Get the free Long-term Disability (ltd) Claim Information Sheet

Get, Create, Make and Sign long-term disability ltd claim

How to edit long-term disability ltd claim online

Uncompromising security for your PDF editing and eSignature needs

How to fill out long-term disability ltd claim

How to fill out long-term disability ltd claim

Who needs long-term disability ltd claim?

Understanding Your Long-Term Disability LTD Claim Form

Understanding long-term disability (LTD) claims

Long-term disability insurance (LTD) is designed to provide financial support to individuals who are unable to work due to a debilitating medical condition. It offers crucial peace of mind as policyholders navigate challenges posed by their illness or injury.

This insurance isn't just a safety net; it covers various essential living expenses and can significantly ease the emotional burden of financial strain while ensuring that individuals can focus on recovery.

Who qualifies for LTD benefits?

Eligibility for long-term disability benefits often depends on several criteria outlined in your insurance policy. Typically, these may include having an injury or illness that significantly interferes with your ability to perform work-related tasks.

Common conditions that qualify for LTD benefits include chronic illnesses, mental health disorders, and severe injuries resulting from accidents. Understanding your policy's specific terms is critical to ensure you meet the defined requirements.

Overview of the long-term disability claim process

Initiating a long-term disability claim can appear daunting, but breaking it down into structured steps can simplify the process. The first step involves gathering necessary documentation to validate your claim.

This includes obtaining medical records, proof of income, and any other relevant documentation required by your insurer. Timeliness is essential; each policy often has specific deadlines for submitting claims.

Common reasons for claim denial

Claims may be denied for various reasons, often stemming from misunderstandings about the policy terms or errors related to form completion. Frequent missteps include failing to provide adequate medical documentation or overlooking vital information that supports your claim.

Awareness of these potential pitfalls can significantly improve your chances of a successful claim. Always read your policy's fine print and clarify uncertainties with your insurance representative.

