Get the free California Exempt Organization Annual Information Return - as csuchico

Get, Create, Make and Sign california exempt organization annual

Editing california exempt organization annual online

Uncompromising security for your PDF editing and eSignature needs

How to fill out california exempt organization annual

How to fill out california exempt organization annual

Who needs california exempt organization annual?

California exempt organization annual form: Your comprehensive guide

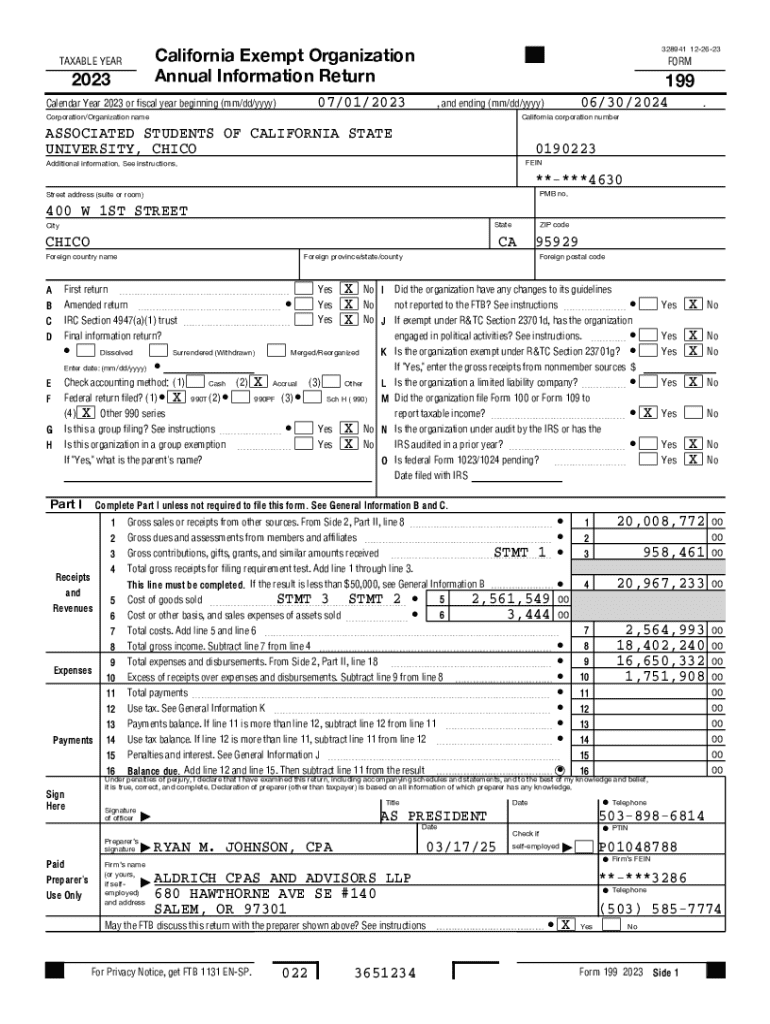

Overview of the California exempt organization annual form

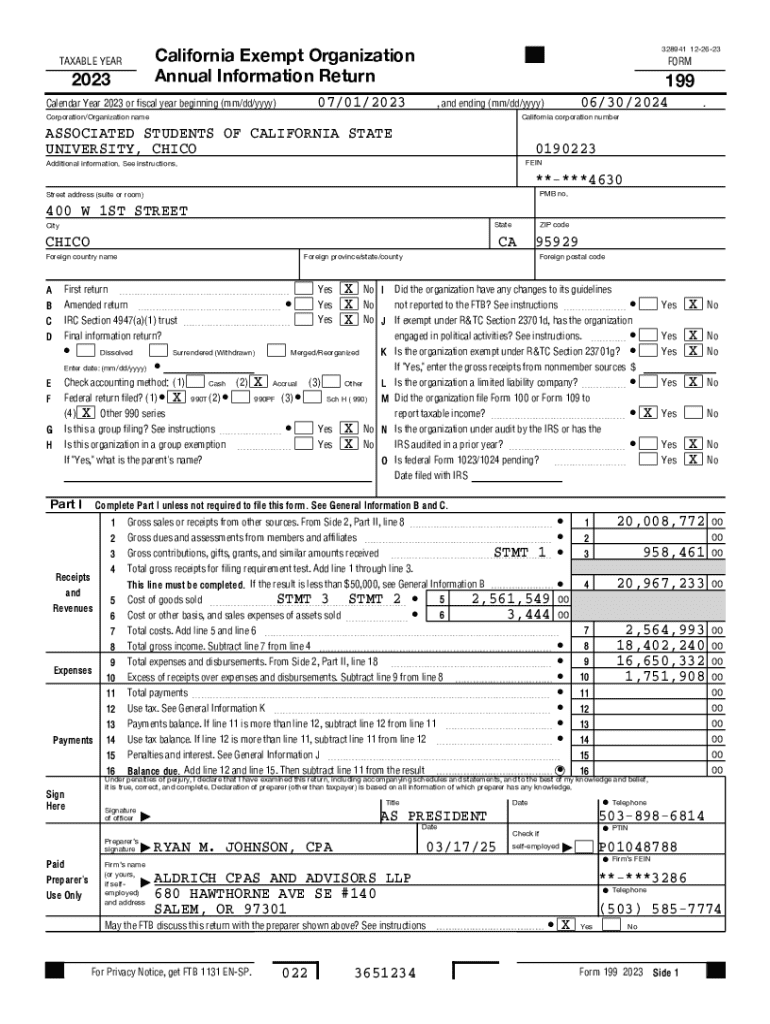

The California exempt organization annual form is a crucial document that nonprofit organizations must file to maintain their tax-exempt status under California state law. This form, specifically the FTB Form 199, ensures that organizations report their financial activities and comply with state regulations. Filing this form helps track the charitable contributions made by organizations and protects the integrity of the nonprofit sector in California.

