of these common mistakes can save time and resources.

Electronic vs. paper forms

The debate between electronic and paper forms often boils down to practicality and efficiency. Electronic forms, such as those offered by pdfFiller, provide numerous advantages. Users can access forms from anywhere with an internet connection, allowing for flexibility and convenience that paper forms simply cannot match.

Enhanced security features, such as encryption and access controls, further safeguard sensitive financial data. Moreover, electronic forms are easier to edit and manage. If a mistake is made or information changes, users can update their forms seamlessly without the need for physical copies. pdfFiller offers tools such as eSigning and collaboration features that enhance the document management process, ensuring that users can streamline their workflows effectively.

Managing your credit card use request forms effectively

Managing your credit card use request forms is crucial for compliance and effective record-keeping. Best practices involve creating a dedicated storage system where these documents can be easily accessed and organized—whether physical or digital. It's essential to ensure that your documents comply with company policies to avoid unnecessary conflicts or auditing issues down the line.

Retention guidelines are equally important; knowing how long to keep signed forms can impact financial audits and internal controls. Generally, retaining these forms for at least three to five years is advisable, as it aligns with common fiscal practices. This proactive approach can safeguard against potential disputes or questions regarding transactions.

Frequently asked questions (FAQ)

When submitting a credit card use request form, one common concern is what happens if a transaction is disputed. Generally, the issuer will initiate a review process, which may require additional documentation or evidence to substantiate claims. It's crucial to retain all records associated with the transaction to safeguard interests.

Can I revoke my authorization after submission? Yes, most companies allow for revocation of authorization, provided you formally notify the required parties as per corporate policy. Understanding your rights as a cardholder is equally important; generally, you have the right to dispute charges and inquire about your spending records. Lastly, a credit card use request form is legally binding, so all parties must ensure the information included is correct and agrees to the terms outlined.

Related resources for further learning

For those interested in mastering financial transactions, a wealth of articles provides best practices, templates, and insights into securing customer data. Reviewing templates and examples of credit card use request forms can illustrate effective usage and compliance. Additionally, resources on preventing fraud can greatly enhance your organization's commitment to financial security, thus improving overall operational efficiency.

Success stories and use cases

There are numerous real-life applications of the credit card use request form, demonstrating its utility across various organizations. Users often testify to the benefits of using pdfFiller, particularly for ease of access and streamlined processes. Companies have reported time savings and reduced errors in transactions due to the efficiency of electronic forms, showcasing the substantial advantages these document management solutions can provide.

Explore more document creation solutions

In addition to the credit card use request form, understanding other essential forms used in financial transactions can enhance overall efficiency. Exploring tools like pdfFiller can simplify document management processes by providing interactive solutions that adapt to user needs. Whether it’s for expense reports, purchase orders, or contracts, having a reliable cloud-based platform can streamline your document workflow, making it more effective and user-friendly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit credit card use request in Chrome?

Can I create an electronic signature for signing my credit card use request in Gmail?

How do I complete credit card use request on an Android device?

What is credit card use request?

Who is required to file credit card use request?

How to fill out credit card use request?

What is the purpose of credit card use request?

What information must be reported on credit card use request?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.