Get the free Deposit Coupon

Get, Create, Make and Sign deposit coupon

How to edit deposit coupon online

Uncompromising security for your PDF editing and eSignature needs

How to fill out deposit coupon

How to fill out deposit coupon

Who needs deposit coupon?

Deposit Coupon Form: A Comprehensive How-to Guide

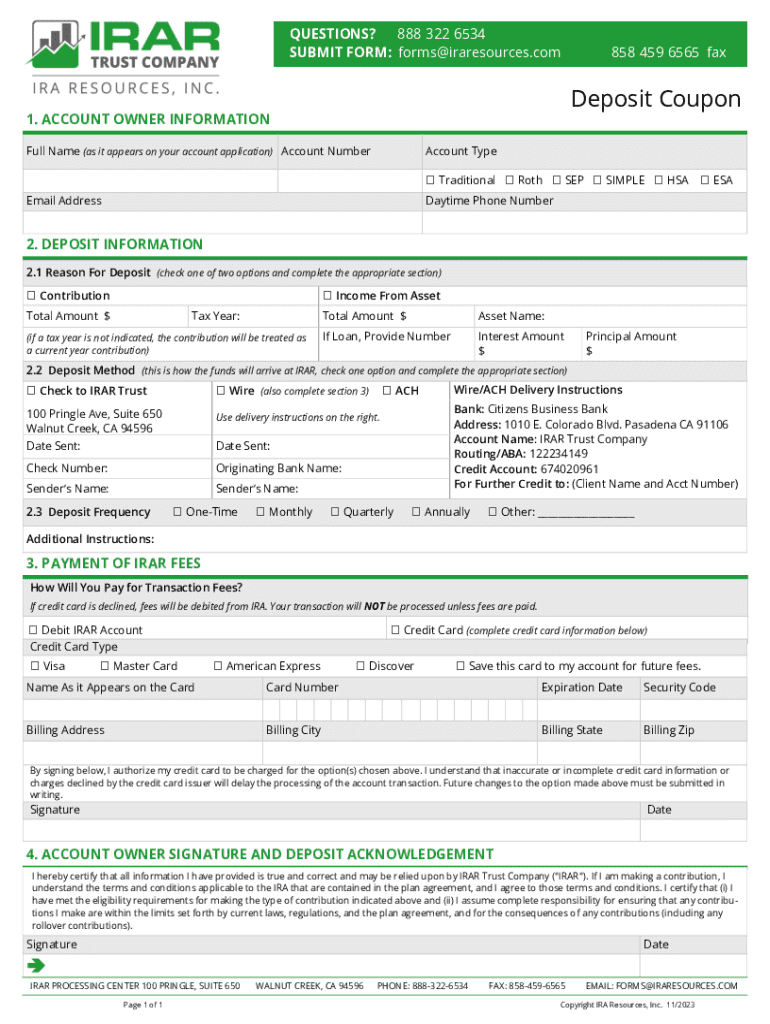

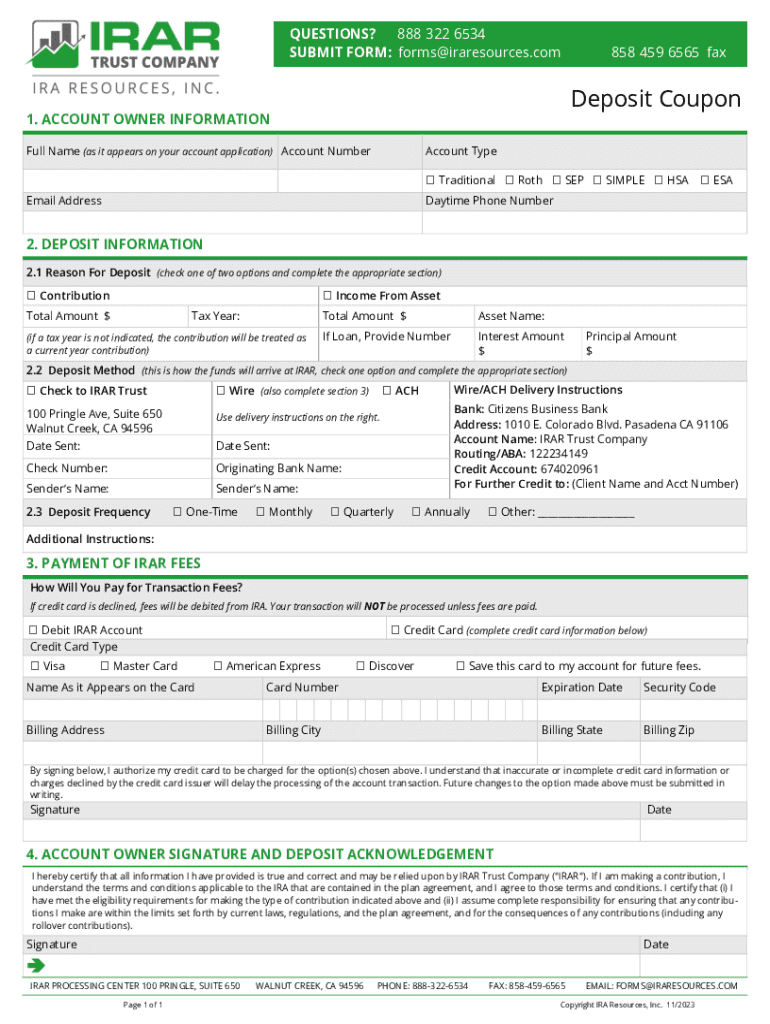

Understanding the deposit coupon form

A deposit coupon form serves as a critical tool in the realm of financial transactions, simplifying the process of securely depositing funds into an account. This form is typically utilized by banks and financial institutions, acting as a formal request and record for deposits made by the account holder.

The importance of a deposit coupon form cannot be overstated. It provides both the depositor and the financial institution with a clear paper trail, which is essential for accountability and transparency. This form helps prevent fraud, incorrect fund allocation, and errors during transactions.

Deposit coupon forms are particularly vital in scenarios where cash or checks are being deposited directly into an account. Without this documentation, tracking deposits can become cumbersome, leading to potential discrepancies and misunderstandings.

Key components of the deposit coupon form

Understanding the components of a deposit coupon form is essential for accurate completion. Essential information typically required includes the account holder's name, account number, and contact details. The form also necessitates the deposit amount, the currency being used, and the date of the transaction, which helps in tracking and record-keeping.

In addition to these essential fields, there may also be additional fields that enhance the utility of the form. For instance, specifying the purpose of the deposit provides context for the transaction, while a reference number may be included if the deposit pertains to a specific transaction or invoice.

A sample layout of a filled-out deposit coupon form typically follows a structured format, often divided into designated sections for easy reading and clarity. This visual representation ensures that all required information is included.

How to fill out a deposit coupon form

Completing a deposit coupon form accurately is vital for ensuring proper transaction processing. Here’s a step-by-step guide to help you navigate the process:

When filling out this form, accuracy is paramount. Common mistakes include typographical errors in the account number or deposit amount, which can lead to serious complications. Therefore, it's a good practice to take a moment to review your entries before finalizing the form.

Customizing your deposit coupon form on pdfFiller

pdfFiller provides a user-friendly platform for customizing your deposit coupon form to suit your unique needs. To access this powerful tool, you first need to sign up and log in to your pdfFiller account.

Once logged in, editing your deposit coupon form is straightforward. You can use pdfFiller’s tools to make adjustments, such as adding logos or personal notes. This customization allows your form to reflect your brand or personal touch.