Compliance is paramount in California, given its stringent laws governing nonprofit organizations. Nonprofits must adhere to all required filing protocols to avoid penalties, including fines and potential loss of tax-exempt status. Organizations face specific deadlines that, when missed, can derail annual planning and fundraising activities.

Who needs to file the California exempt organization annual form?

Not all organizations in California are required to file the California exempt organization annual form. Generally, those that have received federal tax exemption under Section 501(c)(3) or other qualifying sections must submit this form annually. Common examples include charitable organizations, religious entities, and educational institutions. Additionally, homeowners' associations and specific nonprofit groups also fall under the same filing requirements.

However, there are exceptions. Some organizations may be exempt from filing if they qualify under specific state provisions, such as having below a certain revenue threshold. Groups that consist of multiple chapters can consider a group filing option, streamlining the process for them as they can file one form for all chapters.

Understanding the filing process

The filing process for the California exempt organization annual form can seem daunting, but it becomes manageable when broken down into clear steps. First, organizations must prepare necessary documents, including financial statements, records of contributions, and disclosures of compensation. Next, the form can be accessed online via the California Franchise Tax Board’s website, or organizations can utilize tools like pdfFiller to enhance efficiency.

Completing the form involves filling in various sections accurately. Once filled, it's critical to review the document for any errors to prevent complications during submission. After ensuring accuracy, organizations can choose their submission method, with options for online submission or traditional mail. Adhering to deadlines is essential, with most organizations required to file by the 15th day of the 5th month after the close of their fiscal year.

In-depth instructions for the California exempt organization annual form (FTB Form 199)

The FTB Form 199 requires detailed input, particularly concerning the organization’s financial activities. Key sections include gross receipts reporting, where nonprofits must disclose total income, and compensation disclosure, detailing salaries for officers and key employees. Organizations must accurately report contributions and grants they received, and they should also include information regarding other types of income, if applicable.

Mistakes made during this process can lead to delays or penalties; thus, it's important to familiarize oneself with common pitfalls. For instance, underreporting income, failing to provide complete information, or misunderstanding the specific definitions of 'gross receipts' can lead to complications. Attention to detail is paramount in ensuring the form reflects the organization’s activities truthfully and comprehensively.

Interactive tools and resources

Utilizing interactive tools like pdfFiller can transform the experience of filing the California exempt organization annual form into a streamlined and efficient process. By allowing users to upload existing PDFs, editing forms directly online, and eSigning documents, pdfFiller provides an invaluable service tailored to nonprofit organizations.

Moreover, the platform offers robust document management features, including storage and organization of essential files, making it easy to access necessary information at any time. Collaboration tools further assist teams in ensuring that all necessary stakeholders can weigh in during the completion of the filing process, providing a cohesive approach to compliance.

Frequently asked questions (FAQs)

Navigating the intricacies of the California exempt organization annual form often leads to questions about compliance and procedural norms. For instance, organizations frequently wonder about the repercussions of missing the filing deadline. Late filing can result in penalties and mandates to file late fees, which can burden nonprofit budgets considerably.

Other common inquiries include correcting submission errors. It's vital to understand that organizations can amend their forms post-filing; however, this process must also adhere to certain deadlines. The penalties tied to late filings or lack of submission range from fines to stricter scrutiny from regulatory bodies, which can impact the organization’s reputation.

Related content and resources

Understanding the California exempt organization annual form goes hand in hand with familiarizing oneself with other essential forms and publications pertinent to exempt organizations. Links to federal forms for exempt organizations, as well as state-specific tax information for nonprofits, should be considered key resources for proper compliance. Nonprofits should also utilize compliance checklists to ensure they have met all necessary filing obligations, enhancing the likelihood of successful annual reporting.

It’s also wise to gain insights into related topics, such as tax filing requirements for nonprofits that have employees and navigating unrelated business income (UBI). Understanding these additional complexities ensures that organizations can maintain their tax-exempt status while effectively managing their operational activities.

Support and assistance

Filing the California exempt organization annual form can pose challenges, making access to support crucial. Nonprofits can receive assistance in various ways, including customer service through pdfFiller, which provides dedicated help for users navigating their document management processes. Utilizing the online chat feature can further expedite response times, ensuring users have their questions answered promptly.

In addition, many state and local nonprofit networks offer filing assistance. These networks frequently provide resources tailored to help organizations comply with state regulations, answering queries and offering workshops that empower nonprofits to understand their responsibilities better.

Stay informed with updates and changes

Remaining informed about updates and legislative changes affecting the California exempt organization annual form is essential for maintaining compliance. Organizations can subscribe to updates from the California Franchise Tax Board and other regulatory agencies to receive timely information. This proactive approach enables nonprofits to adjust their practices as regulations evolve.

Efforts should also be made to provide resources in multiple languages, particularly for non-English speaking users. Accessibility in communication promotes a community where all nonprofit organizations can understand their obligations thoroughly and participate actively in compliance efforts.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify california exempt organization annual without leaving Google Drive?

Can I create an electronic signature for the california exempt organization annual in Chrome?

How do I fill out the california exempt organization annual form on my smartphone?

What is california exempt organization annual?

Who is required to file california exempt organization annual?

How to fill out california exempt organization annual?

What is the purpose of california exempt organization annual?

What information must be reported on california exempt organization annual?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.