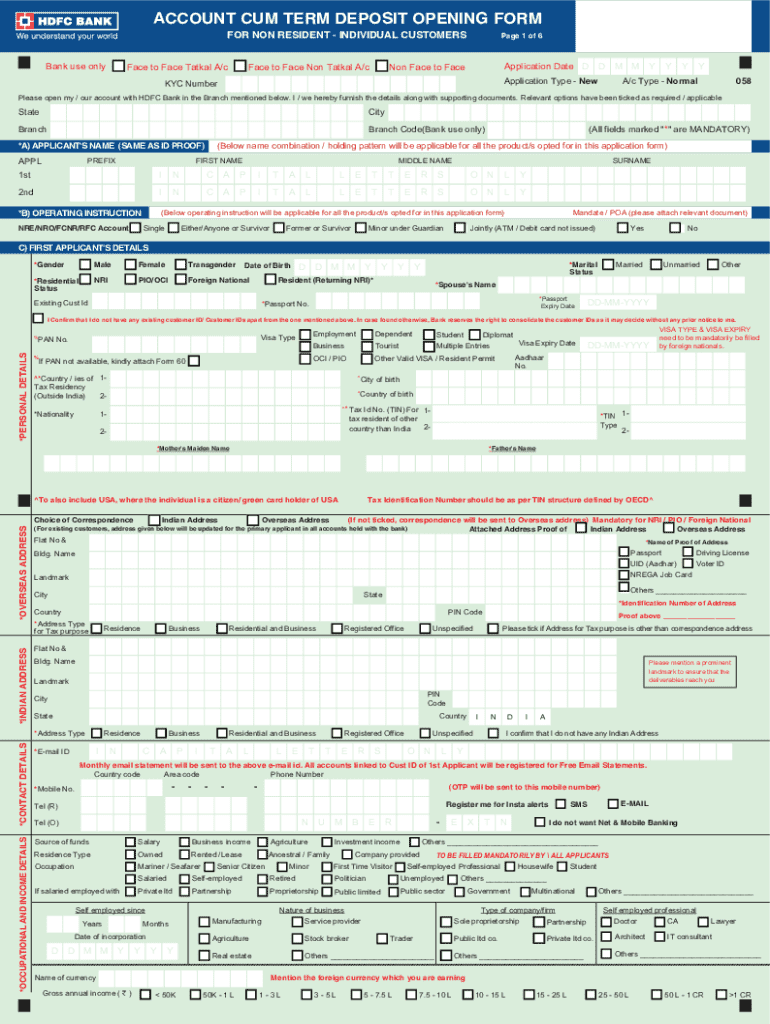

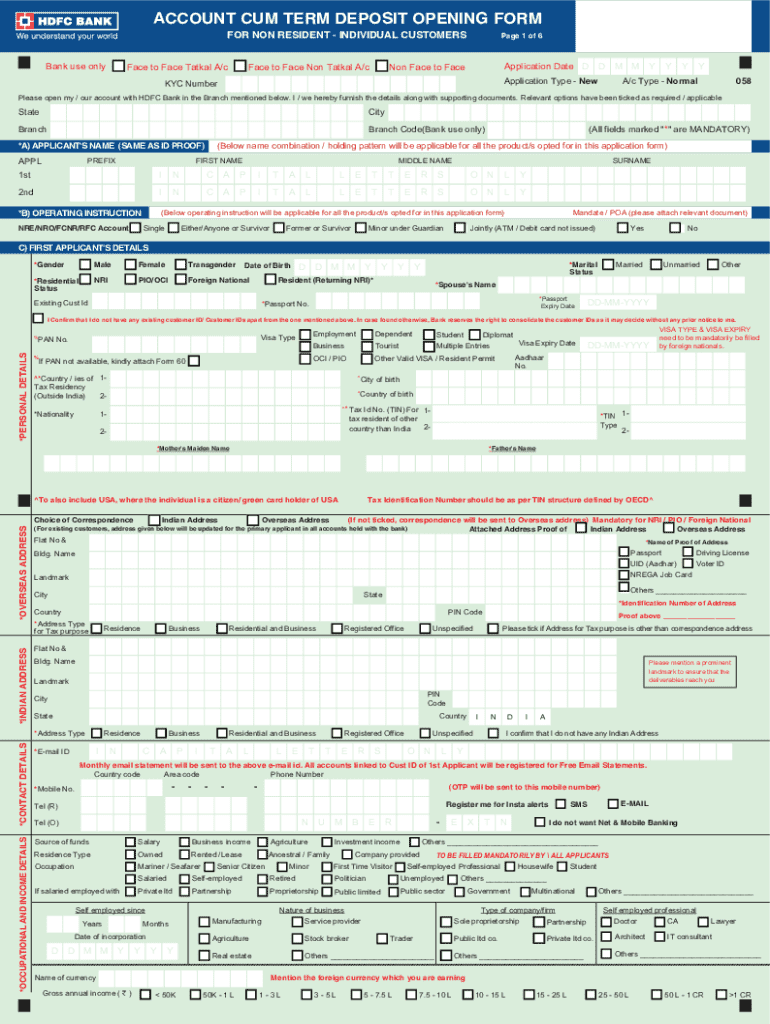

Get the free Account Cum Term Deposit Opening Form

Get, Create, Make and Sign account cum term deposit

Editing account cum term deposit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out account cum term deposit

How to fill out account cum term deposit

Who needs account cum term deposit?

Account cum term deposit form: A comprehensive guide

Understanding the account cum term deposit form

An account cum term deposit form serves as a critical tool for individuals and businesses looking to manage their finances effectively. It acts as both a savings and term deposit account, allowing depositors to benefit from higher interest rates typically associated with term deposits while retaining some liquidity advantages of a regular savings account.

The primary purpose of this form is to facilitate the opening of an account that combines features of both savings and term deposits. This is particularly important in personal and commercial banking, where financial strategies often require flexibility and opportunity for growth. Users can easily decide between locking in their funds for a predetermined period versus keeping their money accessible to a certain extent.

Differentiating between term deposits and regular savings accounts is essential for effective financial planning. Regular savings accounts typically provide lower interest rates, offer easy access to funds, and involve fewer restrictions. On the other hand, term deposits offer higher interest rates but require taking on the commitment of leaving funds untouched for a specified duration. Understanding these contrasts allows users to choose the right financial product as per their goals.

Key features of the account cum term deposit form

