Get the free Employers' Pension Provision Survey 2013

Get, Create, Make and Sign employers pension provision survey

How to edit employers pension provision survey online

Uncompromising security for your PDF editing and eSignature needs

How to fill out employers pension provision survey

How to fill out employers pension provision survey

Who needs employers pension provision survey?

Employers Pension Provision Survey Form - How-to Guide

Overview of the Employers Pension Provision Survey

The Employers Pension Provision Survey serves a pivotal role in understanding and improving pension strategies across various industries. This survey collects vital data that helps shape pension-related policies, ensuring they meet both the employer's and employees' needs.

Participating in this survey is essential for employers who wish to remain competitive and compliant with evolving pension regulations. It fosters deeper engagement between employees and management in retirement planning.

The survey targets HR professionals, financial advisors, and business owners across various sectors, aiming to gather diverse perspectives on pension provision.

Understanding Employers Pension Provision

Pension provision is the establishment of financial reserves to support employees post-retirement. These provisions are crucial as they provide security and peace of mind for the future, ensuring a stable income when individuals are no longer employed.

There are primarily two types of pension schemes: Defined Benefit and Defined Contribution. In a Defined Benefit plan, the employer guarantees a specific payout at retirement based on salary and years of service. Conversely, a Defined Contribution plan places the emphasis on employee contributions and investment performance, influencing the eventual retirement benefits.

Employers play an integral role in pension provision, not only by choosing suitable plans but also by educating employees about their options.

Recent trends indicate a shift towards hybrid pension plans that blend features from both types, catering to a more diverse workforce.

Survey participants: Who you are and why it matters

In this survey, demographic insights help paint a clearer picture of the current state of pension provisions across various industries. We collect data on employer size, industry sector, and the demographic profile of employees, including age, salary, and employment status.

This information is crucial as it directly influences pension policies, helping shape future initiatives that benefit both employers and employees.

The survey's outcomes can lead to improved pension schemes that enhance employee retention and satisfaction.

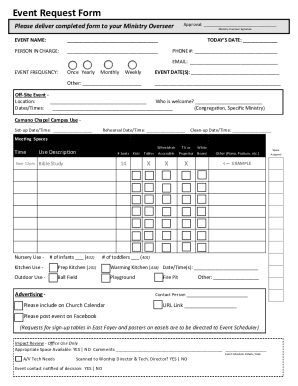

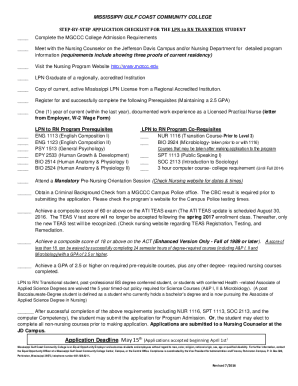

How to complete the Employers Pension Provision Survey

Completing the Employers Pension Provision Survey is straightforward. Follow these simple steps to ensure your participation is effective and accurate.

The form is designed to be compatible with various devices and is accessible for individuals with disabilities. Familiarize yourself with the form’s layout to streamline the completion process.

Support and assistance for survey completion

Completing the survey might raise questions or concerns. We provide comprehensive support to assist all participants in navigating the process.

Don't hesitate to reach out for help, as we aim to make your experience smooth and hassle-free.

Important dates related to the survey

Mark your calendar with the key dates for the Employers Pension Provision Survey. Understanding these timelines will help ensure your participation.

Adhering to these dates ensures that your valuable insights contribute to shaping effective pension initiatives.

Understanding the implications of your responses

Each response you provide in the survey plays a crucial role in influencing future pension initiatives. The collective insights gathered will reflect trends and highlight areas needing attention.

Moreover, confidentiality is paramount, and data protection measures are strictly enforced to ensure participants' privacy.

Stay tuned for the findings, as they will influence strategic decisions moving forward.

Related topics and further reading

For those interested in gaining more informed perspectives on pension provision, exploring related topics can be highly beneficial.

Reading these materials equips employers with knowledge to enhance their pension strategies further.

Engagement and collaboration opportunities

Employers can engage deeply with the survey findings, turning data into actionable insights for improved pension management.

Collaboration with pdfFiller can streamline document management, ensuring that you have the right tools to handle pension-related tasks efficiently.

This collaborative approach can boost efficiency and enhance the overall effectiveness of pension provision.

Connecting with us for more information

For further insights regarding the Employers Pension Provision Survey and related topics, pdfFiller is here to assist.

We look forward to supporting employers as they navigate the complexities of pension provision and contribute to enhancing the retirement landscape.

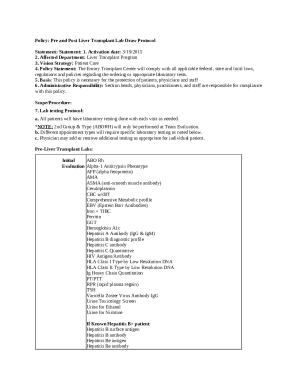

Appendix

To facilitate a better understanding of pension provisions, we've included a glossary of key terminology commonly used in the field.

Refer to links to relevant legal and regulatory documents that provide further context for pension policies and practices.

These resources are invaluable for employers managing their pension schemes effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify employers pension provision survey without leaving Google Drive?

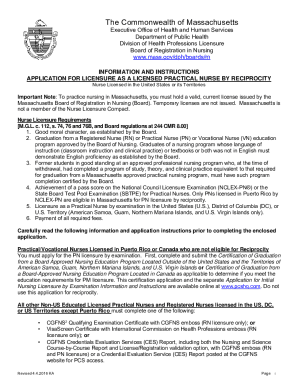

How do I complete employers pension provision survey online?

How can I fill out employers pension provision survey on an iOS device?

What is employers pension provision survey?

Who is required to file employers pension provision survey?

How to fill out employers pension provision survey?

What is the purpose of employers pension provision survey?

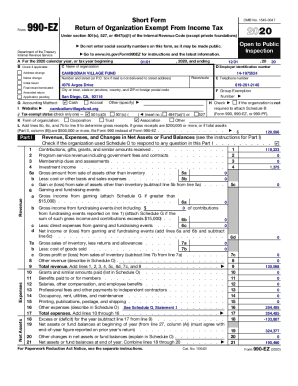

What information must be reported on employers pension provision survey?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.