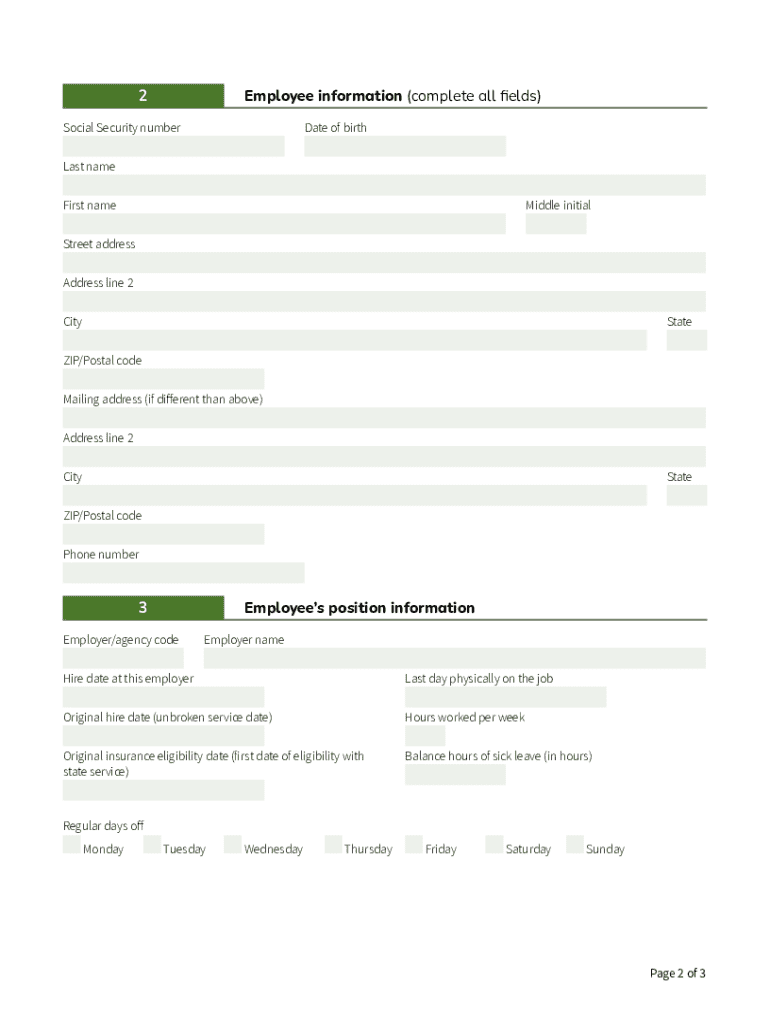

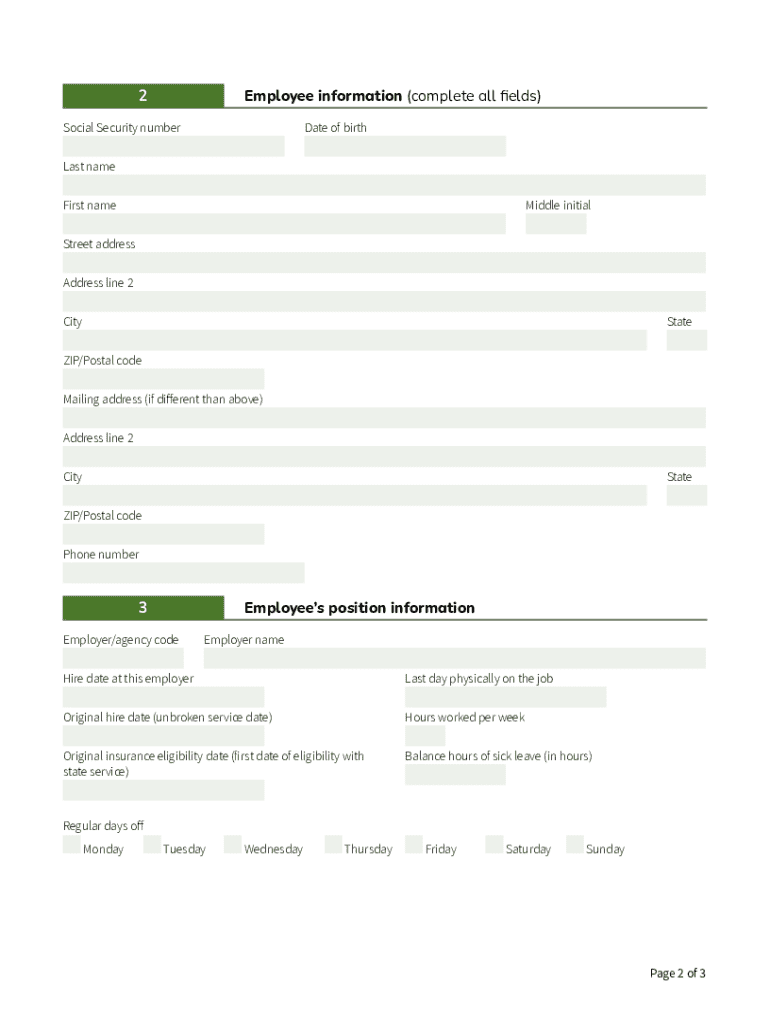

The long-term disability LTD claim form explained

Understanding the structure of the long-term disability LTD claim form is essential for completing it successfully. The form typically includes several sections requiring specific information.

You must provide personal information, detailed medical history, employment status, and income details. Don't forget to include a section for the designation of a beneficiary.

Tips for completing each section effectively

When filling out the LTD claim form, accuracy and thoroughness are paramount. Begin by gathering necessary documentation ahead of time. Utilize pdfFiller’s platform for an easier experience by editing and annotating your form digitally.

Review each section of the claim form carefully, ensuring no details are omitted. For added ease, consider collaborating with a medical professional who can provide relevant information to support your claim.

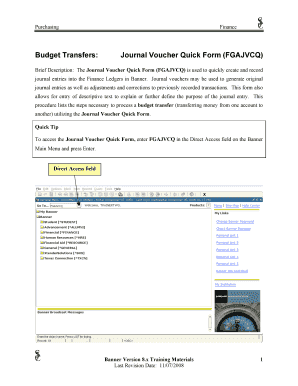

Using pdfFiller to manage your LTD claim form

pdfFiller greatly enhances your ability to manage your long-term disability claims effectively. With its user-friendly interface, pdfFiller allows you to easily edit your claim form, enabling you to make any necessary adjustments swiftly.

To engage with the platform, simply upload your claim form, make desired changes, and save your draft. The benefits of using pdfFiller include cloud storage and accessibility from any device.

eSigning and submitting your claim

Once you’ve completed and reviewed your LTD claim form, pdfFiller provides options for electronically signing your document. This eliminates the need for physical signatures, streamlining submission.

You can submit your claim directly through the platform or download it to send via email or postal channels, ensuring secure delivery to your insurance provider.

Collaborating with professionals

Navigating the claims process may require collaboration with various professionals. It’s wise to consult a legal professional if you encounter significant hurdles or claims delays.

Legal experts can help elucidate complex policy language and ensure your rights are upheld throughout the claims process.

Working with insurance representatives

Effective communication with your insurance representative is crucial. Be prepared to ask questions about your policy, benefits, and the claims process to gain clarity.

Ensure you maintain a record of conversations and correspondence with your insurance provider, as this can be invaluable if you face challenges down the line.

Managing your claim after submission

Once your long-term disability claim is submitted, staying informed about its progress is essential. Regular follow-ups can assure you that your claim is being processed within the expected timelines.

Keep an organized file of all communications and documentation related to your claim, as this information may be necessary for appeals or future inquiries.

Preparing for potential appeals

Understanding that a claim may be denied requires preparing for a potential appeal. Familiarize yourself with common reasons for appeals, such as inadequate support from medical documentation or administrative errors.

Structuring your appeal clearly is essential; addressing each denial point and providing evidence or context can significantly increase your chances of a favorable outcome.

Additional tools and resources

Accessing educational resources on long-term disability claims can provide valuable insights. Online platforms offer FAQs, guides, and articles that greatly enhance your understanding of the process.

Additionally, consider joining support forums where you can share experiences and gain advice from others who have navigated similar paths, enhancing your knowledge and confidence.

Utilizing templates and checklists

Having a structured checklist can significantly reduce anxiety while preparing your long-term disability claim. pdfFiller provides templates that guide you through the necessary elements required for your claim.

Utilize these resources to ensure that nothing is overlooked, particularly when it comes to submitting your claim correctly and on time.

Final considerations

Staying organized is vital throughout the claims process. Maintain comprehensive records of all your documents and communications related to your long-term disability claim. Having a clear organization system can greatly streamline follow-ups and future reference.

Understanding your rights as an LTD policyholder is also essential. Familiarize yourself with these protections to ensure you advocate for your needs effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find long-term disability ltd claim?

Can I create an electronic signature for the long-term disability ltd claim in Chrome?

How can I edit long-term disability ltd claim on a smartphone?

What is long-term disability ltd claim?

Who is required to file long-term disability ltd claim?

How to fill out long-term disability ltd claim?

What is the purpose of long-term disability ltd claim?

What information must be reported on long-term disability ltd claim?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.