Get the free Event Worker Earnings

Get, Create, Make and Sign event worker earnings

Editing event worker earnings online

Uncompromising security for your PDF editing and eSignature needs

How to fill out event worker earnings

How to fill out event worker earnings

Who needs event worker earnings?

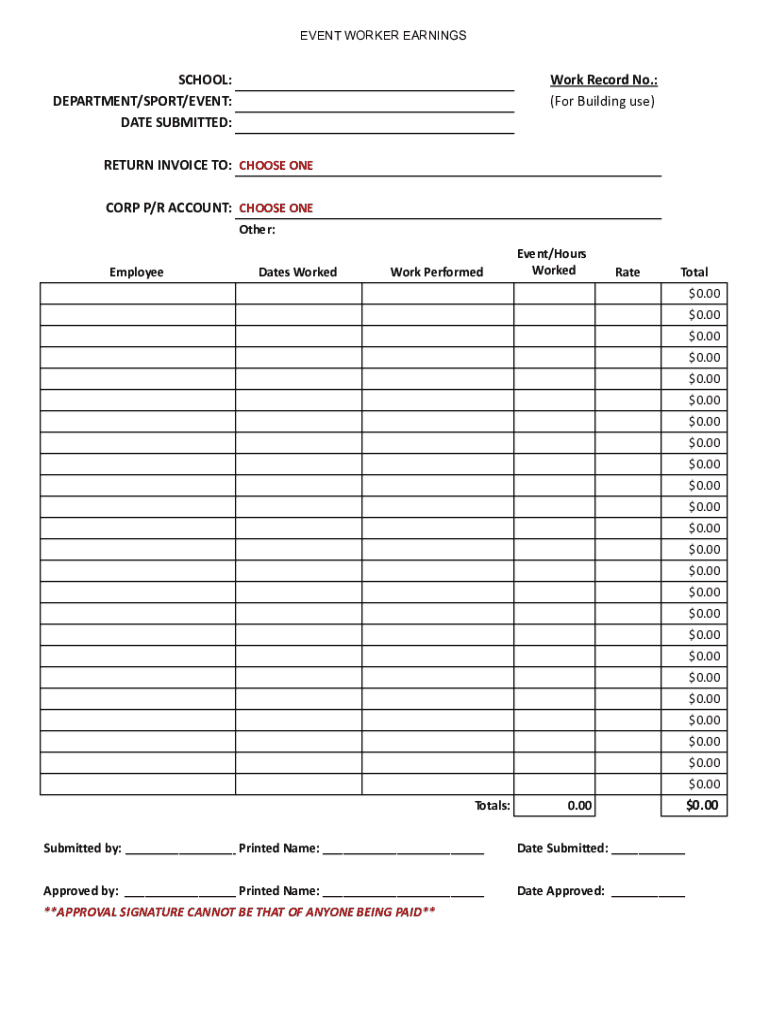

Comprehensive Guide to the Event Worker Earnings Form

Understanding the event worker earnings form

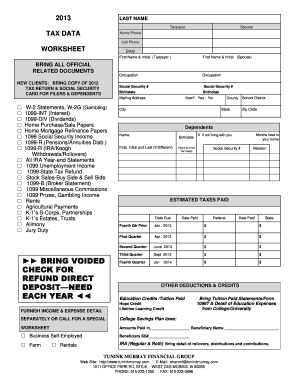

The event worker earnings form is a crucial document that helps freelancers and contractors accurately report their income generated through event-related activities. It provides a structured format for recording various earnings, expenses, and deductions, ensuring that event workers remain compliant with tax regulations and can easily track their financial performance.

Accuracy in reporting earnings is essential, not only for tax purposes but also for personal financial awareness. Misreporting can lead to penalties or lost income opportunities, making it vital for event workers to understand how to fill it out correctly.

This form is primarily targeted at freelance event workers, contractors, and anyone involved in the event management industry who receives compensation on a per-event basis. Situations that require the completion of this form include gigs such as wedding planning, corporate events, concerts, and trade shows.

