Get the free Petition to Determine Exempt Property

Get, Create, Make and Sign petition to determine exempt

Editing petition to determine exempt online

Uncompromising security for your PDF editing and eSignature needs

How to fill out petition to determine exempt

How to fill out petition to determine exempt

Who needs petition to determine exempt?

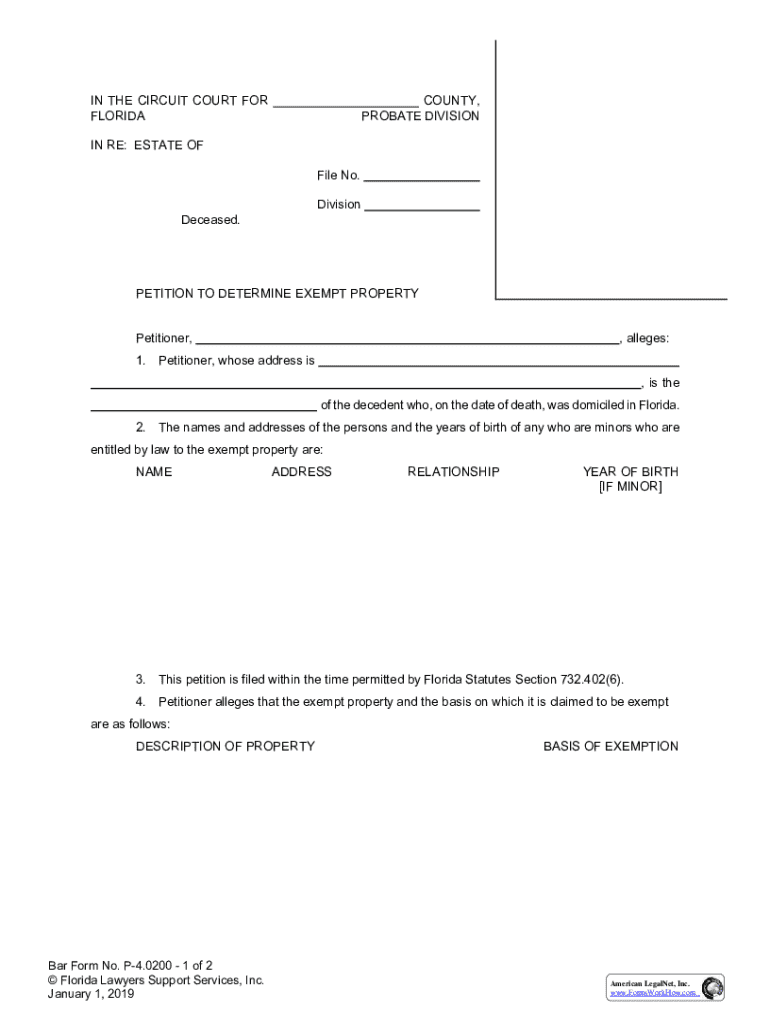

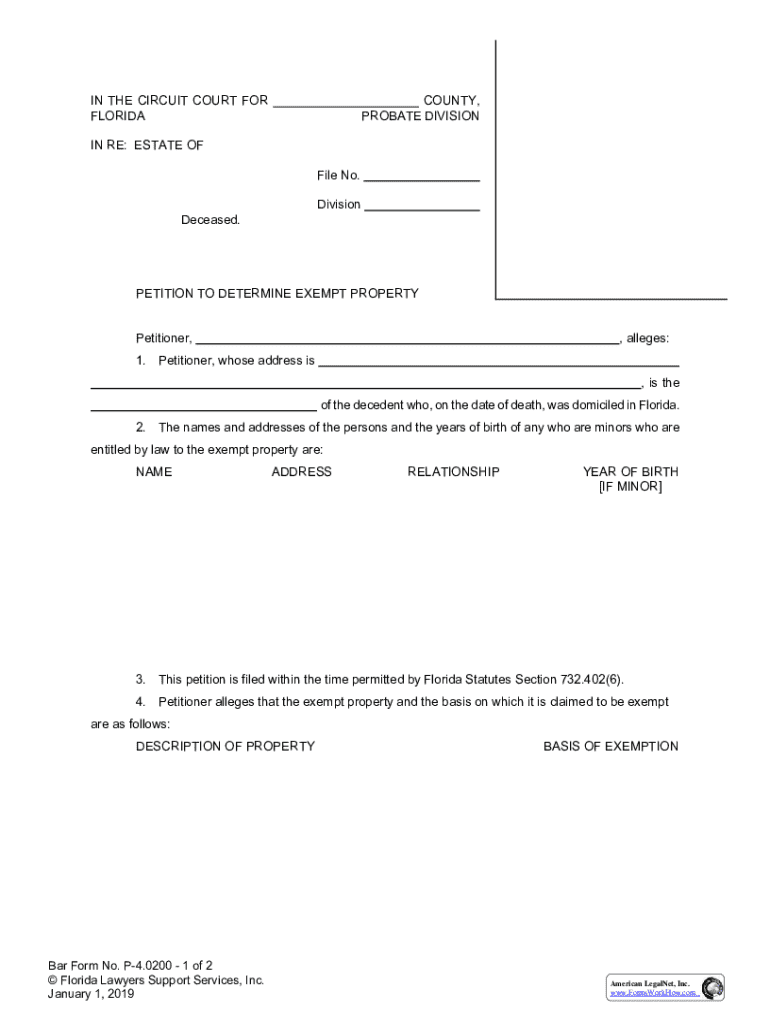

Petition to Determine Exempt Form: A Comprehensive Guide

Understanding the petition to determine exempt form

The petition to determine exempt form is a crucial legal document aimed at requesting an exemption from certain taxes or regulatory requirements based on specific qualifications. This form is often utilized by entities such as nonprofits, religious organizations, and educational institutions that operate under tax-exempt status. Understanding the nuances of this process is essential for those hoping to benefit from exemptions, which can lead to significant financial relief for organizations that serve the public.

