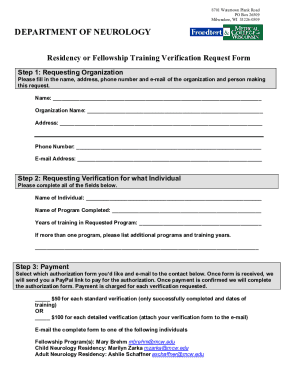

Get the free Collin Central Appraisal District Budget

Get, Create, Make and Sign collin central appraisal district

Editing collin central appraisal district online

Uncompromising security for your PDF editing and eSignature needs

How to fill out collin central appraisal district

How to fill out collin central appraisal district

Who needs collin central appraisal district?

Guide to Collin Central Appraisal District Forms

Overview of Collin Central Appraisal District (CCAD) Forms

The Collin Central Appraisal District (CCAD) plays a crucial role in assessing property values throughout Collin County, Texas. Established to ensure fair taxation, CCAD is responsible for appraising residential, commercial, and agricultural properties. An accurate property tax assessment hinges on the usage of the correct forms provided by CCAD. These forms facilitate the communication of essential information, enabling taxpayers to assert exemptions, appeal assessments, or notify the district of changes affecting property status.

Utilizing the appropriate CCAD forms not only streamlines the property tax process but also minimizes the risk of errors that could lead to financial implications. Therefore, understanding which forms to use for specific scenarios can profoundly impact a property owner’s tax responsibilities.

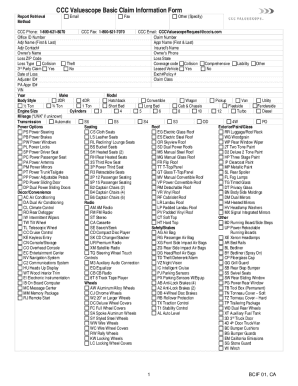

Types of CCAD Forms

CCAD offers several forms to cater to different property types, ensuring that all taxpayers have the tools necessary for their specific needs. Understanding each form’s purpose is vital for any property owner or business operator within Collin County.

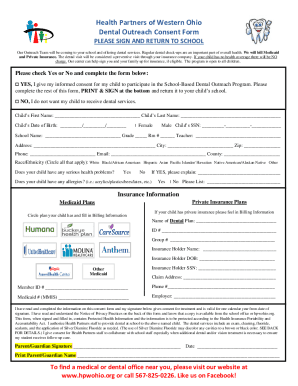

Filling out CCAD forms

Completing CCAD forms accurately is essential for ensuring that your property tax assessments are correct. Each form has specific requirements and deadlines that must be adhered to. Proper preparation and attention to detail can make the difference between acceptance and rejection of your application.

Editing and signing CCAD forms

In today’s digital world, editing and signing documents electronically has become commonplace. Utilizing tools like pdfFiller allows users to enhance their experience when filling out CCAD forms. Being able to modify forms without starting from scratch can save a considerable amount of time and ensure accuracy.

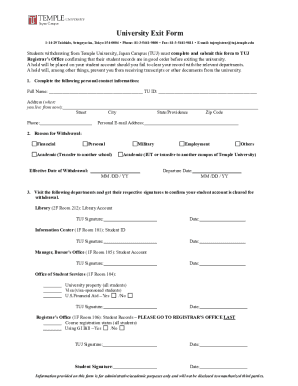

Tips for submitting CCAD forms

Submitting your completed forms correctly is just as important as filling them out accurately. Knowing your options for submission, along with methods to track your forms, can provide peace of mind during the process.

Common mistakes to avoid when filing CCAD forms

Mistakes in filing can lead to unnecessary delays, rejected forms, or missed opportunities for tax savings. Familiarizing yourself with common pitfalls can help safeguard against errors.

Resources and tools available on pdfFiller

To further assist users in navigating the CCAD forms, pdfFiller offers a range of specialized resources and tools that can enhance the filing experience.

Contact information for further assistance

If you encounter challenges while filling out or submitting your CCAD forms, assistance is readily available. Understanding how to reach out can expedite resolution of your inquiries.

Additional services offered by pdfFiller

Beyond filling and editing CCAD forms, pdfFiller offers a variety of complementary services designed for enhanced document management and collaboration. Understanding available tools can simplify workflows and improve efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit collin central appraisal district online?

Can I sign the collin central appraisal district electronically in Chrome?

Can I create an eSignature for the collin central appraisal district in Gmail?

What is collin central appraisal district?

Who is required to file collin central appraisal district?

How to fill out collin central appraisal district?

What is the purpose of collin central appraisal district?

What information must be reported on collin central appraisal district?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.