Key components of the event worker earnings form

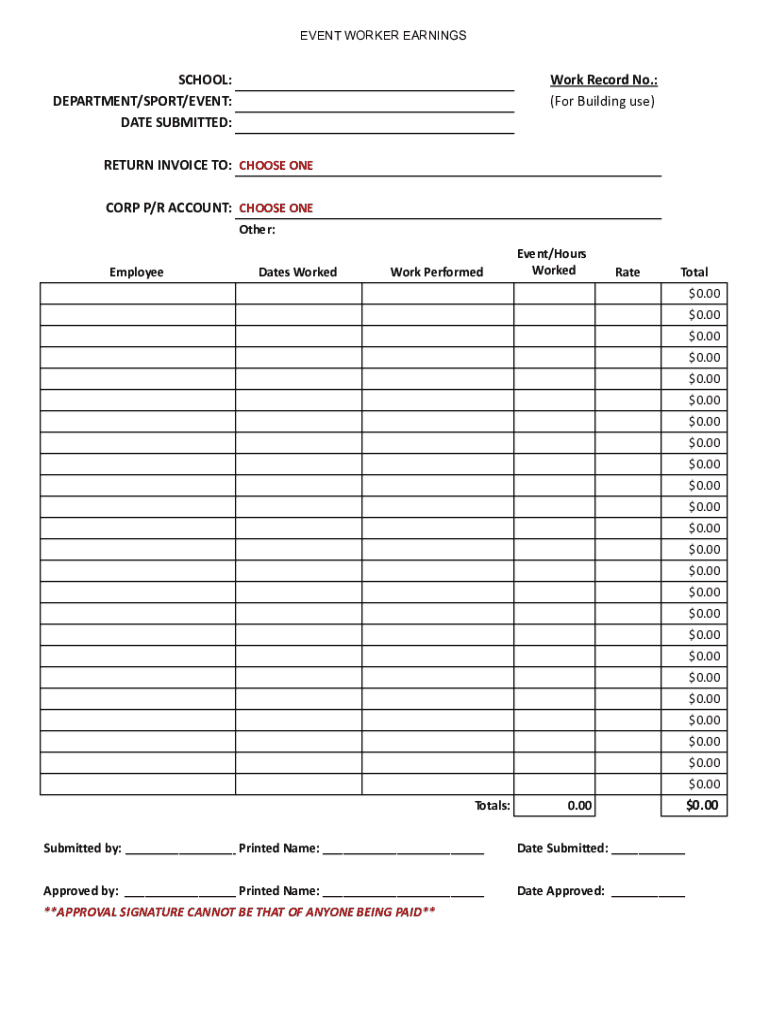

The event worker earnings form consists of several key sections that must be filled out accurately to ensure compliance and proper reporting. Understanding these components is the first step toward completing the form correctly.

One crucial section is the earnings information, where you need to report various income sources. Be sure to include all net earnings related to your events while avoiding common pitfalls such as forgetting to account for tips or bonuses. It's also vital to delineate which earnings are taxable.

Another important part is the personal information section. This includes your name, contact details, and tax identification number, which are necessary for processing the form correctly.

The event details section allows you to specify income earned from particular events, detailing the nature of each job, the date, and amount earned. Supporting documents such as invoices or contracts may be required, so it’s best to keep these organized.

How to complete the event worker earnings form

Completing the event worker earnings form can initially seem daunting, but breaking it down into manageable steps can simplify the process. Start by gathering all necessary information, including earnings generated, personal details, and specific event information.

To fill out the form, begin by entering your personal information in the designated section. Next, move to the earnings information section. Report total income, distinguishing between event earnings and other income streams. Always add clear descriptions to avoid any misinterpretation by tax authorities.

Common mistakes include miscalculating earnings or omitting important details. Always double-check numbers against invoices, and ensure you have documented everything thoroughly.

Editing and managing your form

Managing the event worker earnings form efficiently is essential in today’s digital world. pdfFiller offers great capabilities for editing this form digitally. Using pdfFiller allows you to not only fill out the form but also modify it as needed with additional functionalities.

Collaboration is seamless with pdfFiller. You can easily share your form with teammates or clients for review. Best practices for storage include utilizing cloud-based solutions, which ensure your important documents are safe and accessible anytime, anywhere.

eSigning the event worker earnings form

Electronic signing (eSigning) has become a standard practice for many document types, including the event worker earnings form. Using eSignatures not only adds a layer of legal authenticity but also streamlines the process, saving time for all parties involved.

To add your signature using pdfFiller, simply navigate to the eSignature section, where you can easily create a signature using your mouse or a stylus. Follow the prompts to place it where needed on the document, confirming authenticity while ensuring quick processing.

Frequently asked questions (FAQs)

Many event workers encounter queries regarding their earnings forms. For starter, if your earnings fluctuate due to varying gigs, ensure that you consistently update your form to reflect a realistic view of your income. This practice is crucial, especially during tax compliance.

If a form is rejected, it's vital to review the specific reasons for rejection. Common issues include incomplete sections or inconsistencies with the information provided. Find the source of the problem and promptly correct it before resubmitting.

Best practices for event workers

To ensure you report earnings accurately, maintain detailed records of all transactions related to your work. This includes keeping copies of contracts, invoices, and receipts for expenses and income sources.

Planning for tax implications is also essential. Understanding how your reported earnings affect your taxes can assist you in budgeting for tax season effectively. Finally, remaining compliant with regulations surrounding taxes will safeguard your work and financial well-being.

Benefits of using pdfFiller for your earnings form

pdfFiller serves as an all-in-one solution for managing your event worker earnings form. Its cloud-based platform provides flexibility to create, edit, and store documents from anywhere, addressing the needs of individuals and teams alike.

Additionally, collaboration tools facilitate easy teamwork on documents, making updates and reviews straightforward. Furthermore, with advanced security features, pdfFiller ensures your sensitive information remains protected, assuring peace of mind.

Explore related forms and resources

As an event worker, you may find that several other forms are essential in managing your business. Forms like the independent contractor agreement or expense report can help you maintain a comprehensive record of your work.

Online resources regarding event management are abundant. Platforms offering valuable guides related to project management can help you hone your skills, while community support forums allow you to connect with other event workers, exchanging experiences and insights.

Interactive tools and calculators

Making use of interactive tools can significantly benefit event workers. Income calculators available online can help estimate your total earnings based on the types of events you handle, allowing for better budget planning.

Additionally, utilizing earnings report templates can streamline your earnings reporting process. These templates ensure a professional presentation, saving you time while maintaining clarity in your documentation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit event worker earnings from Google Drive?

How do I execute event worker earnings online?

How do I edit event worker earnings on an Android device?

What is event worker earnings?

Who is required to file event worker earnings?

How to fill out event worker earnings?

What is the purpose of event worker earnings?

What information must be reported on event worker earnings?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.