Filing a petition for exemption is vital as it legally recognizes an entity's specific circumstances that warrant relief from taxes or regulations. This process not only reduces financial burdens but also enables organizations to reinvest saved resources back into their missions. Understanding who needs to file these petitions is crucial as various entities may qualify depending on local and state regulations.

Eligibility criteria for filing a petition

Eligibility to file a petition to determine exempt form typically includes several categories, mainly focusing on nonprofit organizations, religious entities, and educational institutions. These entities must demonstrate that their primary purpose aligns with charitable, educational, or religious activities, which in turn qualifies them for tax-exempt status under state or federal law.

General requirements may include a demonstration of actual operation for public benefit, adherence to specific bylaws, and active engagement in the community. Common scenarios prompting the need for a petition include exemptions for property taxes, income tax relief, and sales tax exemptions. For instance, a local church may seek an exemption for its property, while a nonprofit education program might pursue relief from income taxes.

Navigating the petition process

The process of completing a petition to determine exempt form involves several key steps to ensure a smooth and successful filing. Here is a step-by-step guide to make this process clearer:

It’s important to be mindful of key deadlines and timelines for petition submission, as various regions may have different requirements. Missing deadlines could lead to denial of your petition, resulting in the loss of potential tax relief.

Detailed breakdown of the petition form sections

The petition form typically consists of several key sections that guide the applicant in providing necessary information. A closer look at these sections can help in preparing a thorough submission:

Common issues and FAQs

Filing a petition to determine exempt form might lead to a series of common issues that applicants should prepare for. One major concern is the prospect of a denied petition. If your petition is denied, the immediate step is to understand the reasons behind the denial. This could relate to missing documentation or lack of strong justification. Applicants can typically appeal the decision, so it's essential to follow the outlined procedures promptly.

Another frequent query relates to how to amend a filed petition. Should changes need to be made after submission, it's important to contact the appropriate office as soon as possible to begin the amendment process. Here are some additional FAQs about the petition process:

Tips for successfully completing the petition

Successfully completing the petition to determine exempt form demands attention to detail. Best practices include being precise when filling out the form and providing as much clarity as possible on the organization's purpose and activities. Many applicants fall into the trap of omitting necessary details that could strengthen their case.

Common mistakes to avoid include not double-checking the accuracy of information and submitting incomplete documentation. Accurate and clear documentation is crucial; thus, cultivating a meticulous approach to gathering and submitting necessary information cannot be overstated.

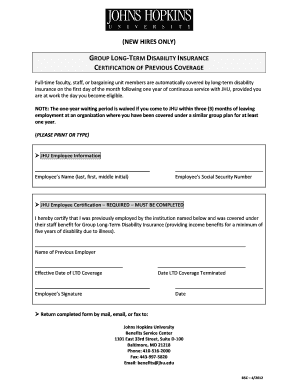

Using pdfFiller for your petition to determine exempt form

pdfFiller offers an accessible platform for complete document management, ideal for anyone needing to fill out a petition to determine exempt form. The process is seamless: users can edit the petition form directly within the platform. This feature allows for easy corrections, ensuring that all information is accurate before submission.

The platform also facilitates eSigning and collaboration, so multiple stakeholders can review and sign the document without the need for back-and-forth emails. Furthermore, pdfFiller includes secure storage options to manage your petition forms effectively, ensuring you can access them whenever necessary. The interactive tools available simplify the filing experience, allowing users to navigate through their document efficiently and confidently.

Updates and changes to exempt petition regulations

The legal landscape surrounding exemptions is continually evolving. Staying updated on regulatory changes is crucial for organizations hoping to secure exemptions. Recent changes in the law may affect eligibility criteria, jurisdictional requirements, or even filing procedures.

Furthermore, it is essential to pay attention to important notices from regulatory authorities regarding these updates. Subscribers to newsletters or industry publications can receive timely updates that inform them of changes and help them adjust their approach accordingly.

Advanced considerations

When dealing with the petition to determine exempt form, it's crucial to consider that not all situations are straightforward. Special circumstances, such as mixed-use properties or partnerships, may necessitate additional insights or adjustments in the filing strategy.

Understanding state-specific variations in exemption laws is also essential, as each state may interpret and implement exemption criteria differently. Given the complexities involved, consulting legal experts for complicated cases is often a wise decision to avoid pitfalls and ensure proper filing.

Getting help and support

Navigating the petition process can be daunting, so seeking assistance from various resources can be significantly beneficial. For example, legal aid organizations often provide guidance and support for those filing petitions to determine exempt forms, especially for those new to the process.

Additionally, online tutorials and webinars are excellent resources for further understanding the intricacies of exemption petitions. Reaching out to local authorities responsible for handling these petitions can also help clarify procedures and answer specific queries relevant to your filing needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find petition to determine exempt?

How can I edit petition to determine exempt on a smartphone?

How do I complete petition to determine exempt on an Android device?

What is petition to determine exempt?

Who is required to file petition to determine exempt?

How to fill out petition to determine exempt?

What is the purpose of petition to determine exempt?

What information must be reported on petition to determine exempt?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.