Moreover, signing your deposit coupon form electronically through pdfFiller is compliant with legal standards. The steps to eSign are intuitive, guiding you through the necessary process to ensure your documents are valid and secure.

Managing and storing your deposit coupon form

One significant advantage of using pdfFiller is the cloud-based document management system that it offers. Storing your deposit coupon forms in the cloud not only enhances security but also ensures you can access your documents from anywhere, at any time.

A well-organized system makes it easy to retrieve your forms whenever needed. pdfFiller provides tools for organization, such as folders and tagging, which assist users in effectively managing and searching for their forms. Utilizing these features aids in maintaining a clear and organized digital document environment.

Troubleshooting common issues with deposit coupon forms

Despite the best planning and intention, mistakes can still occur with deposit coupon forms. Common errors include submitting a form with incorrect amounts or details. If you find that there’s an issue with your submitted form, rectify it by contacting your bank or institution promptly. They can guide you through the necessary steps to correct any discrepancies.

If you require further assistance, pdfFiller’s customer support team is available to help resolve any challenges you might face. It’s important to know how to reach them and what resources they offer, which can include live chat, a knowledge base, or email support.

Real-life applications and benefits of using deposit coupon forms

Multiple industries have successfully leveraged deposit coupon forms to streamline their operational efficiency. For instance, retail businesses often rely on deposit coupons during cash drop-offs, while non-profits utilize them for donations. Additionally, small businesses may employ these forms to manage client payments efficiently.

The benefits of a cloud-based solution like pdfFiller extend beyond mere convenience. Users experience time-saving features through quick document editing, eSigning, and collaboration options. The ability to manage documents in a centralized platform fosters improved communication among teams, amplifying overall productivity.

Frequently asked questions (FAQs)

When managing deposit coupon forms, it’s common for individuals to have questions. For instance, what should you do if you lose your deposit coupon form? The first step is to inform your bank or financial institution. Most places will require a written statement outlining the details of the lost coupon.

Another frequent inquiry relates to fees associated with using a deposit coupon form. Various financial institutions may have different policies regarding associated costs. It is advisable to check directly with your bank to understand any applicable fees related to your deposits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send deposit coupon to be eSigned by others?

How can I get deposit coupon?

How do I complete deposit coupon on an Android device?

What is deposit coupon?

Who is required to file deposit coupon?

How to fill out deposit coupon?

What is the purpose of deposit coupon?

What information must be reported on deposit coupon?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.