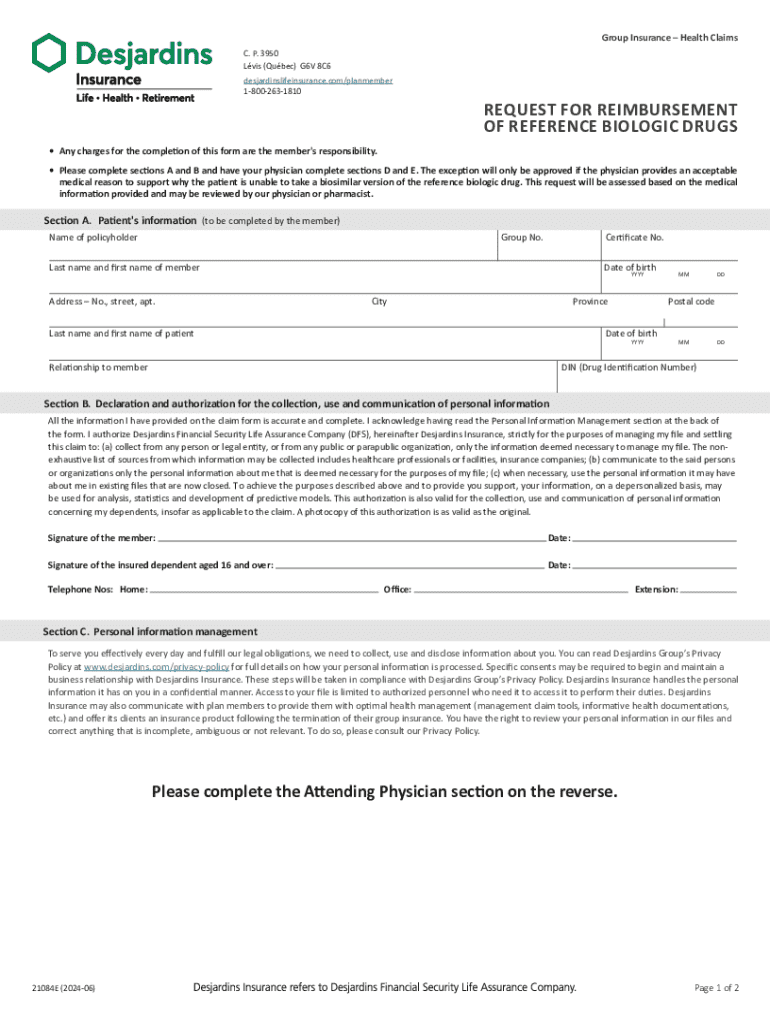

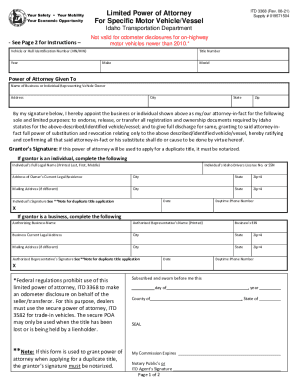

Get the free Group Insurance – Health Claims

Get, Create, Make and Sign group insurance health claims

Editing group insurance health claims online

Uncompromising security for your PDF editing and eSignature needs

How to fill out group insurance health claims

How to fill out group insurance health claims

Who needs group insurance health claims?

A Comprehensive Guide to Group Insurance Health Claims Form

Understanding group insurance health claims

Group insurance is a health coverage plan provided by employers or organizations that protects a group of individuals under a single policy. This form of insurance is fundamentally different from individual policies, as the cost and risk are shared among all participants. Group insurance typically involves lower premiums and wider coverage options, making it an attractive option for many employees.

Filing claims is a crucial aspect of obtaining the health benefits promised by your group insurance plan. A timely submission can expedite healthcare reimbursements and ensure that you aren't left with unexpected medical bills. However, many individuals face hurdles such as misunderstanding policy coverage or encountering issues with claim documentation.