The account cum term deposit form presents several key features that make it appealing to potential account holders. One of the most notable features is the interest rates, which can either be fixed or variable. Fixed interest rates remain consistent throughout the term, offering predictability on returns. Variable interest rates, conversely, may fluctuate with market conditions, impacting overall returns.

Another important aspect is the maturity periods available for deposits, which can range from a few months to several years. The choice of duration can significantly influence the interest earned, with longer terms typically yielding higher rates. Furthermore, it's crucial to consider the conditions for early withdrawal, as attempting to access funds before maturity can result in penalties, impacting overall savings.

Using the account cum term deposit form for financial management comes with additional benefits. It encourages disciplined saving, provides a structured approach to financial growth, and often yields better returns on investments when compared to traditional savings accounts. Thus, this form serves as a functional tool for different financial strategies.

How to complete the account cum term deposit form

Completing the account cum term deposit form effectively is crucial for ensuring a smooth account setup. Here’s a step-by-step guide to assist you:

Editing and managing your account cum term deposit form

Once you've completed the account cum term deposit form, you may need to edit or manage it later. Utilizing tools like pdfFiller streamlines this process. Start by accessing your document on pdfFiller to make necessary modifications without hassle.

When you edit the form, it’s important to save any changes periodically to maintain document integrity. pdfFiller allows you to auto-save changes, ensuring you don’t lose any crucial information. Additionally, you'll want to securely share the completed form with financial institutions for further processing by either downloading it as a PDF or sharing it directly through the platform.

