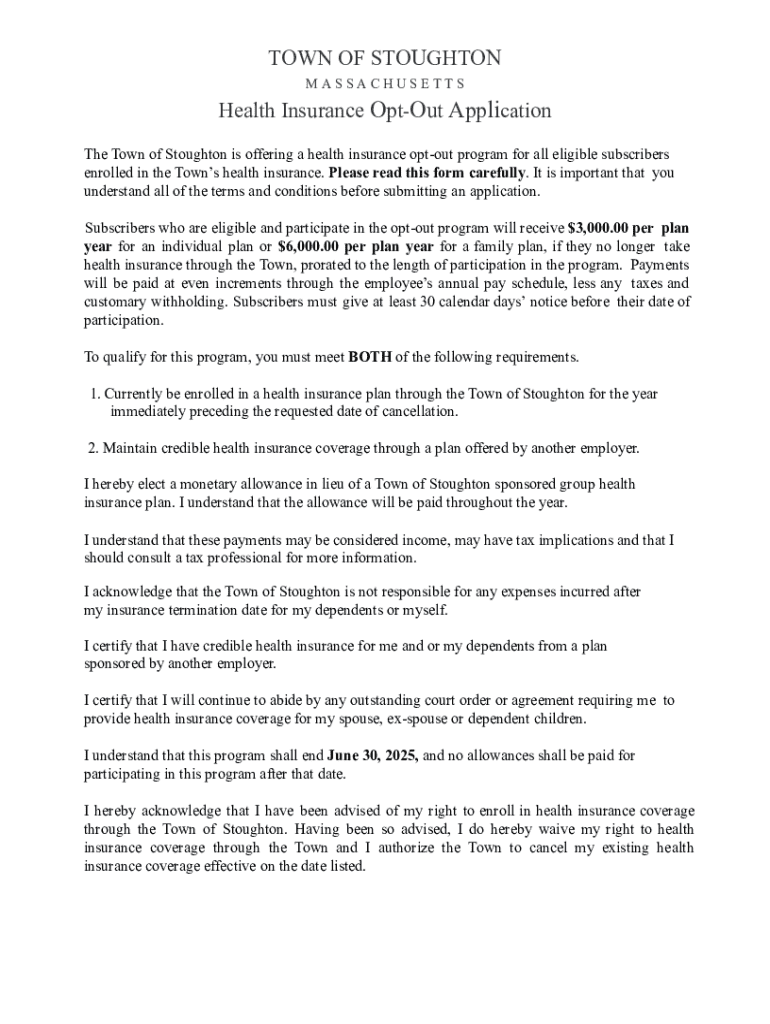

Get the free Health Insurance Opt-out Application

Get, Create, Make and Sign health insurance opt-out application

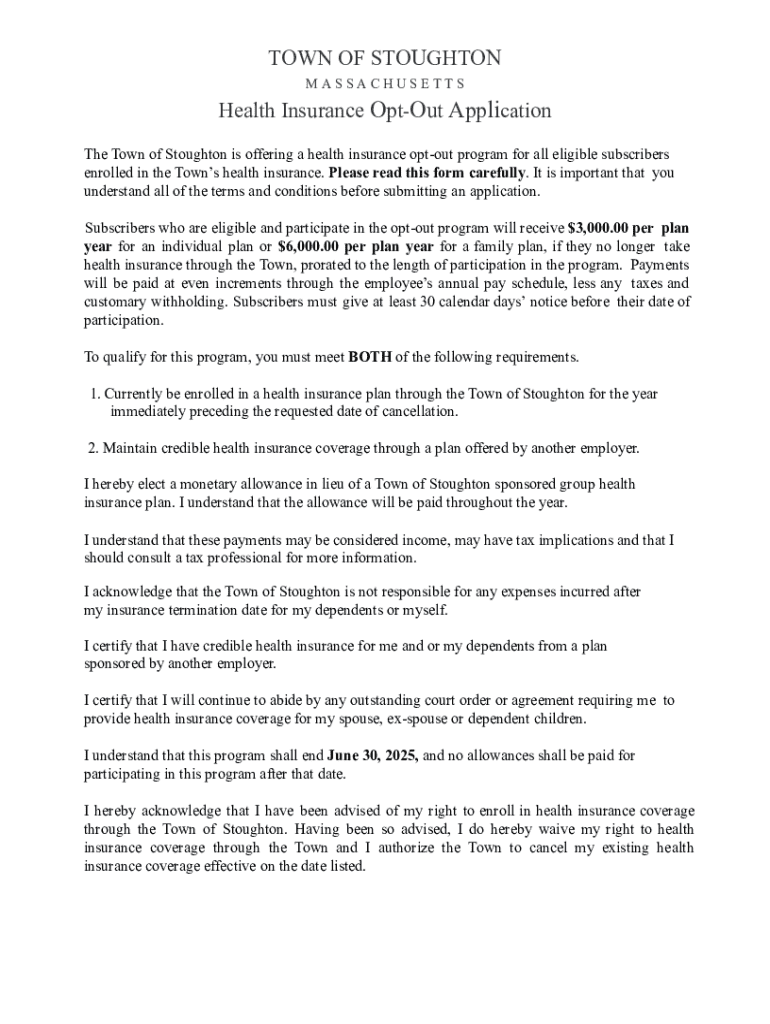

Editing health insurance opt-out application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out health insurance opt-out application

How to fill out health insurance opt-out application

Who needs health insurance opt-out application?