Preparing to file your group insurance health claim

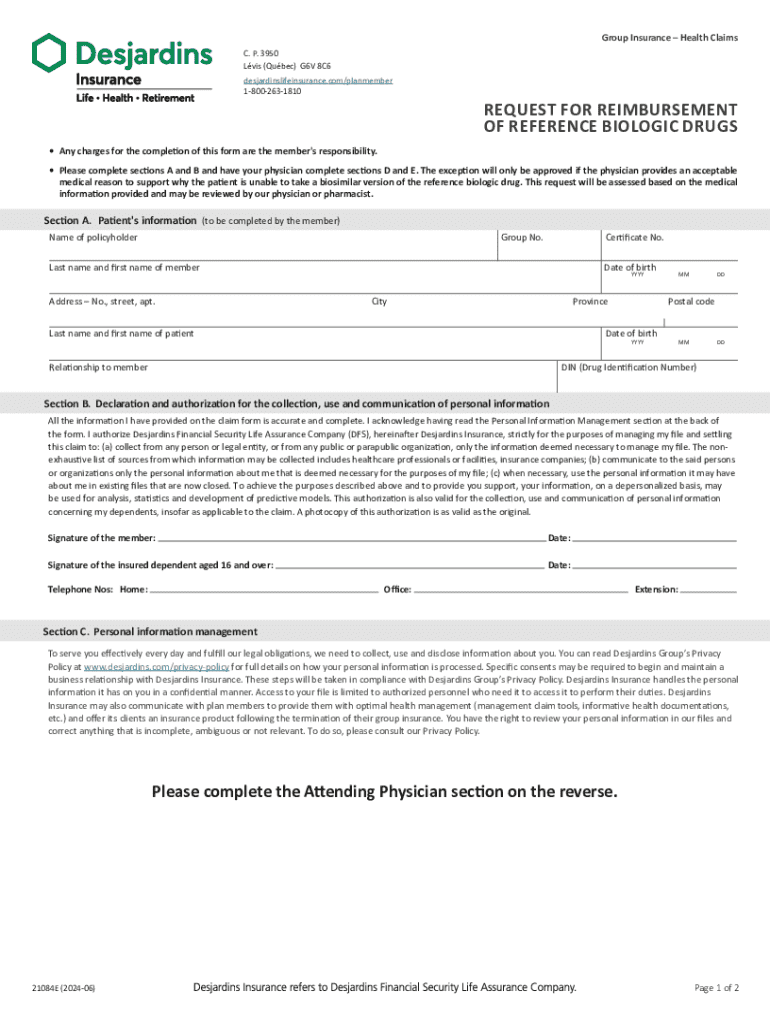

Before you dive into filling out the claims form, it's essential to gather all necessary information. The required personal details typically include your name, contact information, and member ID, in addition to details pertaining to your group insurance plan, such as the policy number and type of coverage. Medical documentation typically encompasses invoices, bills from healthcare providers, and possibly an authorization for disclosure of health information.

Understanding your policy coverage is vital. Ensure you’re aware of what services are covered, any limitations, and specific exclusions. For example, some plans may have restrictions on pre-existing conditions or wellness claims that may affect your claim approval.

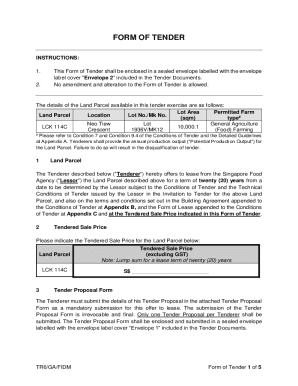

The step-by-step process for completing the health claims form

To start the claim process, you’ll need to access the group insurance health claims form. This form can often be found on your insurance provider’s website or through your employer’s human resources department. For ease of use, consider utilizing pdfFiller, which allows you to access and edit the form directly online.

When filling out the claims form, pay attention to each section carefully. Make sure to correctly input details such as dates of medical service, type of illness or accident, and the total amount being claimed. It’s essential to double-check your entries to avoid common pitfalls, like incorrect billing codes or missing signatures.

Submitting your claims form

Once completed, you have several options for submitting your claims form. Most insurance providers now offer online submission options via their mobile apps or websites for instant processing. If you prefer physical submission, mailing the form requires careful attention to address details, ensuring you retain proof of mailing for records.

You may also have the option for in-person submission at designated service centers, though it’s wise to check if this route is available. After submitting your claim, expect typical processing times to vary. Many insurers provide a claim status tracking feature, allowing you to stay informed about your claim progress.

Follow-up and managing your claim

Tracking your claim ensures you are aware of progress and any additional documentation required. Many platforms, including pdfFiller, provide capabilities to monitor the status of your claims efficiently. If your claim is denied, don't lose hope; this is a common occurrence and can often be resolved through a proper appeal.

Common reasons for claim denial include missing information or documentation. Understanding the denial reason is crucial to successful appeals. It's important to follow the outlined steps to appeal effectively, ensuring all required information, such as a pre-existing investigation statement, is included.

Frequently asked questions

When it comes to group insurance claims, certain inquiries often arise. For instance, processing times can vary significantly, but most insurers aim to complete reviews within a matter of weeks. If your submission lacks information, it’s essential to submit the missed details as soon as possible to prevent delays in processing.

It’s also possible to amend your claim after submission if new information arises. However, doing so may require following specific procedures laid out by your insurance provider, so always refer to their guidelines.

Interactive tools and resources

pdfFiller offers a suite of tools designed to simplify the process of filing claims. Its eSigning feature enables quick signatures, while collaboration tools allow for team input on forms. Additionally, their editing features facilitate necessary adjustments to claims forms with ease, making the claims process user-friendly.

Creating a claims form with pdfFiller involves simple steps, from choosing a template to filling in your details. The platform’s interface is designed for accessibility, allowing users to manage their documents efficiently from anywhere.

Expert tips for successful claims filing

For a smooth claims experience, adhere to best practices in form completion. Always fill out claims forms legibly and accurately, ensuring that all required information is provided. Double-check all entries, particularly the financial details involving electronic funds transfer requests, to minimize any chance of delay.

If you need assistance, don’t hesitate to reach out to pdfFiller’s customer support. Their team can help guide you through the process, answering questions about claim submissions or addressing specific concerns related to your group insurance policy.

Optimizing your document management with pdfFiller

While navigating group insurance health claims is crucial, having a reliable document management system is equally important. pdfFiller not only supports health claims but can also help manage various other forms like loan requests or life surrender requests, consolidating your essential documents in one location.

This digital document platform also fosters collaboration among teams; whether you're working on a wellness claim or navigating insurance complexities, pdfFiller ensures you have access to every form you need, streamlining your process from start to finish.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete group insurance health claims online?

How do I edit group insurance health claims online?

Can I edit group insurance health claims on an iOS device?

What is group insurance health claims?

Who is required to file group insurance health claims?

How to fill out group insurance health claims?

What is the purpose of group insurance health claims?

What information must be reported on group insurance health claims?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.