Get the free Fl-150

Get, Create, Make and Sign fl-150

How to edit fl-150 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out fl-150

How to fill out fl-150

Who needs fl-150?

FL-150 Form: Your Comprehensive How-To Guide

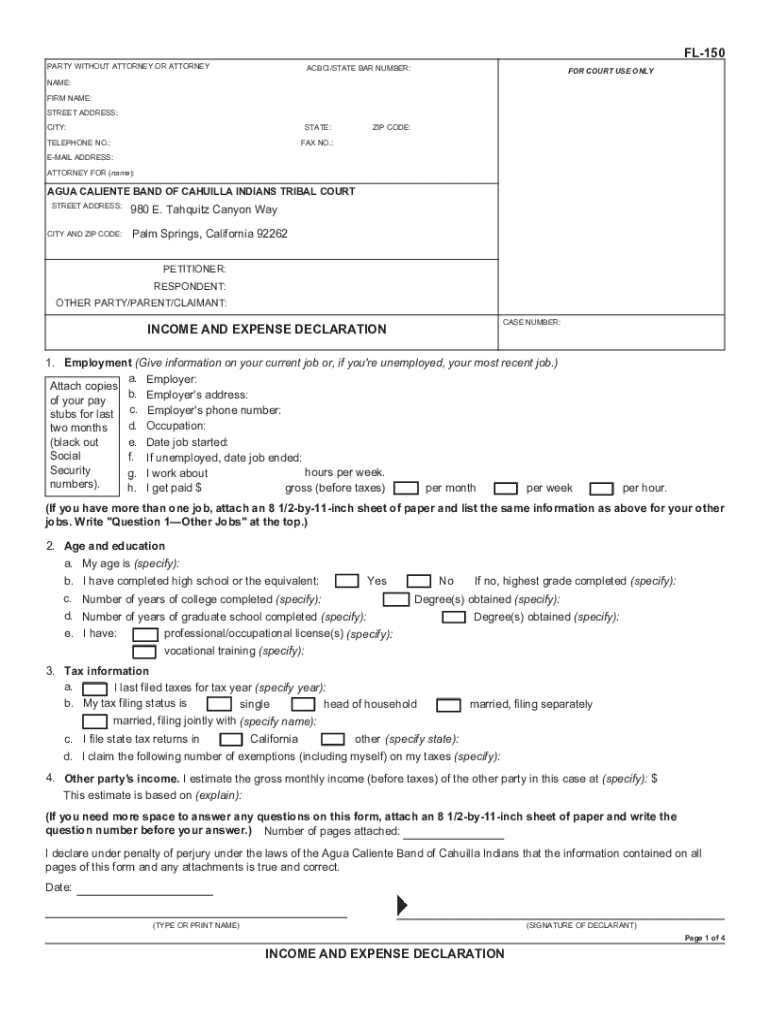

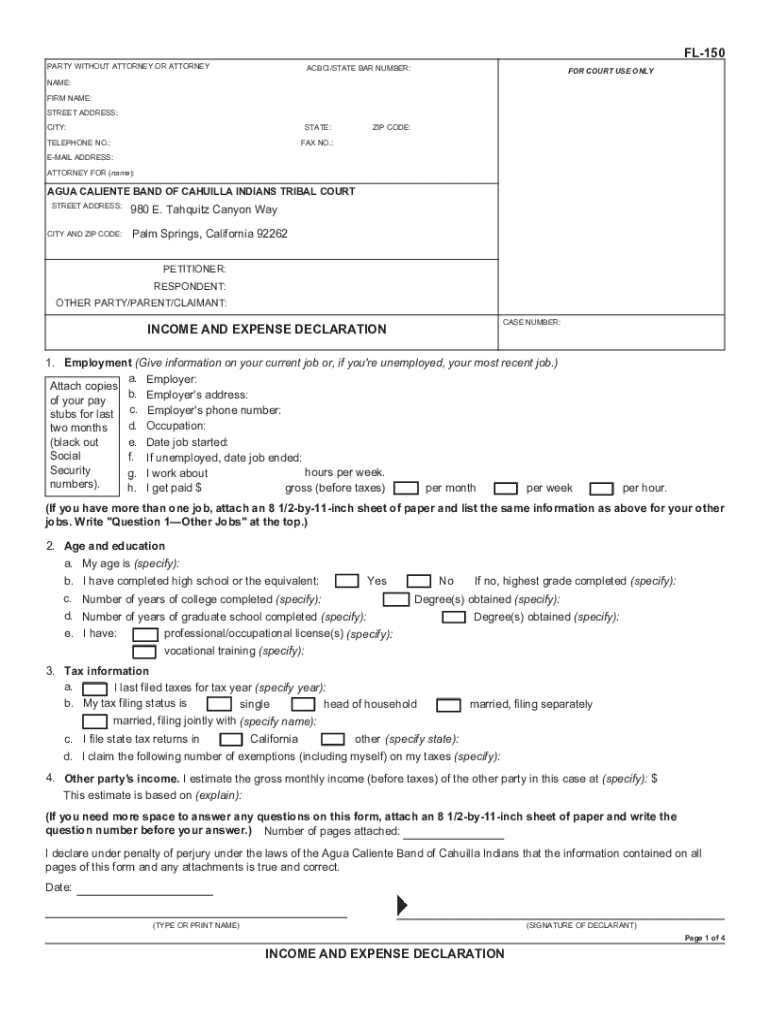

Understanding the FL-150 form: Income and expense declaration

The FL-150 form, formally known as the Income and Expense Declaration, plays a crucial role in California family law proceedings. This document is essential for individuals involved in disputes over child or spousal support, as it helps courts assess the financial standing of each party. Accurately filling out the FL-150 is vital for ensuring fair and just decisions in support cases.