Your Complete Guide to the Health Insurance Opt-Out Application Form

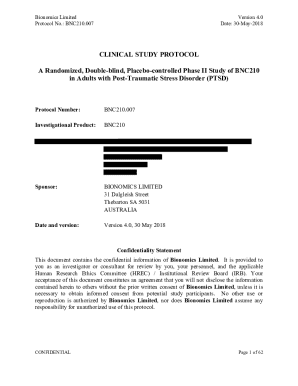

Understanding the health insurance opt-out program

The Health Insurance Opt-Out Program allows eligible individuals to decline certain health insurance offerings, usually provided by employers. This program is designed for those who may have alternative coverage or prefer to manage their healthcare costs differently. Opting out can be a strategic choice for many, but it’s essential to understand the implications it carries.

Common reasons why individuals might choose to opt out include having coverage through a spouse's plan, being covered under a government program, or simply reducing expenditures during financial constraints. If you believe you meet the criteria, navigating the opt-out process can save you money and provide flexibility in managing your healthcare options.

Who should consider opting out?

Opting out of health insurance isn't a one-size-fits-all decision. It can be beneficial for individuals who already have sufficient coverage or those working in organizations with diverse healthcare options. Understanding your unique situation is crucial before making this decision.

Particularly, individuals with coverage through a family member, such as a spouse, may find that their existing plan suffices, thus making opting out a financially smart choice. Additionally, small teams and organizations often evaluate the overall benefit of their health insurance plans against employee needs and may collectively decide to pursue alternative routes.

Key components of the health insurance opt-out application form

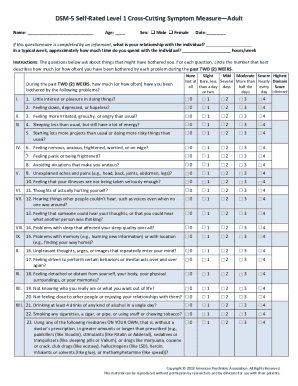

To complete the health insurance opt-out application form, you need to supply various pieces of information to demonstrate your eligibility and current healthcare arrangement. This form acts as an official notice of your intent to forego offered health insurance.

Typically, the form includes sections where you disclose personal information, your date of employment, and details regarding your existing health insurance coverage. Accurate completion is vital, as it directly influences the approval of your application.

Step-by-step guide to completing the opt-out application form

Completing the health insurance opt-out application form can seem daunting, but by breaking it down into manageable steps, you can ensure that you navigate the process smoothly.

The first step involves gathering all necessary information. Ensure you have your current insurance documents handy, as well as any additional reflections on why you're opting out. Next, fill out the application form with attention to detail, confirming each section is correct to avoid processing delays. After completing the form, make sure to review it thoroughly to ensure all information is accurate and complete.

Once completed, the application may be submitted through various channels such as online platforms, directly to your HR department, or via mail. Familiarize yourself with the submission deadlines specific to your organization to ensure timely processing.

Interactive tools for managing your opt-out process

pdfFiller offers advanced digital solutions designed to simplify the health insurance opt-out process. Utilizing tools provided by pdfFiller, you can easily fill out, edit, and sign your application form online, which not only expediates the submission process but also enhances your document management experience.

Real-time collaboration features allow multiple parties to contribute and edit the form if necessary, reducing errors and ensuring everyone is on the same page. Additionally, with eSigning capabilities, you can complete the form quickly and securely from anywhere, making your application process as efficient and smooth as possible.

Frequently asked questions about the opt-out process

The health insurance opt-out process often raises several questions, especially regarding eligibility criteria. Typically, individuals wonder about whether they can reapply in the future or what happens after they submit their application. It's essential to stay informed about policies surrounding incentives for opting out, as some companies may offer monetary benefits for those who do.

Others often ask about how opting out might impact their future health insurance options. Understanding the implications of your choices now can help you create a more sustainable plan for your future healthcare needs.

Additional considerations

Before opting out, consider how it might affect your workplace benefits. Furthermore, with changing regulations and healthcare initiatives, it's crucial to stay updated on any shifts that could influence your decision to opt out. Engaging in discussions around current trends can shed light on collective behaviors and preferences that may guide your own decisions.

Additionally, consider reviewing industry statistics or employee feedback regarding the impacts of opting out on overall workplace morale and satisfaction. Opting out may provide immediate relief from costs but could also reduce benefits that play a significant role in employee health.

Contact information and support resources

If you encounter challenges while filling out the health insurance opt-out application form, there are several support options available. Your HR department can provide detailed guidance or clarification regarding the company's specific forms and requirements. pdfFiller also offers extensive resources to assist you with document management.

Whether you need help editing your application or understanding the submission protocols, reaching out for assistance can make the process more straightforward. Remember, support is just a click away at pdfFiller.

Real-life experiences: testimonials and case studies

Hearing from individuals who have successfully navigated the health insurance opt-out process can provide valuable insights and confidence in your decision. Many have reported that opting out permitted them to redirect funds toward more customized healthcare options that fit their personal needs.

However, some have also encountered challenges that made the process more complex. Understanding these experiences can prepare you for potential hurdles. Testimonials reveal how teamwork and proactive communications can ease the transition of opting out while fostering a supportive environment.

Preparing for future enrollment

If you choose to opt out, remembering the importance of future health insurance enrollment is crucial. Stay aware of open enrollment periods and be prepared to reassess your needs based on any changes in your personal or family health circumstances.

Being proactive means continuously evaluating your health insurance options and understanding the context of your healthcare needs. Taking the time to review different plans can help ensure you make the right coverage decisions moving forward.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send health insurance opt-out application to be eSigned by others?

How can I get health insurance opt-out application?

How do I complete health insurance opt-out application online?

What is health insurance opt-out application?

Who is required to file health insurance opt-out application?

How to fill out health insurance opt-out application?

What is the purpose of health insurance opt-out application?

What information must be reported on health insurance opt-out application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.