Signing the account cum term deposit form

Signing is a vital step in the completion of the account cum term deposit form, as it serves as your consent to the conditions laid out by the financial institution. eSigning options provided by pdfFiller are convenient and compliant with legal standards, ensuring all electronic signatures are valid and secure.

To ensure the authenticity of your signature, best practices include using secure devices, confirming the identity of individuals involved in the signing process, and utilizing reputable electronic signature services. With pdfFiller, you can easily create and manage your electronic signatures without any confusion.

Collaborating on the form with team members

If you're working within a team, the features of pdfFiller enable you to collaborate effectively on the account cum term deposit form. You can invite team members to review and edit the document directly on the platform, fostering a collaborative environment.

Managing permissions is crucial when collaborating. Ensure that you set appropriate access levels for different users, allowing some members to edit while others may simply view the document. This approach maximizes productivity and maintains the integrity of the original form.

Common mistakes to avoid when filling out the form

Filling out the account cum term deposit form can be straightforward, but users often make certain mistakes that can complicate the process. Common errors include providing incorrect personal information, miscalculating deposit amounts, and not understanding the terms of interest rates.

Such mistakes can hinder account setup and affect fund management. If errors occur, pdfFiller provides tools that allow users to revise mistakes easily. You can either edit the document directly or revert to a previous version without losing significant time or effort.

Next steps after form submission

After submitting your account cum term deposit form, it’s essential to understand the next steps in the process. The processing time for term deposits can vary, but most banks will provide a timeline. Typically, it takes anywhere from a few hours to several business days for your application to be processed.

Once your form has been reviewed, the bank will send you confirmation and account details. Monitoring your deposit account is crucial—ensure you have access to statements, as well as account management features that allow you to analyze your savings and interest earnings over time.

Frequently asked questions (FAQs)

Understanding frequently asked questions about the account cum term deposit form is important for new users. Common inquiries often revolve around penalties for early withdrawal, potential changes in interest rates, and the specific terms associated with the account.

Addressing these concerns can alleviate anxiety for users. Furthermore, making resources available for further assistance, such as contact details for customer support, can empower account holders to seek help when needed. Knowledge is key when it comes to effective financial management.

Customer experiences and testimonials

Real user stories can be insightful when considering the account cum term deposit process with pdfFiller. Many users have reported that the ease of filling out financial forms online has streamlined their banking experiences. Positive testimonials highlight the user-friendly interface, efficient editing tools, and reliable customer service.

Users have shared practical tips, such as taking advantage of collaborative features that allow for shared access among team members. Furthermore, statistical insights into user satisfaction show high rates of approval for pdfFiller, as customers find their form usability intuitive and straightforward.

Related financial forms to consider

Aside from the account cum term deposit form, there are several other banking and finance forms that users should be aware of. These include loan applications, credit card applications, and investment account forms. Understanding how these forms correlate and interact with the account cum term deposit form can ensure a seamless financial experience.

Having access to these documents through pdfFiller not only simplifies the process of form completion but also allows users to maintain better overall document management. Resources that link to other relevant forms can enhance user knowledge and promote financial literacy.

Getting support and assistance

For those seeking help with the account cum term deposit form, accessing pdfFiller's customer support is straightforward. Users can find tutorial videos, user guides, and community forums that offer invaluable guidance.

Engagement with community feedback channels allows users to share experiences and seek assistance for any issues faced while filling out forms. Getting the right support ensures that all users have the necessary tools to manage their accounts successfully.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my account cum term deposit directly from Gmail?

How can I edit account cum term deposit from Google Drive?

Can I edit account cum term deposit on an Android device?

What is account cum term deposit?

Who is required to file account cum term deposit?

How to fill out account cum term deposit?

What is the purpose of account cum term deposit?

What information must be reported on account cum term deposit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.