The importance of the FL-150 cannot be overstated. It not only outlines your income and expenses but also provides a clear picture of your financial responsibilities. This declaration helps courts determine the appropriate level of financial support needed, making it a pivotal component in family law cases.

Filing the FL-150 is not just advisable; in many cases, it is mandatory. Understanding when and why this form is required—such as during custody disputes, support hearings, or modifications of existing support orders—is crucial to avoid unnecessary legal consequences, such as delays or penalties.

Key information required for completing the FL-150

To successfully complete the FL-150 form, you must gather specific financial information. This preparation is essential for accurately representing your economic situation in a court of law. Comprehensive data collection can streamline the process, making it easier to fill out the form and ensuring no important details are overlooked.

Some key information you'll need includes:

Being thorough in this section will ensure your FL-150 reflects an accurate portrayal of your financial situation, which ultimately contributes to the court’s ruling.

Step-by-step instructions for filling out the FL-150 form

Completing the FL-150 can seem daunting, but breaking it down into sections makes it manageable. Each part of the form serves a distinct purpose and understanding what is required can simplify the process.

Taking time to thoroughly complete each section will minimize errors and provide a clear financial picture to the court.

Common mistakes to avoid when filling out the FL-150

Many individuals make mistakes when completing the FL-150 form that can have significant consequences. Awareness of these errors can help you avoid pitfalls that might affect your case negatively.

Common mistakes include:

Accurately documenting your financial circumstances is vital for receiving a fair ruling in your case. Double-checking your form for completeness and accuracy can save you from challenges later.

Tips for organizing supporting documents for the FL-150 form

When filing the FL-150, it’s essential to accompany your form with supporting documents that verify your financial situation. Proper organization of these documents can facilitate smoother processing and bolster the legitimacy of your submission.

Some recommended documentation includes:

Organizing these documents logically—perhaps categorizing them by income, expenses, and deductions—can simplify the process. A clear and concise presentation of supporting evidence strengthens your case significantly.

Special considerations for updating the FL-150

As your financial situation evolves, updates to your FL-150 form may also be necessary. It is important to understand how to amend this document correctly to reflect your current circumstances.

You can update the FL-150 if your income or expenses change significantly. For instance, a new job, a change in marital status, or substantial medical bills are valid reasons to revise your form. Keeping the court informed not only adheres to legal obligations but also helps maintain an equitable support scenario.

To submit updated information, follow similar procedures as the original submission. Complete a new FL-150 form, ensuring that all changes are accurately captured. Include any necessary supporting documents to validate your claims, and file it with the appropriate court.

FAQs about the FL-150 form

Questions often arise regarding the FL-150 form, as understanding its nuances can significantly impact individuals navigating the family law landscape.

Additional legal forms related to family law

In the context of California family law, there are other important forms related to the FL-150 that may be necessary, depending on your situation. Familiarizing yourself with these forms can ensure you are prepared for any legal proceedings.

For instance, the FL-160 form, which provides a declaration of financial information for those involved in custody and visitation cases, may also be required. Understanding when to use these forms can help you present a comprehensive view of your financial circumstances to the court.

Resources for assistance with the FL-150 form

Numerous resources are available for individuals seeking help with the FL-150 form. From legal aid organizations to online tutorials, support is easily accessible.

Recommended online tools, like pdfFiller, offer features that simplify the FL-150 completion process. Interactive tools allow for easy form filling, while collaboration features enable you to share documents safely with legal counsel or family members, ensuring everyone involved can contribute effectively.

A pdfFiller tutorial can guide you through utilizing these tools, making document management fluid and straightforward. Its user-friendly interface means that individuals and teams can approach document creation with confidence.

Final thoughts on the FL-150 and document management

Completing the FL-150 form thoroughly and accurately is paramount, as it profoundly affects family court decisions. The implications of this document necessitate comprehensive and organized submissions, highlighting the need for effective document management.

Utilizing tools like pdfFiller can streamline your experience, allowing for seamless editing, eSigning, and collaboration—all from a single, cloud-based platform. Approaching the FL-150 with the proper tools at your disposal can make the entire process more manageable and substantially enhance your submission's quality.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my fl-150 directly from Gmail?

Can I sign the fl-150 electronically in Chrome?

Can I edit fl-150 on an Android device?

What is fl-150?

Who is required to file fl-150?

How to fill out fl-150?

What is the purpose of fl-150?

What information must be reported on fl-150?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.