Get the free Fidelity Guarantee Insurance Proposal Form

Get, Create, Make and Sign fidelity guarantee insurance proposal

Editing fidelity guarantee insurance proposal online

Uncompromising security for your PDF editing and eSignature needs

How to fill out fidelity guarantee insurance proposal

How to fill out fidelity guarantee insurance proposal

Who needs fidelity guarantee insurance proposal?

Fidelity Guarantee Insurance Proposal Form: A Comprehensive Guide

Understanding fidelity guarantee insurance

Fidelity guarantee insurance is designed to protect businesses from financial losses caused by dishonest acts of employees. The primary purpose of this type of insurance is to safeguard a firm’s assets against losses sustained due to fraud, theft, or other dishonest behaviors perpetrated by its employees. Many businesses, especially those that handle cash, accounts, or confidential information, find fidelity guarantee insurance vital.

For both individuals and companies, fidelity guarantee insurance serves a crucial role in risk management, as it helps to instill trust and security in business operations. Neglecting this insurance can expose businesses to significant financial risks, especially in an age where employee fraud is a prevalent concern.

Key stakeholders in fidelity guarantee insurance typically include the insured party, the insurance provider, and regulatory bodies that may oversee compliance and claims processes. Understanding these dynamics is crucial for anyone looking to acquire or manage this insurance.

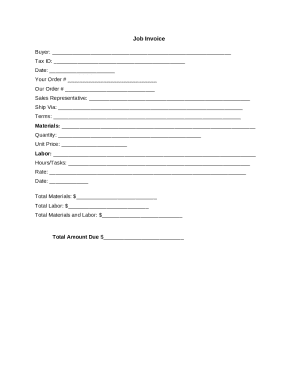

Overview of the fidelity guarantee insurance proposal form

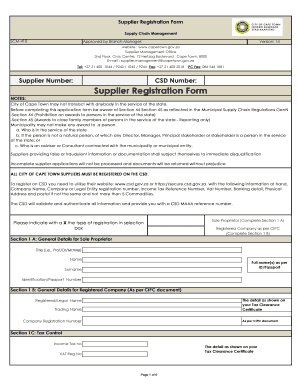

The fidelity guarantee insurance proposal form is a critical document in the insurance acquisition process. It serves as a formal request from the applicant to the insurance provider, encapsulating all necessary details about the business and the risks it seeks to cover. Filling out this form correctly is essential for ensuring that the insurance provider can accurately assess the risk and determine appropriate coverage and premiums.

Despite its importance, many individuals misunderstand the proposal form. Some believe it simply requires basic information, while in reality, it involves detailed disclosures about business operations, employee details, and prior claims. A well-completed proposal form increases the chances of obtaining the desired coverage.

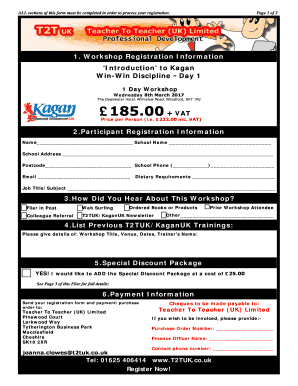

Steps to complete the fidelity guarantee insurance proposal form

Completing the fidelity guarantee insurance proposal form involves several steps that ensure accuracy and completeness. Preparing beforehand can save time, reduce errors, and improve your chances of having your application approved.

Preparing to fill out the form

Step-by-step instructions for filling out each section

The first section usually pertains to the applicant information. You will need to provide personal details, such as full name, contact information, and business name. Accurately filling in this section helps avoid common errors in communication.

Tips for efficiently completing the form include using interactive tools like pdfFiller for guided assistance and ensuring clarity and accuracy in your responses.

Editing and customizing your proposal form

Editing the fidelity guarantee insurance proposal form may be necessary if you notice any errors or wish to make changes after initial completion. Using tools like pdfFiller allows for easy modifications, and the platform’s user-friendly interface enables you to adjust your document seamlessly.

Benefits include the ability to collaborate with team members in real-time, which can ensure that all stakeholders are on the same page. Interactive features make customizing your document straightforward, enabling you to integrate specific details or additional clauses as needed.

Signing and submitting your proposal form

Once you’ve filled out the fidelity guarantee insurance proposal form, the next step is signing and submitting it properly. Understanding the requirements for eSigning is crucial, as many insurance companies now accept electronic signatures, making the process quicker and more efficient.

The legality of eSignatures in fidelity guarantee insurance is well established, provided the signature meets certain legal standards. Traditional mail submissions still exist, but online submissions offer better tracking and immediacy.

Managing your fidelity guarantee insurance proposal

After submission, managing your fidelity guarantee insurance proposal effectively is essential. Storing your completed proposal form in a secure location enables easier access during follow-ups or claim submissions.

Monitoring the status of your insurance application can also help you stay informed about approval times and any additional information the insurer may require. Regular check-ins can expedite the process and clear up any potential misunderstandings.

Frequently asked questions (FAQs)

Many individuals have common concerns about the fidelity guarantee insurance proposal process. Questions can range from the completion of the form to clarity surrounding coverage details. Addressing these FAQs can clarify the process and help alleviate uncertainties.

Case studies and real-life applications

Analyzing real-life examples of successful fidelity guarantee insurance claims can provide valuable lessons for both businesses and individuals. Understanding these case studies highlights the different scenarios in which the insurance has been beneficial.

Common proposal mistakes that led to unnecessary challenges can also shed light on what to avoid during your own application process. By learning from these real-world cases, you can strengthen your approach and ensure your proposals are submitted correctly.

Conclusion: ensuring a smoother experience with pdfFiller

Navigating the fidelity guarantee insurance proposal form is a vital step for businesses seeking protection against employee dishonesty. pdfFiller simplifies this process by offering tools that streamline the creation, editing, and management of your documentation.

Embracing such comprehensive solutions not only empowers teams but also enhances efficiency, allowing users to focus on core business operations rather than administrative hurdles. Implementing proactive documentation strategies will ultimately lead to a more secure and streamlined business environment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my fidelity guarantee insurance proposal directly from Gmail?

How can I modify fidelity guarantee insurance proposal without leaving Google Drive?

How do I edit fidelity guarantee insurance proposal on an Android device?

What is fidelity guarantee insurance proposal?

Who is required to file fidelity guarantee insurance proposal?

How to fill out fidelity guarantee insurance proposal?

What is the purpose of fidelity guarantee insurance proposal?

What information must be reported on fidelity guarantee insurance proposal?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.